The value added of central bank digital currencies: a view from the euro area

Central bank digital currencies do have added value, but this is not the same for every country.

Executive Summary

- Different jurisdictions have set out different reasons for creating central bank digital currencies (CBDCs). Some countries, particularly those with already-operational CBDCs for retail purposes, aim to to promote financial inclusion. But in countries where most citizens have access to financial services, central banks are interested in CBDCs as an aspect of the increasing digitalisation of finance.

- Central banks could also choose to use CBDCs to guarantee in full citizen’s holdings (currently, deposits in commercial bank are only partially guaranteed), but this would trigger major changes in the financial system in terms of the role of commercial banks in intermediation and the role of fiat money. So far, central banks have not opted to go this way.

- In the euro area, consumers have multiple payment options and a very efficient retail payments system. The currency enjoys high levels of trust and is not challenged by the emergence of private currencies, such as Bitcoin, or by the risk that cash, a monetary system’s anchor, will disappear. Therefore, creating a CBDC for retail purposes in the euro area offers little obvious value added, at least for the foreseeable future.

- However, there is a strong case for building a CBDC that banks could use for cross-border wholesale purposes (ie with other currencies). Wholesale CBDCs could revolutionise the way that cross-border, cross-currency payments are made for two reasons.

- Cross-border payments are currently slow and inefficient. Pilot projects have shown that wholesale payments with CBDCs can generate substantial time and cost savings.

- Any two central banks that have operational wholesale CBDCs could settle transactions between themselves. This would be very different from the current system, as most settlements today are done via the dollar (and then the euro) infrastructure and use correspondent banks.

- The euro area and the United States would have to consider carefully from a geopolitical perspective how wholesale CBDCs might affect their global economic standing. By developing a CBDC for wholesale purposes, the European Union would be able to contribute to developing the global standard.

1 Introduction

Central bank digital currencies (CBDCs), a digital equivalent of cash, are increasingly gaining traction. At least 114 jurisdictions, representing 95 percent of global GDP, are at some stage of developing a CBDC 1 See the Atlantic Council central bank digital currency tracker: https://www.atlanticcouncil.org/cbdctracker/. . In 11 countries, CBDCs are now a reality and operate in parallel to their physical equivalent. But it is not necessarily easy for the consumer to understand the difference between a euro in coin or note form and a digital euro.

A good starting point in identify the benefits of CBDCs is to understand the problem that cannot be solved through the increasing range of digital payment options provided by the private sector, and which therefore requires the state’s intervention. This is important in explaining why the taxpayer might be asked to finance the creation of a CBDC.

We argue that CBDCs do have added value, but this is not the same for every country.

We argue that CBDCs do have added value, but this is not the same for every country. In countries with high levels of financial exclusion and where there is a lack of modern and reliable digital payment systems, a CBDC can facilitate access to payments for many people. But in countries with ample payment solutions and where financial exclusion is a second-order problem, the justification is different. Central banks worry that as finance becomes increasingly digitalised, two things might happen: first physical cash, the anchor of any financial system, will be displaced, and second, private currencies will become popular. Both could reduce the monopoly of sovereign money. Central banks fear this would compromise their ability to maintain monetary and financial stability.

CBDCs will have a dual purpose, just like their physical equivalent: for retail purposes, typically by consumers and small businesses to make daily payments, representing a small part of total payments; and for wholesale (ie bulk) purposes by banks and other financial institutions, either domestically or cross border. In the euro area, most efforts to date have focused on how to develop a retail CBDC. Only recently 2 See European Central Bank press release of 28 April 2003, ‘Eurosystem to explore new technologies for wholesale central bank money settlement’, https://www.ecb.europa.eu/press/pr/date/2023/html/ecb.pr230428~6a59f44e…. has there been also an attempt to advance thinking on the wholesale aspects as well.

On the retail side, the arguments for a digital euro put forward by the European Central Bank revolve around the speed of digitalisation of finance and the notion of strategic autonomy. The prospect of finance becoming predominantly and eventually even exclusively digital threatens the existence of sovereign money and compromises the role of its guardian, the central bank. The ECB also argues that a big part of all payments is managed by foreign players, who collect sensitive information about EU citizens. A pan-European payment method that is very close to cash would help reduce this vulnerability. It would also help homogenise payments in the euro area and, given easier access, may help promote the international role of the euro.

However, these reasons, understandable as they might be, do not make a compelling case for a retail digital euro, at least for now. There is no imminent threat that digitalisation will undermine the role of the physical euro. And there are easier ways, like through regulation, to promote the creation of a uniformly-accepted digital instant payment method in the EU, without having the taxpayer finance a CBDC. Meanwhile, Europe’s vulnerability arising from foreign players being present in the payment sphere is a very delicate argument. Does the EU want to create European payment players at the expense of competition?

Finally, the euro has acquired a very stable international role, second to, and quite far from, the dollar. At best, a digital equivalent can only expand the euro’s international appeal at the margins. Other factors that pertain to a more integrated and well-governed European economy would advance more significantly its international acceptability. There are also several technical choices, including limits on the amount of digital euros that any citizen can hold, or the fact that these deposits will not be remunerated, that also prevent the greater international use of the euro. In addition, the Eurosystem has a very fast and efficient retail payment system and can still find efficiency gains within the current system. All these make the case for a digital euro even less attractive.

However, the EU and the global financial system can really benefit from developing wholesale CBDCs for making payments outside the euro area. This can generate efficiency gains for all payments made outside the EU. In our view, the creation of CBDCs globally has the potential of revolutionising cross-border payments. For now, one reason why the dollar is the currency of choice globally is because it offers the infrastructure via which any two parties can settle a transaction. Any two countries that have CBDCs will have in principle the ability to settle transactions between them, bypassing the current dollar-based system.

Before this could happen however, there would have to be a commonly agreed global standard on how to design and use CBDCs. This is a significant barrier as it requires mutual recognition of legal systems and agreement on economic and technical design issues (BIS, 2022). Global governance will be a major obstacle to this revolution and the euro area and the United States would have to consider carefully how their economic standing globally would be affected.

For example, current sanctions on Russia mean that countries that want to continue economic relations with Russia cannot do so in dollars or euros. Mutually accepted CBDCs between any two countries could allow them to continue trading and therefore bypass sanctions. This reduces the need for the dollar infrastructure in international settlements and, importantly, raises the threshold for returning to the dollar when the option presents itself in the future. International financial fragmentation encourages the development of CBDCs and may be part of the explanation for their rapid advancement in the past few years.

2 The emergence of CBDCs

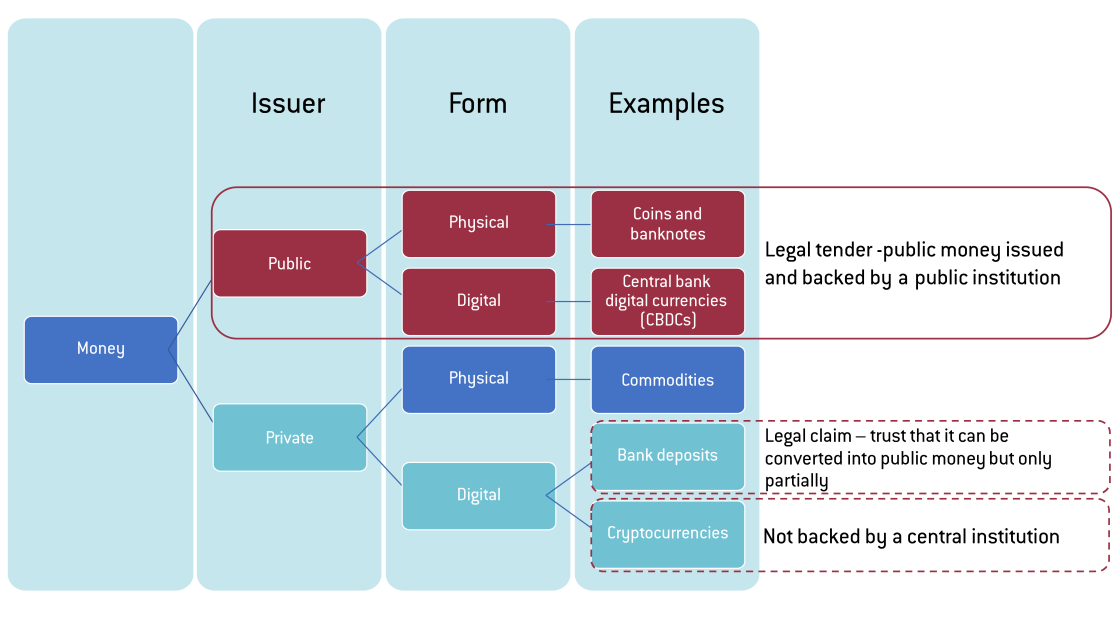

We first clarify how CBDCs may differ from physical cash. Figure 1 describes the taxonomy of money. The digital form of a sovereign currency, a CBDC would be legal tender and fully guaranteed by public authorities. This contrasts with deposits in commercial banks which are guaranteed only in part: for example, €100,000 in the euro area and $250,000 in the US. As legal tender, CBDCs could not be refused as means of payment or for repaying debts in the respective jurisdictions.

However, legal tender laws are not sufficient to guarantee the acceptability of a new currency, as shown in the literature (Lotz and Rocheteau, 2002). In a two-sided market, acceptability comes not only from take-up by consumers, but also from take-up by merchants, who must invest in the necessary equipment. This has been shown to be an obstacle and would have to be addressed for CBDCs.

Also, CBDCs will be convertible one-to-one into other forms of central bank money – reserve balances or cash. A CBDC will be the closest substitute possible to physical cash, which settles near instantly. However, while the technology may be able to ensure privacy, CBDCs will not allow for anonymity in the same way as physical cash. Last, holding CBDCs would mean holding a direct liability with the respective central bank, very much like holding a banknote.

Figure 1: Taxonomy of money

Source: Adapted from Claeys et al (2018).

Central banks have become interested in the idea of CBDCs for three main reasons:

- The emergence of cryptocurrencies. The Bitcoin revolution has provided means of payment that are privately issued and managed. If private money were to become successful, especially if it is in principle available to everyone globally, it could displace publicly issued money (cash) and fiat money that is issued by financial institutions but monitored and guaranteed in part by public authorities. The existence of private money reduces the money base that central banks control, and therefore reduces their ability to control inflation and monitor financial stability. With CBDCs, central banks would provide a digital equivalent of public money that would mimic the technological features of cryptocurrencies.

- Increasing use of digital payments. The increased digitalisation of payments reduces the role and use of cash in most economies. Cash is often referred to as the anchor of the financial system, providing the necessary trust to the whole system. The worry is that with decreasing use of cash in everyday transactions, physical cash would disappear, thus eroding trust in the system. A digital equivalent of cash would maintain the anchor while addressing the change in payment preferences.

- Improve the reach and efficiency of payment systems. In several countries where many people do not have access to the financial system or digital payments, CBDCs offer increased financial inclusion. This is potentially a game changer, and it is not a coincidence that those countries already using CBDCs, such as Nigeria and the Bahamas, have financial inclusion as a prime motive. However, even for countries where financial exclusion is a small and isolated problem, there are benefits to improving the efficiency of payments. This is particularly true for payments across borders, where CBDCs have the potential to create a global standard for international payments that is both efficient and universally accepted. This has the potential to revolutionise the way payments are settled between any two entities anywhere in the world.

While these three reasons are not exhaustive, they are the main arguments put forward by most countries. Other reasons that have been mentioned for developing CBDCs are a more cost-effective issuance and management of physical cash (Reserve Bank of India, 2022),

support for the wide application of new technology and innovation, and the strengthening of operational resilience and cybersecurity

3

See Danmarks Nationalbank (2022) for more detail.

. Central banks worldwide are experimenting with the technology to identify which type of CBDC, retail and/or wholesale, will provide value-added for their consumers and cover their needs.

3 The case for a retail CBDC

Currently, a consumer (payer) who wants to make a payment instructs their bank to make a transfer to the payee’s account. The transaction involves an amount moving from one bank to the other and is settled by the central bank. With CBDCs, however, both the payer and the payee will have accounts directly at the central bank. There will be no commercial banks involved 4 This is the basic argument, though most central banks agree that CBDC accounts will be managed by private institutions. . Both the payment and the settlement will happen via the central bank directly. Furthermore, CBDCs could use new technology, such as distributed ledger technology (DLT), which is being explored.

The motive for deploying a retail CBDC depends crucially on how the three factors we have described in section 2 have impacted a particular jurisdiction. Are cryptocurrencies a threat to traditional forms of payment and possibly a source of financial instability? Is physical cash redundant, therefore, threatening to de-anchor trust in the monetary system? Are there efficiency gains to be had in payments both for retailers and in wholesale?

3.1 Cryptocurrencies are not taking over payments

The emergence of cryptocurrencies has democratised payments and financial services in that it has provided easier access by removing intermediaries. However, cryptocurrencies have also proved to be very bad means of payment or store of value because their price has been very volatile (Demertzis and Martins, 2023).

In practice, the fear that cryptocurrencies could displace sovereign money has so far proved unfounded. Nevertheless, the experience is not the same around the world, and of course things might change in the future.

Despite its increasing size, the crypto market still represents a small fraction of the total financial system. According to the ECB, the value of all crypto assets represented less than 1 percent of total global financial assets by April 2022 (Panetta, 2022a). They also represent a small component of the total value of payments. The Global Payments Report (FIS, 2023) noted that cryptocurrencies are used much more for investment purposes than as a means of payment (77 percent compared to 18 percent, according to their survey), and that the value of e-commerce payments using crypto represented 0.19 percent of global e-commerce value in 2022.

However, in Africa, Asia and Latin America, cryptocurrencies are increasingly playing a more active role. An index compiled by Chainalysis (2022) tried to capture a broad picture of cryptocurrency adoption by scoring countries on a variety of measures. It ranks only two high-income countries – the US and the United Kingdom – among the top 20 crypto adopters in 2022 (Table 1).

Table 1: 2022 Global Crypto Adoption Index

|

Overall index ranking |

Country |

Overall index ranking |

Country |

|---|---|---|---|

|

1 |

Vietnam |

11 |

Nigeria |

|

2 |

Philippines |

12 |

Turkey |

|

3 |

Ukraine |

13 |

Argentina |

|

4 |

India |

14 |

Morocco |

|

5 |

United States |

15 |

Colombia |

|

6 |

Pakistan |

16 |

Nepal |

|

7 |

Brazil |

17 |

United Kingdom |

|

8 |

Thailand |

18 |

Ecuador |

|

9 |

Russia |

19 |

Kenya |

|

10 |

China |

20 |

Indonesia |

Source: Chainalysis (2022).

According to White and White (2022), Africa is the fastest-growing cryptocurrency market among developing regions. Between 2020 and 2021, Africa saw a 1,200 percent increase in cryptocurrency payments. Remittances, which are a very important source of income for the continent, have been greatly facilitated by cryptocurrencies (White and White, 2022). In Nigeria, 10.3 percent 5 See https://triple-a.io/crypto-ownership-nigeria-2022/. of the population owned cryptocurrency in 2022. The popularity of crypto in Nigeria is explained by financial exclusion, the lack of access to financial services. However, the weakness of the domestic currency and inflation is also a reason for the popularity of crypto alternatives. A CBDC would help, at least in principle, to reduce financial exclusion, but would not by itself alleviate doubts about the strength of the sovereign currency.

3.2 Cash is still popular

The increased popularity of digital payments, particularly during the COVID-19 lockdowns, has reduced the need for cash. Nevertheless, cash still has an important role in point of sale (PoS) payments, particularly in less-developed regions and it is here to stay at least for the foreseeable future (BIS, 2023; FIS, 2023).

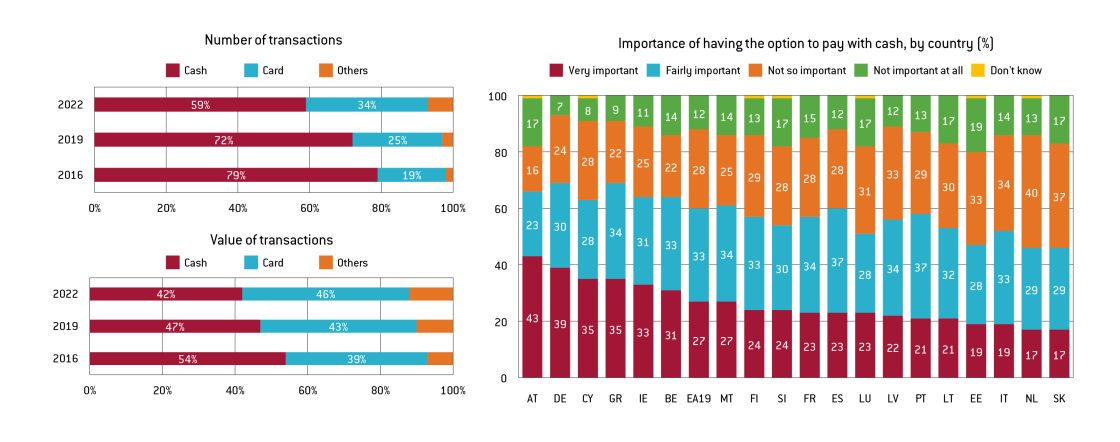

European Central Bank data for the euro area indicates that, despite the reduction in cash payments at the point of sale, from 79 percent in 2016 to 59 percent in 2022, cash remains the most popular payment method, especially for low-value transactions (Figure 2, left panel). Citizens’ opinions on the importance of having the cash option demonstrates that a society without cash is nowhere close. The proportion of people considering cash ‘very important’ and ‘fairly important’ is above 50 percent for most euro-area countries (Figure 2, right panel). This goes against the popular belief that cash will soon be abandoned.

Figure 2: Payment preferences and the importance of cash in the euro area

Source: Bruegel based on ECB (2022).

Zamora-Pérez et al (2022) argued that, at the global level, the demand for cash has not decreased but rather has increased. This has happened despite the many new innovative solutions that have emerged for non-cash payments. Some of this increased demand may be related to a precautionary savings motive: a means of storing value in a period of low-interest rates that spanned several years. Additionally, even countries like Sweden, that have attempted to go totally cashless, have acknowledged that this might not be possible and that some, even if limited, amounts of cash will always be needed 6 See https://sweden.se/life/society/a-cashless-society. . Armelius et al (2020) went as far as arguing that Sweden may be an outlier when it comes to the trend towards a cashless society, and not the trendsetter.

Nevertheless, it is important to acknowledge that the process of digitalisation will mean that the demand for physical cash will continue to decline. It is much more difficult to assess whether it will disappear completely or, like in Sweden, stabilise at a low level 7 According to FIS (2023), the value of cash transactions in Sweden was 8 percent of the total value of point-of-sale transactions. . Part of the answer will depend on how well CBDCs, as the closest digital equivalent to cash, can take over the role of cash in providing an anchor for the system. Choices in the design of the CBDC will determine how close to cash CBDCs can be. Privacy and anonymity, the thresholds for consumer holdings of CBDCs and whether it will be remunerated or not will be relevant in this regard.

3.3 Financial exclusion and the introduction of retail CBDCs

Perhaps the most compelling argument for introducing retail CBDCs is that it will increase financial inclusion. It is therefore not surprising that countries where a substantial part of the population is excluded from financial services were the first to introduce their national currencies in digital form.

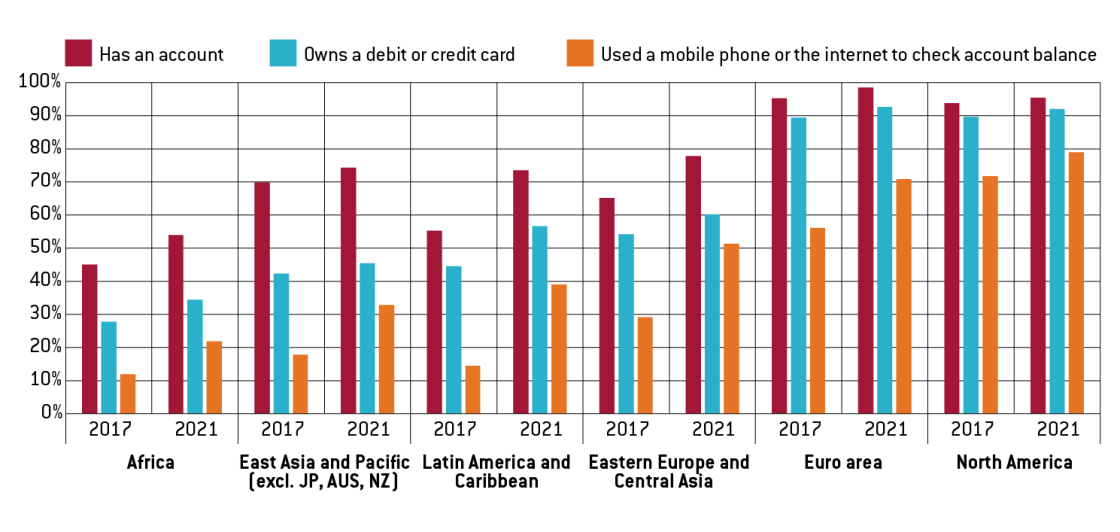

Nigeria’s eNaira, for example, was launched at the end of 2021, with the aims of increasing remittances, fostering cross-border trade, improving financial inclusion, enabling the government to make welfare payments more easily and making monetary policy more effective 8 See State House, Abuja press release of 25 October 2021, ‘At Official Launch of eNaira, President Buhari Says Digital Currency will Boost Nigeria’s GDP by $29 bn in 10yrs’, https://statehouse.gov.ng/news/at-official-launch-of-enaira-president-b…. . Providing the local population with access to digital payments and through them facilitating cross-border transactions in the form of remittances is particularly important, given the relevance of remittances as a source of income for the country. Figure 3 shows the level of financial inclusion worldwide.

Figure 3: Financial inclusion, three metrics

Source: Bruegel based on the Global Findex Database 2021. Notes: JP = Japan, AUS = Australia, NZ = New Zealand.

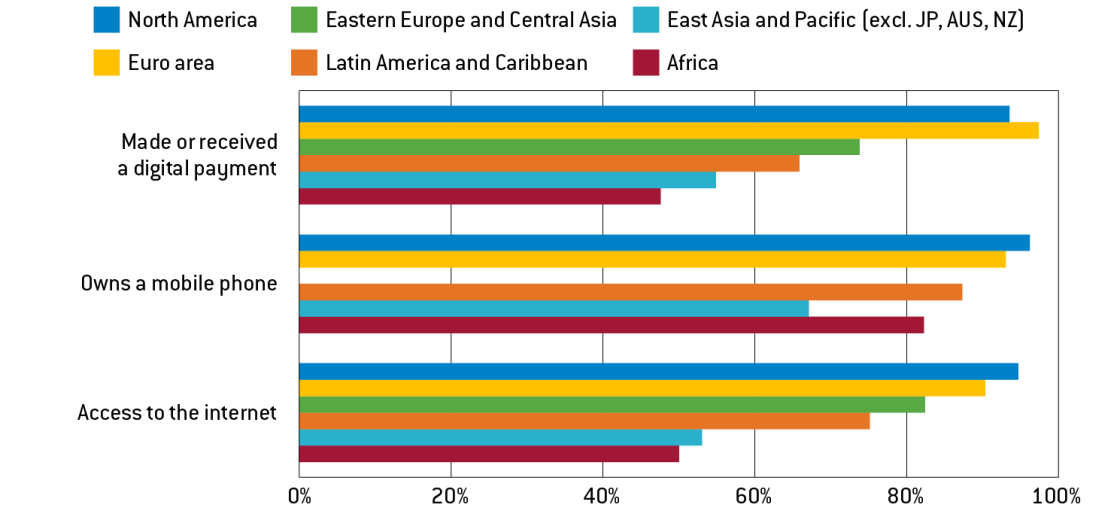

Advanced economies such as euro-area countries, the US and Canada have very high levels of financial inclusion. This is not the case for African countries or some Caribbean countries, where CBDCs are already being introduced. However, a CBDC by itself is not enough to reduce financial exclusion. For CBDCs to be adopted widely there needs to be broad access to internet connection, consumers need to have mobile phones and merchants need to have invested in the equipment to accept payments in CBDCs. Figure 4 shows that while a large proportion of the African population has access to a mobile phone, access to the internet by contrast is not as widespread (50 percent), which defines the limits of success that the introduction of a digital currency can have.

Figure 4: Digital infrastructure and penetration

Source: Bruegel based on the Global Findex Database 2021.

It is worth noting that even if there is digital access, it is not immediately the case that the introduction of CBDCs is the only or even the easiest way to improve financial inclusion, as shown by India and Brazil. Officially launched in 2016, Unified Payments Interface (UPI) 9 See https://www.npci.org.in/what-we-do/upi/product-overview. is an Indian instant payment system widely adopted in the country. Given its huge success, it is seeking agreements with other countries to enable its acceptance abroad 10 See for example Liquid Group/NPCI International Payments Limited press release of 13 September 2021, https://en.prnasia.com/releases/apac/liquid-group-to-power-upi-qr-accep…. .

The Central Bank of Brazil meanwhile launched a platform for real-time digital payments called PIX which has proved an enormous success. Since the launch, the number of registered users has increased continuously, reaching more than 137 million in May 2023 11 See https://www.bcb.gov.br/estabilidadefinanceira/estatisticaspix. , which represents more than 60 percent of the country’s population. PIX does not require any exchange of personal data, as the payer just asks for the payee’s QR code, and payment transfers happen at very high speed at any time of the day. According to the 2023 Global Payment Report, average fees on PIX transactions are 0.22 percent of the transaction cost compared to 1 percent for debit cards and 2.2 percent for credit cards. It would be very difficult to make a case for introducing a retail CBDC that can provide more value added than this to the consumer, a fact that explains why the Central Bank of Brazil’s interest in introducing a CBDC is mainly for wholesale purposes 12 Grace Broadbent, ‘Brazil wants to build on digital payment success with CBDC pilot’, Insider Intelligence, 8 March 2023, https://www.insiderintelligence.com/content/brazil-wants-build-on-digit…. .

3.4 How popular are CBDCs?

Admittedly, digital equivalents of sovereign currencies have existed for no more than two years. But their uptake is not as impressive as authorities hoped. Table 2 shows their uptake level for three countries, Nigeria, the Bahamas and China. Compared to total currency in circulation, CBDCs represent very small amounts and in none of these cases above 0.17 percent of the total.

Table 2: CBDCs in circulation

| December 2022 values | Nigerian eNaira | Bahamian Sand Dollar | Chinese e-CNY |

|---|---|---|---|

| CBDC in circulation | 3 billion eNaira | 303,785 Sand dollars | 13.61 billion eCNY |

| % of total currency in circulation | 0.01% | 0.17% | 0.13% |

Source: Bruegel based on Central Bank of Nigeria, Central Bank of The Bahamas and People’s Bank of China.

There are major problems to overcome. For the Sand Dollar, the CBDC of the Bahamas, introduced in October 2020, at least two issues might contribute to its small uptake 13 Paul Blustein, ‘Can a Central Bank Digital Currency Work? The Bahamas Offers Lessons’, Centre for International Governance Innovation, 14 December 2022, https://www.cigionline.org/articles/can-a-central-bank-digital-currency…. . First, the public confuses the Sand Dollar with privately issued cryptocurrencies that are not immediately trusted. After the scandal around FTX, which was based in the Bahamas, the public grew very sceptical about any digital currency. Second, the Sand Dollar is not readily accepted everywhere. Merchants do not all have the right equipment to accept it (a reason also given for the eNaira), even though they incur no cost for having the equipment.

This raises interesting questions about how to increase public acceptability. Historical incidents show that legal tender laws are not sufficient to guarantee the acceptability of a new currency (Lotz and Rocheteau, 2002). In a two-sided market, acceptability comes not only in the form of consumer take-up, but also from merchants who must invest in the necessary equipment. This has been shown to be an obstacle. Zamora-Pérez et al (2022) found that providing the status of legal tender is not always the right means of increasing the popularity of a currency, as the cost of building the infrastructure necessary for a currency’s adoption must be addressed. However, Brazil’s PIX payment system shows that mandatory participation of certain private players may be enough to create sufficient network effects, necessary for such markets to pick up. Similarly, Chinese public authorities are beginning to pay civil servants salaries in e-yuan 14 Iori Kawate, ‘Chinese cities begin to pay public employees in digital yuan’, Nikkei Asia, 5 May 2023, https://asia.nikkei.com/Business/Markets/Currencies/Chinese-cities-begi…. .

An important reason for low uptake is the lack of trust in the underlying currency. The digital representation of a currency is not sufficient to generate trust. It may allow for easier access but that can only help marginally. This is shown to be an important explanatory factor in the poor adoption of the eNaira in Nigeria 15 Web3Africa, ‘One year into Nigeria’s adoption of the eNaira’, Further Africa, 8 November 2022, https://furtherafrica.com/2022/11/08/one-year-into-nigerias-adoption-of…. . An interesting experiment is taking place in Zimbabwe, where authorities have issued a gold-backed token 16 Camomile Shumba, ‘Zimbabwe to Introduce Gold-Backed Digital Currency: Report’, CoinDesk, 24 April 2023, https://www.coindesk.com/policy/2023/04/24/zimbabwe-to-introduce-gold-b…. as a way of improving the trust in the local currency, the Zim dollar. Pegging the currency to a trusted asset is one way of trying to improve its stability and reputation. But it can also prove to be very expensive and ultimately non-credible. It will be interesting to see how far this effort goes to establish trust in the country’s CBDC.

3.5 A mixed case for establishing a retail CBDC

We have so far discussed arguments that are regularly made to justify the introduction of a retail CBDC, and the experience of countries that have decided to launch CBDCs. The process of digitalisation in payments has not made a clear case for CBDCs. If anything, there is still insufficient understanding among the public in countries where they are already in operation, of the difference between CBDCs and private cryptocurrencies. The most compelling reason in favour of a CBDC is financial inclusion. But even for this, CBDCs are not a solution by themselves. Other elements, like digital infrastructure, need to be available. And the Brazilian example shows that when digital infrastructure is available, there are other solutions to financial inclusion. The key is finding effective ways of creating network effects.

The welfare implications of introducing retail CBDCs remain very understudied. Piazzesi and Schneider (2022) suggested that the emergence of digital currencies could distort the level of competitiveness in payment systems. This is of relevance in jurisdictions, such as the euro area, where there are plenty of other available private payment alternatives. CBDCs have the potential to prevent useful innovation in private markets, therefore, reducing aggregate welfare. On the other hand, Williamson (2022) took a different view. Competing with private means of payment, CBDCs will attract safe assets (deposits). This, he argued, is a way of managing safe assets in a better, more welfare-enhancing way compared to how private banks deal with this stock. CBDCs could in theory be a way of bypassing the imperfections of partial deposit guaranteed systems.

However, CBDCs are not the only way of guaranteeing deposits in full. Regulatory adjustments could do this instantly. Importantly, a regime that shifts deposits from private banks to the central bank will necessarily change the face of retail banking, an action that should not be done lightly. This has never been the motive behind introducing CBDCs and should not be dealt with as a mere unforeseen consequence.

There remain operational risks of introducing a retail CBDC. How will deposit holders retrieve them from private banks and place them at the central bank? Can this happen all at once, or will it trigger a run on the banks? There are also issues of cyber security and no system can be completely secure. How does technology and the regulation that applies to it ensure financial stability? Finally, there is overwhelming evidence that consumers worry about privacy and anonymity (ECB, 2021; Noll, 2023). While the technology that the ledger provides may offer novel solutions to a number of issues, the legal framework behind CBDCs is as credible as that of physical currencies and the institutions responsible for their issuance. A digital representation of a currency cannot solve governance shortcomings.

4 What is novel about wholesale CBDCs?

4.1 Improving wholesale payments

In the current system, bank reserves in the central bank available for wholesale transactions are already a form of central bank digital currency. In other words, payers and payees in the wholesale market – banks – already have accounts at the central bank. This means that, unlike CBDCs for retail purposes, wholesale CBDCs do not need to be created from scratch. Rather, it is about using the most modern technology – distributed ledger technology (DLT) – to operate wholesale transactions.

Then the question is whether this new technology can provide efficiency gains in wholesale payments domestically, or between central banks across borders.

In various advanced economies, domestic payment systems are already very efficient: for example, real-time gross settlement systems such as T2, launched by the Eurosystem in March 2023 to replace the previous TARGET2 system, which settles euro-denominated payments, and the Fedwire Funds Service, which settles dollar-denominated transactions. The systems are operated by the respective central bank. T2 is already meant to improve cost efficiency, provide greater cyber security and optimise the use of liquidity by harmonising and integrating various TARGET services 17 See European Central Bank press release of 21 March 2023, ‘Successful launch of new T2 wholesale payment system’, https://www.ecb.europa.eu/press/pr/date/2023/html/ecb.pr230321~f5c7bddf…. . Even though wholesale settlement systems are quite advanced in the EU and in the US, the ECB and the Fed are both exploring how DLT can prove more efficient and secure for domestic interbank transfers 18 See European Central Bank press release of 28 April 2023, ‘Eurosystem to explore new technologies for wholesale central bank money settlement’, https://www.ecb.europa.eu/press/pr/date/2023/html/ecb.pr230428~6a59f44e… and https://www.newyorkfed.org/aboutthefed/nyic/facilitating-wholesale-digi…. .

However, it is in cross-border and cross-currency transactions that DLT could provide sizeable gains. These transactions are subject to inefficiencies related to the current correspondent banking architecture (Hebert et al, 2023). International payment systems have not kept up with the scale of cross-border financial flows in an increasingly open world. The systems used are costly, slow and complex, which means that many participants from emerging markets and the developing world have been left with no access to the global financial system. In an increasingly interconnected world, the need to improve cross-border payments has been established as a priority by the G20, with the Financial Stability Board leading in coordination of efforts 19 See Financial Stability Board press release of 13 October 2020, ‘FSB delivers a roadmap to enhance cross-border payments’, https://www.fsb.org/2020/10/fsb-delivers-a-roadmap-to-enhance-cross-bor…. .

BIS (2021) provided a flavour of the potential gains from new ways of making cross-border payments. Table 3 summarises the results of such comparisons. A transaction that currently takes three to five days could be completed in less than 10 seconds. Cost savings could also be significant, but their magnitude would vary between banks and regions. For example, average costs for overseas transactions amount to 2 percent in Europe, while in Latin America such costs amount to as much as 7 percent. New payment solutions being explored could reduce this cost to as low as 1 percent. Savings would come from removing the network of correspondent banks in the chain of transactions and putting in place instead direct corridors that allow central banks to communicate.

Table 3: Efficiency gains from DLT compared to the current payment system

|

|

Current payment system |

New technologies for payments |

|---|---|---|

|

Transaction time |

3 – 5 days |

2 – 10 seconds |

|

Costs |

<2% – >7% |

As low as 1% |

|

Accessibility |

Via corresponding banks |

Peer-to-peer |

Source: Bruegel based on BIS (2021).

Such efficiency gains were achieved in a pilot project called mBridges (BIS, 2022), in which the following central banks participated: the Hong Kong Monetary Authority, the Bank of Thailand, the Central Bank of the United Arab Emirates, the People’s Bank of China, and the BIS Innovation Hub Hong Kong Centre. Using DLT, the project established a multi-CBDC platform via which market participants could make cross-border peer-to-peer payments directly using central bank money. Along with efficiency and cost gains, the project demonstrated an ability to reduce settlement risk and allow for the use of local currencies for international payments, a move away from having to rely on international tradable currencies like the dollar and the euro. The pilot showed though that several complex choices would have to be made.

4.2 From a dollar-centric system to bilateral settlements

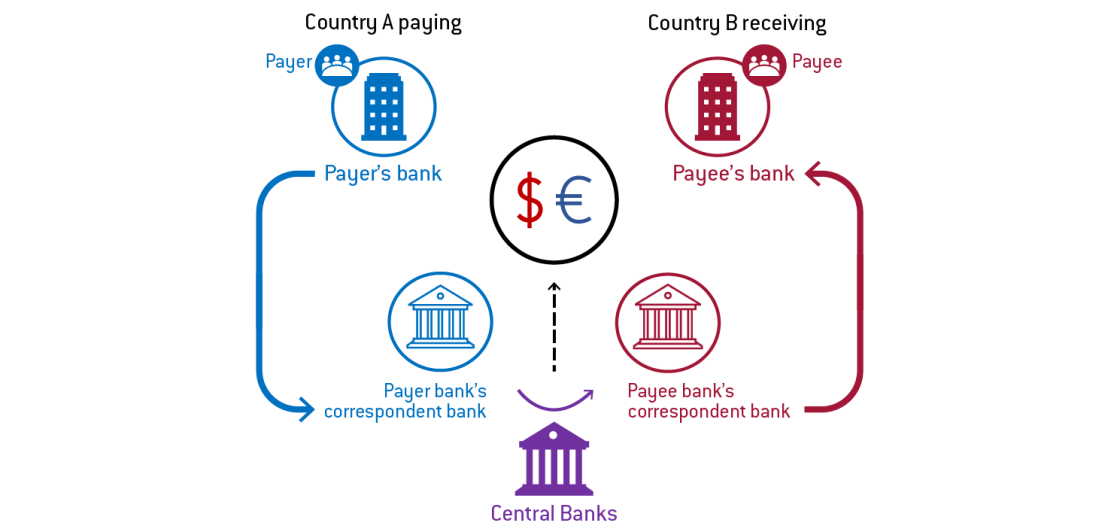

The international financial system has long relied on the dollar, which has meant having to rely on the dollar settlement system. Figure 5 describes the current system of economic exchange between any two countries. A company in country A, the payer, instructs its bank to make a payment; the bank then contacts its correspondent bank. The latter will engage with the correspondent bank in country B, which finalises the cycle by contacting the payee’s bank and crediting the due amount to the receiver’s account.

Figure 5: The dollar (euro) based international financial system

Source: Bruegel based on BIS (2022).

Depending on the currency in which the exchange is made, the respective central bank will be involved. It is important to note that the dollar is by far the main currency of choice globally in trade invoicing (more than half of global trade) and foreign exchange transactions (almost 90 percent of the total volume) (Moronoti, 2022). This also means that US settlement authorities are involved in finalising most global transactions.

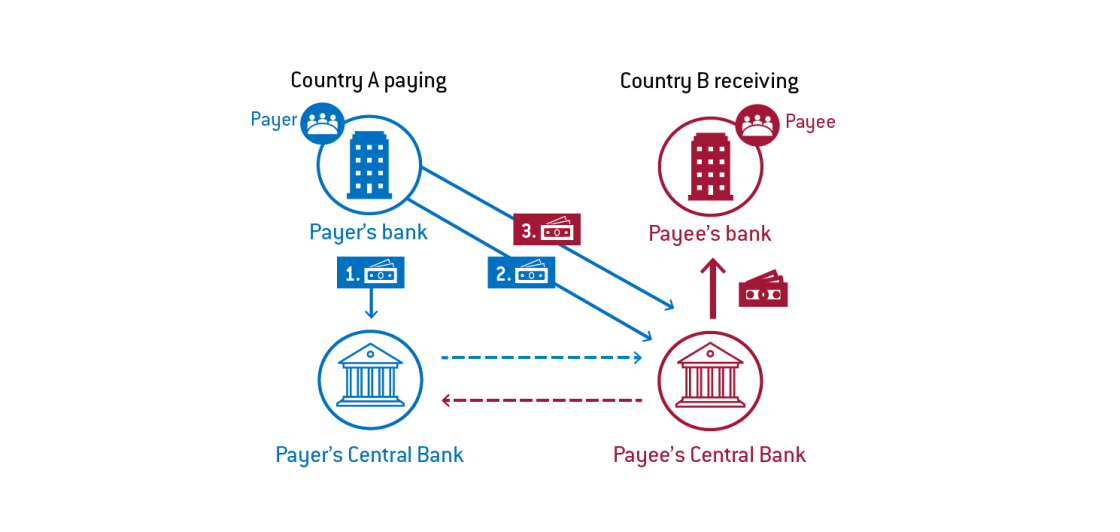

Wholesale CBDCs would change this system. Central banks would have dedicated corridors (like the mBridges described above) for settlement directly between themselves. There would be no need for correspondent banks. The payer’s bank would have an account directly at the country’s central bank, which in turn would communicate directly with the central bank in the payee’s country. This would mean more diversification of currency pairs, with increased liquidity for currency pairs that do not include the dollar. Also, more direct relationships between parties would lead to the de-risking of transactions.

Figure 6: Commercial banks’ CBDC accounts at a central bank

Source: Bruegel.

The payer’s bank can pay the payee’s bank in one of three ways (Figure 6). First, it can hold domestic currency in an account in the domestic central bank, in which case the two central banks will transact using a pre-agreed currency. Second, the payer’s bank could have a domestic currency account at the foreign central bank and would pay with its domestic currency. Third, the payer’s bank would have a foreign currency account at the foreign central bank and would pay with this.

The first method is closest to what happens today; the dedicated corridors between central banks will allow the settlement of any transaction. The mBridge pilot showed that the third method is the most efficient because it involves the fewest steps between the two transacting parties.

An important issue that DLT solves is interoperability. The current system does not allow for interoperability because communication needs to happen through secure messages. If countries use different systems, they run the risk of not being able to communicate between themselves. Blockchain 20 Blockchain is a form of DLT in which all transactions are recorded and organised in linked digital blocks. For more details on DLT and blockchain see Demertzis and Martins (2023). technology has provided solutions that allow communication between parties via corridors. But before such dedicated corridors are created, a number of choices need to be made on technical, legal (and governance) and economic issues.

For the system to function, established rules to provide legal certainty are needed. Would current rules for holding foreign securities be sufficient for wholesale CBDCs, or would a new legal framework be needed? Global coordination on this issue would be preferable and indeed necessary for wholesale CBDCs to challenge the current ways of settling international transactions. Arguably, the governance of wholesale CBDCs will be the most important obstacle to their uptake.

But bilateral recognition of legal systems would also be sufficient for any two central banks to settle transactions between them. Wholesale CBDCs then have the potential to change the current dollar-based system into one that is more diverse. It is not immediately obvious why two countries that trade in dollars would prefer to trade in their own currencies. However, if one of them was sanctioned by the US, for example, then the dollar would no longer be available to them. A settlement system that is operational between any two central banks would guarantee the continuity of economic activity. While an alternative settlement system by itself does not automatically reduce the appeal of the dollar as the currency of choice, it does reduce the threshold for using other currencies. Many countries that are thinking about strengthening their resilience will no doubt examine the geopolitical importance of ensuring functioning settlement system. It is no coincidence that so many central banks, including China’s, are eager to develop a digital equivalent of their currency. It is not difficult to imagine CBDCs being weaponised for geopolitical reasons, as central bank reserves have been since Russia’s invasion of Ukraine 21 See Maria Demertzis, ‘Central Bank digital currencies as weapons of finance’, Bruegel, 14 December 2022, https://www.bruegel.org/comment/central-bank-digital-currencies-weapons…. .

However, many issues remain. On the governance side, choices will have to be made on issues including data privacy, preserving anonymity, monetary sovereignty and conflict settlement. The mBridges pilot showed that the most efficient payment method would be for foreign companies to have accounts at the domestic central bank if they trade domestically. What would that mean for monetary sovereignty? How would potential conflicts be resolved? Equally, economic issues would also have to be decided. How would countries deal with counterparty risk? Would the domestic central bank agree to carry that risk on behalf of foreign institutions?

5 A digital euro: design options and its future

5.1 The ECB’s thinking so far

The Eurosystem is considering the introduction of the digital euro for retail use. The digital euro project is at time of writing in the investigation phase, which will come to an end in October 2023 at which point the ECB will decide on the next steps 22 See https://www.ecb.europa.eu/paym/digital_euro/shared/pdf/Digital_euro_pro…. . Three progress reports have been issued so far (Box 1).

The first progress report, published in September 2022, focused on the functionalities and limits for users. It concluded that the consumer should be able to pay with digital euros online and offline, and that the digital euro should mimic cash-like features as much as possible. While privacy is to be ensured, the digital will not be fully anonymous because of worries about money laundering. Also, it should be used exclusively for payments and not as a form of investment. This choice also reflects financial stability considerations, and particularly the prevention of excessive migration of bank deposits to the central bank, which could disrupt the current financial system. To this end, individual holdings should be limited to between €3000 and €4000 (Panetta, 2022b).

The second progress report, issued in December 2022, focused on defining the settlement and distribution roles and ensuring an easy conversion between digital euros and cash/private money. The Eurosystem intends to retain full control over the issuance/redemption and settlement of digital euros, but has not decided on the technology to use – traditional, DLT or a combination of both. The distribution and direct interaction with end users would be the responsibility of banks and other payment service providers. They would develop the interfaces and services – such as wallets – and perform regular anti-money laundering checks. The third progress report (April 2023) clarified that payments would be done using technology already familiar to most European citizens, for example, contactless or QR codes, through either the existing apps of intermediaries or a Eurosystem app, depending on the user’s preference.

The April 2023 report also discussed the possibility of access for non-euro area residents. The primary focus of the initial releases of the digital euro however will be for euro-area residents only (individuals, merchants and governments), even though access to non-residents could be possible if they have an account in the euro area. Access for residents of the European Economic Area and selected third countries could be envisaged in later releases of the digital euro. A last important point made in this report is that the digital euro will not be programmable money. This means that the ECB would not determine or interfere with where, when and for which purpose the digital euro is used.

Early in the second half of 2023, the Eurosystem will present the overall thinking on how to design a digital euro. Box 1 summarises its thinking so far.

Box 1: The ECB’s thinking on the retail digital euro

- Target users: Primarily euro-area residents (individuals, merchants and governments). Possible extension of access to non-residents.

- Intended as: means of payment and not form of investment (avoid excessive migration of bank deposits to the central bank). It will not be remunerated.

- Availability: both online and offline solutions envisaged.

- Limits: €1 trillion to 1.5 trillion total, meaning around €3000 to €4000 digital euro per capita. Limits apply to individuals, who can have only one account. Merchants would not have digital-euro holdings but would accept payments in digital euros.

- Privacy: the digital euro should replicate as much as possible cash-like features, but no full anonymity. Possibly, greater privacy for low-value low-risk payments.

- Issue and settlement: responsibility of the Eurosystem; digital euro is direct liability of the central bank (convertible one to one with the euro).

- Onboarding, distribution and services: responsibility of banks and other payment service providers (supervised financial intermediaries). These would perform the regular onboarding procedures (eg anti-money laundering checks) and can develop consumer-oriented services beyond the core mandatory functionalities.

- Access and use: via existing apps provided by the PSPs or via an Eurosystem app. Payments done using technology such as contactless or QR code.

The ECB will also investigate cross-currency functionalities as a way of improving the transparency and efficiency of cross-border payments (as endorsed by the G20). This functionality could be implemented by ensuring interoperability between the digital euro and other CBDCs or by relying on a common infrastructure that could host multiple CBDCs.

5.2 Other advanced economies’ approaches to CBDCs

Several countries are more advanced than the euro area in this process and have decided not to issue a retail CBDC in the foreseeable future. This is mainly because they do not see CBDCs as offering added value in terms of payment options or to their citizens. This is the situation in Canada 23 See https://www.bankofcanada.ca/digitaldollar/. , Denmark (Danmarks Nationalbank, 2022), Japan 24 See Bank of Japan press release of 9 October 2020, ‘The Bank of Japan's Approach to Central Bank Digital Currency’, https://www.boj.or.jp/en/about/release_2020/data/rel201009e1.pdf , Sweden (Swedish Government, 2023) and Switzerland 25 See https://www.swissbanking.ch/en/topics/digitalisation-innovation-and-cyb…. Also, confirmed in January 2023 by a Swiss National Bank governing board member; see https://www.cnbc.com/video/2023/01/12/swiss-national-bank-says-it-doesn…. . In the United Kingdom, the Chair of the House of Lords Economic Affair Committee argued that a CBDC was “a solution in search of a problem” 26 See UK Parliament press release of 13 January 2022, ‘Central bank digital currencies: a solution in search of a problem?’ https://www.parliament.uk/business/lords/media-centre/house-of-lords-me…. . Similarly to the euro area, the US is still investigating whether to issue a retail CBDC, but is finding it difficult to justify it. In April 2023, Fed Governor Michelle W. Bowman said “it is difficult to imagine a world where the trade-offs between benefits and unintended consequences could justify a direct access CBDC for uses beyond interbank and wholesale transactions” (Bowman, 2023).

This does not mean, however, that their respective central banks are not investigating and preparing for a possible future launch, should the conditions and assessment change. Importantly, the idea of a wholesale CBDC is being pursued by some. For instance, Switzerland is participating in various projects focused on better understanding the wholesale potential 27 Finance.Swiss, ‘Why the Swiss National Bank is examining the usability of CBDCs’, 4 October 2021, https://finance.swiss/en/news-and-events/why-the-swiss-national-bank-is…. : ‘Project Helvetia’, a collaboration between the Swiss National Bank, the BIS and SIX, a commercial infrastructure operator, and ‘Project Jura’, which the Banque de France has also joined. Other countries, including the UK and the US, have expressed their potential interest in a wholesale CBDC.

It is important to note that the decision to issue a CBDC is ultimately political, mostly taken by the respective governments, rather than the central bank. Governments’ positions can change over time, as developments of CBDCs in other countries advance and they gain a better understanding of the operational, legal, financial and economic implications of CBDCs (whether retail or wholesale).

5.3 The future of the digital euro

A digital euro for wholesale purposes has substantial potential for reducing frictions in cross-border (ie beyond the euro-area borders) payments. As explained earlier, these improvements could bring a fundamental change in the international financial settlement system. Governance will be crucial. Legal issues, economic choices and technical uniformity would all need to be agreed at global level for CBDCs to challenge the status quo in global wholesale payments. But the Eurosystem cannot afford to be left out of this debate. Moreover, as the ECB has invested in understanding the workings of CBDCs, it is well placed to contribute to setting the global standard and helping promote global coordination. As a standard-setter, the EU could exert influence as societies adapt to an increasingly digitalised financial ecosystem. As an active participant and contributor to the debate, the EU should aim to protect its global interests.

When it comes to using a digital euro for retail purposes inside the euro area, we do not see a compelling case for issuance at this stage. There are many issues to clarify, and a digital euro might bring significant changes to the financial system that need to be considered carefully.

Privacy vs anonymity. In response to the public’s concerns about privacy, the ECB has been very clear about protecting consumer data when using the digital euro. However, privacy is not the same as anonymity and the ECB is also clear that transacting in digital euros will not be anonymous. This makes the digital euro only an imperfect substitute for cash. As 42 percent (Figure 3) of the value of all transactions in the euro area in 2022 was in cash, there is still a great deal of anonymity in the way that payments are made currently. As one of the motivations for launching CBDCs was the need to provide a digital equivalent of cash, this is a clear shortcoming.

Cash as the anchor of the financial system. Would the elimination of cash in the future destabilise the system? It is often argued that cash is the anchor of trust in the financial system. In a world of fiat money, deposits are only partly guaranteed. For the consumer, the only other money guaranteed in full by the sovereign is cash. Being able to revert to cash at any time is what provides trust in the system. Can a CBDC that is also guaranteed in full provide the equivalent anchor to the system? The answer to this is important and citizens will need to be assured that digital money is at the very least not programmable (ie money with built-in rules that impose restrictions on how it is used). Also, it is difficult to see how digital cash can provide the anchor to the system if consumers are allowed to have only limited holdings of CBDCs (see below).

Limited holdings. If the amount of digital euros allowed per person is small, as is currently the intention (between €3000 and €4000 per person), then the digital euro risks never taking off. Why would the euro-area consumer opt to have one more account, this time at the central bank, if it is only of limited use? The amount allowed would need to be at least equal to the amount in deposits that is currently guaranteed (€100,000) for the consumer to have a motive to switch. Moreover, the consumer has ample payment alternatives in the euro area. If the worry is that payment alternatives are country-specific, then imposed coordination (like the IBAN system for bank deposits) would provide an adequate solution. Regulation therefore can achieve the same result with much less effort.

If on the other hand, the ECB were to allow unlimited amounts of digital euros to be held in the form of deposits, that could potentially be a game changer. Having all deposits guaranteed by the state is an attractive proposition for the consumer. But for her to switch, she would still need to see interest paid on these deposit accounts, or she would be left worse off. But interest-bearing deposits at the central bank would transform the roles of both the central banks and financial intermediaries. Commercial banks, which are currently mainly funded by deposits, would have to find alternative operating models. What would be the cost to the system of providing such a guarantee? Or would the amount of money in circulation necessarily have to decrease? The ECB and other central banks have not justified their interest in CBDCs as a way of altering the financial system. Rather, their thinking focuses on imposing as small a distortion as possible. With that in mind, digital euro holdings would remain very small.

European strategic autonomy. Last, the ECB also uses the argument of strategic autonomy to justify its interest in the project. What is the risk in current European payment systems that requires intervention? An ECB report on open strategic autonomy from a central banking perspective (ECB, 2023) mentioned that “non-European payment-related service providers handle around 70% of European card payment transactions”. A retail CBDC could address this concern though, as explained above, it might also distort competition and innovation in domestic payment systems. The strategic autonomy argument adds a layer of protectionism that would need to be very carefully justified economically and politically, or risk going against the EU’s own principles. De-risking is a much better argument: asking the question of how a digital equivalent of the sovereign currency can prepare society for what cannot be controlled (eg a system that is potentially fully digitalised and where the global appeal of CBDCs is high).

Communication gap. There is still a gap in the public’s understanding of the extent to which a digital euro is a useful innovation. The ECB needs to take time to explain the reasons for the digital euro in ways that will make a tangible difference to public perceptions. Without public support, the project will not take off. Evidence from countries that have launched CBDCs highlights the importance of clear understanding among citizens. In the meantime, the efforts the ECB has made to understand the complexities of a digital euro are very useful.

6 Conclusions

With 114 central banks worldwide at some stage of developing a digital equivalent of their sovereign currency, it is difficult to believe that the idea will not take off or that there is no added value in having a CBDC. However, there is a gap between central banks’ motivations for launching CBDCs and the general understanding of what that motivation is.

Central banks in countries where financial exclusion is a first-order problem are keen to use CBDCs to provide wide access to payments. But this is not useful if there is insufficient digital infrastructure and penetration in the country. Moreover, if the underlying sovereign currencies are weak and the institutions behind them lack credibility, the digital representation of the currency is not necessarily the tool for building trust. Nevertheless, inclusion and protecting consumers from the pitfalls of cryptocurrencies are good societal objectives that can provide visible welfare improvements.

But for countries or jurisdictions (like the euro area) where these problems are much less prevalent, the case for establishing a retail CBDC is not strong. That does not necessarily devalue the efforts to understand the choices and trade-offs that must be considered in the process of creating a CBDC. Moreover, as an attempt to prepare for a future in which the global financial system is more digitalised or there is a need to rethink intermediation, the ECB’s efforts are worthy investments.

However, more efforts should be made in terms of creating wholesale CBDCs to facilitate cross-border payments outside the euro area. There are immediate and sizeable savings to be had in both time and costs. Wholesale CBDCs also have the potential to change the international financial system and therefore the EU’s position in it. From the perspective of the US (and to a lesser extent the EU), as more countries seek to create wholesale CBDCs, the greater the threat of a fragmented global financial system, with other currencies taking a more prominent role.

It may be early days, but the EU must explore how to reap the benefits of new technology in wholesale payments, while protecting the global cooperation from which it benefits. Given the work it has already done on the retail digital euro and the EU’s very advanced payment methods, the ECB is uniquely positioned to help create the global standard, and in the process to help protect the EU’s global strategic interests.

Armelius, H., C.A. Claussen and A. Reslow (2020) ‘Withering Cash: Is Sweden ahead of the curve or just special?’ Working Paper Series No 393, Sveriges Riksbank, available at https://www.riksbank.se/globalassets/media/rapporter/working-papers/2019/no.-393-withering-cash-is-sweden-ahead-of-the-curve-or-just-special.pdf

BIS (2021) Inthanon-LionRock to mBridge: Building a multi CBDC platform for international payments, BIS Innovation Hub, Bank for International Settlements, available at https://www.bis.org/publ/othp40.htm

BIS (2022) Project mBridge: Connecting economies through CBDC, BIS Innovation Hub, Bank for International Settlements, available at https://www.bis.org/publ/othp59.htm

BIS (2023) ‘Digital payments make gains but cash remains’, CPMI Brief No 1, Bank for International Settlements, available at https://www.bis.org/statistics/payment_stats/commentary2301.pdf

Bowman, M. W. (2023) ‘Considerations for a Central Bank Digital Currency’, speech at Washington DC, 18 April, available at https://www.federalreserve.gov/newsevents/speech/bowman20230418a.htm

Chainalysis (2022) The 2022 Geography of Cryptocurrency Report, available at https://go.chainalysis.com/geography-of-crypto-2022-report.html

Claeys, G, M. Demertzis and K. Efstathiou (2018) ‘Cryptocurrencies and monetary policy’, Policy Contribution 10/2018, Bruegel, available at https://www.bruegel.org/policy-brief/cryptocurrencies-and-monetary-policy

Danmarks NationalBank (2022) ‘New types of digital money’, Analysis No. 8, available at https://www.nationalbanken.dk/en/publications/Documents/2022/06/ANALYSIS_no%208_New%20types%20of%20digital%20money.pdf

Demertzis, M. and C. Martins (2023) ‘Decentralised finance: good technology, bad finance’, Policy Brief 09/2023, Bruegel, available at https://www.bruegel.org/policy-brief/decentralised-finance-good-technology-bad-finance

ECB (2021) Eurosystem report on the public consultation on a digital euro, European Central Bank, available at https://www.ecb.europa.eu/pub/pdf/other/Eurosystem_report_on_the_public_consultation_on_a_digital_euro~539fa8cd8d.en.pdf#page=11

ECB (2022) Study on the payment attitudes of consumers in the euro area (SPACE) – 2022, European Central Bank, available at https://www.ecb.europa.eu/stats/ecb_surveys/space/html/ecb.spacereport202212~783ffdf46e.en.html

ECB (2023) ‘The EU’s Open Strategic Autonomy from a central banking perspective: Challenges to the monetary policy landscape from a changing geopolitical environment’, International Relations Committee Work stream on Open Strategic Autonomy No. 311, European Central Bank, available at https://www.ecb.europa.eu/pub/pdf/scpops/ecb.op311~5065ff588c.en.pdf

FIS (2023) The Global Payments Report, available at https://www.fisglobal.com/-/media/fisglobal/files/campaigns/global-payments-report/FIS_TheGlobalPaymentsReport_2023.pdf

Hebert, J., E. Moshammer and H. Barth (2023) ‘Wholesale central bank digital currency - the safe way to debt capital market efficiency’, European Stability Mechanism Discussion Paper Series/22, available at https://www.esm.europa.eu/system/files/document/2023-03/DP 22 FINAL.pdf

Lotz, S. and G. Rocheteau (2002) ‘On the Launching of a New Currency’, Journal of Money, Credit, and Banking 34(3): 563-588, available at https://doi.org/10.1353/mcb.2002.0003

Moronoti, B. (2022) ‘Revisiting the International Role of the US Dollar’, BIS Quarterly Review, December, available at https://www.bis.org/publ/qtrpdf/r_qt2212x.htm

Noll, F. (2023) ‘What Consumer Surveys Say about the Design of a U.S. CBDC for Retail Payments’, Payments System Research Briefing, Federal Reserve Bank of Kansas City, available at https://www.kansascityfed.org/research/payments-system-research-briefings/what-consumer-surveys-say-about-the-design-of-a-us-cbdc-for-retail-payments/

Panetta, F. (2022a) ‘For a few cryptos more: the Wild West of crypto finance’, speech at Columbia University, 25 April, available at

https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220425~6436006db0.en.html

Panetta, F. (2022b) ‘The digital euro and the evolution of the financial system’, speech to the European Parliament Committee on Economic and Monetary Affairs, 15 June, available at

https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220615~0b859eb8bc.en.html

Piazzesi, M. and M. Schneider (2022) ‘Credit lines, bank deposits or CBDCs? Competition and efficiency in modern payment systems’, mimeo, available at https://web.stanford.edu/~piazzesi/CBDC.pdf

Reserve Bank of India (2022) ‘Concept Note on Central Bank Digital Currency’, October, available at https://rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=1218#CP3

Swedish Government (2023) The state and the payments, Summary of the report of Betalningsutredningen, Swedish Government Official Reports SOU 2023:16, available at https://www.regeringen.se/contentassets/c01377cf65424cf0b12addf64c04374a/english-summary-the-state-and-the-payments.pdf

White, T. and A. White (2022) ‘Figure of the week: The rapidly increasing role of cryptocurrencies in Africa’, Africa in Focus, Brookings, 27 January, available at https://www.brookings.edu/blog/africa-in-focus/2022/01/27/figure-of-the-week-the-rapidly-increasing-role-of-cryptocurrencies-in-africa/

Williamson, S. (2022) ‘Central Bank Digital Currency: Welfare and Policy Implications’, Journal of Political Economy 130(11): 2829-2861, available at https://www.journals.uchicago.edu/doi/10.1086/720457

Zamora-Pérez, A., E. Coschignano and L. Barreiro (2022) ‘Ensuring adoption of central bank digital currencies – An easy task or a Gordian knot?’, ECB Occasional Paper Series No 307, European Central Bank, available at https://www.ecb.europa.eu/pub/pdf/scpops/ecb.op307~c85ee17bc5.en.pdf

[1] See the Atlantic Council central bank digital currency tracker: https://www.atlanticcouncil.org/cbdctracker/.

[2] See European Central Bank press release of 28 April 2003, ‘Eurosystem to explore new technologies for wholesale central bank money settlement’, https://www.ecb.europa.eu/press/pr/date/2023/html/ecb.pr230428~6a59f44e41.en.html.

[3] See Danmarks Nationalbank (2022) for more detail.

[4] This is the basic argument, though most central banks agree that CBDC accounts will be managed by private institutions.

[7] According to FIS (2023), the value of cash transactions in Sweden was 8 percent of the total value of point-of-sale transactions.

[8] See State House, Abuja press release of 25 October 2021, ‘At Official Launch of eNaira, President Buhari Says Digital Currency will Boost Nigeria’s GDP by $29 bn in 10yrs’, https://statehouse.gov.ng/news/at-official-launch-of-enaira-president-buhari-says-digital-currency-will-boost-nigerias-gdp-by-29-bn-in-10yrs/.

[10] See for example Liquid Group/NPCI International Payments Limited press release of 13 September 2021, https://en.prnasia.com/releases/apac/liquid-group-to-power-upi-qr-accep….

[12] Grace Broadbent, ‘Brazil wants to build on digital payment success with CBDC pilot’, Insider Intelligence, 8 March 2023, https://www.insiderintelligence.com/content/brazil-wants-build-on-digital-payment-success-with-cbdc-pilot.

[13] Paul Blustein, ‘Can a Central Bank Digital Currency Work? The Bahamas Offers Lessons’, Centre for International Governance Innovation, 14 December 2022, https://www.cigionline.org/articles/can-a-central-bank-digital-currency-work-the-bahamas-offers-lessons/.

[14] Iori Kawate, ‘Chinese cities begin to pay public employees in digital yuan’, Nikkei Asia, 5 May 2023, https://asia.nikkei.com/Business/Markets/Currencies/Chinese-cities-begin-to-pay-public-employees-in-digital-yuan.

[15] Web3Africa, ‘One year into Nigeria’s adoption of the eNaira’, Further Africa, 8 November 2022, https://furtherafrica.com/2022/11/08/one-year-into-nigerias-adoption-of-the-enaira/.

[16] Camomile Shumba, ‘Zimbabwe to Introduce Gold-Backed Digital Currency: Report’, CoinDesk, 24 April 2023, https://www.coindesk.com/policy/2023/04/24/zimbabwe-to-introduce-gold-backed-digital-currency-report/.

[17] See European Central Bank press release of 21 March 2023, ‘Successful launch of new T2 wholesale payment system’, https://www.ecb.europa.eu/press/pr/date/2023/html/ecb.pr230321~f5c7bddf6d.en.html.

[18] See European Central Bank press release of 28 April 2023, ‘Eurosystem to explore new technologies for wholesale central bank money settlement’, https://www.ecb.europa.eu/press/pr/date/2023/html/ecb.pr230428~6a59f44e41.en.html and https://www.newyorkfed.org/aboutthefed/nyic/facilitating-wholesale-digital-asset-settlement.

[19] See Financial Stability Board press release of 13 October 2020, ‘FSB delivers a roadmap to enhance cross-border payments’, https://www.fsb.org/2020/10/fsb-delivers-a-roadmap-to-enhance-cross-border-payments/.

[20] Blockchain is a form of DLT in which all transactions are recorded and organised in linked digital blocks. For more details on DLT and blockchain see Demertzis and Martins (2023).

[21] See Maria Demertzis, ‘Central Bank digital currencies as weapons of finance’, Bruegel, 14 December 2022, https://www.bruegel.org/comment/central-bank-digital-currencies-weapons-finance.

[22] See https://www.ecb.europa.eu/paym/digital_euro/shared/pdf/Digital_euro_project_timeline.en.pdf.

[24] See Bank of Japan press release of 9 October 2020, ‘The Bank of Japan's Approach to Central Bank Digital Currency’, https://www.boj.or.jp/en/about/release_2020/data/rel201009e1.pdf

[25] See https://www.swissbanking.ch/en/topics/digitalisation-innovation-and-cyber-security/digital-currencies-and-payment-systems. Also, confirmed in January 2023 by a Swiss National Bank governing board member; see https://www.cnbc.com/video/2023/01/12/swiss-national-bank-says-it-doesnt-need-a-cbdc.html.

[26] See UK Parliament press release of 13 January 2022, ‘Central bank digital currencies: a solution in search of a problem?’ https://www.parliament.uk/business/lords/media-centre/house-of-lords-media-notices/2022/january-2022/central-bank-digital-currencies-a-solution-in-search-of-a-problem/.

[27] Finance.Swiss, ‘Why the Swiss National Bank is examining the usability of CBDCs’, 4 October 2021, https://finance.swiss/en/news-and-events/why-the-swiss-national-bank-is-examining-the-usability-of-cbdcs/.