Greek exposure to Cyprus: the unintended consequences of restructuring

Europe failed to properly address the consequences of the Greek debt restructuring. The crisis came back with a vengeance when the Cypriot crisis even

The restructuring of Greek government debt contributed significantly to the downfall of the Cypriot banking system and Laiki and Bank of Cyprus in particular. Laiki lost 2.3–2.5bn EUR on these assets and Bank of Cyprus 1.8bn, representing around 60 % of the banks’ total equity. When the restructuring was undertaken, however, the European policy system did not pro-actively address its repercussions on Cypriot banks. This blog investigates the fragility of Greek banks to similar adverse surprises from Cyprus (without taking a stance on the likelihood of that possibility) and argues that Europe should be prepared to react.

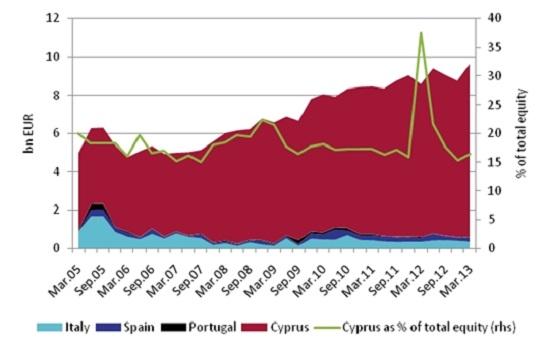

Cypriot assets form a non-negligible part of the balance sheet of Greek banks. The figure below shows that they dwarf exposures on other Southern European countries by orders of magnitude. In 2013Q1, the Greek exposure to Cyprus totaled 9bn EUR. This represented 16.5 % of the total capital of the Greek banking system.

Exposure of Greek banks to selected Southern European countries.

Note: The spike in the share in 2012Q2 was a consequence of the temporary capital shortfall of Greek banks following the country’s sovereign debt restructuring.

Source: Bruegel based on BIS (cross-border exposure data) and ECB (capital and reserves).

Greek debt restructuring was arguably delayed to safeguard the stability of the European financial system. Yet, French banks – while having the largest exposure to Greece pre-crisis - still had a share below the Greek banks’ exposure to Cyprus. Their Greek claims as a share of total capital and reserves peaked at 14.2 % in 2009Q1 and stayed above 10 % until 2010Q2. In addition, Greek banks are in a weaker position to raise new capital.

Europe failed to properly address the consequences of the Greek debt restructuring. The crisis came back with a vengeance when the Cypriot crisis eventually came to the fore. Steil and Walker note a similar interdependency in the Iberian peninsula, with claims by Spanish banks on Portugal totaling 13.4 % of total capital and reserves in 2013Q1. Our colleague Ashoka Mody has argued that more debt restructurings may be needed. If they are, Europe should be better prepared to act swiftly. Delaying the resolution of the consequences of restructuring is risky.