Alicia García-Herrero

Alicia García Herrero is a Senior fellow at Bruegel.

She is the Chief Economist for Asia Pacific at French investment bank Natixis, based in Hong Kong and is an independent Board Member of AGEAS insurance group. Alicia also serves as a non-resident Senior fellow at the East Asian Institute (EAI) of the National University Singapore (NUS). Alicia is also Adjunct Professor at the Hong Kong University of Science and Technology (HKUST). Finally, Alicia is a Member of the Council of the Focused Ultrasound Foundation (FUF), a Member of the Board of the Center for Asia-Pacific Resilience and Innovation (CAPRI), a member of the Council of Advisors on Economic Affairs to the Spanish Government, a member of the Advisory Board of the Berlin-based Mercator Institute for China Studies (MERICS) and an advisor to the Hong Kong Monetary Authority’s research arm (HKIMR).

In previous years, Alicia held the following positions: Chief Economist for Emerging Markets at Banco Bilbao Vizcaya Argentaria (BBVA), Member of the Asian Research Program at the Bank of International Settlements (BIS), Head of the International Economy Division of the Bank of Spain, Member of the Counsel to the Executive Board of the European Central Bank, Head of Emerging Economies at the Research Department at Banco Santander, and Economist at the International Monetary Fund. As regards her academic career, Alicia has served as visiting Professor at John Hopkins University (SAIS program), China Europe International Business School (CEIBS) and Carlos III University.

Alicia holds a PhD in Economics from George Washington University and has published extensively in refereed journals and books (see her publications in ResearchGate, Google Scholar, SSRN or REPEC). Alicia is very active in international media (such as BBC, Bloomberg, CNBC and CNN) as well as social media (LinkedIn and Twitter). As a recognition of her thought leadership, Alicia was included in the TOP Voices in Economy and Finance by LinkedIn in 2017 and #6 Top Social Media leader by Refinitiv in 2020.

Disclaimer of external interests

Featured work

China’s Innovation and Industrial Policy: Achievements, challenges and consequences for Europe

At this event, we will explore both China's successes and challenges when it comes to innovation.

China’s ‘new productive forces’ risk overcapacity bubble

India's economy can overtake China's if it can stay on track

China continues to dominate an expanded BRICS

EU-China relation and de-risking global decarbonisation

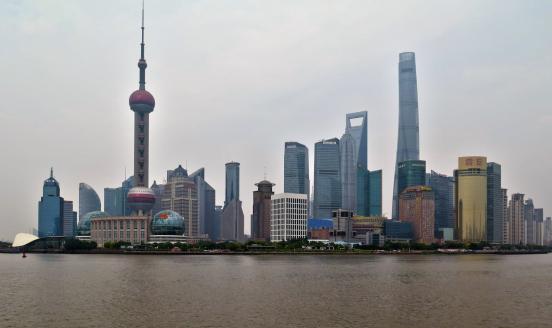

China economic database

Repository of what we consider to be the most relevant macroeconomic data for China and EU-China relations.

China's continued focus on the same export-driven model is bound to hit an impasse

South Korea's rollercoaster relations with China offer lessons for Europe

China and WTO reform: what to expect?

Indonesia’s post-election balancing act

Indonesia must reconcile its aim to be a leading Asian power with its current over-reliance on China

The post-election Taiwanese economy: decisions ahead and takeaways for the European Union

The EU should try to attract more business from Taiwan, though Taiwan’s January 2024 election has not made the job easier

Asia 2024 Outlook

Taiwan's elections: key takeaways for the European Union

Global Supply Chain Resilience: Facts and Implications

Taiwan’s future economic direction hinges on the election outcome

Depending who wins Taiwan’s 13 January election, the island could swing towards closer relations with China, or entrench decoupling from China.

Taiwan's election will mark an economic crossroads

Growth is rebounding, but island must decide whether to deepen links with China.

Potential Geoeconomic and Geopolitical Consequences of an Expanded BRICS

2024 will be about Western economic normalisation, China’s deceleration and India’s catch-up

China will continue to decelerate slowly but steadily while the rest of emerging Asia will do well.

EU-China summit remains a ‘dialogue of the deaf’ for EU trade concerns

Taiwan poised for economic bounceback in 2024

Growth should more than double from 1.2% to 2.9% so long as geopolitical risks including pivotal elections don’t bubble over

Foreseeing world economy chokepoints in 2024

A rather positive scenario is subject to several risks, starting from geopolitics

Against the odds, China’s push to internationalise its currency is making gains

Geopolitical concerns help support the use of the renminbi despite weak foreign investment trends

'Green tech partnership' offers way to de-risk while decarbonizing

Dependence on China carries supply risks beyond just geopolitics

Why the European Union-China summit is bound to disappoint

The European Union is increasingly disappointed with China over trade.

Biden-Xi dialogue instrumental for a successful EU-China Summit in Beijing

What has changed since our ZhōngHuá Mundus series started in 2021?

Third time lucky? China’s push to internationalise the renminbi

This paper analyses China’s different attempts to internationalise its currency and how they have fared.

De-risking and decarbonising: a green tech partnership to reduce reliance on China

Greater alignment of the major economic powers is needed around a collective effort to improve security of supply for decarbonisation goods.

How to de-risk dependence on China while decarbonising

How should the EU manage its dependence on China for clean tech?

What is behind China's structural deceleration?

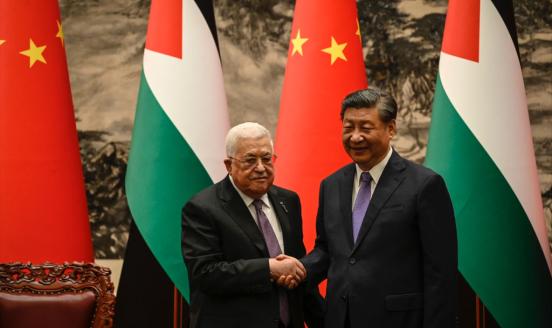

China’s position on Israel leading to a cold war

The most far-reaching ramification of recent events is the inexorable advance of a world splitting into two poles.

How might China hit back over the EU’s electric vehicle anti-subsidy investigation?

China’s silence towards the European Union’s electric vehicle probe could mean that a more harmful retaliation is on its way

To what extent can urbanisation mitigate the negative impact of population ageing in China?

Our analysis reveals that ageing accounts for only about 1 percentage point of the GDP growth rate deceleration over the past decade.

Will the Renminbi become an international currency? Policy issues for the European Union

Invitation-only event organised in the frame of the China Horizons project

China’s growing presence in Latin America is a problem for the West

¿Qué precio pagará Italia por abandonar la Ruta de la Seda?

China’s currency slide adds to its economic headaches

Can Italy leave the Belt and Road Initiative without a backlash?

How China responds to Italy’s exit from the BRI may influence other members who are contemplating a similar move.

As China’s Economy Drags, the Rest of Asia Offers Hope

Bruegel Annual Meetings, 6-7 September 2023

A symphony in progress: shaping a new agenda for Europe

The War in Ukraine: Economic impact on Asia

How big is China’s global economic footprint? Takeaways for the European Union

Following a boom, China's electric vehicle industry now faces weak domestic demand and heightened geopolitical risk

The story of China's EV industry.

The dangerous link between China’s real estate demise, the economy and the financial system

China’s property sector is plunging further into a crisis that could have major ramifications on the country’s real economy and financial sector.

Will China's quest for innovation help mitigate structural deceleration?

China’s GDP data point to need for stimulus, but will it come?

The main reason for the relatively poor second quarter is lackluster domestic demand.

Resilience of Global Supply Chain: Facts and Implications

Companies diversifying their production away from the People's Republic of China might be a rather rational decision based on an economic rationale.

China’s quest for innovation: progress and bottlenecks

We identify three potential bottlenecks that might be hindering the translation of China’s innovation efforts into productivity growth.

China's growing and complex economic relationship with the Gulf States

To what extent can innovation and global economic dominance mitigate China’s structural slowdown?

Event in the frame of the project China Horizons - Dealing with a resurgent China (DWARC)*.

Can Chinese growth defy gravity?

This paper discusses China’s growth for the next two decades, identifying the main challenges and factors that could mitigate its deceleration.

China-EU roller-coaster relations: Where do we stand and what to do?

US Congress hearing on "Europe, the United States, and Relations with China: Convergence or Divergence?"

Resilience of Global Supply Chain: Facts and Implications

China’s weak recovery is turning off foreign investors

Quick rebound expected after the relaxation of zero-Covid policies has not materialised.

China’s growing power in Latin America

China and the US might not be decoupling but their technologies are bifurcating

Once the process of building alliances starts, it is hard to stop.

China’s overseas lending needs a full-fledged debt restructuring

China’s structural deceleration: population aging versus innovation

Closed-door event discussed the importance of rapid aging for the future of the Chinese economy and dwelling on China’s major innovation trends

What really influences United Nations voting on Ukraine?

Speculation has been triggered about new alliances emerging in the Global South, inspired by China and India's voting behaviour.

EU-China relations have been – and will remain – a rollercoaster

Global trends in countries' perceptions of the Belt and Road Initiative

In this paper, we have analysed the sentiment towards the Belt and Road Initiative in the world using a large open-access dataset, namely GDELT.

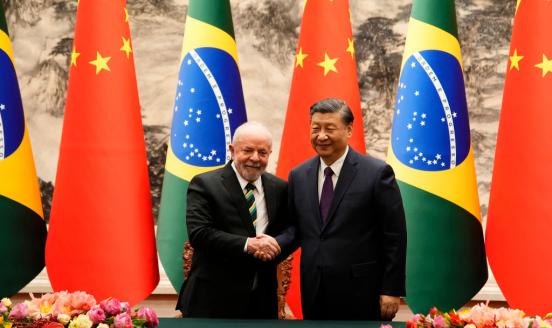

Brazil is not a real middle power if it just takes China's side

Lula cannot show strategic autonomy by parroting Xi Jinping

China's good relations with Africa rely more on narratives than economic impact

Will Lula find his El Dorado in China?

The Brazilian president is seeking Beijing’s support for his quest for middle power prowess

China’s 2023 work report and what it means: an AI post-mortem

China is taking a more nuanced approach to the overarching goal of GDP growth.

No gains for Europe from latest pilgrimage to Beijing

Emmanuel Macron and Ursula von der Leyen are petitioning Xi Jinping on Ukraine and other pressing issues

The Belt and Road Initiative transformation makes it a more – not less- useful tool for China

A European Think Tank’s Experience with the Global Pandemic: The Case of Bruegel

This chapter reviews Bruegel's experience and role in policy formation during the Covid-19 pandemic.

China’s new regulator hints at a major clean-up of the world’s largest financial sector

Among several institutional changes, the most significant might be the creation of a new nationwide regulator to oversee China’s financial industry.

Li Keqiang’s farewell points to employment as China’s major problem

China's modest 2023 growth target provides more evidence of a focus on sustainable growth and jobs.

The transformation of China’s Belt and Road Initiative: What is in it for Europe?

Closed-door event discussing China's BRI project.

How well does China’s reopening bode for the economy? A political economy story

The boom, bust and future of China's real estate sector

Don’t expect Asia to save the global economy in 2023

Southeast Asian economies, as well as India, are expected to decelerate, which will blur the positive impact of China’s reopening.

China-India relations and their impact on Europe

The COVID–19 pandemic and China’s economic slowdown

Any convergence with the U.S. economy will not continue for long.

China protests add to uncertainty for investors

Demonstrations show how the country is struggling to deal with Covid and an easing of lockdowns.

Xi Jinping’s new smiles got China off the hook at climate talks

Beijing's bandwidth to deliver is shrinking as its economic performance wanes.

Promotion of high capacity broadband to rebuild and recover from the pandemic

High-capacity broadband infrastructure will be a key enabler of a forward-looking recovery after COVID-19.

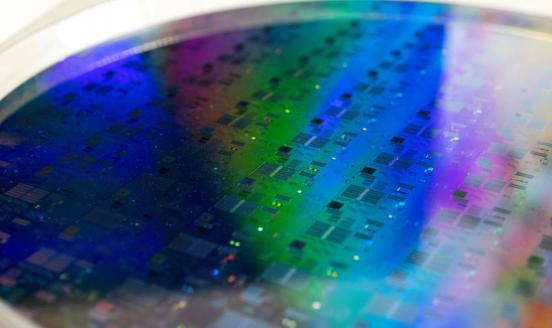

Lessons for Europe from China’s quest for semiconductor self-reliance

This paper explores China's quest to become a domestic-demand-driven economy, and the lessons that can be learnt from its quest for self reliance.

Biden, Xi focus on Taiwan and forget about Ukraine

The meet did not seem to offer solutions to the two most pressing problems for the international order.

The geopolitics of semiconductors and what Europe can expect

At Party Congress, Xi doubles down on China’s direction

The two key objectives are targeted self-reliance and national security

Europe’s promised semiconductor subsidies need to be better targeted

The proposed European Chips Act over-emphasises semiconductor production subsidies, focusing too little on increasing value-added in research.

China’s real estate sector goes south

The demise of China’s real estate sector, pushed by developer defaults and mortgage boycotts, is a major risk for the Chinese economy.

China's role in the global financial architecture

What risks does China's rise pose to the security of the international financial architecture?

China and the West: growing apart as geopolitical tensions grow

The model of increasing economic interdependence between the West and the emerging world was built on assumptions that no longer hold.

China can learn from the bursting of Japan's real estate bubble

Beijing cannot count on economic growth or fiscal space to tide through crisis

Shinzo Abe’s economic legacy: a glass half full

Abenomics has fallen short in many ways, but Japan has still largely coped with an aging society while maintaining a high level of income equality.

China’s Economy Needs More Stimulus. Beijing’s Room for Maneuver Is Limited.

Bruegel Annual Meetings, 6-7 September 2022

The Annual Meetings are Bruegel's flagship event which gathers high-level speakers to discuss the economic topics that affect Europe and the world.

Ukraine and Taiwan on the Biden-Xi chessboard

Overall, Biden and Xi seem to be converging on their strategies for global dominance

China’s non-market practices, impact on the world, and what to do about it?

Testimony before the U.S.-China Economic and Security Review Commission.

A new kind of Belt and Road Initiative after the pandemic

The Belt and Road Initiative is turning from infrastructure financing into an instrument for Chinese soft and hard power.

BRI 2.0: How has the pandemic influenced China’s landmark Belt and Road Initiative?

China's BRI is undergoing a transformation after two years of pandemic. How is it changing and what are the consequences for Europe.

Xi, Biden switching strategies for dominance

The US now sees Asia more through an economic lens, while China shifts toward a security focus

Is China’s private sector advancing or retreating?

A look into the Chinese private sector.