Boosting the resilience of Europe’s financial system in the coronavirus crisis

Europe has a heavily bank-based financial structure, but bank-based financial structures are associated with higher systemic risk than market-based fi

Bank-based and market-based financial structures mobilise savings, allocate capital, price risks and absorb shocks in different ways. While banks conduct financial intermediation and bear risks on their balance sheets, markets channel resources directly from savers to borrowers, serving as platforms via which equity and debt securities are priced, distributed and traded. A key question is whether differences in financial structure are associated with systemic risk, which has implications for public policy efforts to sustain real economic activity.

The literature published after the Great Financial Crisis of 2008 generally speaks in favour of market-based financial systems. This is because financial crises are more severe in bank-based than in market-based financial structures (see eg Gambacorta et al, 2014). In bank-based structures, systemic risk may be greater because banks are highly leveraged and interconnected institutions, with sizable maturity mismatches on their balance sheets and direct linkages to the payments infrastructure. By contrast, systemic risk may be lower in market-based financial structures since markets channel resources straight from savers to borrowers, and are less dependent on intermediation through highly leveraged and interconnected institutions with large balance-sheet mismatches and links to payments systems. Moreover, market financing recovers quickly during banking crises and, if well-developed, functions as an alternative to financial intermediation by banks (Becker and Ivashina, 2014; Crouzet, 2018). This reduces disruption to the flow of financial services and thus serves to protect the real economy.

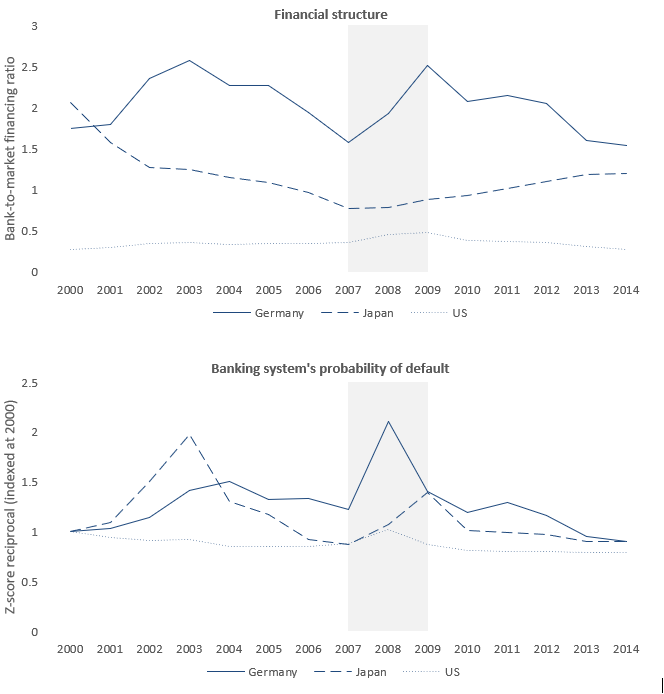

Differences in countries’ financial structures correspond to differences in the short-term dynamics of the probability of default of banking systems (Figure 1). During the financial crisis (indicated by the shaded area in Figure 1), the banking system’s default probability increased only a little in the United States, which has a relatively market-based financing system. But it increased substantially in Germany and Japan, which have relatively bank-based financial structures. This suggests that differences between countries in terms of their financial structures indeed help explain differences in financial stability.

Figure 1: Banking system default probabilities in bank- and market-based financial structures

Source: Bruegel based on World Bank Global Financial Development Database (GFDD; July 2018 version). Notes: This figure shows two time-plots of, respectively, a country’s financial structure and the default probability of its banking system. Financial structure is represented by the ratio of a country’s outstanding bank credit over the sum of non-financial sector debt and stock market capitalisation. The banking system’s probability of default is measured by the reciprocal of the Z-score of a country’s banking system, indexed at 2000. The shaded area represents the Global Financial Crisis.

To empirically explore the relationship between financial structure and systemic risk, we estimated linear and non-linear regression models for a panel of 22 Organisation for Economic Cooperation and Development countries (Bats and Houben, 2020). The financial structure indicator represents the ratio of bank credit to total non-financial debt and stock market capitalisation. The systemic risk indicator measures the nominal amount of the expected equity capital shortfall of stock-listed financial institutions, including non-banks. Two other systemic risk indicators are used for separate robustness checks.

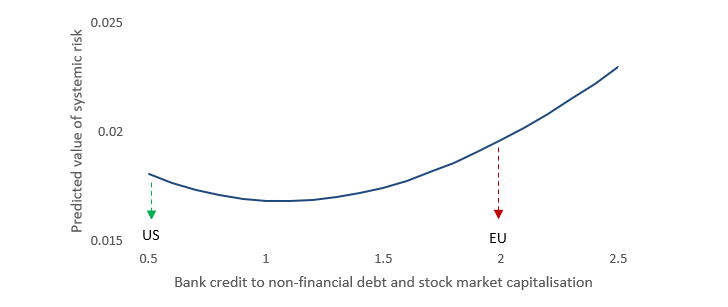

Our analysis has four key conclusions. First, the results confirm that bank-based financial structures are associated with greater systemic risk than market-based financial structures. Systemic risk rises more than proportionately when bank financing rises relative to market financing. Second, the relationship is found to be non-linear (Figure 2). Systemic risk is minimised when the financial structure is relatively market-based. Third, bank financing no longer contributes to systemic risk in relatively market-based financial structures. A diversified financial structure is thus important. Separate threshold regressions show that in relatively bank-based financial structures, such as in Europe, bank financing increases systemic risk, while market financing decreases systemic risk. By contrast, in relatively market-based financial structures such as the United States, bank and market financing do not significantly impact systemic risk. Fourth, from a systemic perspective, stock market financing is preferable to debt finance, whether market or bank debt finance. This reflects how equity finance increases loss absorption capacity and thereby reduces systemic risk.

Figure 2: Non-linear relationship between financial structure and systemic risk

Source: Bats and Houben (2020). Notes: This figure shows the non-linear relationship between financial structure and the predicted value of systemic risk as estimated by Bats and Houben (2020). The vertical axis represents the predicted value of systemic risk as a percentage of financial institutions’ total assets. The horizontal axis is the ratio of bank credit to non-financial debt and stock market capitalization.

Policy implications in the context of COVID-19

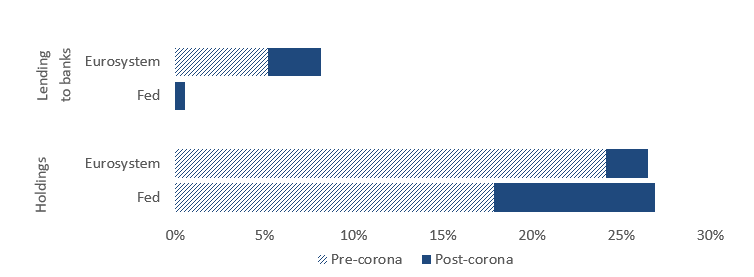

The COVID-19 pandemic and related behavioural restrictions have caused an unprecedentedly sharp economic downturn. To mitigate the downturn, monetary and prudential policies aim to sustain financing flows to the real economy. In delivering this policy stimulus, financial structure matters. Indeed, the different designs of these policies reflect differences in financial structure. In particular, while the expansion of the Federal Reserve’s balance sheet has predominantly been driven by large-scale purchases of debt securities and funding facilities for a host of market participants, the expansion of the Eurosystem’s balance sheet relates mostly to increased lending to banks. These Eurosystem lending operations are aimed at the supply of credit from banks to the real economy (Figure 3). In addition, European authorities have eased financial sector policies to further support the lending capacity of banks, including through the release of macroprudential buffers and greater flexibility in microprudential requirements. Meanwhile, banks have provided debt service holidays and new credit to help customers through what is assumed to be a temporary crisis.

Figure 3: Eurosystem and Federal Reserve lending and securities holdings before and after the COVID-19 outbreak (in % GDP)

Source: Bruegel based on Federal Reserve and Eurosystem. Notes: This figure shows the amounts of securities holdings and loans for monetary policy purposes by the Fed and Eurosystem as a ratio of GDP (Q4 2019). The shaded area represents the total amount of claims at the start of the corona crisis (end-February 2020). The diagonal lines indicate the total amount of claims by mid-May 2020.

Stimulating capital markets in Europe

While the objective of COVID-19 policy measures is to sustain bank lending to the real economy, our results highlight another consideration. The greater level of systemic risk in Europe calls for caution when stimulating debt creation and risk taking by banks, because this can lead to financial instability. Put differently, what started as a crisis in the real economy must not lead to systemic stress in the financial sector, ultimately making the crisis much more severe. To safeguard the functioning of the financial system in times of stress, two aspects of financial structure deserve special attention in Europe.

First, Europe needs more diversity in its financial sector. Disruption to the flow of finance is less when more financing sources exist alongside each other. More financing through markets will also serve to reduce systemic risks posed by the sovereign-bank nexus and to spread credit risks privately, beyond national borders. There is a structural force at work in the European financial system that is already contributing to more market-based finance. Fuelled by increasing pension savings, the rise of institutional investment is spurring the development of European capital markets. This is because institutional investors prefer to invest in marketable securities such as bonds and equities (Darvas and Schoenmaker, 2018). Professional institutional investment also brings about a declining home bias in bond and equity portfolios, which improves risk sharing and fosters capital-market integration.

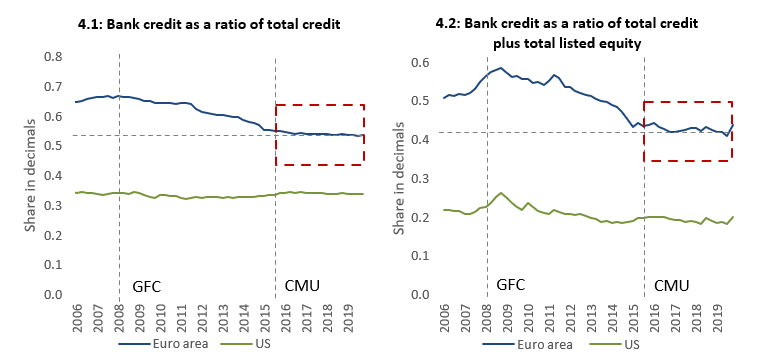

However, Figure 4 shows that the increase in the relative share of market debt and equity financing stagnated after 2015. Ironically, progress in diversifying the financial structure of the euro area has slowed since the start of the EU capital markets union (CMU). This contrasts with the sustained decline in the dominance of banks in the seven years after the Great Financial Crisis, reflecting inter alia the waterbed effects of higher prudential requirements for banks (Cizel et al, 2018). To increase the relative share of market-based finance in Europe, the policy efforts to underpin CMU thus need to be substantially stepped up.

Figure 4: The structure of financing to private non-financial companies

Source: Bruegel based on Credit Statistics of the BIS, Statistical Data Warehouse of the ECB and Economic Data of the Federal Reserve Bank of St. Louis. Notes: This figure shows the evolution of bank credit to private non-financial corporates in the euro area and the United States as a ratio of: 1) total credit to private non-financial companies; 2) the sum of total credit to private non-financial companies and listed equities issued by private non-financial companies. All data represent closing balance sheet positions (ie stocks), such that share buybacks are accounted for. GFC = Great Financial Crisis.

Reinvigorating CMU requires measures across a broad range of policy areas (see Sapir et al, 2018; CEPS-ECMI, 2019). In particular, on the institutional front, creating a strong supervisory body at the centre of the EU is needed to foster the integration of capital markets. This has become urgent. Brexit has caused London capital market activities that require a passport to operate in the EU to move to the EU27 countries. The European Securities and Markets Authority (ESMA) should grow from its role as a coordinator of national supervisors to a supervisory body with direct powers. ESMA would then become the central supervisor (in a hub-and-spokes model with national supervisors) of the EU capital market, similarly to the Securities and Exchange Commission in the US capital markets (Sapir et al, 2017). Other policy areas can also contribute. For instance, European Central Bank purchases of corporate bonds are found to contribute to a more diversified financial structure by reducing larger companies’ dependence on banks (Bats, 2020).

The second aspect is that Europe should buttress the resilience of its financial sector by increasing the share of businesses’ risk-bearing funding. More equity financing is the first best way to reduce systemic risk in Europe. Schemes to support businesses with equity can strengthen transition incentives to deal with the COVID-19 challenges, while boosting the economy’s loss-bearing capacity (Boot et al, 2020). Regulation and procedures for equity issuance should be streamlined accordingly. More fundamentally, the time is ripe to tackle the fiscal bias favouring debt over equity finance.

Recommended citation

Bats, J., A. Houben and D. Schoenmaker (2020) 'Boosting the resilience of Europe’s financial system in the coronavirus crisis', Bruegel Blog, 17 July, available at https://bruegel.org/2020/07/boosting-the-resilience-of-europes-financia…

References

Bats, J. (2020) ‘Corporates’ dependence on banks: The impact of ECB corporate sector purchases’, DNB Working Papers 667, De Nederlandsche Bank

Bats, J. and A. Houben (2020) ‘Bank-based versus market-based financing: Implications for systemic risk’, Journal of Banking & Finance 114, 105776

Becker, B. and V. Ivashina (2014) ‘Cyclicality of credit supply: firm level evidence’, Journal of Monetary Economics 62: 76-93

Boot, A., E. Carletti, H.-H. Kotz, J.-P. Krahnen, L. Pelizzon and M. Subrahmanyam (2020) ‘Corona and Financial Stability 3.0: Try Equity – Risk sharing for companies, large and small’, SAFE Policy Letter 81, Frankfurt

CEPS-ECMI Task Force (2019) Rebranding Capital Markets Union – A market finance action plan

Cizel, J., J. Frost, A. Houben and P. Wierts (2019) ‘Effective macroprudential policy: Cross-sector substitution from price and quantity measures’, Journal of Money, Credit and Banking 51 (5): 1209-1235

Crouzet, N. (2018) ‘Aggregate implications of corporate debt choices’, Review of Economic Studies, 85 (3): 1635-1682

Darvas, Z. and D. Schoenmaker (2018) ‘Institutional Investors and Development of Europe’s Capital Markets’, in D. Busch, E. Avgouleas and G. Ferrarini (eds) Capital Markets Union in Europe, Oxford University Press

Gambacorta, L., J. Yang and K. Tsatsaronis (2014) ‘Financial structure and growth’, BIS Quarterly Review, March: 21-35

Sapir, A., D. Schoenmaker and N. Véron (2017) ‘Making the best of Brexit for the EU27 financial system’, Policy Brief 2017/1, Bruegel

Sapir, A., N. Véron and G. Wolff (2018) ‘Making a reality of Europe’s Capital Markets Union’, Policy Brief 2018/8, Bruegel