China’s outward foreign direct investment

China’s outbound foreign direct investment (ODI) may have exceeded inbound foreign direct investment (FDI) for the first time in 2014, according to th

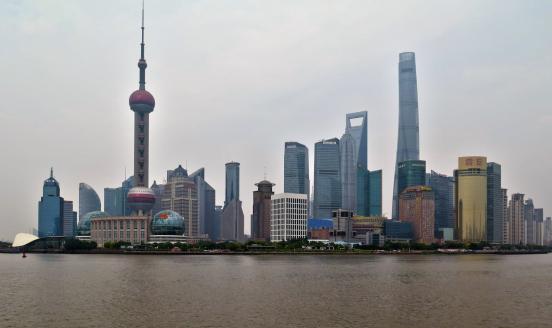

This result is remarkable because it implies that China may have already become a net exporter of FDI, something surprising given the country’s stage of development as well as its relatively low share of global ODI stocks (Figure 1).

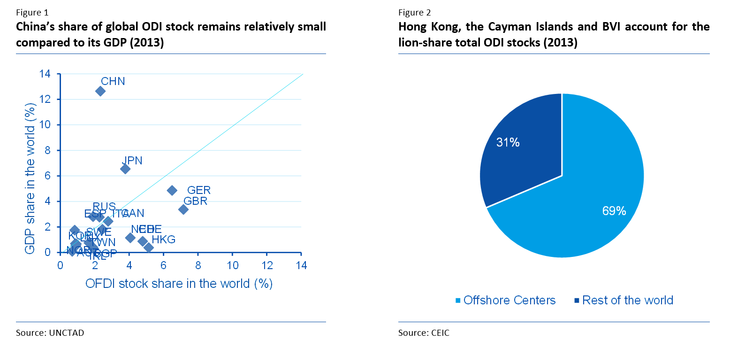

The reality could actually be quite different. ODI figures may be substantially distorted due to the presence of offshore intermediaries such as Hong Kong, and tax havens in the Caribbean, which accounted for circa 70% of China’s total ODI flows and stocks in 2013 (Figure 2). MOFCOM requires companies to register the first (not the final) destination of their cross-border transactions and not to take into account reverse flows, making it hard to determine the final size and distribution of Chinese ODI. In a recent Working Paper with Carlos Casanova and Xia Le[i], we recalculate China's Outbound Foreign Direct Investments (ODI) in a way which accounts for these distortions.

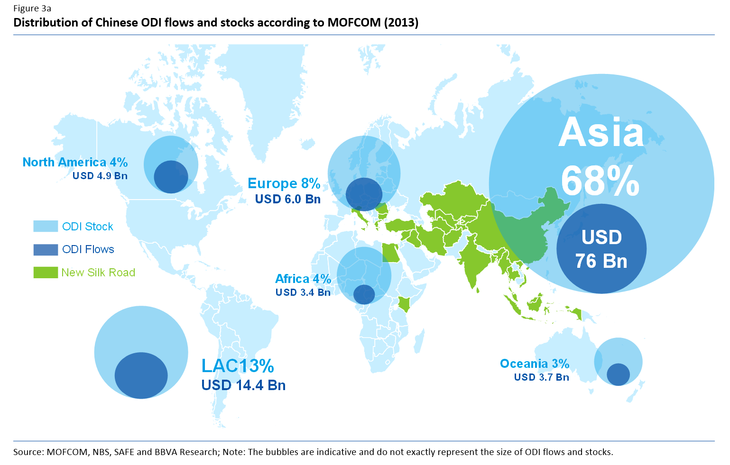

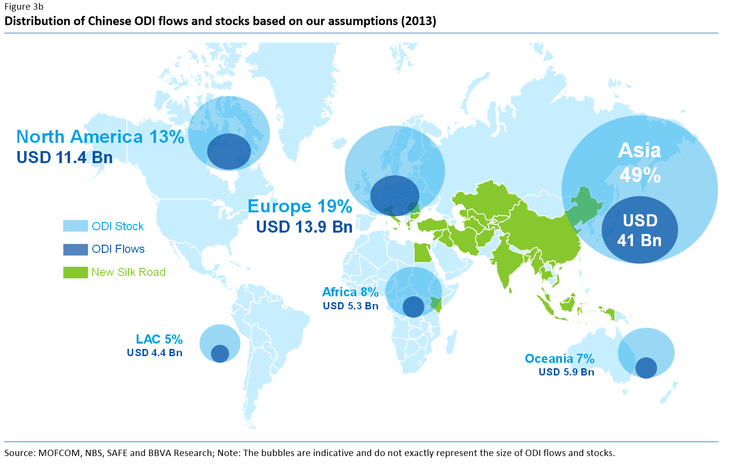

Our estimates show that China's ODI flows and stocks may have been overestimated andcould actually be more diversified that previously thought (Figure 3). First of all, ODI flows and stocks in 2013 may have been much lower than reported by MOFCOM. The reason for this discrepancy is that approximately 40% of all flows to Hong Kong ending up being reinvested in China as inbound FDI , in order to benefit from preferential conditions (Xiao, 2004).

In addition, the geographical distribution of Chinese ODI stocks and flows may be more balanced than previously thought, with developed markets in North America and Europe accounting for a larger share of final flows and stocks.

While Asia remains the largest recipient of Chinese ODI, its share falls from 70% to 50% according to our estimates. The fact that Asia is the main recipient of Chinese ODI makes sense given the region’s geographical proximity and close trade links with China. However, Chinese official statistics define Asia in very broad terms – to include the Middle East and Central Asia – so this figure would decrease significantly based on narrower geographical classifications.

Europe emerges as the second largest recipient according to our estimates. The continent goes from being a relatively modest recipient of ODI (8% of stocks and 6% of flows in 2013), to accounting for 19% of total stocks, and 17% of total flows in 2013. Take the European Union (EU) as an example: recent media reports have claimed that we are witnessing wave of Chinese investments into the EU; however official statistics place this figure at a modest USD 4.4 billion in 2013. Our estimates show that in reality Chinese ODI flows into the EU could have been closer to USD 10.4 billion, challenging previously held assumptions that China remains a minor investor in the EU.

North America also sees an increase in its share of ODI, with the United States accounting for over 75% of flows and stocks to North America. This comes as no surprise. MOFCOM’s statistics show that Chinese ODI flows into the US were USD 3.8bn in 2013, a figure which is lower than the value of the largest transaction that year (the purchase of Smithfield’s Food for USD4.7bn, which happened via the Cayman Islands). Our estimates put this figure at around USD 9.0 billion (stocks: USD 49.2 billion).

Latin America is the only region that experiences a drop in Chinese ODI, however if we exclude offshore centers from the equation, ODI stocks to the region actually increase after accounting for data limitations based on our estimates (USD 9.9 billion according to MOFCOM vs. USD 23.2 billion based on our estimates).

All in all, even if China did not really make it to surpass the landmark of becoming a net creditor in 2014, there is no doubt that it will in the future as China’s ODI stocks in the world are underrepresented relative to the country’s size. In particular, a number of issues will add to the existing momentum behind Chinese ODI. First, the easing of application procedures for ODI is bound to continue as China moves forward with capital account liberalization. Second, there is a growing need to internationalize Chinese corporations to boost productivity and reduce excessive capacity in several sector. Boosting ODI to overseas markets where demand is still on the rise, as is the case with most ASEAN countries, will enable China to outsource this excessive capacity. Labor-intensive sectors will also seek to expand overseas in order to benefit from relatively lower labor costs and maximize profit margins, favoring ODI flows to manufacturing activities in ASEAN and to a lesser extent Africa. Third, China’s huge amount of reserves will need to be diversified into higher yielding assets over time. Fourth and most importantly, the Chinese government is the one pushing this process not only at the level of the individual company but also with grandiose initiatives such as the 21st Century Silk Road.

With the growing importance of Chinese ODI, we also hope that tracking where this huge amount of money is going becomes easier over time.

[i] https://www.bbvaresearch.com/en/publicaciones/chinas-odi-how-much-goes-where-after-round-tripping-and-offshoring/