Brexit, phase two (and beyond): The future of the EU-UK relationship

Whether it looks more like ‘CETA-plus’ or ‘EEA-minus’, the trade deal that emerges from phase two of the Brexit negotiations should not be the limit o

The European Commission has recommended to the Council that sufficient progress has been made in phase one of the EU-UK negotiations. With the Council expected to endorse the recommendation this week, phase-two discussions on the future relationship can start (possibly in March).

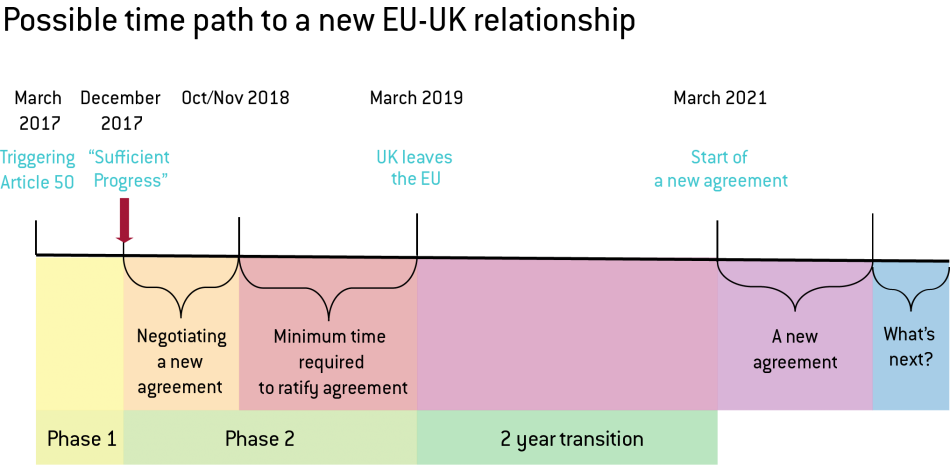

A possible timeline of the next steps in the EU-UK relationship is shown in the diagram below:

- a one-year period of negotiations that will take us up to October/November of 2018, at the latest. This allows for the minimum time required for the new agreement to be ratified by the EU by March 2019 – the cut-off date for the UK to leave the EU.

- After March 2019, a two-year period is envisaged in which the UK would most likely remain a full member of the EU single market and customs union, but without any voting rights. During this period, the UK would also remain bound by decisions of the European Court of Justice and continue to pay its full share in the EU budget. This should ensure a smooth transition from EU membership to the new EU-UK framework.

- By March 2021, the new negotiated trade agreement between the EU and the UK will come into effect.

An alternative timeline could be as follows: by October/November 2018, the two parties have agreed on the broad contours of the future trade deal, but not on the details. In this case, the ratification process which will take place between that time and March 2019 would only be about the two-year interim arrangement. During this transition period, the UK would probably remain in the EU single market and customs union, and abide by EU budget and ECJ rules, like in the timeline described above. The only difference with the previous timeline would be that negotiations on the details of the trade deal would continue during the transition period, which would need to include sufficient time for the ratification of the agreement.

What can we expect the future EU-UK relationship to look like? Ideally it should encompass both a trade component as well as a more political, strategic component.

As far as trade is concerned, Liam Fox, the UK secretary of state for international trade, has recently declared that the UK would like an agreement with the EU that would be “virtually identical” to the one it has at the moment, as an EU member.

The EU side is willing to offer the UK a trade deal that looks either like the CETA arrangement with Canada, or the EEA agreement with Norway, Iceland and Liechtenstein.

The EU side is willing to offer the UK a trade deal that looks either like the CETA arrangement with Canada, or the EEA agreement with Norway, Iceland and Liechtenstein.

A CETA-type trade deal would fall much short of what the UK is looking for, mainly because it offers relatively limited access in services, with no passporting rights for financial services – an important sector for the UK.

On the other hand, an EEA-type agreement would give the UK much of what it is looking for in trade, including passporting rights for financial services. However, the EU insists that access to its single market, which EEA countries enjoy, must mean not only free movement of goods, services and capital, but also of labour – a demand that the UK is not willing to accept.

In other words, the UK is looking for a ‘CETA-plus’ (i.e. plus services, including financial services) or an ‘EEA-minus’ (i.e. minus free movement of labour) agreement. For its part, the EU is sticking to its CETA or EEA offer, without plus or minus. Whether there is room for a compromise between the two positions and at what price – in terms of UK contributions to the EU budget and with respect of ECJ decisions – is what the negotiations of phase two will really be about.

As an aside, but an important one, it should be mentioned that CETA and the EEA are both free-trade agreements (FTAs) rather than customs unions (CUs). Neither Canada on the one hand, nor Norway, Iceland and Liechtenstein on the other, belong to the EU customs union. This implies that trade within CETA or the EEA requires rules of origin and therefore some border controls, which are absent inside the EU. In principle CETA-plus or EEA-minus could be CUs rather than FTAs, but it is unlikely that the UK would accept leaving the EU and yet remaining tied to its trade policy for longer than the transition period. As a matter of fact, among the many reciprocal preferential trade arrangements signed by the EU, all but one are FTAs. The only exception is the EU-Turkey CU that Turkey was keen to sign in 1995 as a step towards its EU candidate status, which it obtained in 1999.

Given the tight schedule of phase two, which requires a deal to be reached by October/November 2018, CETA-plus looks much more feasible than EEA-minus. For the EU, CETA plus would avoid getting into the discussion on the indivisibility of the single market’s four freedoms, which it considers sacrosanct at this stage and which EEA-minus would imply. For the UK, CETA-plus would probably require less contribution to the EU budget and less respect of ECJ decisions than EEA-minus, and therefore be easier to accept politically.

But the problem with a CETA-type agreement, even if it were upgraded to CETA-plus, is that it is an agreement designed for countries outside Europe, not for European neighbours – let alone for a neighbour with close economic and political ties, like the UK. So even if the future EU-UK trade agreement were “virtually identical” to the current trade arrangement inside the EU, it would miss the other dimensions of the EU-UK relationship.

Indeed, the discussion on the future relationship cannot stop at trade. The historical ties between the UK and continental European countries, individually and collectively, cannot be erased with EU withdrawal. Moreover, in a world of shifting economic powers and competing models for economic global engagement, nurturing natural alliances is crucial.

The EU-UK relationship is one such alliance that needs to be preserved and promoted. But for this to be ensured, the agreement reached at the end of phase two will need to allow for a certain fluidity to potentially morph it one day into a new partnership, of which trade would be just a single, albeit important, component.

To be specific, what we have in mind is for the possibility that, after the UK has left the EU and after the transition, the EU and the UK sit down again at the table of negotiations to try to reach a more ambitious agreement than the trade deal that will be the outcome of the phase-two negotiations. This agreement should, in accordance with Article 217 TFEU that defines association agreements, establish “an association involving reciprocal rights and obligations, common action and special procedures”. The areas of cooperation should be as broad as possible and cover not only economic matters, both inside and outside single market-related issues, but also internal and external security. Such agreement would create a new partnership between the EU and the UK to reflect historical alliances.

The way to ensure that the trade deal – whether it is concluded by October/November 2018 or during the two-year transition period – is only a step towards a more ambitious association agreement that allows for a genuine partnership, is to include appropriate language in the preamble of the trade agreement.