The potential of sovereign sustainability-linked bonds in the drive for net-zero

Sovereign SLBs could help incentivise climate policies in EU countries, and accelerate emission reductions.

Executive summary

- European Union governments have for some years issued green bonds that raise funds for climate-related spending. These bonds have been received well in capital markets but because they promise a certain use of proceeds, they complicate budget management and may not match investors’ claims of having an impact on national climate policies.

- Public commitments made by major investors and asset owners suggest that limiting climate transition risks and the assessment of the alignment of sovereigns with net-zero targets will now become key determinants of portfolio allocation. Yield differentials in bond markets are already beginning to reflect transition risks that arise from the inadequate pursuit by issuers of climate targets.

- Unlike standard green bonds, sustainability-linked bonds (SLBs) create a link between performance (outcome) indicators and the financial terms of the bonds. SLBs have grown rapidly in importance in private markets and are now being assessed by sovereign issuers.

- We show that sovereign SLBs could help incentivise climate policies in EU countries, and accelerate emission reductions. They would be an effective tool for signalling commitment. A common EU framework for issuance by EU countries would enhance capital market integration and the transparency of national policies, and would limit climate transition risks in EU capital markets more broadly.

The authors thank Daniel Hardy, Jeromin Zettelmeyer and participants in a Bruegel workshop for valuable comments.

1 Introduction

The implications of the climate transition and the risk that companies will not reduce their emissions quickly enough have occupied investors for some time. Climate-related risks are now also beginning to influence sovereign debt markets (OECD, 2022). This is evident in the greater interest investors pay to issuer disclosure, in the form of environmental, social and governance (ESG) metrics, and also in the greater political accountability for climate outcomes required for public-sector issuers.

Two principal types of instruments have emerged in bond markets to reflect issuer policies and investor mandates. A first set, including green bonds, restricts the use of proceeds to certain expenditures and rewards issuers for documenting this green spending. A second and more recent type of bond links rewards for issuers to certain outcomes. These bonds give the issuer much greater freedom in spending, but impose financial penalties if commitments are not met. These bonds might also reward achievement of climate targets.

The greening of sovereign debt is important because a large part of the expected €350 billion in additional annual capital expenditures to achieve net-zero emissions in the EU will need to be mobilised by the public sector, possibly amounting to 1.8 percent of annual GDP (Baccianti, 2022; Klaaßen and Steffen, 2023). In addition to meeting climate-related funding needs, sovereign debt managers must also contain the risks that will arise if their governments manage the transition to a low-carbon economy poorly – which could result in higher borrowing costs or liquidity constraints in debt markets (Bingler, 2022). Sovereign-debt issuance will need to adapt to these new investor demands that result from the climate transition. A debt-issuance strategy that reflects investors’ concerns about climate outcomes would be complicated by the fact that climate targets are largely set at the EU level, though implemented partially at the national level. Ambition and credibility in meeting EU and national climate commitments still vary widely between states.

In an effort to capture this shift in investor motivations, 13 European Union countries and the United Kingdom have issued green bonds since 2016. Yet, the volume of issuance to date is small relative to what will be required of public budgets. Volumes are set to rise: under the NextGenerationEU (NGEU) programme, the EU could mobilise up to €185 billion in green bond funding for spending in member states. This will come on top of green spending under other EU funds and programmes, which will increasingly absorb countries’ capacities to generate and account for public-sector green projects. But this notwithstanding, EU debt issuers lack a single instrument that delivers additional climate-related finance at scale, contains climate transition risks and delivers climate policy outcomes to investors.

The inherent features of sovereign green bonds, in particular relating to restrictions on the use of proceeds raised in capital markets, may make this instrument problematic in the management of fiscal revenues. Problems may become more pronounced if national, EU and other supranational green bond issuance is expanded (Hardy, 2022; Domínguez-Jiménez and Lehmann, 2021). A greater volume of green bonds outstanding would complicate sovereign-debt management and the functioning of government bond markets, which should be the bedrock of the EU’s capital markets union (CMU). In the face of this, sovereign issuers are now examining as an alternative sustainability-linked bonds (SLBs), which reward issuers for outcomes rather than the use of proceeds, and which have been expanding rapidly in corporate bond markets.

In this paper, we show that the ongoing shifts in investors’ motivations and their greater focus on climate outcomes can make sovereign SLBs viable within the EU. We find that sovereign SLBs would have many of the characteristics desired by debt managers and would constitute a much-needed ‘climate hedge’ for investors in the corporate bond market. However, national debt management offices would need to prepare various technical aspects, crucially by documenting and reporting climate outcomes reliably, by fostering coordination on the bond format and by designing a primary issuance process that reflects both the financial and climate-related terms of their bonds.

We start by assessing the extent to which sovereign green bonds issued by EU countries have established a meaningful new funding tool in line with the traditional objectives of sovereign debt management and capital market efficiency, and if this format could indeed mobilise the needed additional funds. We then examine shifting investor motivations. In regulation and in private law interpretations of their fiduciary duties, investors are now accountable for climate risks in their portfolios, and sovereign debt is no exception to this. We then examine whether sovereign SLBs can provide this accountability. Finally, we offer a framework for EU government SLBs, which would offer investors clarity on impact, and more credibly discipline national policy based on existing commitments under EU laws.

2 The limitations of sovereign green bonds in the EU

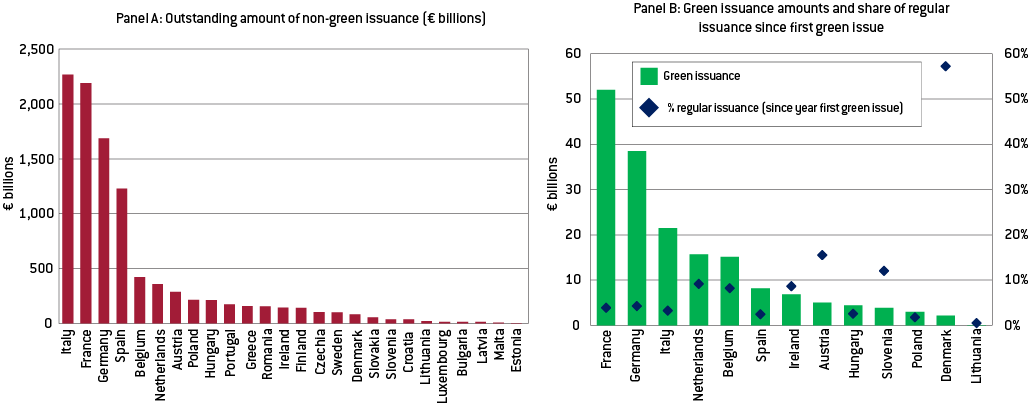

Since they were first issued in 2016, green bonds have become an increasingly popular tool in the budgetary funding strategies of EU governments. The amounts outstanding are still small: €176 billion at end-2022, relative to the overall size of over €10 trillion of debt issued by EU central governments (Figure 1). Thirteen EU debt agencies have issued green bonds, many in repeated issues. Several, including France as Europe’s largest national issuer, consider green bonds an integral tool in their funding strategies, and now regularly derive part of their budget funding through this instrument. Other issuers, including Denmark, Austria and Sweden, now also derive a substantial part of their budget funding through green bonds (Figure 1, right panel).

Use of the green bonds by national issuers comes on top of issuance by national promotional banks (which are fully guaranteed by the sovereign) and substantial issuance by the European Investment Bank (EIB), one of the first players in this market.

The EU itself is committed to using green bonds for a significant share of funding of the NextGenerationEU (NGEU) programme 1 See https://next-generation-eu.europa.eu/index_en. . EU countries must allocate at least 37 percent of post-COVID-19 economic recovery expenditures to green projects. Spending that has been approved (in national Recovery and Resilience Plans) has in fact slightly exceeded this target for the green share. Hence the EU could potentially issue over €185 billion in green bonds by end-2026, slightly more than the total issued so far by the 13 member states. By end-2022, €36 billion in NGEU green bonds had been raised and funds had been allocated to roughly one quarter of the eligible expenditures 2 EU Commission Green Bond Dashboard: https://commission.europa.eu/strategy-and-policy/eu-budget/eu-borrower-…. . EU countries will of course seek to absorb NGEU funding fully. However, their capacity to generate additional green projects that could underpin parallel national green bond programmes will likely be constrained.

Figure 1: Regular and green bond issuance by EU governments

Source: Bruegel, based on Bloomberg. Notes: Outstanding and issued amounts as of 5 December 2022. The share of regular issuance refers to the ratio of green bond issuance to regular bond issuance since the year (not date) of the first issuance of a green bond in each country.

Investors could be forgiven for being confused about the different frameworks on which national, EIB and EU green bond issues are based. The national frameworks that set conditions, such as expenditures eligible for financing (or refinancing) and the issuer’s reporting on allocations or impact, vary widely. This arises from different budgetary laws and, in many cases, parliamentary prerogatives over budgetary allocations, including green spending. While issuers adhere to the high-level industry guidelines issued by the International Capital Markets Association, there is no easy match with the EU classification of sustainable activities (the taxonomy 3 See https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/eu…. ), the last parts of which became effective only in January 2023, or the future EU Green Bond Standard 4 See https://www.europarl.europa.eu/legislative-train/theme-an-economy-that-…. .

Moreover, only a few of the governments that issue green bonds have set out a convincing story about how green bonds fit into their broader debt management strategies. Our review of debt-management documentation suggests that out of seven major green bond issuers, only Germany and Italy have attempted such a justification. Germany, for instance, refers to diversification and innovation as an integral part of debt management 5 Through its green bonds, Germany expects to introduce “new financial instruments to leverage additional potential for interest cost savings, improve diversification, create even more efficient ways of borrowing, and tap new investor groups.” Green bonds are presented as an “example of innovation and have now become a fixed part of strategic issuance planning.” See Deutsche Finanzagentur website: https://www.deutsche-finanzagentur.de/en/federal-funding/debt-managemen…. . Italy also adds that green bond investors have desirable characteristics for a sovereign issuer, such as more long-term investment horizons, and they are less prone to divest holdings in turbulent markets. Many issuers, explicitly or implicitly, see the new instrument as a tool to promote their green credentials to a larger pool of investors, thereby reaping benefits in other funding instruments or by establishing a wider investor base 6 See also Doronzo et al (2021) for a broader review of the sovereign issuer’s cost-benefit assessment. . The EU’s net-zero emissions goal by 2050, and the need to mobilise public spending to that end, were referenced in national green bond frameworks, though in none of the general debt management strategies we reviewed.

For investors, green bonds issued by EU governments remain a niche asset class in financial markets, ill-suited as a tool in liquidity management. Investors will be concerned that national issuers will be unable to roll out a further supply of green bonds backed by local projects, or that standards of impact will slip. Governments will also seek through their green bonds funding for climate-related spending that cannot be easily aligned with the EU taxonomy, or for projects with lifetimes that do not match investors’ investment horizons 7 Under the EU’s Sustainable Finance Disclosure Regulation (2019/2088), investors and advisors need to disclose the taxonomy alignment of financial products. This is inherently more difficult for sovereign than for corporate green bonds. . The continued green bond issuance by EU countries may hence fall foul of increasing investor scrutiny and may not be in line with traditional debt management objectives, which emphasise predictability of supply and liquidity of a single asset class.

2.1 Incentive problems

Moreover, green bonds create at least three problems in relation to the incentives of issuers and investors.

First, bond investors lack a direct means of enforcing green commitments made by governments. The International Capital Market Association’s 2014 Green Bond Principles 8 See https://www.icmagroup.org/sustainable-finance/the-principles-guidelines…. , which in the absence of EU-level regulation still form the basis of most green bond frameworks, rest on four key issuer commitments: specification of the use of proceeds; a process for project selection and evaluation; a framework for managing the bond proceeds (which often remain in ringfenced accounts); and ongoing reporting of spending from the bond (though not necessarily of impact). The compliance with these principles of an issuer’s framework (not of an individual bond) is normally confirmed through a so-called second-party opinion by an outside private verification provider.

Bond investors have known for some time that they have no contractual rights to enforce green spending by the issuer, or recourse to the issuer should such spending fail to materialise 9 Poor enforcement is therefore a problem for all investors that hold green bonds within a portfolio that needs to comply with certain non-financial (ESG) characteristics. It would be a more severe problem for so-called impact investors, who seek behavioural change on the side of the issuer and need to account for this change. However, impact investors are as yet a niche segment of the investor landscape, and sovereign bonds are not normally part of their holdings. . Failure to use proceeds in the way initially set out by the issuer in its green bond framework would not normally constitute an event of default, nor would it give the bondholder the option to accelerate repayment or demand other remedies (Doran and Tanner, 2019). Bolton et al (2022), in a detailed review of 150 public sector green bonds, predictably found that these bonds promise little or nothing that would be legally enforceable. The issuer’s failure to adhere to initial commitments may result in a withdrawal of the second-party opinion, though this would cause no more than reputational damage. The absence of enforceable remedies could be a concern for investors when projects that are strictly green may not be available in sufficient quality, size or predictability, or can only be financed retroactively. The bondholder, whose asset may no longer conform with its ESG-based investment mandate and who may need to sell at a loss, has no way of seeking redress.

Second, even if proceeds are used exactly as described, it is unclear whether, in the absence of green bond issuance, budgetary spending would have been any different. Green bonds lack what ESG investors seek in terms of ‘additionality’. Crucially, the composition and volume of project spending is unlikely to be different if budgetary allocations are an act of parliament. Issuers will not allow a green-bond contract, let alone commitments within the rather informal green-bond frameworks, to come into conflict with regular budgetary processes governed by higher law. Germany, for instance, explicitly devotes all green-bond proceeds to past expenditures, undermining any investor notion of additionality or impact. Because budgetary receipts are fungible within the government’s cash account it is impossible to attribute certain spending items to individual bond issues (Hardy, 2022). Whereas a corporate green bond may have tangible effects on funding volumes and project capital expenditures, this attribution is very difficult to establish for a sovereign. It is a stretch for investors in sovereign green bonds to claim to have contributed to certain climate outcomes.

A third and final flaw of sovereign green bonds is that few issuers have benefitted from a meaningful issuance premium in primary auctions (the so-called ‘greenium’). Sovereign issuers may expect a reduction in their financing costs, though any greenium would need to outweigh the additional transaction costs inherent in the green-bond format. Yet this expectation seems misplaced, given that in liquid bond markets, investors will arbitrage away any premium for instruments that carry the same credit quality, and will offer investors the same recourse to issuer assets. Any margin indeed seems insignificant relative to issuance costs (Grzegorczyk and Wolff, 2022). Bolton et al (2022) similarly found only a miniscule greenium for EU issuers (in the order of a few basis points).

This lack of a meaningful greenium could give rise to two interpretations: either investors do not care about green spending (an assertion we will contest in a moment), or they care only with sufficient enforcement and additionality that lead green bond holding to foster additional spending. Bolton et al (2022) found an issuance premium in developing countries exposed to frequent physical climate risks. This could point to investors’ altruistic motivations. Green bond issuance normally only funds spending on climate change mitigation, which does little to build resilience against climate disasters. Any effect from government spending on climate risk exposure would, in any case, be observed for plain vanilla bonds as well.

3 What investors want

Whether and to what extent investors care about a sovereign issuer’s climate policies thus matters greatly for the future issuance strategy, and the design of new bond instruments by EU countries.

The emergence of green bonds and other ESG instruments in capital markets has been driven by the changing mandates of institutional investors, which now reflect sustainability risks and opportunities to a much greater extent. Sovereign bond portfolios are now also increasingly covered by sustainability objectives in investor mandates, even though the effects of climate on credit quality are more indirect than for corporate bonds. The adverse effects of physical climate risks on the bond spreads of highly exposed countries have been established for some time (Volz et al, 2021). Climate transition risks will also matter for sovereigns that are slow to implement their stated climate policies. Such risks could materialise when carbon-based infrastructure is revalued as a ‘stranded asset’, if economies do not benefit from emerging technologies or because they become less-attractive economic partners for rapidly-transitioning countries. The sovereign issuer’s exposure to transition risks will be more indirect than is the case for a corporate issuer in a ‘brown’ industry. The effects on credit quality may still be material through fiscal revenues, growth, a revaluation of public assets and possible public guarantees to the financial sector.

Empirical evidence indeed suggests that investors are sensitive to climate transition risks in both advanced and emerging markets. Bingler (2022) found that since the 2015 Paris Agreement, yields of long-term government bonds of advanced countries that performed on climate transition were lower than those of climate laggards, so countries that perform better on climate benefit in terms of funding costs. Collender et al (2022) even showed that substitution away from natural resources into renewable energy lowers sovereign debt borrowing costs, though this transition is more costly in developing countries with more limited prospects for diversification and attracting climate finance. Cheng et al (2022b) underlined the potentially significant reallocations, should investors seek net-zero emissions in their sovereign bond portfolios. Based on their simulation, several EU sovereign issuers could be exposed to a substantial and abrupt rebalancing of investor portfolios as climate change unfolds. Even though sovereign bond investors normally allocate portfolios ‘passively’ based on a market-weighted index, there are now bond indices that tilt such allocations based on climate risks and opportunities 10 For instance the indices offered by FTSE Russell: https://www.ftserussell.com/index/spotlight/climate-wgbi. .

Investors increasingly attempt to contain climate transition risks through portfolios that are consistent with a ‘net-zero’ world (ie with carbon neutrality that limits the global temperature rise to 1.5°C above pre-industrial levels). At least three developments explain the evident investor sensitivity to sovereign climate policies.

A first and fundamental factor lies in the reinterpretation of the fiduciary duty of asset managers. This is an age-old legal concept that applies to any person or organisation that holds power in the interest of another in a relationship based on trust and confidence, and where information is not easily shared. Fiduciary duty is central for asset managers, who are generally expected to act in the best interest of beneficiaries and to invest as an ‘ordinary prudent person’ would. The interpretation of this concept has shifted considerably in all key jurisdictions and is now widely seen as encompassing the inclusion of sustainability factors in investment analysis and decision-making, active engagement in investee firms, and a requirement to understand sustainability preferences, whether or not they are financially material. The integration of ESG factors is already reflected in many investment mandates defined by asset owners. This of course differs depending on the nature of the fund, which may simply track a basket of sovereign debt exposures passively, or be required to hold the local sovereign’s assets. In any case, failing to reflect ESG concerns entirely is now widely regarded as a failure of fiduciary duty (PRI, 2020; CCLI, 2022).

This reinterpretation of fiduciary duty in private law has also been reflected in strengthened regulation in the EU and elsewhere. Under EU capital market legislation, in particular the revision of the Markets in Financial Instruments Directive (MiFID II, 2014/65/EU) in 2019, asset managers, including insurance companies and pension funds, are now required to integrate ESG factors into investment decisions, advise clients on the climate performance of any asset and assess their preferences on sustainability (ESMA, 2022). In addition, the Sustainable Finance Disclosure Regulation (SFDR, EU 2019/2088), applying from 2023, requires all key participants in financial markets to explain the sustainability ambition in every product and all financial advice. The implementation of EU legislation is still in flux and does not extend to fleshing out the exact nature of a sovereign bond with sustainability characteristics. Nevertheless, transparency and integrity requirements for asset managers are much improved.

Lastly, asset managers and the ultimate asset owners, such as pension and sovereign wealth funds, increasingly adopt and publicise climate pledges, individually or as part of various industry alliances.

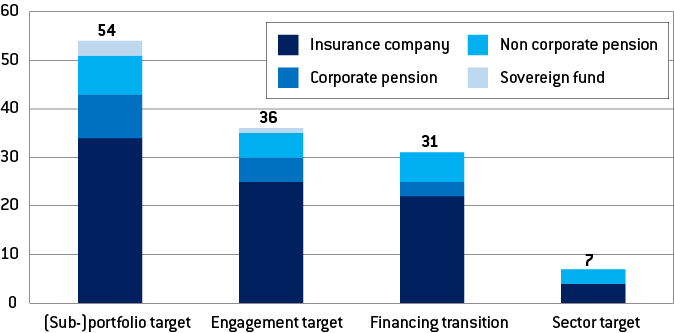

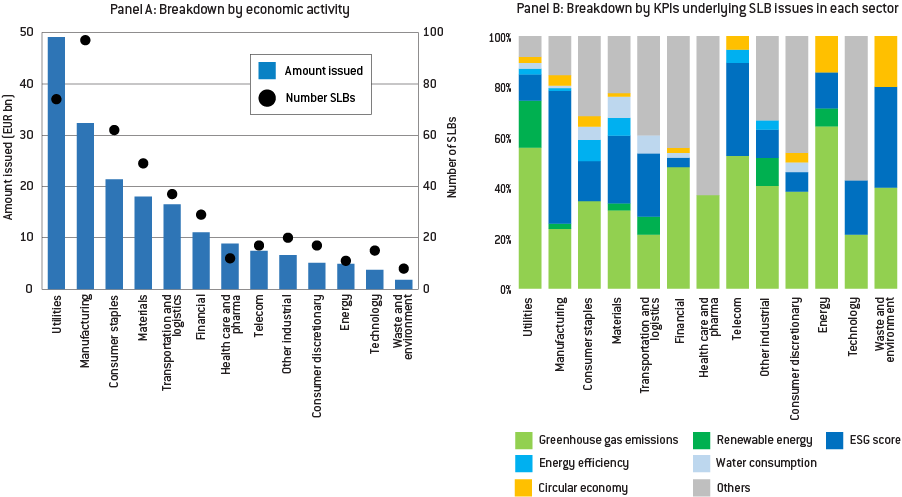

To assess the motivations of large investors in sovereign assets in more detail, we examined the commitments made by some of the largest global asset owners covered by the UN-convened Glasgow Financial Alliance for Net Zero (GFANZ). In September 2022, this group had 74 members, accounting for roughly $11 trillion in assets under management. By the end of 2022, 58 member institutions had made binding commitments 11 See https://www.unepfi.org/net-zero-alliance/resources/member-targets/. . These include commitments on transition financing, portfolio carbon emissions and emission reductions in specific sectors, in addition to targets for engagement with investee firms.

Figure 2 suggests that there is relatively strong support for reducing carbon emissions embodied in the portfolios, potentially reflecting investors’ growing awareness of transition risks. However, the net-zero objective as yet only translates into future carbon-emission reduction targets for the corporate bond, listed equity and real-estate portfolios. Limited reductions are set for the interim date of 2025, while more substantial reductions are to follow in subsequent years. Members of the Net-Zero Asset Owners Alliance within GFANZ have so far focused on establishing more near-term objectives (for 2025), mostly in the form of intensity-based targets, as opposed to absolute reductions in portfolio emissions 12 In the case of emissions-intensity targets, financed emissions are normalised by some measure of financing, ie overall emissions could still rise. . Panel B of Figure 2 suggests that some members are more ambitious and go beyond the indicative ranges set by the alliance, but there is still some dispersion among pledges.

Sovereign bonds, often the largest asset class in investor portfolios, were initially not included in the target setting under the GFANZ initiative, mainly because of difficulties in determining the carbon footprint of portfolios. More recently, some investors have agreed on tools that allow such an assessment 13 In future, government bonds may be assessed based on a measure of financed emissions, rather than attributed to the issuer’s policies. Direct emissions accounted for by the government are typically minimal, while indirect emissions are difficult to account for and risk double-counting. For the methodology developed by the Partnership for Carbon Accounting Financials, see PCAF (2021). . The 2023 revision of the GFANZ toolkit that guides investors in making decarbonisation pledges therefore suggests that sovereign exposures should be measured, and that targets be set from later in 2023 14 The third ‘protocol’ for making commitments; see See UN Environment Programme Finance Initiative, ‘Net-Zero Asset Owner Alliance raises expectations for members’ real economy impact with updated Protocol’, 31 January 2023, https://www.unepfi.org/industries/net-zero-asset-owner-alliance-raises-…. .

In addition to such net-zero pledges, several investor groups collaborate on designing an improved measure of the climate alignment of sovereign bond issuers, assessing current and future climate policies, and thereby their potential exposure to transition risks. One such initiative will assess the “full range of government actions, including economy-wide and sector-specific policies in areas such as carbon pricing, energy subsidies, transport deforestation and land use planning, and policies that manage transition risk and mitigation” 15 Principles for Responsible Investment, ‘ASCOR Consultation to Assess Sovereign Debt Issuers on Climate Change’, 7 February 2023, https://www.unpri.org/news-and-press/ascor-consultation-to-assess-sover…. .

Figure 2: Commitments by members of the Net-Zero Asset Owners Alliance

Breakdown of members by type and target

Breakdown of sub-portfolio targets

Source: Bruegel based on Net-Zero Asset Owners Alliance (website and second progress report). Notes: Panel A bold numbers reflect number of members that have commitment to each objective. A member can make commitments to multiple objectives. Panel B shows a simplified summary of the targets members have committed to under the Sub-portfolio target pillar (which as yet excludes sovereign bonds). There is a split into Intensity-based (CO2 equivalent per euros invested) and absolute targets (GHG emissions). The category ‘Portfolio’ includes commitments which did not mention a specific asset class or when all three (equity, corporate bonds and real estate) asset classes were mentioned. The NZAOA indicative ranges are described in the second progress report as follows: “22 to 32% CO2e reduction by 2025 (per IPCC 1.5°C SR scenarios) on equity and debt to listed corporates, infrastructure, and with the same reduction or CRREM national pathways for real estate” and “49 to 65% CO2e reduction by 2030 (per IPCC 1.5°C SR scenarios)”.

Changes to investor mandates, regulation and investor pledges suggest investors are simultaneously motivated by the financing of green assets and by limiting their transition risks by holding assets that are consistent with a net-zero world. While green asset mobilisation has been the most prominent motivation to date, and has been evident in the strong demand for green bonds, the balance is clearly shifting to the latter objective. The approaching investor targets for climate alignment, and novel methodologies that account for the carbon footprint of most asset classes, will now stimulate a search for climate-aligned assets, including in sovereign bond markets.

The early empirical evidence suggests bond investors are indeed willing to pay for good climate mitigation policies, which limit the transition risk of the country as a whole and, thereby, of the sovereign issuer. This result seems more robust than that of a sustained and meaningful yield discount on primary issues of advanced-country sovereign green bonds.

In sum, it appears that bond investors with ESG mandates increasingly seek reliable information and disclosure about what climate policies sovereign issuers plan to pursue. However, EU governments lack commitment devices in their funding programmes that reassure investors that worthwhile plans are indeed implemented on schedule. If such a credible commitment device existed in the form of a new bond contract, sovereigns with the right targets could then issue plain vanilla bonds more cheaply than other sovereigns, as the discipline imposed would reduce financing costs for the entire stock of outstanding debt.

4 Sustainability-linked bonds as an alternative option

Sovereign green bonds commit the issuer to allocate funds to certain projects and budgetary expenditures. Within complex national budgets, spending invariably exceeds significantly the funds raised from green bonds. The attribution of project expenditures to a specific type of bond is weak and may well be conceptually flawed (Hardy, 2022). Following the primary issue, the investor has no tools to enforce change within a government that is not already committed to green spending. The government may seek to maintain the continued certification of its green bond framework and prevent the reputational damage that would result from a withdrawal of this assessment. However, investors typically have no specific contractual rights of redress for any loss should their bond holdings no longer be deemed ESG compliant 16 An example was the 2016 $6 billion green bond issued by the Mexico City Airport Trust. After the government halted construction of the airport, a part of the outstanding stock of green bonds was bought back, with the remainder technically remaining ‘green’, though at a diminished rating (Doran and Tanner, 2019). .

By contrast, sustainability-linked bonds reset the financial characteristics of the bond if the issuer fails to meet a specific target. At certain test dates, sustainability outcomes are evaluated and the bond coupon that the issuer pays to the investor will be raised if the target has not been met 17 There are also step-down structures, and other characteristics of the bond could also vary, for instance principal repayment or maturity. . The additional ‘ESG’ quality of the bond will be determined by the choice of key performance indicator (KPI) as a measure of progress. KPIs could be linked, for example, to aggregate emissions or the use of renewable energy, the target levels, and the timing of test dates.

Sustainability-linked bonds therefore seem more promising as an instrument to resolve the investor’s enforcement problem. Terms can be set to reflect the investor’s ambition – at least in principle – and penalties can be made large enough to discipline the issuer. The bond’s design could be particularly attractive for investors who market their portfolios as aligned with a certain climate scenario, and the associated global and national emissions of greenhouse gases. These investors would face a costly portfolio redesign should individual holdings no longer conform to such scenarios 18 The EU’s climate transition benchmarks and Paris-aligned benchmarks set specific decarbonisation targets for portfolios, as defined in the amended Regulation 2016/1011. . The bonds could be free of transition risk if targets reflect the issuer’s path to net zero, and the contingent payoff would compensate the investor, should that path not be followed.

SLBs are agnostic about how funds are spent and the problem of fungibility of funds does not arise. Thus, the issuer will not need to identify eligible projects or track the allocation of funds. This makes SLBs particularly attractive in so-called ‘hard-to-abate’ industries, such as shipping, where there is a lack of green technologies and projects in the near term. Several European energy utilities that have made commitments to the low-carbon transition have also used this type of bond. SLBs could also be attractive for countries where much of cost of the shift to sustainability will involve compensating those who lose out, such as owners of, and workers in, carbon-intensive industries, rather than investment in specific projects.

Targets that are weak or distant will of course raise concerns about greenwashing. There is no reason to assume that a successful SLB issue will necessarily result in additional green spending or changed issuer conduct. In fact, many of the roughly 200 corporate SLBs issued so far in Europe seem simply to reflect targets the issuer announced well in advance of the bond issue 19 Priscila Azevedo Rocha, Akshat Rathi and Todd Gillespie, ‘Empty ESG pledges ensure bonds benefit companies, not the planet’, Bloomberg, 4 October 2022, https://www.bloomberg.com/news/features/2022-10-04/greenwashing-enters-…. . Penalty coupon rates have shown little relation to issuer credit quality, muting the incentive effect for poorer-rated issuers (ESMA, 2023). Sovereign SLB issuers may similarly commit to outcomes which they have had every intention of achieving anyway, or offer contingent payoffs that will not be meaningful.

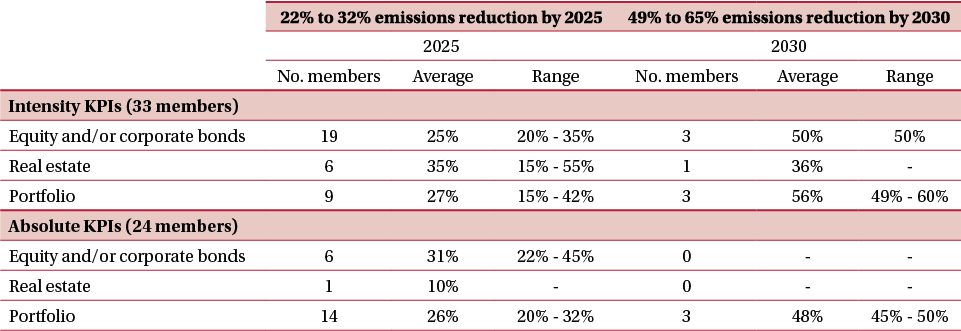

4.1 The growth of the SLB market to date

From a low base, corporate SLBs have grown rapidly in the past years, with about €89 billion issued in EU corporate bond markets in 2022 (Figure 3). Globally, SLB issuance increased tenfold in 2021, to 338 bonds in total. At the same time, the market is generally seen as still immature, with a near-uniform structure and typically undemanding coupon step-up penalties of only 25 basis points. Many of the performance targets set in corporate bond issues seem to have been unambitious, or failed to capture relevant emissions. Often, investors did not have sufficient insights into where the issuer stands relative to the announced targets 20 Ibid. .

A first empirical study of corporate SLBs suggests there is a significant premium at the point of primary issuance. In other words, investors seem to be willing to pay for climate outcomes (Kölbel and Lambillon, 2022). Mielnik and Erlandsson (2022) also showed that issuers can benefit from a significantly lower yield (ie a positive greenium) if the penalty for non-performance is bigger and more front-loaded, and if sustainability targets are ambitious.

To date, only Chile and Uruguay have issued sovereign SLBs, both in 2022 21 Also, at least one European municipality (a city in Sweden) has issued an SLB. . In both cases, interest by investors exceeded by several multiples the amounts placed (Chile, $2 billion; Uruguay $1.5 billion) 22 Chile defined two targets: one establishing maximum absolute emissions over the current decade (combined with a reduction in annual emissions in the target year) and another defining a target for electricity generation from renewable sources. Missing either target at the test point in 2030 will result in a step-up in the coupon by 12.5 basis points, ie cumulatively up to 25 bps. In Uruguay’s SLB, the first target establishes a reduction in aggregate emissions intensity (expressed in CO2 equivalent per real GDP unit) and the second relates to the preservation of Uruguay's native forest area. The bond uses a more complex payoff structure in which both step-ups and step-downs in the coupon rate are envisaged. Missing one and overachieving on the other, for instance, would keep the coupon rate unchanged. Documentation for Chile available here: https://www.hacienda.cl/english/work-areas/international-finance/public…, and for Uruguay here: http://sslburuguay.mef.gub.uy/. . Both countries defined performance targets based on commitments made in their nationally determined contributions (NDCs) under the Paris Agreement, which are widely seen as ambitious. Targets were already well defined based on an international methodology, and Uruguay also committed to increase the frequency of its reporting.

Figure 3: Corporate sustainability-linked bonds issued in the European Union

Source: Bruegel based on Bloomberg. Notes: Panel A shows total issued amount and number of SLBs issued up until December 2022. Panel B shows the type of KPIs associated with SLB issuance in each sector. The proportions refer to the number of times that KPIs were used for each industry. Around 32 percent of SLBs have more than one KPI. Others includes categories such as gender equality, sustainable farming and food, transport, biodiversity, sustainable sourcing and affordable housing.

The fact that SLBs are not more popular among governments could be due to two factors. First, various market failures and information barriers are inherent in contingent sovereign debt. Neither inflation-linked nor GDP-indexed bonds account for a significant share of emerging market debt, mainly because investors doubt that indicators that drive the bond’s pricing are compiled independently and transparently. A significant problem in otherwise liquid sovereign markets seems to be that contingent debt requires the ongoing analysis of non-financial performance criteria, such as emission reductions, which investors are not best placed to monitor. Second, in the recent environment of loose financing conditions and low interest rates investors have not discriminated sufficiently between the different green bond frameworks. Issuers hence incurred few costs in funding green projects up front, even though projects would only be completed with a delay.

4.2 Could sovereign SLBs make sense for European issuers?

Could sovereign SLBs issued by EU governments contribute meaningfully to decarbonisation and open up additional financing options in support of the European Green Deal? If sovereign SLBs are designed well, it is likely that they could, for three reasons.

First, investors have expressed interest in bonds with limited transition risks and in creating portfolios aligned with the net-zero goal. The first interim targets are still some years in the future, but the early evidence reviewed above suggests this reallocation is already underway. Investors that seek to make an impact are a small niche segment in the investor landscape, though they are becoming more important and might become more vocal in future.

Second, as discussed in the previous section, current mechanisms for green-spending disclosure and commitment in the various national bond frameworks seem imperfect and disparate. In any case, they notionally tie proceeds to certain spending (if fungibility is ignored), not to policies or outcomes.

Third, the experience of the first two sovereign SLB issuers, Chile and Uruguay, suggests that SLBs can be designed in a way to strengthen commitment and disclosure, given a need to publish KPIs regularly. To instil confidence, the enforcement of the SLB sustainability targets through penalty coupon rates is a necessary, though not sufficient, condition. The path sketched in the SLB contract may be exactly what the sovereign would have done anyway. The question is therefore whether EU issuers already have net-zero targets that are not fully credible, and whether sufficiently meaningful penalties can be defined. The transparency of a government’s climate plans, and its disclosure in the markets, is less of a problem than for companies. Emission-reduction targets are regularly announced and scrutinised publicly.

If issued at sufficient scale, countries with credible climate policies would likely see a convergence in pricing of their sovereign SLB and conventional (‘plain vanilla’) bonds in the secondary market. The discipline exerted by the SLB contract would solve the government’s credibility problem and would reduce transition risk in the eyes of investors. Conversely, countries without SLBs, or that implement climate policy poorly, would have a credibility problem and would see a difference in borrowing costs resulting from transition risk, relative to other issuers of similar credit quality.

Needless to say, there are also some important drawbacks of SLBs for sovereigns. The issuer ties the hands of current and future governments to deliver on climate commitments made at the time of issuance, though these may look more demanding as the climate transition progresses. Moreover, the government would subject climate policy performance to the scrutiny of bond markets as investors’ assessments of the risk of a breach of sustainability targets would become public knowledge. Sovereign debt would be rated on the basis of both traditional measures of risk of default, and also the risk of missing the self-imposed climate targets. This latter risk could be the basis of a warrant contract, split off from the original SLB. In effect, the bond market would put a price on the government’s climate policy credibility 23 Even though the government may not be able to prevent such a split pricing, it is in its interest to offer the climate contract in a ‘bundled’ format in the initial primary auction. .

5 A proposal for European climate-linked sovereign bonds

The European Commission and the European Central Bank have repeatedly stated their aim that capital markets should support the climate transition (Lagarde, 2021). The EU’s objectives for the climate transition and capital markets integration should now be promoted through a deeper coordination of national debt issuance related to climate commitments.

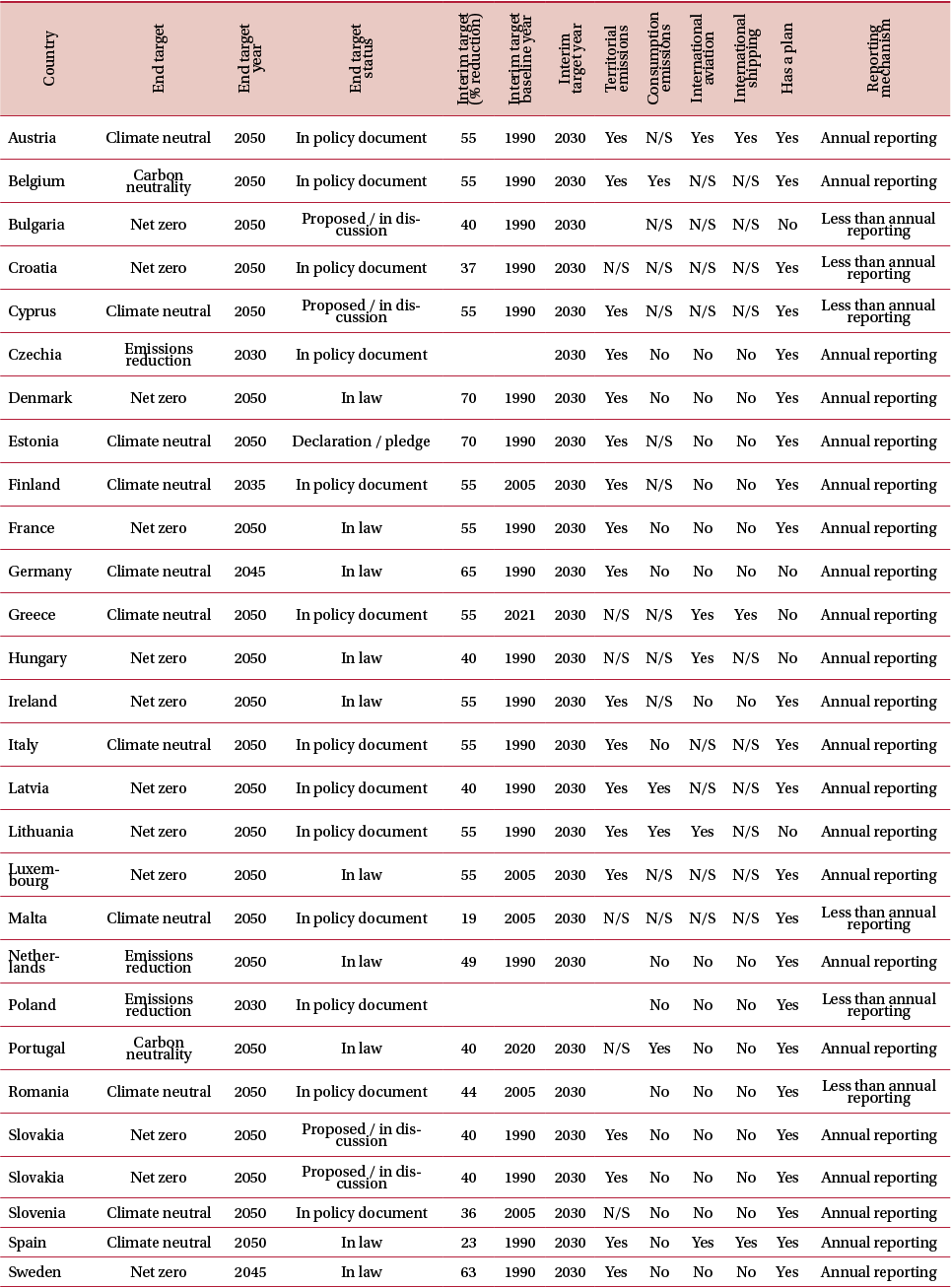

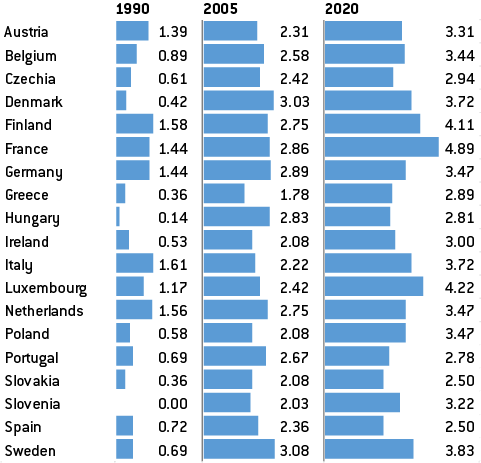

All EU governments have made net-zero pledges in one form or another, though the speed of convergence, transparency of targets and their legal significance vary considerably (Table 1). Investors are bound to view these plans as lacking credibility. An OECD index of environmental policy stringency shows that EU country policies have not improved at the same pace (Figure 4). All 19 EU countries covered by the OECD have improved over the past 15 years, but divergence has, if anything, increased. A closer look at the component policy indicators shows that the implementation of market-based incentives, such as emissions trading and taxes, is the main factor behind the divergence. Support for fossil-fuel consumption, including through various tax rebates, also remains relatively high in some major countries.

If designed well, sovereign SLBs issued by EU countries could satisfy the investor appetite for credible net-zero exposures, and would allow EU governments to signal their commitment to climate targets. Should these targets be missed, countries could be subject to meaningful financial penalties. As general budgetary resources, the proceeds of SLBs could finance a variety of the expanding public sector climate expenditures.

National debt-management offices would approach any new instrument with the aim of delivering on long-standing principles of efficient debt management and, as a secondary objective, improving the functioning and liquidity of the local bond market. Bond market participants, for their part, will require an instrument that prices in the risk of a delayed national climate transition, which could in turn impact on private-sector climate plans 24 As for other contingent debt instruments, two risks determine the SLB’s price in secondary markets: that of a conventional default (reducing the price and raising the yield as this becomes more likely), and that of a breach of the sustainability target (making the bond more valuable to investors in the case of a ‘step-up’ penalty on the coupon rate). .

A further incentive for government debt management offices could be to make the broader capital market more resilient to climate transition risks. By investing in a sovereign SLB that pays a premium if national climate policies disappoint, investors hold a ‘climate hedge’ that could offset the potential loss in value of private sector securities impacted by the country’s inadequate progress on emissions.

Table 1: Climate targets set by EU governments

Source: Bruegel, based on Net Zero Tracker. Note: Data for the majority of countries was updated in June 2022.

Figure 4: Climate policy stringency in EU countries

Source: Bruegel based on OECD. Note: The Environmental Policy Stringency index ranges from 0 (not stringent) to 6 (highest degree of stringency). It is based on 13 environmental policy instruments, primarily related to climate and air pollution, and across three categories: market-based policies (including trading schemes and taxes), non-market-based policies (including emission limits), and technology-support policies (including upstream support via low-carbon R&D expenditures, and support for solar and wind energy).

5.1 A possible design

If sustainability-linked bonds were to be issued, there is a strong case for a single framework and contract structure, to help address the limited integration and illiquidity of EU markets. A single standard for sovereign SLBs would be a major improvement over the currently disjointed national green-bond frameworks, which have done little to overcome the underlying flaws in the European public debt market. This should be easy to do if a single set of targets and performance metrics could be agreed on the basis of existing EU legislation.

The EU’s sovereign debt managers already collaborate loosely within the Economic and Financial Committee (EFC) 25 See https://economic-financial-committee.europa.eu/index_en. . The mandate for the sovereign debt markets sub-committee was last updated in 2010 and tasks debt managers with promoting the efficient functioning of the primary and secondary markets and the integration of markets, and establishing some good practices in terms of, for instance, transparency of issuance plans 26 See https://economic-financial-committee.europa.eu/efc-sub-committee-eu-sov…. A recent outcome of the work of this group was the introduction of collective action clauses which facilitate the restructuring of national sovereign bonds under the ESM Treaty. . Though debt management and fiscal policy remain national prerogatives, there appears to be some shared interest in the smooth functioning of primary-issuance processes and in ensuring market liquidity. An important new task for the EU’s debt managers and this committee should be to increase transparency about sustainability aspects of national debt-management strategies and issuance plans.

The EFC sovereign debt markets sub-committee could be a forum in which to reach consensus on that common design, including for EU SLBs. For sovereign issuers of SLBs, the EFC should define a single format that reflects national climate commitments and defines a common metric and timing of the trigger point. National debt managers would still have discretion over what scope to give this instrument in their national debt-issuance plans.

In terms of a regulatory framework for SLBs, the new EU green bond standard could be easily adapted. Existing industry standards already define the basic structure of the instrument, and set standards for the reliability and transparency of performance targets, which may well differ between issuers and industries (ICMA, 2020). This could be assessed by the verification providers, for which an accreditation process exists in the EU green bond regulation. SLBs are a form of transition finance, committing the issuer to certain climate outcomes, and it would be important for EU regulations to give this equal weight in the green finance that rests on alignment with the taxonomy. Government bonds of course play a key role in prudential liquidity measures and banks’ refinancing operations. Sovereign SLBs should be given equal access to all central-bank facilities. The ECB has already granted this for corporate SLBs 27 The ECB’s 2020 acceptance of corporate SLBs relates to those that target environmental objectives set in the EU Taxonomy Regulation or UN Sustainable Development Goals. Because SLBs are contingent debt instruments and may be callable by the issuer, there could be complications in recognising the instrument under EU prudential capital and liquidity rules. .

5.2 Targets that discipline national policy

In the design of sustainability-linked bonds, the nature of the sustainability performance target and the timing and the metric that measure it are crucial. For sovereign SLBs, the World Bank (2022) proposed a number of conditions for the KPI, including public availability (and remaining so for the foreseeable future), being associated with sovereign intervention, frequent and regular compilation, and comparability across countries.

Investors will indeed look for a measure that is transparent, reported independently and reliably, and aligns with their underlying investment mandate. A basic condition for efficient pricing in secondary markets is that investors can develop a probability distribution around the target being achieved, based on historical data (Mielnik and Erlandsson, 2022). National greenhouse gas emissions reductions would likely meet these criteria.

Issuers would however look for a performance target that is largely, if not entirely, under their control. This would call for a narrower measure than national emissions, as these are determined by both EU-level and national policies. A number of industries, including electricity and heat generation, energy-intensive industry sectors (oil refineries, steel industry, cement, glass and paper production, etc) and some commercial aviation, are covered by the emissions trading system (ETS). These sectors account for around 40 percent of total EU emissions. A reform of the ETS, agreed in June 2022 28 See https://www.consilium.europa.eu/en/press/press-releases/2022/06/29/fit-…. , will expand its scope by including maritime shipping emissions and creating a separate ETS for emissions from buildings and road transport. Most other industrial activities not within the scope of the EU ETS or EU rules on land use, are subject to national targets. These targets are set under the so-called Effort Sharing Regulation (ESR, EU 2018/842), which covers sectors including road transport, heating, agriculture, industry and waste management 29 See https://climate.ec.europa.eu/eu-action/effort-sharing-member-states-emi…. . Allocations of emissions targets are based on GDP per capita, but with some limited adjustments to address cost-efficiency concerns. A 2021 Commission proposal to review the ESR was provisionally agreed in November 2022 and increases the aggregate EU greenhouse gas emissions reduction goal in the covered sectors from minus 29 percent to minus 40 percent by 2030 relative to 2005 30 See https://www.europarl.europa.eu/legislative-train/package-fit-for-55/fil…. .

The Commission argues that EU-level measures, such as rules on energy efficiency, renewables and emissions standards for cars are by themselves insufficient to achieve the collective EU targets. National measures, such as infrastructure investment, tax benefits for zero-emission cars or building renovation should complement EU-level measures.

Issuers would seek to rely on these national policies and measures when designing SLBs. The EU’s revised ESR could define the performance target and metric and the timing of the test point. Using the ESR targets would require the Commission to publish at least annually data on emissions in the covered sectors of EU countries.

Several other details would still need to be fleshed out, though could be left to individual debt-management offices. Issuers might define targets that exceed those of the ESR, or offer more or less demanding penalty coupon rates should targets be missed. In primary auctions of SLBs, investors would then bid for volume and yields based on conventional sovereign credit quality, and issuers would at the same time need to fix the timing and ambition of the sustainability performance target, and the penalty coupon rate 31 In the product mix auction developed in Klemperer (2009), an auctioneer sells multiple differentiated contracts in a single round. The application of this model in government bond primary auctions of climate-linked debt would allow debt managers to capture different investor classes with different preferences for climate targets and impact. . At whatever scale and in whatever format ESR-linked bonds are issued, the risk of EU countries missing national emission targets would be assessed and priced by the market 32 As is the case with any other contingent debt instrument, trading in secondary markets could lead to a situation where the traditional bond investor’s rights to enforcement are split off from the sustainability performance commitment. An independent certificate for climate performance would emerge and be priced in the markets. .

Given limited initial volumes, the potential financial penalty for failing to meet a sustainability target will be quite small relative to the size of a public expenditure programme that would be needed to achieve the target (Cheng et al, 2022a). Even though volumes would be small, the risk of national governments failing to meet their climate targets would impose a reputational risk. Also, the risk of such failure would be priced by the market, which could by itself discipline policy.

5.3 Anticipating issuer supply

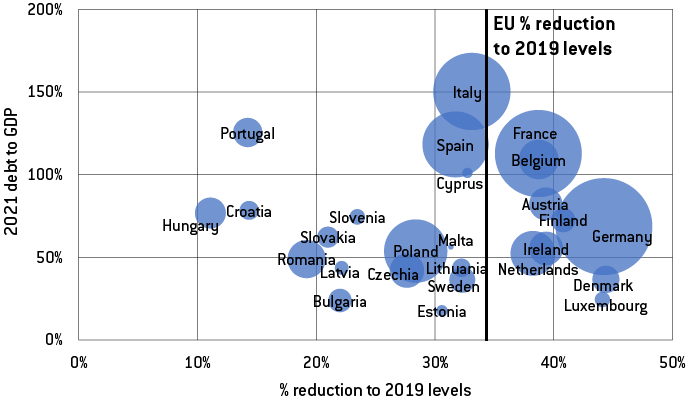

EU countries need to deliver on varying relative emission reductions under the ESR (Figure 5). Germany, for instance, will need to achieve reductions above the EU average, while a number of smaller EU countries, mostly in central and south-eastern Europe, will only need to deliver emission reductions below the EU average.

Countries that commit to their tougher targets in SLB contracts (in the right part of Figure 5) would likely see stronger demand for their SLBs, and lower coupon rates if policies are credible. Where fiscal headroom is already limited (in the upper part of Figure 5), SLB issuance may be particularly attractive for the issuer. If traditional sovereign credit quality is poor but climate policies are sound, SLBs would represent a funding tool less likely to be impacted by creditor runs. Fiscal hawks may well be climate laggards and vice versa.

Figure 5: Estimated emission reductions under the ESR, current levels of government debt and total 2019 emissions (CO2 equivalent)

Source: Bruegel, based Eurostat (debt data) and European Environmental Agency (greenhouse gas emissions data). Notes: Unit is carbon dioxide equivalent, which is used to compare emissions from different greenhouse gases. We try to approximate the sector coverage to that of the ESR, selecting waste, agriculture, road transport and residential and commercial buildings. Small industries are not captured, so the numbers represent a lower bound. The percentage reduction in emissions by 2030 was calculated by comparing 2019 levels with the emissions ceiling determined by 2005 levels, for the selected sectors. Total emissions (the size of the bubble) refer to ESR-covered emissions only for 2019. We chose not to include Greece in the chart to avoid confusion, since our calculations indicated an increase in emissions compared to the ESR target.

6 Conclusions

From a low base, corporate issuance of sustainability-linked bonds has grown rapidly over the past two years. Differently to green bonds, issuers of SLBs are free to spend bond proceeds on general purposes, though coupon rates or other bond terms would become more onerous should key performance targets be missed. There is a risk of issuer using SLBs to greenwash their true environmental credentials, though SLBs also offer the potential for investors to monitor and discipline sustainability outcomes more effectively than would be the case for green bonds.

The attraction of SLBs for sovereign issuers lies in being able to support a broad expenditure programme (including tax incentives), even though projects that are strictly green may not be available in sufficient quality, size or predictability. Crucially for investors, the instrument can be consistent with a certain climate scenario. In an ideal case, targets would be ambitious, and bond terms for failing to meet these targets would be significantly penalising.

Unlike green bonds, investors can potentially argue that the counterfactual (of no discipline through bond investor scrutiny) would allow the issuer to relapse into the status quo ante of inadequate climate action. By contrast, the prevailing sovereign green bond programmes in EU countries respond to investor appetite for green financing but do little to deliver good climate policy outcomes, while complicating debt and budgetary management.

Issuing sustainability-linked sovereign bonds tied to existing commitments under EU rules would accomplish three objectives the government should pursue: financing costs would likely be reduced relative to the present market environment in which bond instruments do not allow issuers to effectively signal commitment; budgetary management of bond proceeds would be simplified; and the risk of a government missing EU climate targets would become transparent in bond markets. Even if sovereign SLBs are issued in only limited amounts, this greater transparency of national government climate performance could play a useful signalling role. Depending on investor appetite, a share of outstanding conventional bonds could then be converted into the SLB format.

Issuance of sustainability-linked bonds premised on achieving EU emission targets would, by definition, offer investors a net-zero exposure. Unlike in a portfolio construction based on backward-looking national emissions, pricing of SLBs could be based on existing policy commitments and the EU climate transition path, increasing the credibility of those issuers where the bulk of the transition is yet to come, and penalising those that ultimately fail to live up to it. By mitigating the climate transition risk embodied in sovereign bond exposures in this way, SLBs can both reinforce the needed long-term policy commitment to sustainability and enhance debt-management strategies.

References

Baccianti, C. (2022) ‘The public spending needs of reaching the EU’s climate targets’, in F. Cerniglia and F. Saraceno (eds) Greening Europe: 2022 European Public Investment Outlook, Open Book Publishers

Barker, S., C. Williams and A. Cooper (2021) Fiduciary duties and climate change in the United States, Commonwealth Climate and Law Initiative, available at: https://commonwealthclimatelaw.org/fiduciary-duties-and-climate-change-in-the-united-states/

Bingler, J. (2022) ‘Expect the worst, hope for the best: the valuation of climate risks and opportunities in sovereign bonds’, Working Paper 22/371, Center of Economic Research at ETH Zurich

Bolton, P., L. Buchheit, M. Gulati, U. Panizza, B. Weder di Mauro and J. Zettelmeyer (2022) Climate and debt, Geneva Reports on the Global Economy 25, Centre for Economic Policy Research

Cheng, G., T. Ehlers and F. Packer (2022a) ‘Sovereign and sustainable bonds: challenges and new options’, BIS Quarterly Review, September, Bank for International Settlements

Cheng, G., E. Jondeau and B. Mojon (2022b) ‘Building portfolios of sovereign securities with decreasing carbon footprints’, BIS Working Paper 1038, Bank for International Settlements

Collender, S., B. Gan, C. Nikitopoulos, K. Richards and L. Ryan (2022) ‘Climate transition risks in sovereign bond markets’, mimeo, available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3861350

Domínguez-Jiménez, M. and A. Lehmann (2021) ‘Accounting for climate policies in Europe’s sovereign debt market’, Policy Contribution 10/2021, Bruegel

Doran, M. and J. Tanner (2019) ‘Critical Challenges facing the green bond market’, International Financial Law Review, October/November

Doronzo, R., V. Siracusa and S. Antonelli (2021) ‘Green bonds: the sovereign issuers’ perspective’, Markets, Infrastructures, Payment Systems 3, Banca d’Italia

ESMA (2022) Final Report, Guidelines on certain aspects of the MiFID II suitability requirements, European Securities and Markets Authority, available at https://www.esma.europa.eu/sites/default/files/library/esma35-43-3172_final_report_on_mifid_ii_guidelines_on_suitability.pdf

ESMA (2023) Report on trends, risks and vulnerabilities, European Securities and Markets Authority, available at https://www.esma.europa.eu/sites/default/files/library/ESMA50-165-2438_trv_1-23_risk_monitor.pdf

Flugge, M.L., R. Mok and F.E. Stewart (2021) Striking the Right Note: Key Performance Indicators for Sovereign Sustainability-Linked Bonds, World Bank Group, Washington DC, available at https://openknowledge.worldbank.org/handle/10986/36805

Grzegorczyk, M. and G. Wolff (2022) ‘Greeniums in sovereign bond markets’, Working Paper 17/2022, Bruegel, available at https://www.bruegel.org/working-paper/greeniums-sovereign-bond-markets

Hardy, D. (2022) ‘Alternatives in the design of sovereign green bonds’, wiiw Policy Note/Policy Report No. 62, Vienna Institute for International Economic Studies, available at https://wiiw.ac.at/alternatives-in-the-design-of-sovereign-green-bonds-p-6412.html

ICMA (2020) Sustainability-linked bond principles, International Capital Markets Association, available at https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/June-2020/Sustainability-Linked-Bond-Principles-June-2020-171120.pdf

Klaaßen, L. and B. Steffen (2023) ‘Meta-analysis on necessary investment shifts to reach net zero pathways in Europe’, Nature Climate Change 13: 58-66, available at https://www.nature.com/articles/s41558-022-01549-5

Klemperer, P. (2009) ‘A new auction for substitutes: central bank liquidity auctions, toxic asset auctions and variable product mix auctions’, CEPR Discussion Paper No. DP7395, Centre for Economic Policy Research, available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1469874

Kölbel, J. and A. Lambillon (2022) ‘Who pays for sustainability? An analysis of sustainability-linked bonds’, Swiss Finance Research Paper 27, available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4007629

Lagarde, C. (2021) ‘Towards a green capital markets union for Europe’, speech at the European Commission’s high-level conference on the proposal for a Corporate Sustainability Reporting Directive, 6 May, available at https://www.ecb.europa.eu/press/key/date/2021/html/ecb.sp210506~4ec98730ee.en.html

Mielnik, S. and U. Erlandsson (2022) ‘An option pricing approach for sustainability-linked bonds’, Anthropocene Fixed Income Institute, available at https://anthropocenefii.org/afii-slb

OECD (2022): ‘ESG practices and challenges from a public debt management perspective’, in OECD Sovereign Borrowing Outlook 2022, Organisation for Economic Co-operation and Development

PCAF (2021) New methods for financial institutions measuring and reporting scope 3 category 15 emissions, Draft for public consultation, Partnership for Carbon Accounting Financials, available at https://carbonaccountingfinancials.com/files/consultation-2021/pcaf-draft-new-methods-public-consultation.pdf

PRI (2022) Fiduciary duty in the 21st century, final report, Principles for Responsible Investment

Volz, U., J. Beirne, N. Ambrosio Preudhomme, A. Fenton, E. Mazzacurati, N. Renzhi and J. Stampe (2021) Climate change and sovereign risk, SOAS University of London, Asian Development Bank Institute, World Wide Fund for Nature Singapore, and Four Twenty Seven

Footnotes

[2] EU Commission Green Bond Dashboard: https://commission.europa.eu/strategy-and-policy/eu-budget/eu-borrower-investor-relations/nextgenerationeu-green-bonds/dashboard_en#.

[3] See https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/eu-taxonomy-sustainable-activities_en.

[4] See https://www.europarl.europa.eu/legislative-train/theme-an-economy-that-works-for-people/file-eu-green-bond-standard.

[5] Through its green bonds, Germany expects to introduce “new financial instruments to leverage additional potential for interest cost savings, improve diversification, create even more efficient ways of borrowing, and tap new investor groups.” Green bonds are presented as an “example of innovation and have now become a fixed part of strategic issuance planning.” See Deutsche Finanzagentur website: https://www.deutsche-finanzagentur.de/en/federal-funding/debt-management/portfolio-management.

[6] See also Doronzo et al (2021) for a broader review of the sovereign issuer’s cost-benefit assessment.

[7] Under the EU’s Sustainable Finance Disclosure Regulation (2019/2088), investors and advisors need to disclose the taxonomy alignment of financial products. This is inherently more difficult for sovereign than for corporate green bonds.

[8] See https://www.icmagroup.org/sustainable-finance/the-principles-guidelines-and-handbooks/green-bond-principles-gbp/.

[9] Poor enforcement is therefore a problem for all investors that hold green bonds within a portfolio that needs to comply with certain non-financial (ESG) characteristics. It would be a more severe problem for so-called impact investors, who seek behavioural change on the side of the issuer and need to account for this change. However, impact investors are as yet a niche segment of the investor landscape, and sovereign bonds are not normally part of their holdings.

[10] For instance the indices offered by FTSE Russell: https://www.ftserussell.com/index/spotlight/climate-wgbi.

[12] In the case of emissions-intensity targets, financed emissions are normalised by some measure of financing, ie overall emissions could still rise.

[13] In future, government bonds may be assessed based on a measure of financed emissions, rather than attributed to the issuer’s policies. Direct emissions accounted for by the government are typically minimal, while indirect emissions are difficult to account for and risk double-counting. For the methodology developed by the Partnership for Carbon Accounting Financials, see PCAF (2021).

[14] The third ‘protocol’ for making commitments; see See UN Environment Programme Finance Initiative, ‘Net-Zero Asset Owner Alliance raises expectations for members’ real economy impact with updated Protocol’, 31 January 2023, https://www.unepfi.org/industries/net-zero-asset-owner-alliance-raises-expectations-for-members-real-economy-impact-with-updated-protocol/.

[15] Principles for Responsible Investment, ‘ASCOR Consultation to Assess Sovereign Debt Issuers on Climate Change’, 7 February 2023, https://www.unpri.org/news-and-press/ascor-consultation-to-assess-sovereign-debt-issuers-on-climate-change/11157.article.

[16] An example was the 2016 $6 billion green bond issued by the Mexico City Airport Trust. After the government halted construction of the airport, a part of the outstanding stock of green bonds was bought back, with the remainder technically remaining ‘green’, though at a diminished rating (Doran and Tanner, 2019).

[17] There are also step-down structures, and other characteristics of the bond could also vary, for instance principal repayment or maturity.

[18] The EU’s climate transition benchmarks and Paris-aligned benchmarks set specific decarbonisation targets for portfolios, as defined in the amended Regulation 2016/1011.

[19] Priscila Azevedo Rocha, Akshat Rathi and Todd Gillespie, ‘Empty ESG pledges ensure bonds benefit companies, not the planet’, Bloomberg, 4 October 2022, https://www.bloomberg.com/news/features/2022-10-04/greenwashing-enters-a-22-trillion-debt-market-derailing-climate-goals.

[20] Ibid.

[21] Also, at least one European municipality (a city in Sweden) has issued an SLB.

[22] Chile defined two targets: one establishing maximum absolute emissions over the current decade (combined with a reduction in annual emissions in the target year) and another defining a target for electricity generation from renewable sources. Missing either target at the test point in 2030 will result in a step-up in the coupon by 12.5 basis points, ie cumulatively up to 25 bps. In Uruguay’s SLB, the first target establishes a reduction in aggregate emissions intensity (expressed in CO2 equivalent per real GDP unit) and the second relates to the preservation of Uruguay's native forest area. The bond uses a more complex payoff structure in which both step-ups and step-downs in the coupon rate are envisaged. Missing one and overachieving on the other, for instance, would keep the coupon rate unchanged. Documentation for Chile available here: https://www.hacienda.cl/english/work-areas/international-finance/public-debt-office/esg-bonds/sustainability-linked-bonds, and for Uruguay here: http://sslburuguay.mef.gub.uy/.

[23] Even though the government may not be able to prevent such a split pricing, it is in its interest to offer the climate contract in a ‘bundled’ format in the initial primary auction.

[24] As for other contingent debt instruments, two risks determine the SLB’s price in secondary markets: that of a conventional default (reducing the price and raising the yield as this becomes more likely), and that of a breach of the sustainability target (making the bond more valuable to investors in the case of a ‘step-up’ penalty on the coupon rate).

[26] See https://economic-financial-committee.europa.eu/efc-sub-committee-eu-sovereign-debt-markets_en. A recent outcome of the work of this group was the introduction of collective action clauses which facilitate the restructuring of national sovereign bonds under the ESM Treaty.

[27] The ECB’s 2020 acceptance of corporate SLBs relates to those that target environmental objectives set in the EU Taxonomy Regulation or UN Sustainable Development Goals. Because SLBs are contingent debt instruments and may be callable by the issuer, there could be complications in recognising the instrument under EU prudential capital and liquidity rules.

[28] See https://www.consilium.europa.eu/en/press/press-releases/2022/06/29/fit-for-55-council-reaches-general-approaches-relating-to-emissions-reductions-and-removals-and-their-social-impacts/.

[29] See https://climate.ec.europa.eu/eu-action/effort-sharing-member-states-emission-targets/effort-sharing-2021-2030-targets-and-flexibilities_en.

[30] See https://www.europarl.europa.eu/legislative-train/package-fit-for-55/file-review-of-the-effort-sharing-regulation.

[31] In the product mix auction developed in Klemperer (2009), an auctioneer sells multiple differentiated contracts in a single round. The application of this model in government bond primary auctions of climate-linked debt would allow debt managers to capture different investor classes with different preferences for climate targets and impact.

[32] As is the case with any other contingent debt instrument, trading in secondary markets could lead to a situation where the traditional bond investor’s rights to enforcement are split off from the sustainability performance commitment. An independent certificate for climate performance would emerge and be priced in the markets.