How Ukrainian gas storage can contribute to Europe’s security of supply

To top up stored gas volumes for the coming winter, Europe can use spare capacity in Ukraine.

Europe is continuing in its so-far successful effort to wean itself off Russian gas supplies. Gas storage facilities are filling at a healthy pace, with all signs pointing to the European Union hitting its target for storage to be 90 percent full well before the 1 November deadline 1 These are established in the EU Gas Storage Regulations; see https://energy.ec.europa.eu/topics/energy-security/gas-storage_en. . A large jump in imports of liquified natural gas has helped. Meanwhile, the 15 percent demand reduction target that the EU set itself continues to be respected 2 See Bruegel Natural Gas Demand Tracker, https://www.bruegel.org/dataset/european-natural-gas-demand-tracker. . Once storage is full, there is little more the EU can do to better prepare for the coming winter.

It is possible, however, that during September and October there may be an oversupply of gas in the EU. Storage facilities will be full and winter demand will not yet have picked up. This capacity limit could undermine the EU’s ability to carry gas over from gas-abundant summer months to potentially gas-scarce winter months.

Gas for the winter costs more, and therefore without more storage capacity, the EU might pay more than necessary. August and September 2023 futures at time of writing are trading at €26 per megawatt hour, while futures for the first quarter of 2024 are trading at €49/MWh. This spread of €23/MWh – greater than the absolute pre-crisis price – reflects the significant premium associated with providing gas to the European continent in the winter compared to the summer, especially if the winter is particularly cold.

The EU should thus look at options to store more gas now. A significant contribution may be offered by storage facilities in Ukraine. Utilising this capacity would increase the EU’s storage capacity by about 10 percent. Figure 1 shows that at current import levels, with demand 15 percent below the five-year average, the EU will reach maximum storage already in September. Ukrainian storage could be an option for gas during October, with the result that the EU would enter winter 2023-24 in a more comfortable position.

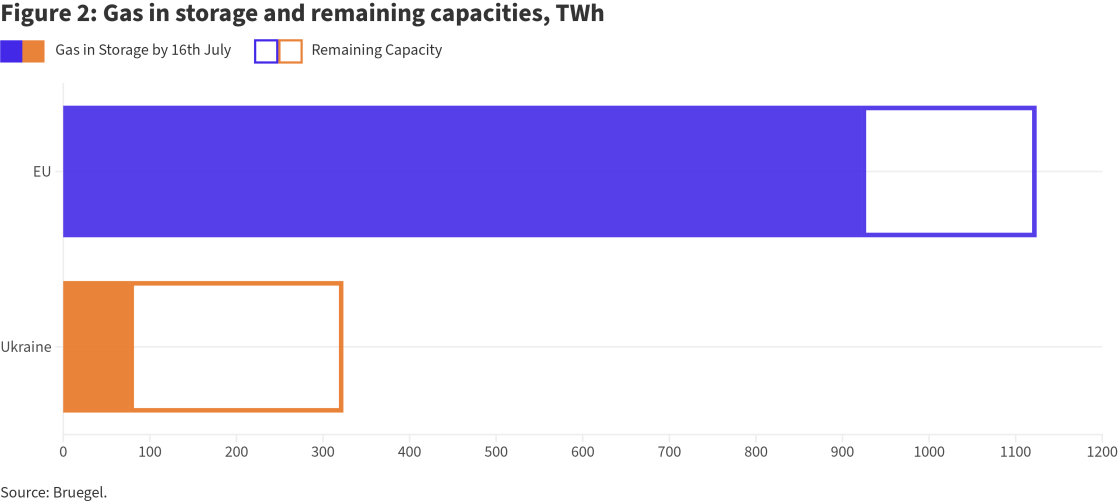

Available storage capacity in Ukraine, in volume terms, currently exceeds as-yet unfilled storage capacity in the EU (Figure 2). Ukraine’s natural gas storage owner, Naftogaz, has made clear that at least one-third of this capacity (100 TWh) is available to foreign traders 3 Frédéric Simon, ‘Ukraine offers 10 bcm of gas storage to Europe for next winter’, Euractiv, 5 April 2023, https://www.euractiv.com/section/energy-environment/news/ukraine-offers…. . This might offer traders potential profits of about €2 billion 4 Assuming traders benefit from the spread of €23/MWh between current monthly future prices and Q1 2024. .

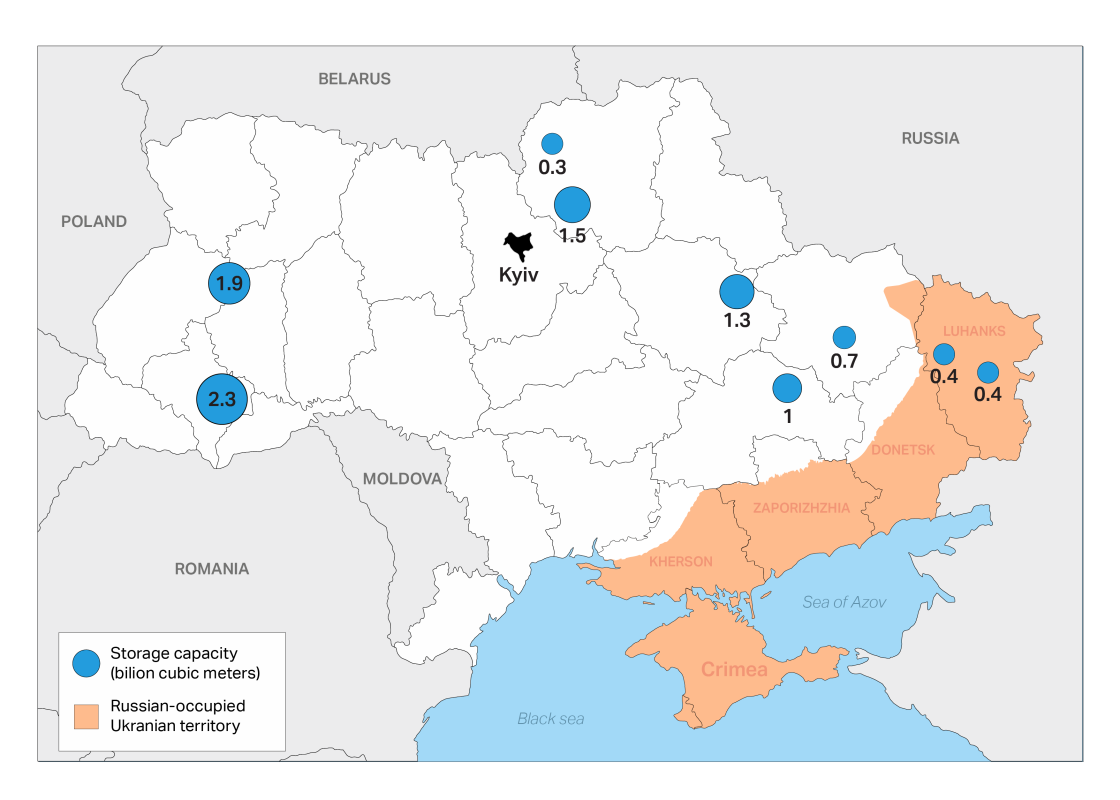

Historically developed to ensure stable flows from the Soviet Union to Europe, the storage facilities in Ukraine are large and located on the country’s western borders (Figure 3). This storage is already linked to the European gas grid with harmonised regulation and was used significantly during the winter of 2020 (Losz and Joseph, 2023).

Figure 3: Ukrainian natural gas storage facilities

Source: Bruegel based on Institute for the Study of War (see https://storymaps.arcgis.com/stories/36a7f6a6f5a9448496de641cf64bd375) and Iwaszczuk et al (2022). Note: correct as of 20/07/2023.

So far in 2023, European traders have not made significant use of Ukrainian storage, for three main reasons. The first is war risk and the potential for damage to gas infrastructure. Given that gas storage facilities themselves are located well below ground, pipeline infrastructure might be more vulnerable. There are calls for the European Union to offer insurance to cover the associated risk borne by traders 5 [1] Bloomberg News, ‘Europe’s Risky Plan to Avert an Energy Crisis: Stash Gas in Ukraine’, 12 June 2023, https://www.bloomberg.com/news/articles/2023-06-12/europe-has-a-plan-to…. .

Second: timing. The EU’s gas-storage filling targets focus on filling to 90 percent storage facilities within each EU country, and as a result incentivise the first volumes of gas flowing there. It is possible therefore that Ukrainian storage will be utilised more once European countries hit their targets. However, an issue with this approach is the capacity limit of getting gas into Ukraine. For the pipeline routes from Slovakia, Poland, Hungary and Romania, we estimate that technically no more than 17-20 TWh per month can travel from the EU into Ukraine. This volume may be topped up by ‘virtual reverse flow’, which involves EU countries virtually sending gas back to Ukraine that was intended to transit into their systems – this will all be Russian gas as that is the only gas which currently transits Ukraine into the EU (Pirani and Sharples, 2020). In any case, waiting until October 2023 to start sending gas to Ukraine would limit the amount of capacity that can be used.

Finally, European traders might worry that Ukraine will not send the gas back to the EU in a very cold winter. As European support and the EU accession process involve a strong commitment from Ukraine to meet its obligations, member states or the EU can confidently provide explicit insurance for traders.

To sum up, utilising the extra 100 TWh capacity available in Ukraine will provide a nice boost to Europe’s winter outlook, and a welcome boost to Ukraine’s income. To better prepare for next winter the EU should find ways to encourage the flow of gas already today into Ukrainian storage sites.

References

Losz, A. and I. Joseph (2023) ‘Ukraine’s Underused Gas Storage Capacity’, Center on Global Energy Policy Blog, 30 May, available at https://www.energypolicy.columbia.edu/ukraines-underused-gas-storage-capacity/

Pirani, S. and J. Sharples (2020) ‘European gas storage: backhaul helps open the Ukrainian safety valve’, Oxford Energy Comment, Oxford Institute for Energy Studies, available at https://a9w7k6q9.stackpathcdn.com/wpcms/wp-content/uploads/2020/05/European-gas-storage-backhaul-helps-open-the-Ukrainian-safety-valve.pdf

Iwaszczuk, N., I. Zapukhliak, A. Iwaszczuk and O. Dzoba (2022) ‘Underground Gas Storage Facilities in Ukraine: Current State and Future Prospects’, Energies 15(18): 6604, available at https://www.researchgate.net/publication/363508480_Underground_Gas_Storage_Facilities_in_Ukraine_Current_State_and_Future_Prospects