How the EU could transform the energy market: The case for a euro crude-oil benchmark

There is a strong case for an oil benchmark in euros. Trading energy markets in more than one currency is not unprecedented, and indeed used to be the

Europe is the largest importer of oil (€188 billion per year), yet it still pays for oil in US dollars.[1] I believe the balance of power has shifted in favour of oil trade in euros. To facilitate the development of energy markets in euros, a change in contracts between buyers and suppliers is needed, supported by a crude oil benchmark in euros. This could also be used as an opportunity to create a benchmark that is more closely aligned to the crude oil mix imported by Europe.

China and Russia have both recently attempted, with mixed success, to establish national crude oil benchmarks. Trading energy markets in more than one currency is not unprecedented, and indeed used to be the norm. Europe – with its powerful currency and reliable regulatory environment – should stand a good chance of success.

Energy trade in euros would foster European economic sovereignty by reducing exposure to dollar transaction risk and hedging costs – as highlighted in the European Commission’s recent paper.[2] The US has demonstrated a willingness to use its dominant position in the global financial markets for geopolitical objectives. The industries that would most benefit from the change include refineries,[3] airlines, and shipping and transportation, which would yield an important benefit that would contribute to the greater use of the euro globally.

Europe imports more than €188 billion-worth of oil per year, and a switch to euro pricing would not only lead to a meaningful realignment of power in energy markets, but would also have an impact on financial markets. The volume of EU energy trade appears small compared to the daily turnover in global FX markets of $5 trillion per day ($1.6 trillion in euros), but a change in EU energy trade could over time have a non-negligible effect.

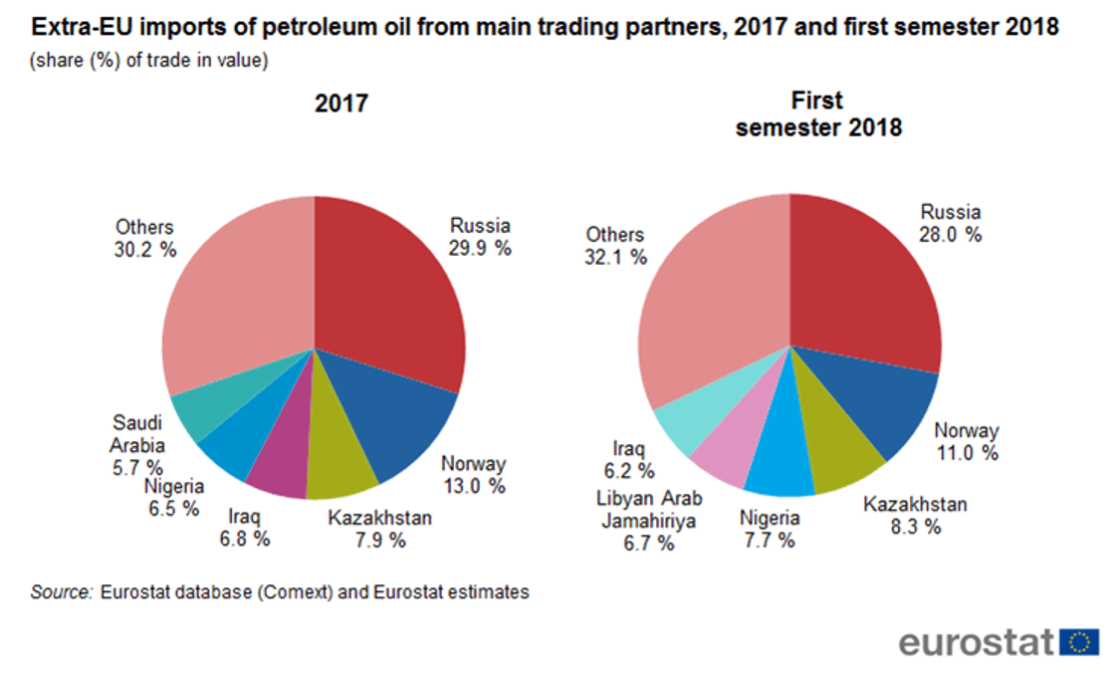

Europe is by far the largest importer of oil, followed by China. Europe’s main suppliers of crude oil are Kazakhstan Norway, Nigeria and Russia. Saudi Arabia accounts for less than 6%.

Since the historic 1974 agreement between the US and Saudi Arabia, most of the energy trade has been dominated in US dollars—the largest buyer (the US) and the most important supplier of oil (Saudi-dominated OPEC) at that time agreed to trade oil in dollars. However, the centre of gravity has since shifted towards Europe and Asia. The US has become the largest producer of oil, albeit so far remaining a lightweight in exports. Europe and China are by far the largest importers.

Europe’s key energy supplier, Russia, is keen to de-dollarise, and some companies are already asking for payments for oil in euros due to the risk of sanctions. In the early 2000s, Germany and Russia explored the establishment of oil futures in euros on a European exchange, but the environment was not favourable. The euro was still young, Russia had a de-facto fixed exchange rate to the dollar (the euro was introduced into the ruble reference basket of the Bank of Russia only in 2005) and was keen to develop a closer strategic relationship with the US.

OPEC has also evolved. To the surprise of most, OPEC now de facto includes Russia as an important partner, following the historic visit by King Salman bin Abdulaziz Al Saud of Saudi Arabia to Moscow in October 2017. Many of the oil exporters either no longer have their currencies pegged to the dollar or are exploring different options. The Bank of Russia moved to a fully flexible foreign-exchange regime supported by a credible inflation-targeting framework (Elvira Nabiullina was named the Governor of the Year by Euromoney in 2015). Looking at the technical work done by Saudi authorities, it is clear that if they do decide to keep the peg, it will not be for the lack of technical ability to move to a floating exchange rate. The Gulf Cooperation Council is also in flux amid Saudi-Qatar disagreements; Qatar most recently left OPEC.

To facilitate the new trade, Europe would also need to develop a benchmark in euros that reflects the type of oil it imports. Price-reporting mechanisms by price-reporting agencies (PRAs) for spot prices – and subsequently exchange-traded futures markets – evolved before the euro came into existence. There is little incentive for incumbents to dramatically overhaul existing benchmarks despite extensive criticism. Reliability of supply and the nature of the regulatory environment also matter. Brent was originally developed in the UK due to ample production and a favourable regulatory regime.

With over 600 different types of crude oil produced globally there are no individual markets for most grades; instead, market participants use a few key benchmark prices to calculate the rest as a differential to the benchmark. Companies report on a voluntary basis to price-reporting agencies; PRAs then establish ‘spot’ prices. Voluntary price reporting to the PRAs developed gradually in the 1980s when trading in spot markets was widespread. Since then, price discovery has largely moved to the exchanges. Exchanges and PRAs simultaneously compete with and complement each other. The futures markets at the exchanges set the price levels and the physical markets set the differentials.[4]

Oil benchmarks, especially following the Enron and LIBOR scandals, are subject to regulation. Key regulations are the Principles for Oil Price Reporting Agencies by IOSCO and the EU Benchmark Regulation. Criteria for benchmarks include good governance, clarity and transparency, liquidity, availability of data, and fair and robust methodology. A regulator cannot mandate for a benchmark to be created, as it is set freely by market participants. A regulator can, however, design a regime that is conducive to the development of liquid and transparent benchmarks.

Brent (European), WTI (West Texas Intermediate; US) and to a lesser extent Dubai (Middle East) are the key global oil benchmarks. Brent is derived from two complementary sources: a physical market via PRAs and a financial market via Intercontinental Exchange (ICE) Brent futures. Leading European price-reporting agency Platts, which is part of Standard & Poor’s, started reporting prices of the physical Brent transactions – Dated Brent – in the 1980s. Towards the end of the 1980s, Dated Brent became the underlying price for the ICE Brent futures. Brent is based on a mix of European oil production and is still the most universally used benchmark, with two-thirds of global oil contracts directly or indirectly referenced to it. WTI is the other key benchmark, focused on the US production. The main instruments that underlie WTI are futures contracts that allow for physical delivery traded on the New York Mercantile Exchange (NYMEX), which is part of the CME group. The role of the PRAs in determining WTI is different and somewhat less complex than that of Brent.[5]

Issues with existing benchmarks provide an opportune moment. Brent and WTI enjoy the advantage of being incumbent benchmarks, but each has significant issues that the reporting agencies and exchanges have been slow to address.

Brent suffers from a long-term production decline, and in a couple of years is likely to reach a volume of output below the critical threshold needed to assess the price. Given that Europe consumes an important amount of Urals oil, it would be natural to add Urals to the Brent benchmark assessment. US crude-oil production is now in excess of 10 million barrels per day (b/d), compared to around 1.5 million b/d from the North Sea that goes into the calculation of Brent.

Contracts traded on WTI/CME surpassed those of Brent/ICE by almost 30% in 2017. WTI’s problem is still its location and terminal capacity, resulting in wide swings in the WTI-Brent differential. WTI as a type of oil is also largely globally irrelevant as, despite being the largest producer, the US is still a lightweight in exports.

Challengers to the established benchmarks are emerging. China, having overtaken the US according to the recent data as a single-country buyer, would like to see a benchmark that more accurately reflects its needs. China launched a crude-oil futures contract in renminbi on the International Energy Exchange (INE) in March 2018. China is already using renminbi to buy oil from Russia and is hoping to do the same with Saudi Arabia. An Urals futures contract started trading on the St Petersburg International Mercantile Exchange (SPIMEX) in November 2016. An important question is whether or not China will see a European benchmark as a rival. Russia has already been diverting some of its oil to the more lucrative contracts in the East.

Issues of market transparency and quality of regulation are central to developing a successful benchmark. This may be the reason why foreign companies have remained on the sidelines of new contracts from China and Russia, and why the Dubai contract – the third most important global oil benchmark – still lags far behind Brent and WTI. Stable regulatory environment is also the reason why the European Union cannot mandate for the markets to create a benchmark.

The EU can open a dialogue on renegotiating contracts with its oil suppliers to change the currency of denomination. This would require coordination among the national authorities and the European Commission. Some suppliers may ask for a higher price to reflect potentially higher cost of hedging currency risk, while others – like Russia – may welcome the change to help it reduce dollar transaction risk. Ultimately, benchmarks evolve because sufficient numbers of suppliers and buyers converge on standardised contracts. As the European Commission has already stated, it would to explore technical details of promoting use of euro in energy trade. Working with oil companies, refineries, exchanges and price-reporting agencies it could help design a benchmark that would most accurately reflect the new contracts.

There is a strong case for an oil benchmark in euros. Europe is the largest oil importer and Russia, its largest supplier, would be keen to de-dollarise. Benchmarks evolve because suppliers and buyers change their behaviour, but reliable regulatory environment matters too. Deep and flexible crude oil benchmarks in different currencies have existed in the past – they do not have to compete, but can supplement each other.

Footnotes:

[1] I would like to thank Michael Baltensperger for excellent research assistance.

[2] In this blog I focus on the energy aspect only, a comprehensive policy paper by Efstathiou and Papadia, 2018 (https://bruegel.org/2018/12/the-euro-as-an-international-currency/) covers other aspects of euro as an international currency.

[3] Refineries may need to adjust as the refined products are also globally traded in US dollars. The EU exports a number of refinery products (the value of this trade is, however, only a tenth of the the crude oil trade, as most is consumed locally).

[4] Technical explanation of the oil price setting practices can be found here https://www.oxfordenergy.org/publications/oxford-energy-forum-oil-bench…

[5] The major trading hub for WTI is Cushing, Oklahoma. Cushing is the delivery point for crude contracts, and it is the price settlement point for WTI. WTI crude oil flows into Cushing from all points of the United States, and then flows outbound through pipelines.