What does euro area adjustment mean for your Big Mac (index)? – an update

The Big Mac Index offers some quick insights into the state of currencies around the globe by comparing the price of Big Macs across countries. In the

Original post February 2013: 'What does the Big Mac say about Euro Area adjustment?'

The Big Mac Index offers some quick insights into the state of currencies around the globe by comparing the price of Big Macs across countries. In the euro area, one of the reasons we have the common currency is to be able to simply compare prices across countries. In this blog post I update my previous findings presented in February to show how much Big Mac prices have changes since then. Has euro area price adjustment continued in the last 6 months when looking at Big Macs?

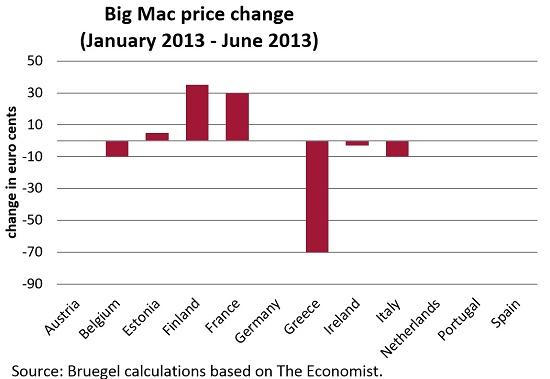

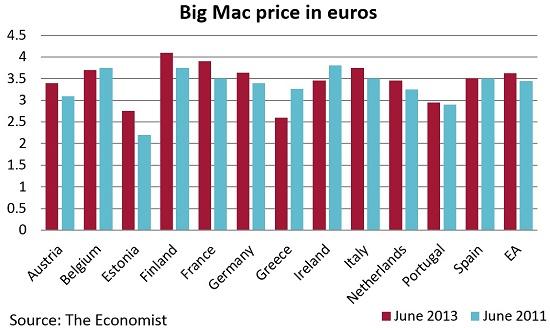

Based on the data just published by the Economist (dataset), the following graph shows that in a number of countries, the Big Mac price was adjusted significantly. Most visibly, in Greece the price was dramatically reduced from €3.3 to €2.6. In Italy and Belgium, the price was reduced by 10 euro cents. Prices were adjusted upwards in Finland (35 cents), France (30 cents), and Estonia (5).

Finland and France have now become the two most expensive countries, while Greece is the cheapest place to get a Big Mac. The price of a German Big Mac is average, with the Spanish Big Mac now cheaper than the German one. It remains quite costly to eat fast food in Italy.

Overall, the Big Mac index shows that price adjustment in EMU continues, and has also continued in the last 6 months, in particular in Greece. However, price increases in France without price increases in Germany suggest that France may be losing a competitive edge to Germany. A similar picture emerges when looking at CPI inflation. German inflation in the last 6 months has been undercutting French inflation. To achieve price adjustment in a sustainable way, German Big Macs will have to become more expensive relative to the euro area while French, Italian and Spanish Big Macs should become cheaper.