Elina Ribakova

Elina Ribakova is a Non-resident fellow at Bruegel. She is also a Non-resident senior fellow at the Peterson Institute for International Economics and a Director of the International Affairs Program and Vice President for foreign policy at the Kyiv School of Economics. Her research focuses on global markets, economic statecraft and economic sovereignty. She has been a senior adjunct fellow at the Center for a New American Security (2020–23) and a research fellow at the London School of Economics (2015–17).

Ribakova has over 25 years of experience with financial markets and research. She has held several senior-level roles, including deputy chief economist at the Institute of International Finance in Washington, managing director and head of Europe, Middle East and Africa (EMEA) Research at Deutsche Bank in London, leadership positions at Amundi (Pioneer) Asset Management, and director and chief economist for Russia and the Commonwealth for Independent States (CIS) at Citigroup.

Prior to that, Ribakova was an economist at the International Monetary Fund in Washington (1999–2008), working on financial stability, macroeconomic policy design for commodity-exporting countries and fiscal policy. Ribakova is a seasoned public speaker. She has participated in and led multiple panels with leading academics, policymakers, and C-level executives. She frequently collaborates with CNN, BBC, Bloomberg, CNBC, and NPR. She is often quoted by and contributes op-eds to several global media, including the New York Times, Wall Street Journal, Financial Times, Washington Post, The Guardian, Le Monde, El Pais, and several other media outlets.

Ribakova holds a master of science degree in economics from the University of Warwick (1999), where she was awarded the Shiv Nath prize for outstanding academic performance; and a master of science degree in data science from the University of Virginia (2023).

Featured work

Use the financial system to enforce export controls on Russia

Use the financial system to enforce export controls on Russia

Prohibition of Western tech exports to Russia is not working; rapid measures are needed to tighten up

Two years later: addressing long-term consequences of Russia’s invasion of Ukraine

The event marked the anniversary of Russia's invasion of Ukraine, focusing on discussions about sanctions, accession, and energy

EU trade and investment following Russia's illegal invasion of Ukraine

The oil price cap and embargo on Russia work imperfectly, and defects must be fixed

Violations of the G7 price cap on Russian oil are becoming evident, but Western countries still can tighten rules and reduce the cash flows to Russia.

Sanctions against Russia will worsen its already poor economic prospects

Sanctions, coming on top of longstanding domestic shortcomings, are gradually weakening Russia.

How have sanctions impacted Russia?

In this paper we assess both the immediate economic impact and the likely longer-term impact of sanctions on the Russian economy.

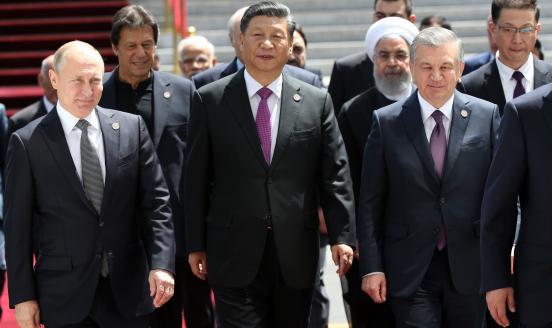

War in Ukraine: Russia-China relations

A special episode of the Sound of Economics Live on China-Russia relations in the context of the Russian invasion of Ukraine.

Economic reform in Belarus: how can we overcome old legacies and dependency and what can Europe do?

Political change in Belarus also requires deep economic reforms - what next for the country?

Credible emerging market central banks could embrace quantitative easing to fight COVID-19

Emerging economies are fighting COVID-19 and the economic sudden stop imposed by the containment and lockdown policies, in the same way as advanced ec

COVID-19’s reality shock for external-funding dependent emerging economies

COVID-19 is by far the biggest challenge policymakers in emerging economies have had to deal with in recent history. Beyond the potentially large nega

Redefining Europe’s economic sovereignty

This Policy Contribution delves into the position of the EU in the current global order. China and the United States increasingly trying to gain geopo

Saving the right to asylum

How to improve the European asylum policy?

How the EU could transform the energy market: The case for a euro crude-oil benchmark

There is a strong case for an oil benchmark in euros. Trading energy markets in more than one currency is not unprecedented, and indeed used to be the

Something Putin and Juncker appear to agree on – the euro

“It is absurd that Europe pays for 80% of its energy import bill – worth €300 billion a year – in US dollars when only roughly 2% of our energy import