Can Europe make its space launch industry competitive?

Europe is falling behind in the global commercial space launch sector; a new programme may not be enough to fix the shortcomings

Pressure on the European space sector from foreign competitors, primarily the United States and China, has led to a rethinking of Europe’s space policy. As part of this, the European Space Agency (ESA), with a membership made up largely of European Union countries, announced in May 2023 the Commercial Cargo Transportation Initiative (CCTI), a call for European companies to develop commercially-sound cargo transportation systems. European satellite infrastructure, Europe’s presence in the International Space Station (ISS) and all exploration and scientific missions depend on transportation into orbit, on which ESA will spend 12.6 percent of its €7 billion budget in 2023.

The hope is that CCTI will stimulate companies to do something Europe has not yet done: develop its own cheap, reusable rocket. In doing this, CCTI is a bid to replicate in Europe the success of NASA’s Commercial Orbital Transportation Services (COTS) programme, which ran from 2006 to 2013 and succeeded in substantially lowering the costs for NASA of getting into orbit by engaging private companies in the development and operation of space transportation systems.

Through COTS, NASA backed SpaceX, for example. Using a mix of public and private resources, SpaceX developed Falcon 9, the first partially-reusable rocket. COTS also kick-started a wave of private investment in the traditionally-public US space industry. Companies have managed to cut the cost of transporting payloads into orbit, leading to an unprecedented increase in the number of satellites that provide improved commercial services, such as internet connectivity and detailed earth-imaging.

But this so-called US ‘New Space’ revolution has eluded Europe. In this analysis, we assess whether the CCTI has the potential to contribute to the reforms needed to replicate US successes. Overall, we find that while CCTI will make some difference, it suffers from a lack of financial certainty and it is unclear if it has sufficient political backing.

Europe’s position in the launch sector

Sending European rockets into space has long relied on stable cross-national public-private partnerships and foreign-made launchers. The French-German Arianespace has dominated the European space-launch market, relying on a stream of secure public funding through ESA. This company provided Europe with the heavy-lift Ariane 5 and smaller Vega rockets. This approach worked well in the past: for years, Ariane 5 was one of the most cost-effective rockets available, making it a preferred launcher for publicly-funded security and science missions and for commercial satellites. To launch medium-sized cargo, Europe used Russian Soyuz 2 rockets, one of the most reliable rockets ever developed.

However, in response to the sanction imposed on Russia after the invasion of Ukraine, Roscosmos halted Soyuz launches from the European launch site in French Guiana 1 See ESA statement of 28 February 2022, https://www.esa.int/Newsroom/Press_Releases/ESA_statement_regarding_coo…. . Meanwhile, the lifecycle of Ariane 5 is reaching its end; it is scheduled to make its last flight on 5 July 2023 2 Mike Wall, ‘Watch the last-ever launch of Europe's powerful Ariane 5 rocket on July 5 after delays’, Space, 4 July 2023, https://www.space.com/ariane-5-final-launch-webcast. . Its replacement, Ariane 6, is delayed for at least two more years, leaving Europe without domestic medium and heavy lift capacity for the first time in half a century.

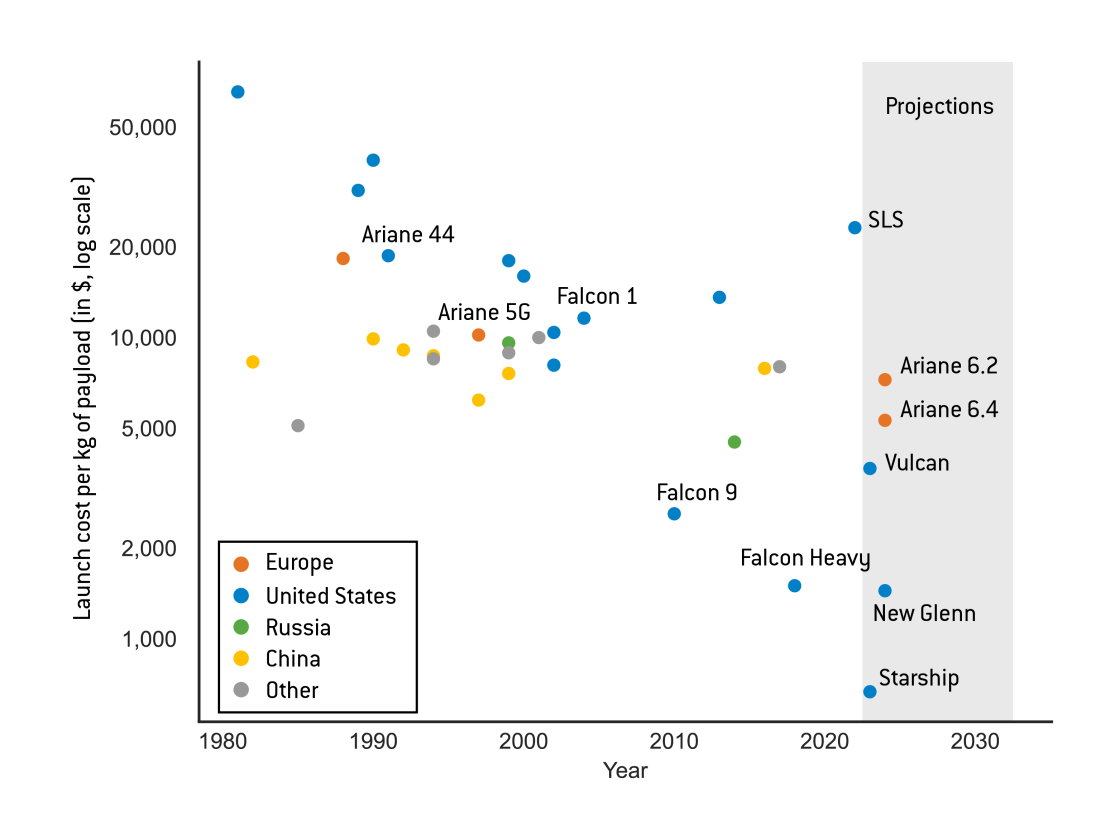

Ariane 5 was already struggling to compete with a new generation of cheaper, partially reusable rockets such as SpaceX’s Falcon 9 (Figure 1). Ariane 6 has been designed for a different era, lacking the inherent reusability and cost-effective production processes that define newer generations of rockets 3 Eric Berger, ‘Europe’s Ariane 6 rocket is turning into a space policy disaster’, Ars Technica, 18 April 2023, https://arstechnica.com/science/2023/04/europes-ariane-6-rocket-is-turn…. , and risks being obsolete when it finally does debut. CCTI is a serious attempt to address these issues and carry out a structural reform of the launch market in Europe.

Figure 1: Cost of transporting payload to outer space for medium and heavy launchers

Source: Bruegel. Note: Medium and heavy launchers are defined as those able to carry at least 2,000kg into low Earth orbit. Year indicates the year of the first successful launch or the predicted year of the first mission. Historical data is adjusted for inflation.

Europe wants NASA’s success

The establishment by NASA of COTS was a key element in the US space revolution of the late 2000s. COTS aimed to incentivise private companies to build vehicles for cargo delivery to the ISS, with NASA acting as the anchor customer in a competitive process.

Through the subsequent Commercial Resupply Services (CRS) programme, which started in 2008, NASA procured delivery services at fixed prices, departing from its previous practice of cost-plus contracts, where firms were de facto insured by NASA against risk and therefore had no incentive to cut costs.

This new and focused approach to procurement proved successful (Weinzierl, 2018; Vernile, 2018). The COTS and CRS programmes have inspired other federal agencies in the space domain, including the American Space Force – a novel structure merging several programmes in the US defence administration – to proceed with dedicated, pro-competition procurement practices, starting in 2024 4 Sandra Erwin, ‘Space Force weighing new approach for selecting national security launch providers’, SpaceNews, 13 January 2023, https://spacenews.com/space-force-weighing-new-approach-for-selecting-n…. . Updated CRS contracts will be issued for resupply of the ISS in 2024, and are expected to be renewed until 2030, when the ISS is scheduled to be shut down 5 Aria Alamalhodaei, ‘SpaceX, Northrop Grumman to resupply the ISS through 2026’, TechCrunch, 25 March 2022, https://techcrunch.com/2022/03/25/spacex-northrop-grumman-to-resupply-t…. .

Europe’s CCTI looks a lot like a European version of COTS and CRS combined. ESA has called for proposals for commercial cargo services to low Earth orbit (LEO) 6 The China Manned Space Agency (CMSA) issued a similar call in May 2023. The Chinese agency is looking for cargo-delivery services to the Tiangong Space Station, China’s low-cost alternative to ISS, built in 2021. CMSA seeks established companies with the capability to launch and transport cargos of no less than 1800kg to Tiangong at a maximum price of $16.88 million per 1000kg. See Andrew Jones, ‘China calls for space station commercial cargo proposals’, SpaceNews, 16 May 2023, https://spacenews.com/china-calls-for-space-station-commercial-cargo-pr…. . The immediate goal is to provide private companies with support to provide commercial transportation services to ISS before 2030 and then to “future commercial LEO destinations” after 2030. ESA is committed to providing resources to ISS including oxygen, food and materials for its astronauts and the scientific activities on the station. ESA also needs periodically to transport cargo back to Earth.

Europe can use US services for some of these missions but the strategic importance of cargo transportation into orbit, beyond the ISS, necessitates Europe’s active involvement, rather than relying on others. The development of an ecosystem of private launchers can serve as a catalyst for the advancement of the whole space industry and is also crucial for European’s defence capabilities 7 Francesco Nicoli and Giuseppe Porcaro, ‘In failure or success, SpaceX is a wake up call for Europe’, Bruegel First Glance, 26 April 2023, https://www.bruegel.org/first-glance/failure-or-success-spacex-wake-cal…. . CCTI should be viewed as a tool to commercialise the European launcher sector and by extension the whole space industry, rather than just a procurement programme.

CCTI: an assessment

CCTI will have three phases. In phase 1, one or two companies will be selected to design a cargo delivery system and secure third-party financing. This phase will end in mid-2024 and is the only phase with a known budget: €2 million. This figure appears meagre, even for preliminary design and fundraising. However, it is in phases 2 and 3 that substantial funding will be needed.

In phase 2 (ending in 2025), system design and tests will be finalised. Phase 3 will be the final step in the procurement process and will be open to all companies (not just those selected for phases 1 and 2). During phase 3, a demonstration mission to the ISS is expected to be carried out before the end of 2028. Funding for phases 2 and 3 will only be agreed at the ESA Ministerial Council in 2025.

In our view, the CCTI faces two main challenges. First, the funding provided by the public sector is uncertain. Second, similar uncertainty applies to private involvement and investment.

On funding, the lack of information about the financial allocation for phases 2 and 3 or the overall funding amounts makes it difficult for private companies to assess the feasibility and potential returns on their investment, potentially reducing their willingness to participate.

If the aim of CCTI is to create a thriving commercial private space launch industry in Europe, the funding policy must be robust enough to propel European companies to the forefront of the New Space sector. European companies would then be able to compete with US companies in the most innovative areas, such as designing fully reusable rockets. It is worth noting that during the COTS programme, NASA distributed $821 million to two companies (SpaceX and Orbital) (NASA, 2014). This may give an idea of the scale of funding Europe will need to offer.

The unknown size of public funding is also problematic because stimulating competition between European companies requires sufficient funds to attract new entrants. Recall that CCTI phase 3 is open to all companies, not just those selected for phases 1 and 2. Assuming that phase 1 selects entrants, the amount of financing provided may not be enough to allow them to compete equally in phase 3 with established players like Arianespace and Thales Alenia. In this case, the CCTI would be considered a failure, as contracting incumbent companies directly would be a cheaper way to achieve the same goals.

The second challenge is the uncertain role that private investment will play in the initiative. The original COTS programme and the CCTI require companies to find their own private funding. Through COTS, NASA provided less than half of the cost for development of each procured transportation system and SpaceX mobilised around $454 million (NASA, 2014). Remarkably, this occurred when investment in start-up space companies was very low: between 2006 and 2010, total global investment in space companies was estimated at about $6 billion (Christensen et al, 2016).

The small investment pool in the US in the late 2000s mirrors the current situation in Europe. Total private investment in the European space sector in 2022 was only €1 billion, making it a small market compared to the US, which in 2022 was worth six times more (ESPI, 2023). COTS can be viewed as one of the levers stimulating American private investment growth since 2010. Questions remain if European space companies will be able to secure private funds needed for the success of the programme and how this will affect European private investment in the future.

Private investment is driven, among other factors, by potential profits. However, the future market size for services contracted via CCTI remains uncertain. The timeline for the first CCTI demonstration mission to the ISS in 2028 raises concerns for participating companies because the ISS is scheduled to close by the end of 2030. With less than two years’ worth of transportation contracts to an existing station (assuming an optimistic scenario of no delays), companies may find it difficult to generate substantial returns on their investments. The ESA CCTI call mentions there could be more contracts for deliveries to “commercial LEO destinations”, but their deployment is highly uncertain and heavily reliant on the US private sector.

Additionally, European transportation providers co-funded by CCTI will face stiff competition from US private companies when they offer commercial services outside the CCTI. Many projects related to commercial LEO destinations are currently being developed by US companies with experience in the launching industry. Potential European transportation providers will thus compete with companies that not only designed the space stations but also possess the capability to transport cargo independently. Such established players may have inherent synergies that could give them a competitive advantage over European firms that want to participate in the CCTI.

Uncertainties ahead

The ESA is thus asking private investors to make a leap of faith. Effectively, instead of acting as an anchor customer for companies, ESA is asking the private sector to fulfil that role, so it can demonstrate to ministers in 2025 that the private sector is serious and worth investing in.

The uncertainty characterising CCTI stems more from the institutional and financing arrangements on which ESA is built, which cannot be fully mitigated by the goodwill and genuinely forward-looking approach of the agency’s planners. ESA is unique because of its international character. But this feature comes with costs, and ESA has never been able to gather resources comparable to those of its counterparts (ESA’s 2022 budget was €7.15 billion compared to €22.86 billion for NASA). Every budget decision has to be approved by the ministerial council of 22 country representatives. This makes it difficult for ESA to put adequate money on the table. However, it is clear that the private sector will need more clarity about the size of the subsidies from ESA and the overall involvement of the public sector.

It is also important to acknowledge that while addressing procurement is crucial, it is not the only solution for Europe’s challenges in the space sector. The technological gap and institutional complexities require serious, high-level political thinking that cannot be delegated to agencies. EU countries must engage actively in strategic planning and decision-making to overcome these hurdles. To ensure the success of European space industrial policy, it is necessary to tackle not only the procurement aspect but also to invest in research and development to bridge the technological gap. Streamlining institutional processes and promoting collaboration between European countries are also essential to achieve a cohesive and competitive space sector.

References

Christensen, C.B., K. Armstrong and R. Perrino (2016) ‘Start-Up Space: Rising Investment in Commercial Space Ventures’, AIAA 2016-5233, American Institute of Aeronautics and Astronautics, available at https://arc.aiaa.org/doi/10.2514/6.2016-5233

ESPI (2023) Space Venture Europe 2022, European Space Policy Institute, available at https://www.espi.or.at/reports/space-venture-europe-2022/

NASA (2014) Commercial Orbital Transportation Services, A New Era in Spaceflight, National Aeronautics and Space Administration

Vernile, A. (2018) The Rise of Private Actors in the Space Sector, SpringerBriefs in Applied Sciences and Technology, Springer, available at https://doi.org/10.1007/978-3-319-73802-4

Weinzierl, M. (2018) ‘Space, the Final Economic Frontier’, Journal of Economic Perspectives 32(2): 173–92, available at https://doi.org/10.1257/jep.32.2.173

[1] See ESA statement of 28 February 2022, https://www.esa.int/Newsroom/Press_Releases/ESA_statement_regarding_cooperation_with_Russia_following_a_meeting_with_Member_States_on_28_February_2022.

[2] Mike Wall, ‘Watch the last-ever launch of Europe's powerful Ariane 5 rocket on July 5 after delays’, Space, 4 July 2023, https://www.space.com/ariane-5-final-launch-webcast.

[3] Eric Berger, ‘Europe’s Ariane 6 rocket is turning into a space policy disaster’, Ars Technica, 18 April 2023, https://arstechnica.com/science/2023/04/europes-ariane-6-rocket-is-turning-into-a-space-policy-disaster/.

[4] Sandra Erwin, ‘Space Force weighing new approach for selecting national security launch providers’, SpaceNews, 13 January 2023, https://spacenews.com/space-force-weighing-new-approach-for-selecting-national-security-launch-providers/.

[5] Aria Alamalhodaei, ‘SpaceX, Northrop Grumman to resupply the ISS through 2026’, TechCrunch, 25 March 2022, https://techcrunch.com/2022/03/25/spacex-northrop-grumman-to-resupply-the-iss-through-2026/.

[6] The China Manned Space Agency (CMSA) issued a similar call in May 2023. The Chinese agency is looking for cargo-delivery services to the Tiangong Space Station, China’s low-cost alternative to ISS, built in 2021. CMSA seeks established companies with the capability to launch and transport cargos of no less than 1800kg to Tiangong at a maximum price of $16.88 million per 1000kg. See Andrew Jones, ‘China calls for space station commercial cargo proposals’, SpaceNews, 16 May 2023, https://spacenews.com/china-calls-for-space-station-commercial-cargo-proposals/.

[7] Francesco Nicoli and Giuseppe Porcaro, ‘In failure or success, SpaceX is a wake up call for Europe’, Bruegel First Glance, 26 April 2023, https://www.bruegel.org/first-glance/failure-or-success-spacex-wake-call-europe