Gazprom: seeking a rapprochement with the EU?

On Monday 21 September Gazprom sent proposals to the European Commission to settle the claims of the antitrust case launched in April. If read in para

Gazprom announced on Monday that it had sent proposals to the European Commission (EC) to settle 'in the near future' the claims formally brought against the Russian company by the EC itself in April this year.

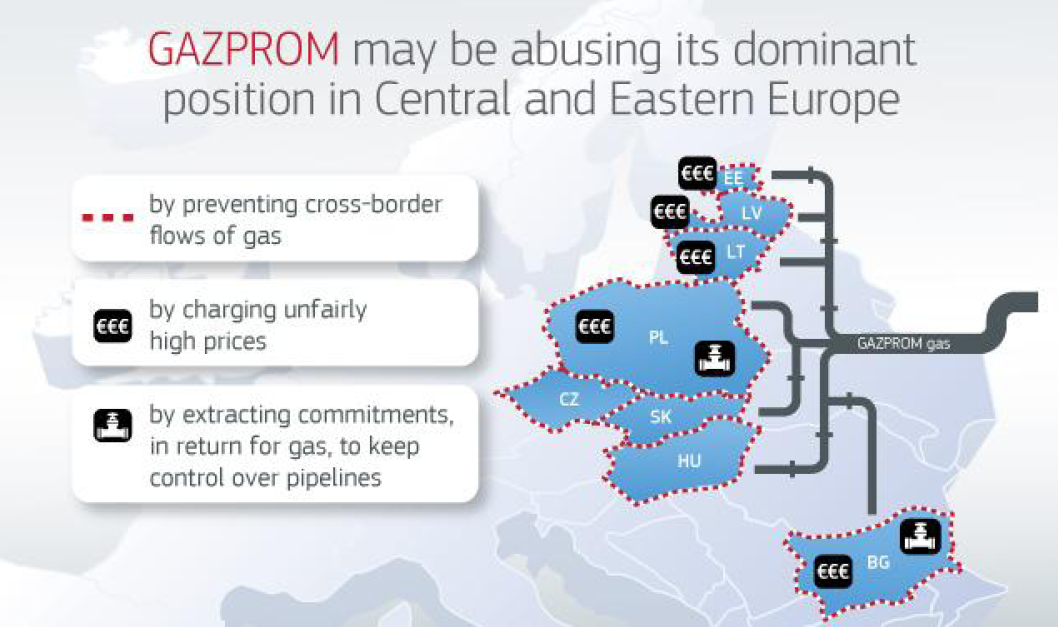

As outlined in a previous blog,the EC alleged in its statement of objections that in the Baltic countries, Bulgaria and Poland Gazprom is:

- Hindering cross-border gas sales, through certain clauses in the contracts with its customers allowing Gazprom to charge higher prices in countries that are more dependent on Russian gas;

- Charging unfair prices through pricing formulae that largely favoured Gazprom over its customers;

- Making gas supplies conditional on obtaining unrelated commitments from wholesalers concerning gas transport infrastructure. Specifically, the Commission's preliminary view is that Gazprom made wholesale gas supplies in Bulgaria conditional on the country's participation in the South Stream pipeline project, and in Poland conditional on the company's control over investment decisions concerning the Yamal pipeline.

The EU antitrust case against Gazprom

Source: European Commission.

There are two possible ways forward for this antitrust case.

If Gazprom cooperates with the EC and conforms to legally binding commitments addressing its concerns, it would be able to settle the charges and to avoid a fine.

However, if Gazprom decides not to cooperate, the EC might decide to issue an infringement decision and ultimately fine the company up to 10 percent of its global annual turnover (the fine could amount to up to approximately US$ 8 billion). In addition to this, the EC might also impose measures to stop the harmful behaviour, restore competition and also reduce the risk of future violations. For instance, as Mariniello (2014) points out, "in some past cases in the energy sector, the EC required the dominant company to divest significant assets for capacity generation and favour competitors' new investment".

Gazprom's new proposals to the EC represent the first step along the path of a potential way forward. In doing so, the Russian company could be motivated primarily by the hope to avoid a fine that would represent a serious burden in its already difficult current financial position.

However, considering some recent evolutions of international gas markets, Gazprom's move might also be read in a much more strategic, and sophisticated, way.

In the aftermath of the Ukraine crisis, gas diversification became a mantra for both the EU and Russia. While the EU formulated its Energy Union concept primarily on the basis of gas security of supply concerns, Russia quickly brought forward previously established old gas cooperation projects with China.

In particular, after a decade of talks, Russia and China signed a contract in May 2014 to open-up the so-called 'Eastern route', a project for the delivery of 38 billion cubic meters (bcm/y) of Russian gas per year to China via the Power of Siberia gas pipeline. In November 2014 another framework agreement was signed by Russia and China, this time for the launch of the so-called 'Western route', a project for the delivery of 30 bcm/y of Russian gas to China via the Altai gas pipeline.

Following the recent economic slowdown in China, the development of these projects, based on bullish assumptions of prospects for Chinese gas demand,has been substantially decelerated, if not even put into question.

In addition to this, the second diversification tool that Russia might have had at its disposal, liquefied natural gas (LNG), was also taken off the table due to international sanctions that, among other things, also target specific technological components needed to develop LNG facilities.

In short, during almost two years of unprecedented political standoffs with the EU over Ukraine, the diversification of gas destination markets has proved to be an extremely difficult exercise for Russia.

Against this background, Gazprom could have done a reality check and reassessed its strategy towards a rapprochement with the EU for purely commercial reasons: Russia needs the EU gas market as much as (if not more than) the EU market needs Russian gas.

Gazprom's new overture vis-à-vis the EC might be read in parallel to other dynamics currently under development:

i) The quick advancement of the Nord Stream II project.

On September 4, 2015 Gazprom and its European partners (E.ON, Shell, OMV, BASF and ENGIE) signed a shareholders agreement to construct the 55 bcm/y Nord Stream II pipeline, designed to substantially diminish Russian gas exports to Europe through Ukraine. Considering the engagement of major European companies, this move seems to conclude the 'Russian pipeline waltz' that started with the demise of South Stream. It appears to show Russia’s renewed commitment to be linked to the European market by bypassing Ukraine and the related transit issues;

ii) The recent auctions of gas supplies on the spot market.

In September 2015 Gazprom conducted a series of gas sales auctions in order to introduce a new pricing mechanism in its key export market: Germany. With this move Gazprom appears to have taken further steps towards the adoption of a new market model in Europe, fundamentally based on spot pricing.

However, the recent auctions might also have been a tool used by Gazprom to acquire further evidence to support its claims to the EC aboutthe full access of the Opal pipeline capacity, an issue that represents a key bottleneck preventing the full utilization of Nord Stream I, and thus the feasibility of the Nord Stream II project.

While the auctions showed the interest of buyers to purchase lots at other delivery points, they also showed basically no demand for alternative supplies via Opal. On the basis of this auction, Gazprom could argue that the EC should allow it to use the full pipeline, instead of leaving half of it empty while waiting for potential customers that might never materialize.

iii) The Gazprom asset swap deals with BASF and OMV.

In early September 2015 Gazprom finalized key asset swap deals with Germany's BASF and Austria's OMV. Under the deal with BASF, Gazprom takes control of jointly operated gas trading and storage businesses, including the biggest gas storage facility in Western Europe. It also receives a 50 percent stake in Wintershall's North Sea operations.

In exchange, Wintershall will receive stakes in two fields in Western Siberia, to be jointly developed with Gazprom. Under the deal with OMV, Gazprom has conceded stakes in a field in Western Siberia in exchange for the participating interest in OMV. These moves signal a U-turn in Gazprom's strategy towards Europe. After the demise of South Stream, Gazprom claimed to be reluctant to be involved in the European market any more (for example in downstream and midstream activities) due to its complex regulations. It preferred to deliver supplies at the European border, as shown by the structure of the Turkish Stream project.

Taken together, Gazprom's proposal to settle the claims of the EC's antitrust case and these three dynamics seem to point to a new rapprochement strategy towards the EU.

Considering the wider dynamics of energy markets, and most notably the constraints on oil producers generated by the new US$50/barrel world, such a strategy would make commercial sense for Gazprom.

After all, a strong partnership with the EU gas market might be one of the few elements of certainty for Gazprom (and therefore Russia) in a very uncertain and volatile international energy landscape.

The author would like to thank Georg Zachmann for helpful comments.