Dirk Schoenmaker

Dirk Schoenmaker is a Non-Resident Fellow at Bruegel. He is also a Professor of Banking and Finance at Rotterdam School of Management, Erasmus University Rotterdam and a Research Fellow at the Centre for European Policy Research (CEPR). He has published in the areas of sustainable finance, central banking, financial supervision and stability and European financial integration.

Dirk is author of ‘Governance of International Banking: The Financial Trilemma’ (Oxford University Press) and co-author of the textbooks ‘Financial Markets and Institutions: A European perspective’ (Cambridge University Press) and ‘Principles of Sustainable Finance’ (Oxford University Press). He earned his PhD in economics at the London School of Economics.

Before joining RSM, Dirk was Dean of the Duisenberg school of finance from 2009 to 2015. From 1998 to 2008, he served at the Netherlands Ministry of Finance. In the 1990s, he served at the Bank of England. He is a regular consultant for the IMF, the OECD and the European Commission.

Disclaimer of external interests

Featured work

Price stability is all about climate change

The European Central Bank should bring in cheaper greening funding for banks, to offset the impact of high interest rates on the energy transition

Low-carbon allocation in monetary policy implementation

A new integrated-value assessment method for corporate investment

To contribute more to the green transition, companies should start to make investment decisions based on integrated-value assessment.

A brown or a green European Central Bank?

The European Central Bank portfolio is skewed towards the brown economy, reflecting a bias in the market.

Green certificates: a better version of green bonds

"The current design of green bonds means they aren't fulfilling their potential. We propose an alternative: issuance of regular bonds with attached gr

Boosting the resilience of Europe’s financial system in the coronavirus crisis

Europe has a heavily bank-based financial structure, but bank-based financial structures are associated with higher systemic risk than market-based fi

The impact economy: balancing profit and impact

The impact economy model is well-positioned to find an appropriate balance across all three pillars: economic, social and environmental.

Should Denmark and Sweden join the banking Union?

Though outside the euro area, Denmark and Sweden could benefit from joining the European Union’s banking union.

Insuring for pandemic-related losses, in this crisis and future ones

What remedies and lessons for the insurance sector in the time of pandemic?

A green recovery

Government policy faces various challenges. Before the COVID-19 outbreak, the European Union set ambitious targets to reduce carbon emissions. Now in

A European approach to fund the coronavirus cost is in the interest of all

We had not seen a common challenge as clear as this pandemic. The sum of national actions and programs is likely to be insufficient.

Climate change and the role of central banks

What connections exist between central banks and climate change, and what are the resulting implications?

Soaring house prices in major cities: how to spot and moderate them

This article examines whether there are regional differences in house price growth within European countries and find a stronger cyclical pattern in c

Principles of sustainable finance

How can finance help save the planet?

Greening monetary policy: An alternative to the ECB’s market-neutral approach

The ECB’s market-neutral approach to monetary policy undermines the general aim of the EU to achieve a low-carbon economy. An alternative tilting appr

Greening monetary policy

The author proposes a tilting approach to steer the allocation of the Eurosystem’s assets and collateral towards low-carbon sectors, which would reduc

How to speed up sustainable finance?

Which steps are needed to really change current practices and speed up sustainable finance?

Sustainable investing: How to do it

Sustainable investment is gaining momentum in Europe, but its current proposed taxonomy might hinder innovation in the field. In this Policy Contribut

European bank mergers: domestic or cross-border?

As the European economy recovers from the global financial crisis, bank mergers are back on the agenda. While cross-border mergers have been predicted

The changing fortunes of central banking

What are the major challenges of central banks today? This book discusses the developing role of central banks and the policies they pursue in seeking

Building a stable european deposit insurance scheme

Deposit insurance, like any insurance scheme, raises moral hazard concerns.

Climate change adds to risk for banks, but EU lending proposals will do more harm than good

Climate change is a relevant risk factor for the banking sector, but the European Commission's plan to lower capital requirements for greener investme

A ‘twin peaks’ vision for Europe

The organisation of the European Supervisory Authorities (ESAs) is based on a sectoral approach with one ESA for each sector, with separate authoritie

The time is right for a European Monetary Fund

Two of the banking union’s pillars – common European supervision by the European Central Bank and common European resolution by the Single Resolution

Spotting excessive regional house price growth and what to do about it

Rapidly rising house prices are a well-known source of financial instability. This Policy Contribution examines whether there are regional differences

How can sustainable finance contribute to the Paris climate goals?

What is the role of sustainable finance in reaching the Paris Climate goals? What are the specific proposals towards this goal and which are the chall

Nordea’s move to the Banking Union is no surprise

Scandinavian banking giant is moving to Finland. This is not just a flight from increasing taxes and tighter regulation in its current home, Sweden. N

Bruegel Annual Meetings 2017, 7-8 September

The Annual Meetings are Bruegel’s flagship event.

Building positive incentives: the potential of coalitions for sustainable finance

We need to move towards more sustainable, long-term thinking in the corporate and financial worlds. Coalitions of willing actors could play a role in

How to make finance a force for sustainability

Traditional finance focuses on financial return, considering the financial sector separate from both society and the environment. In contrast, sustain

Investing for the common good: a sustainable finance framework

Traditional finance focuses solely on financial return and risk. By contrast, sustainable finance considers financial, social and environmental return

A macro approach to international bank resolution

As regulators rush to strengthen banking supervision and implement bank resolution regimes, a macro approach to resolution is needed that considers bo

Can EU actors keep using common law after Brexit?

English common law is the choice of law for financial contracts, even for parties in EU members with civil law systems. This creates a lucrative legal

We need a European Monetary Fund, but how should it work?

Many voices are calling for the ESM to be developed into a fully-fledged European Monetary Fund. But what changes would this entail, and how could the

Les banques européennes se retirent-elles de la scène internationale?

Dirk Schoenmaker conducts a comparative analysis of global systemically important banks (G-SIBs) and examines their evolution (Note: this paper is ava

The Banking Union: An Overview and Open Issues

Dirk Schoenmaker's chapter in 'The Palgrave Handbook of European Banking', a handbook that collates the expertise and research of leading academic and

EBA relocation should support a long-term ‘twin peaks’ vision

As the Commission launches a review of European financial supervision, the authors argue that Europe needs to move towards a twin peaks model – dividi

A call for uniform sovereign exposure limits

Banks’ sovereign bond holdings were at the heart of the euro-sovereign crisis. The concentration of domestic bonds created a vicious cycle between gov

What happened to global banking after the crisis?

The global financial crisis allegedly led to the end of global banking. However, Dirk Schoenmaker finds that reports of the demise of global banking a

Institutional investors and home bias in Europe’s Capital Markets Union

Zsolt Darvas and Dirk Schoenmaker find strong support for the hypothesis that the larger the assets managed by institutional investors, the smaller th

Brexit should drive integration of EU capital markets

Brexit offers EU-27 countries a chance to take some of London’s financial services activity. But there is also a risk of market fragmentation, which c

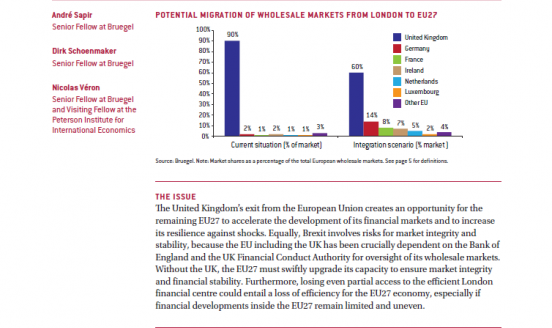

Brexit and the European financial system

Brexit will lead to a partial migration of financial firms from London to the EU27. This Policy Contribution provides a comparison between London and

Making the best of Brexit for the EU27 financial system

The EU27 needs to upgrade its financial surveillance architecture to minimise the financial market fragmentation resulting from Brexit

Tackling Europe’s non-performing loans crisis: restructuring debt, reviving growth

How can we connect the different initiatives for NPL resolution and identify an agenda that is shared between EU, national authorities and the private

Amsterdam’s boom-bust housing market needs its own mortgage limits

House prices in the Netherlands are on the rise again. But at the local level the pattern is very uneven: house prices in major cities are rising fast

Analysis of developments in EU capital flows in the global context (3rd annual report)

The purpose of this report is to provide a comprehensive overview of capital movements in Europe in a global context.

European insurance union and how to get there

What are the arguments for and against centralisation of insurance supervision? What would be the scope of a possible insurance union, and what would

The impact of the legal and operational structures of euro-area banks on their resolvability

Following the financial crisis, the question of how to handle a big bank’s collapse has come to the fore. This Policy Contribution evaluates the obsta

The impact of the legal and operational structures of euro-area banks on their resolvability

This paper evaluates the obstacles to resolvability that the legal and operational structures of the large

euro-area banks could present, assuming th

Integrating stress tests within the Basel III framework

How can we integrate supervisory stress tests with the Basel III framework in a macroprudentially coherent and transparent manner?

Competition policy and regulation in the banking sector

Reform of the European Union financial supervisory and regulatory architecture and its implications for Asia

This Working Paper reviews recent developments in the EU’s financial supervisory and regulatory architecture with a view to draw out lessons for regi

Stealing London’s financial crown would bring both benefits and responsibilities

After Brexit, several major cities across the EU27 are looking to take over London's financial activity. While there are plenty of benefits in hosting

Review of the EU Macro-Prudential Framework

The European Commission held a public hearing on the review of the eu macro-prudential framework on 7 November 2016.

Cross-border insurance in Europe

The cross-border insurance sector is becoming increasingly strong in Europe. This event looks at the current cooporation between national insurance su

Delivering a Green Capital Markets Union

Climate change presents a growing threat to financial stability. This seminar looked at how the European Union could respond by delivering a Green Cap

Fiscal capacity to support large banks

This Policy Contribution outlines a fiscal cost scenario for the recapitalisation of large banks

during a severe systemic crisis.

Taxpayer should not facilitate risky bank cocos

Directly after the great financial crisis, the Basel Committee demanded straight equity as regulatory capital, as several debt forms of regulatory cap

The future of financial services in the UK following the Brexit vote

UK House of Lords EU Sub-Committee on Financial Affairs' call for evidence on the future of Financial Services in the UK following the vote to leave t

Bruegel Annual Meetings 2016, 6-7 September

The Annual Meetings are a high point in Bruegel's calendar.

Bruegel Annual Meetings 2016

The Annual Meetings are a high point in Bruegel's calendar.

Now is the time to open Strasbourg’s ‘Bronislaw Geremek’ European University

It is the right time to revive the proposal made 10 years ago by Bronislaw Geremek and Jean-Didier Vincent to create a truly European University in th

Lost passports: a guide to the Brexit fallout for the City of London

If the UK cannot secure a ‘Norway’ deal and stay within the internal market, the UK will lose passporting rights for financial services and access to

Losing “EU passport” would damage City of London

If the UK cannot secure a “Norway” deal and stay within the internal market, the UK will lose the passporting rights which make London attractive as a

European banking supervision: the first eighteen months

After its first 18 months, how has the SSM affected the European banking system?

European banking supervision: compelling start, lingering challenges

The new European banking supervision system is broadly effective and, in line with the claim often made by its leading officials, tough and fair, but

European banking supervision: the first eighteen months

The Blueprint provides a review of the first 18 months of European banking supervision. It reviews the overall situation and the

situation in a numbe

Financial risks and opportunities in the time of climate change

The current unsustainable use of our environment can lead to financial crisis. To address this risk, financial institutions should measure their exp

The United States dominates global investment banking: does it matter for Europe?

Europe’s banks are in retreat from playing a global investment banking role, and this trend is likely to continue in the future. What will be the cons

Why euro-zone ‘outs’ should join banking union

Joining the banking union could provide a stable arrangement for managing financial stability for the UK and other non-Euro countries.

European banking union: should the 'outs' join in?

To address coordination failures between national institutions regulating banks, we need supranational policies. Banking union encourages further int

Should the ‘outs’ join the European banking union?

This paper analyses the banking linkages between the nine ‘outs’ and 19 ‘ins’ of the banking union. It finds that the out countries could profit from

Impact of regulatory and supervisory reform on the banking sector

Central banking after the great recession

Have Central Banks lost their ability to control domestic inflation? Are macroprudential tools sufficient to ensure financial stability? Do new moneta

Can a global climate risk pool help the most vulnerable countries?

Extreme climate events related to global warming will happen somewhat randomly and could have a huge cost for the most vulnerable countries. A global

Macroprudential supervision: from theory to policy

While there is now consensus that financial supervision has to focus on the aggregate (macroprudential), in addition to the individual (microprudentia

Completing the Banking Union

The Five Presidents’ report published in July 2015 argues that completing the banking union should be one of the most immediate steps of the broader p

Firmer foundations for a stronger European Banking Union

The idea of Banking Union has been instrumental in arresting the euro sovereign crisis. However the long-term rationale behind Banking Union is relate

Cyprus: Financing the Recovery

As Cyprus looks ahead to post-bailout growth, what lessons have been learnt from the crisis and subsequent bank restructuring?

What options for European deposit insurance?

The aim of this blog post is to clarify different options of how to organize European deposit insurance without yet settling on the best option. We a

Bruegel's Annual Conference

Bruegel's Annual Conference is a closed-door event with three panel discussions on banks and capital markets, growth perspectives, and monetary policy