Setting Europe’s economic recovery in motion: a first look at national plans

Plans for spending European Union recovery funds submitted by the four largest EU countries reflect rather different priorities. So far, only Italy is

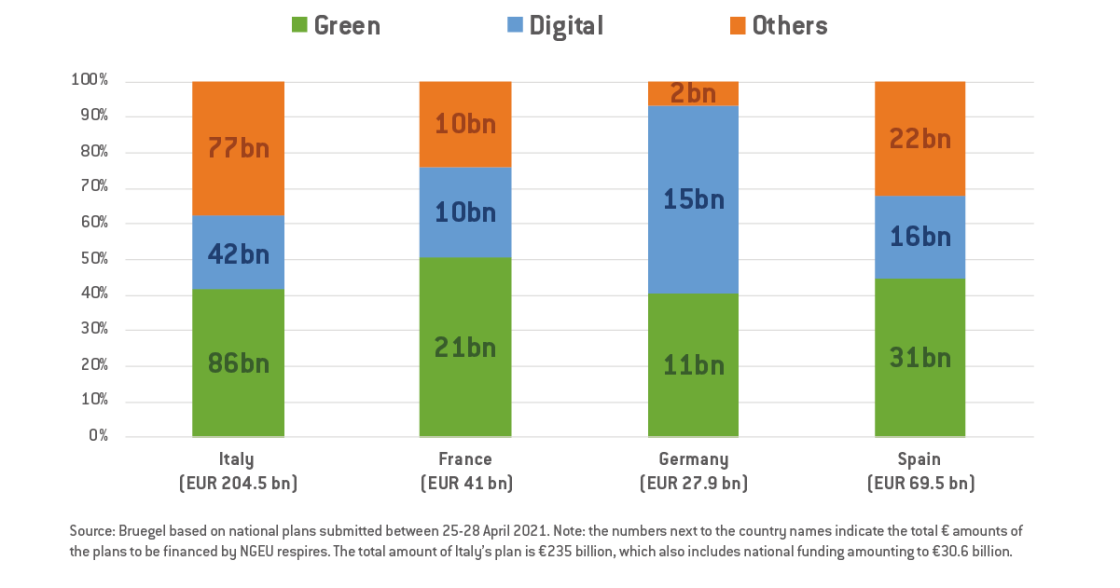

European Union countries are starting to set out how they plan to spend money from Next Generation EU (NGEU), the EU’s landmark instrument for recovery from the coronavirus pandemic. In late April, countries began submitting their recovery and resilience plans. A first quick analysis shows that the plans of the four largest EU countries, France, Germany, Italy and Spain, reflect rather different priorities, even if all meet the minimum expenditure benchmarks of 37% for climate and 20% for digitalisation.

Let’s briefly clarify what plans have been submitted. The total funding envelope for NGEU amounts to €750 billion at 2018 prices or €795 billion at current prices. NGEU includes seven instruments, of which the largest is the Recovery and Resilience Facility (RRF). This is composed of grants amounting to €312.5 billion at 2018 prices or €337 billion at current prices, and loans amounting to €360 billion at 2018 prices or €390 billion at current prices. Most recovery plans relate to RRF only, but in Italy’s plan, ReactEU (another component of NGEU) is also included. Italy also includes some extra spending from national resources in its plan. Here, we focus on spending financed by NGEU. It should be noted we do not examine whether spending plans constitute new spending, or also cover spending that was planned before the pandemic.

Of the four countries, only Italy’s plan envisages borrowing under the RRF and thus the Italian plan amounts to a much larger value (€205 billion = €69 billion RRF grants + €14 billion ReactEU grants + €123 billion RRF loans) than, for example, the Spanish plan, which amounts to €69 billion in RRF grants only. Nevertheless, the Spanish plan indicates the country might apply for RRF loans in the future.

The plans have rather diverse structures, which makes their comparison difficult. In particular, the four largest EU countries categorise differently the various spending priorities. On the green and digital components of sub-headings, France and Germany present precise numbers, Spain reports qualitative information, while Italy has a separate digitalisation and two green categories, but does not report whether other categories, such as education and health, have digital or green components. Nevertheless, all countries report the overall shares of green and digital spending. It would have been advisable to use a common template for classifying and reporting various spending categories and their green and digital components.

Thus, we can reasonably compare the overall shares of planned green and digital spending, while grouping all non-green and non-digital spending into a single group (Figure 1).

Germany plans to spend more than half of the EU money it will receive on digitalisation, while the other three countries will spend a quarter or less. In terms of euro values to be spent on digital priorities, Italy plans to spend the most at €42 billion, followed by Spain (€16 billion), Germany (€15 billion) and France (€10 billion).

France plans to spend half of its share of the EU money on green priorities, while the other three countries will spend around 40%. In terms of euro values to be spent on green priorities, Italy plans to spend the most at €86 billion, followed by Spain (€31 billion), France (€21 billion) and Germany (€11 billion).

Figure 1: Overall resource allocation in national plans

The sub-components of the plans also vary. The German plan includes little funding for non-climate and non-digital related policy areas, possibly because Germany is expected to receive the lowest amount in euros. The plans of the other three countries are much more diversified, and include policy priorities such as social inclusion, education, research, health, and even culture and sports in the case of Spain.

Table 1a: Components of the French plan

Table 1b: Components of the German plan

Table 1c: Components of the Italian plan

Table 1d: Components of the Spanish plan

Significant differences between plans can also be seen in their main spending item: climate. The plans set out similar priorities in this area, featuring, in order of importance, green infrastructure and mobility, green energy and buildings energy efficiency. But specific action plans differ significantly (Figure 2).

For instance, possibly because it receives the lowest amount in euros, Germany's green infrastructure and mobility investments are entirely focused on the development of electric mobility, with incentives to foster the deployment of electric cars, buses and rail vehicles, and a push to develop electric car charging infrastructure. In Spain, starting from a larger euro amount, the plan foresees investments in the development of electric mobility, but also in public transport. Meanwhile, in both France and Italy, half of the investment focuses on the development of the railway system. In France, the focus is rail network modernisation and further development of rail freight and local lines. In Italy the development of high-speed trains is prioritised.

Green energy investments are also structured differently. Probably as a result of the same funding limitation, Germany focuses strongly on the development of a hydrogen economy, through a variety of instruments ranging from research funding to carbon contracts for differences to scale-up deployment. France also plans investment in decarbonised hydrogen, alongside aeronautics support projects and support for the development of key markets for green technology. Italy and Spain – also thanks to the larger resources available to them – plan sizeable investments in renewable energy and smart grids, in addition to support for hydrogen projects.

While investments in buildings energy efficiency follow a similar approach, concentrated on the renovation of both private and public buildings, Italy plans significant investment in climate change adaptation, while France gives greater attention to territorial cohesion in the context of adaptation.

Figure 2: The green components of national plans

We will build on this quick comparison of the plans of four EU countries with a Bruegel dataset covering all the plans. Stay tuned!

We thank Marta Dominguez and Mia Hoffmann for their help with the Spanish and German data.

Recommended citation:

Darvas, Z. and S. Tagliapietra (2021) 'Setting Europe’s economic recovery in motion: a first look at national plans', Bruegel Blog, 29 April