Maria Demertzis

Maria Demertzis is a Senior fellow at Bruegel and part-time Professor of Economic Policy at the Florence School of Transnational Governance at the European University Institute. She was Bruegel’s Deputy Director until December 2022. She has previously worked at the European Commission and the research department of the Dutch Central Bank. She has also held academic positions at the Harvard Kennedy School of Government in the USA and the University of Strathclyde in the UK, from where she holds a PhD in economics. She has published extensively in international academic journals and contributed regular policy inputs to both the European Commission's and the Dutch Central Bank's policy outlets. She contributes regularly to national and international press and has regular column that appears twice a month in various EU newspapers and on Bruegel’s opinion page.

Disclaimer of external interests

Featured work

Industrial policy for economic security

Spend it at home: current account surpluses in the EU

EU leadership needs to identify the factors that hold investment back and the incentives that could persuade investors to stay in Europe

The European Central Bank, inflation tolerance and the last mile

The European Central Bank’s timid operational framework update

The European Central Bank announced limited changes to its operational framework – which is probably right given current uncertainty

Two years later: addressing long-term consequences of Russia’s invasion of Ukraine

The event marked the anniversary of Russia's invasion of Ukraine, focusing on discussions about sanctions, accession, and energy

A confused EU

The state of financial knowledge in the European Union

Financial literacy is essential in modern economies, where saving and preparing for retirement has shifted increasingly to the individual.

Two years later

The EU’s ambitions: scale, strategic investments and skills

Accelerating strategic investment in the European Union beyond 2026

A potential long-term EU approach to the financing of strategic objectives.

Macroeconomic policy frameworks in the EU: in need of renewal

Artificial intelligence and energy consumption

It is difficult to evaluate whether the green transition will compensate for AI energy consumption.

Why I’m not concerned about the billions of central bank “losses”

Central banks’ losses are not a cause for concern

The limits of the effectiveness of EU sanctions on Russia

There is no such thing as normality

Greece paid a high price for learning that it must reform and conform. The rest of the world will pay a much higher price for its unruly politics.

Capital Markets Union, or else what?

Managing Expectations: Inflation and Monetary Policy

Launch of one of the IMF World Economic Outlook analytical chapters

The digital euro’s communication gap

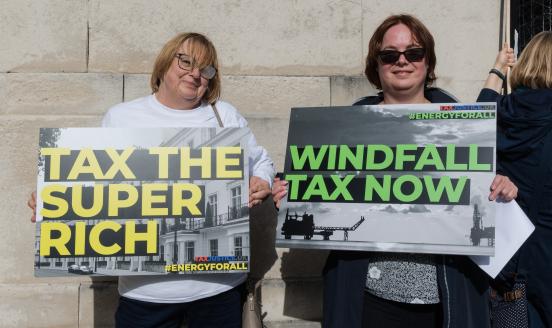

We’ve got it wrong on windfall taxes

The tyranny of EU treaties

It is an overdue question whether those agreements are still fit for purpose or if they must be changed.

Bruegel Annual Meetings, 6-7 September 2023

A symphony in progress: shaping a new agenda for Europe

EU trade and investment following Russia's illegal invasion of Ukraine

On immigration

The EU must collectively appreciate the human capital that enters its borders as opportunities rather than just risks.

From economic policy to economic statecraft

The US and euro area must move faster on their digital currencies for wholesale purposes

How can de-risking lead to greater economic security?

The value added of central bank digital currencies

Can Central Bank digital currencies be considered as the weapons of finance?

The value added of central bank digital currencies: a view from the euro area

Central bank digital currencies do have added value, but this is not the same for every country.

De-risking as an economic strategy

European public opinion remains supportive of Ukraine

Public support for Ukraine is holding up in allied countries, but preparations should be made for scenarios in which support ebbs away.

Looking backwards not forwards: why has the European Central Bank been slow to react?

Bank of Russia’s immobilised assets: what happens next?

De-dollarisation

A change of tack on EU-China relations

Decentralised finance: good technology, bad finance

Given the importance of digitalisation, it is fair to ask whether these digital decentralised services will become established and normalised.

Doing ‘whatever it takes’ to save the banks

Could crypto assets jeopardise the financial system?

How much will the EU pay Russia for fossil fuels over the next 12 months?

With sanctions incomplete, the European Union could pay Russia about €30 billion for fossil fuels in the next year.

There are no shortcuts to finance

The basic underpinnings of regulation, reserves and (legal) recourse are missing in decentralised finance, or DeFi.

The ECB as part of an imperfect architecture

One year in ten numbers

A reflection on how the world has changed since the Ukraine invasion, through the lens of ten revealing numbers.

Are sanctions against Russia working?

The Russian economic model is totally dependent on an industry that will become extinct.

The EU response to the United States Inflation Reduction Act

The EU must avoid the trap of having to take sides in the conflict between the US and China.

Concessional climate finance: the Bridgetown Initiative

Central Bank digital currencies as weapons of finance?

An analysis on how CBDCs can be used in emerging economies to include more people in financial systems.

Fleeing the flood: is the EU ready for climate migration?

How should EU policymakers tackle the growing problem of climate migration?

Is there social added value in digital currencies?

Testimony on crypto and CBDCs to the Fintech committee of the European Parliament.

Why do European countries join the EU?

The direction in which the EU will evolve in the future will depend on finding a minimum common denominator.

NextGenerationEU: an underused facility?

The RRF has great potential to become an instrument for ‘insuring’ EU countries against common shocks.

Political cooperation does not mean economic dependence

A robust economic system that can sustain shocks of any nature, including political, is needed.

How have sanctions impacted Russia?

In this paper we assess both the immediate economic impact and the likely longer-term impact of sanctions on the Russian economy.

The critical importance of chips – and having a plan for them

The Chips Act is the first, and an imperfect, step towards a long-term strategy that still needs to be designed.

The importance of being fiscally earnest

As interest rates increase over the course of the next few months, there are bound to be asset-price corrections & rethinking of investment decisions.

A cold winter

Reforming energy markets must aim to make them less vulnerable to crises such as today’s, even if such crises are rare.

The Sound of Economics Live: Assessing the State of the Union 2022

In this episode, we look at the State of the Union address delivered by Ursula von der Leyen, President of the European Commission.

Bruegel Annual Meetings, 6-7 September 2022

The Annual Meetings are Bruegel's flagship event which gathers high-level speakers to discuss the economic topics that affect Europe and the world.

EU Enlargement in a New Light

A collection of articles compiled following a joint Bruegel-Intereconomics event on EU enlargment.

Euro-dollar parity: beyond symbolism

Lack of certainty that the euro will stay prevents it from a greater international role. Until addressed, the dollar will continue to be hegemon.

An analysis of central bank decision-making

Bank of England MPC celebrates 25 years and we use this occasion to compare its decision-making process to that of the ECB

Is MiCA the end of the crypto wild-west?

As the process of digitalisation makes ideas around decentralised finance more relevant, there will be an increasing need for monitoring

EU enlargement in a new light

What would increase government support around EU enlargement, and what role could membership play in future peace talks?

A new European tool to deal with unjustified rising spreads

The ECB needs a new tool to prevent the current rise in spreads, triggered by monetary policy tightening, from escalating into a new euro-area crisis.

Ukraine and what it means for European Union enlargement

The real issue for EU leaders when they discuss Ukraine’s application at a 23-24 June summit and beyond, is what kind of club the EU should be.

Fragmentation risk in the euro area: no easy way out for the European Central Bank

The ECB should design a specific tool that will accompany interest rate hikes to neutralise the risk of fragmentation directly for countries facing it

Three headaches for the European Central Bank

Once again, the limits of EMU architecture are visible and will require a rethink.

Adapting to European technology regulation: A conversation with Brad Smith, President of Microsoft

Invitation-only event featuring Brad Smith, who discussed the regulation of big tech in the context of Europe's digital transformation.

Buy now, pay later: the age of digital credit

A relatively new fintech market, BNPL is currently not regulated in the EU, meaning that consumers do not have the same protection level as they do fo

How are crises changing central bank doctrines?

How is monetary policy evolving in the face of recent crises? As central banks take on new roles, how accountable are they to democratic institutions?

What is in store for Euro area economies?

ECB Executive Board Member Philip Lane discussed the outlook for Euro area economies.

Repurposing the peace dividend

The war in Ukraine has brought an end to a 60-year period in which Europe has enjoyed a peace dividend, an amount released by reducing defence expendi

A sanctions counter measure: gas payments to Russia in rubles

A requirement for gas to be paid for in rubles is a way for Russia to side-step central bank sanctions.

War on Ukraine: the day after

The international community will have to restart the long process of de-escalation in order to preserve peace. We have a long climb ahead.

Tackling future risks to banks

How to address vulnerabilities in banks in the coming years?

War in Ukraine: reflections on the economic consequences for Russia

Sergei Guriev joined us to discuss how the Russian invasion of Ukraine will affect the economies of Russia and the world.

The week inflation became entrenched

The events that have unfolded since 24 February have solved one dispute: inflation is no longer temporary.

The weakness of average inflation targeting

Introducing average over time without defining what this means is counterproductive and current levels of inflation in the US will sooner or later exp

A debate on fiscal rules and the new monetary strategy

Presentation of the Yearbook of the Euro 2022.

The Euro in 2022

An annual review of the euro published jointly by Fundación ICO and Fundación de Estudios Financieros to expand knowledge, raise awareness of the sing

Venture capital: a new breath of life for European entrepreneurship?

Whether the dynamism of European venture capital of the past two years can be sustained and kick start a credible alternative to bank finance in the E

A new EU treaty to fight climate change

Thirty years after Maastricht, a new treaty is needed: one that will commit the EU to tackling its greatest challenge in the decades ahead, climate ch

Non-fungible tokens (NFTs): the next chapter in crypto

As with any new technology, exciting opportunities are being created, but similarly there are risks.

New model for growth in Europe

Contribution to the European Economic and Social Committee info newsletter of January 2022.

Productivity and the role of Global Value Chains

The 3rd MICROPROD Policy Dialogue will tackle how Global Value Chains (GVC) and productivity affect the fourth industrial revolution.

The euro comes of age

A well-functioning euro reflects a degree of unity that allows the EU to credibly claim a position at the global table and therefore help shape the po

A role for the Recovery and Resilience Facility in a new fiscal framework

Discussions on reforming European Union fiscal rules must consider a more permanent but targeted role for the Recovery and Resilience fund to meet cli

Policy coordination failures in the euro area: not just an outcome, but by design

Discussions on the fiscal framework should aim to correct its procyclical nature with a view to promoting more cooperative outcomes.

Inflation ideology: camp permanent or camp temporary?

Policy focus should be on tackling uncertainties by being able to tackle as many scenarios as possible.

L’Union européenne et les États-Unis, un an après

Après une année troublée par Kaboul et AUKUS, qu'avons-nous retenu de l'an I de la présidence Biden ? Maria Demertzis revient sur les évènements marqu

Inside the European crises: a conversation with Marco Buti

At this event Marco Buti discusses his new book, in which he gives an insiders look at European policy making.

Fiscal policy and rules after the pandemic

What are the possibilities for shaping the new fiscal policy?

Covid recovery and the green transition: What can promotional banks do?

What is the role of promotional banks in financing the green transition?

Growth and inflation after the pandemic in the EU

Countries hit comparatively hard during the financial crisis, helped also by domestic and European policies, are bouncing back from the pandemic faste

Phasing out COVID-19 emergency support programmes: effects on productivity and financial stability

How can European countries phase out the COVID-19 support measures without having a negative impact on productivity and financial stability?

COVID-19 financial aid and productivity: has support been well spent?

In the EU, this support has prevented the emergence of unemployment and has kept average employment high.

The socioeconomic effects of COVID-19 on women

The pandemic has disproportionately affected women both professionally and at home. Although the gender gap in labour force participation since the on

Is the ECB right to take on climate change?

The real issue here is not that the ECB takes a very sizeable risk by pursuing climate objectives but rather, that it cannot afford not to. And by doi

Understanding the socioeconomic effects of the COVID-19 pandemic on women

Testimony before the European Parliament's Committee on Economic and Monetary Affairs (ECON) on the consequences of the pandemic on women.

The inconsistency in global strategic relations

All of this talk on strategic retrenchment and autonomy is the language of escalation, not of appeasement and collaboration.