Do robots dream of paying taxes?

The digital transition should be managed – and taxed – alongside other societal transitions, but any tax on companies that replace employees with aut

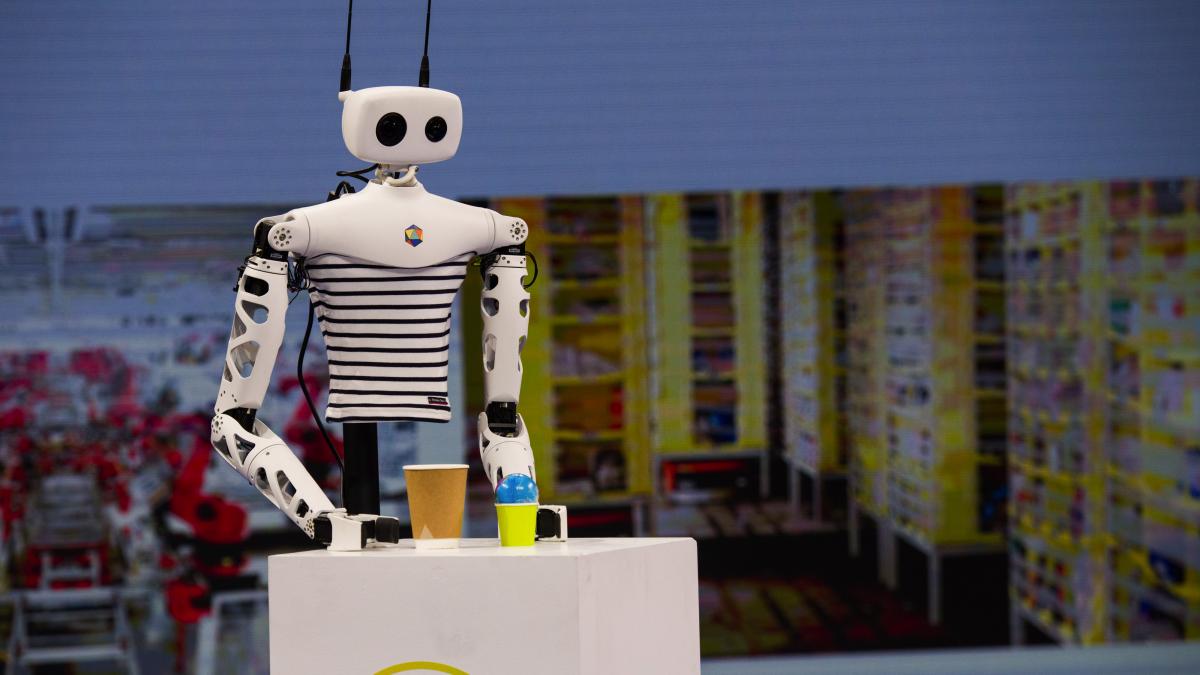

Robot taxes embody the more futuristic challenges of managing automation and legacy workers. As machines and artificial intelligence take on more roles that used to be performed by humans, policymakers and technologists are assessing the costs this transition imposes and what parts of society will pay them. A robot tax on companies that replace employees with automated systems is easy to dismiss in its most simplistic forms but should be considered in the context of managing the next industrial revolution.

A robot tax is a political construction, a way to shape democratic debate around technological shifts and societal needs. It is a construct of the public debate, and as such can contribute to broader discussions about how to make sure profitable companies pay their way in the economy. The political capital of ‘replacement robot’ imagery may be useful in designing a tax framework for legacy firms making the most of new economic opportunities.

It is best to consider a ‘robot tax’ as a rallying concept for targeted levies. These policies should target finance and other data-driven sectors as well as traditional manufacturing and mining automation. Policymakers should consider overall employment, specific job losses and how to assess firms that make layoffs in specific areas of their workforces. This last will be especially difficult in cases where total headcount rises, even though some generations of employees may be put out of work. Tax policy can compensate for distortions due to shifts from human-driven to capital-intensive production in specific sectors.

On the revenue side, there should be appropriate expectations of what a tech tax can raise and over what period, on the scale of targeted retirement assistance or retraining programmes with measurable outcomes, not long-running cash cows. Smaller and more innovative firms should not be asked to contribute disproportionately, particularly in legacy markets that are hard to break into, and they should be eligible for waivers and exemptions. Policymakers should stress that asking producers to help pay the costs of societal change is not immediately equivalent to stifling innovation, and they should make every effort to design policies in ways that protect against this type of side effect. Finally, any new tax on employers needs to fit with broader discussions of the corporate fair share, and with taxing the most profitable parts of the economy instead of relying on workers and consumers to foot society’s bills.

Recommended citation

Christie, R. (2021) ‘Do robots dream of paying taxes?’, Policy Contribution 20/2021, Bruegel

This policy contribution was produced within the project “Future of Work and Inclusive Growth in Europe“, with the financial support of the Mastercard Center for Inclusive Growth.