How serious is Europe’s natural gas storage shortfall?

Europe may not have enough natural gas in storage for the coming winter; close monitoring of the situation will be essential.

Please find our latest related analysis here.

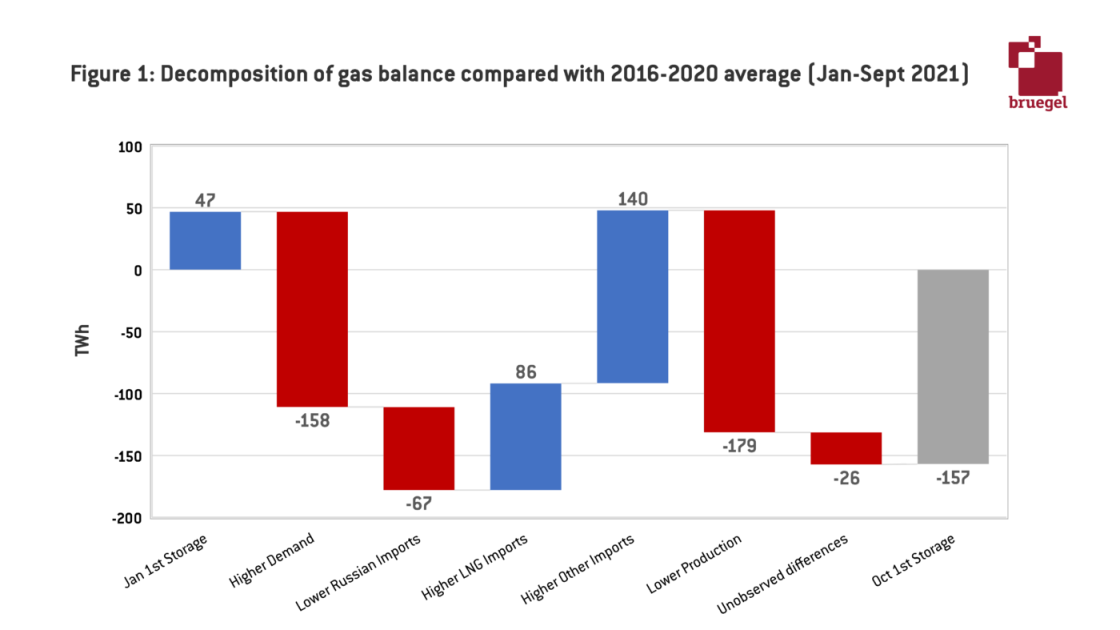

Europe’s natural gas position is uncertain heading into 2022. Strong demand in the first half of 2021 did not allow for a significant build-up of gas reserves in storage facilities prior to the winter period. As a result, Europe has become particularly dependent on imports. Russian reluctance to increase exports and tight liquefied natural gas (LNG) markets have led to concerns that Europe may face an energy crisis this winter, which will see what gas is in storage depleting rapidly. Figure 1 compares gas storage in 2021 with average values between 2016 and 2020. In January, the volume of stored gas was slightly above that average, but by October it had fallen significantly below the average. The figure shows how demand, imports and production have contributed to this change.

Source: Bruegel based on Eurostat.

As of December 2021, storage levels are below the minimum volume recorded for this time of the year in any of the previous five years. In mid-December 2021, Europe had 690 TWh of gas in storage. On average from 2016 to 2020, it took until the third week of January for reserves to drop this low.

To provide a deeper understanding of the situation Europe is in, we explore hypothetical scenarios for this winter, starting from the actual storage volume on 1 December 2021, which was 744 terawatt hours (TWh). Figure 3 uses static assumptions for each of the scenarios to project the evolution of stored gas.

Scenarios for this winter

Our analysis is intentionally simplistic (see details below) but offers an insight into two factors: a colder than usual winter will be very bad news for Europe, and imports must remain at minimum at the average level of the previous five years. As our analysis is static it does not take into account the fact that prices act as a balancing mechanism between demand and supply. The interpretation is therefore that in scenarios with negative or low storage, extremely high prices would remain on European markets in order to force demand off-grid (be it from industry or final consumers) or encourage higher imports. Very high prices since September shows that demand is resistant to price increases, ie demand for natural gas is highly inelastic.

Storage projection

Increased winter demand for gas must be met by stored gas, gas produced domestically and imported gas. In other terms:

This equation offers a close approximation of the evolution of gas storage over a few periods (see appendix). We use this equation to calculate the evolution of stored gas shown in Figure 3. Below we explain the assumptions underpinning this analysis.

Domestic production

European gas production has decreased in the last few years because of the closure of gas fields. This has reduced production capacity. Moreover, domestic gas fields were used for ‘swing production’ which meant ramping up supply during winter months to meet higher demand, and their absence is therefore felt more strongly in winter months. So far, production in 2021 has closely mirrored that in 2020 and we assume that this will continue to be the case for the coming winter.

The evolution of imports and demand is less certain.

Imports

Bruegel has compiled a database of European natural gas imports, based on data from the European Network of Transmission System Operators for Gas (ENTSOG). Using the last five years, we estimate scenarios for average imports, low imports (low imports corresponds to the minimum imported value each month over the last five years) and very low imports (implying no gas exported from Russia).

Simple demand model

Beyond prices, fluctuations in demand will be driven largely by temperature differences. The figures below show this strong correlation[1]. In other words, European gas demand will be high by historic standards if the winter is particularly cold.

To make simple demand forecasts, based on temperature assumptions, we fit monthly demand to a linear regression with an explanatory variable of heating degree days (HDD) and monthly dummies.

This allows us to estimate average and higher demand for the coming winter based on assumptions of the average or highest number of heating degree days (HDDs, see footnote 1) over the previous five years.

There is some elasticity to reduce demand by switching gas-fired power generation to coal-fired. On average around 75 TWh of gas is used each month between December and March for power generation (Ember, 45 TWh power generation at 60% gas turbine efficiency, 2018-2021).

Conclusions

Europe’s natural gas supply balance needs to be monitored closely in the next months as it is already very tight, and it might be difficult to compensate for additional adverse shocks from the demand, domestic production and/or import side. If it becomes obvious that – contrary to current expectations – high market prices will not bring in sufficient new supplies and/or encourage sufficient gas demand reduction to ensure meeting essential demand in a cold winter, policymakers will need enough time to act. We will continue to update our database tracking gas imports and storage and provide an update to this blogpost at the start of each month.

Appendix

[1] Heating degree days compare the daily average outside temperature to a baseline temperature (in Europe, 15.5 degrees Celsius). The difference between this baseline and mean equals number of HDDs, eg a day with average temperature of 5.5 degrees Celsius has 10 HDDs.