Catarina Martins

PhD Student, Stockholm School of Economics

Catarina worked at Bruegel as a Research analyst until July 2023. She studied her BSc in Economics at the University of Porto. She then pursued an international quantitative MSc in Economics via the QTEM Network, studying the first semester at the University of Porto, the second at HEC Montréal and the third semester at Solvay Brussels School of Economics and Management (SBS-EM).

Before joining Bruegel, Catarina worked at the European Central Bank in the Directorate General Market Operations, the department responsible for the implementation of Monetary Policy. As part of DG-M, Catarina joined the Money Market and Liquidity division, where she worked very closely with topics related to financial markets, benchmark reforms and liquidity developments. She had previously done a quantitative internship in Banco de Portugal at BPLim Microdata Research Laboratory of the Economics and Research department.

Catarina is interested in various areas of economics and financial topics and has developed over time a fascination for data-related work. She is fluent in Portuguese and English and has a good command of Spanish and French.

Featured work

Russian foreign trade tracker

EU trade and investment following Russia's illegal invasion of Ukraine

The value added of central bank digital currencies

Can Central Bank digital currencies be considered as the weapons of finance?

The value added of central bank digital currencies: a view from the euro area

Central bank digital currencies do have added value, but this is not the same for every country.

Decentralised finance: good technology, bad finance

Given the importance of digitalisation, it is fair to ask whether these digital decentralised services will become established and normalised.

The potential of sovereign sustainability-linked bonds in the drive for net-zero

Sovereign SLBs could help incentivise climate policies in EU countries, and accelerate emission reductions.

Funding the Green Deal: green bonds and alternative options for EU sovereign debt managers

Invitation-only roundtable to discuss the EU public sector green bond market

The impact of the Ukraine crisis on international trade

The direct aim of trade sanctions seems to have been achieved, while Russia’s capacity to finance the war from fossil fuel revenues is bound to shrink

Is there social added value in digital currencies?

Testimony on crypto and CBDCs to the Fintech committee of the European Parliament.

Tackling inflation: learning from the European Central Bank's six lapses

While mistakes unduly constrained rate hikes, gradual tightening is the right approach along with a new instrument to address energy bottlenecks.

The ECB’s monetary tightening: a belated start under uncertainty

A paper assessing the ECB policy errors that occurred in the last year, and the appropriateness of the current monetary policy stance of the ECB.

Russia’s huge trade surplus is not a sign of economic strength

Russia has recorded a record trade surplus, but more than half of its increase is due to the collapse of imports.

An analysis of central bank decision-making

Bank of England MPC celebrates 25 years and we use this occasion to compare its decision-making process to that of the ECB

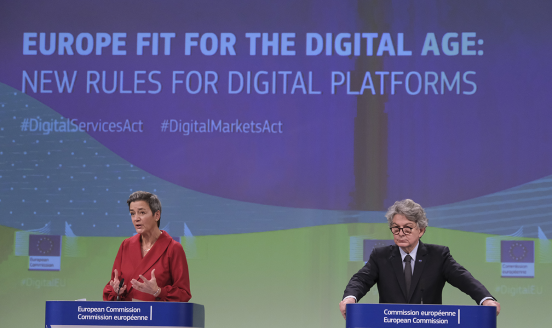

Insights for successful enforcement of Europe’s Digital Markets Act

The European Commission will enforce digital competition rules against big tech; internally, it should ensure a dedicated process and teams.

Close cooperation for bank supervision: The cases of Bulgaria and Croatia

In-depth analysis on the banking supervision cooperation in Bulgaria and Croatia prepared for the European Parliament's Committee on Economic and Mone

Which platforms will be caught by the Digital Markets Act? The ‘gatekeeper’ dilemma

The scope of the Digital Markets Act has emerged as one of the most contentious issues in the regulatory discussion. Here, we assess which companies c

Including home-ownership costs in the inflation indicator is not just a technical issue

The ECB’s preferred method to include owner-occupied housing services in the inflation indicator would involve an asset price.

The new euro area inflation indicator and target: the right reset?

In-depth analysis on the European Central Bank's revised inflation target prepared for the European Parliament's Committee on Economic and Monetary Af