Towards further liberalisation of the capital account in China

In China, discussions on capital account liberalisation have recently intensified. The Chinese government plans to gradually liberalise certain capita

Summary: In China, discussions on capital account liberalisation have recently intensified. The Chinese government plans to gradually liberalise certain capital account items in the areas in which there is sufficient demand from the real economy and areas with relatively low investment risk, while maintaining tight regulation/supervision over the other items of the capital account and the financial sector. In response, Korean financial institutions need to establish strategies that will enable them to take part in this change, especially in the areas expected to undergo capital account liberalisation in the early stage.

Discussions on capital account liberalisation in China made significant headway in 2012, and various moves will be made in this direction to further open the capital account. China became one of the International Monetary Fund’s Article 8 countries in December 1996, making its current account fully convertible. After its accession to the World Trade Organisation in 2001, China partially opened its financial market, including commercial banks, while maintaining strict control over cross-border FX flows on the capital account.

However, the efforts to liberalise the FX market were suspended for years with the onset of the global financial crisis. Then, in January 2012, Zhou Xiaochuan, then the governor of the People’s Bank of China (PBOC), said that China would not refuse to make its currency increasingly convertible on the capital account. Following this, the PBOC’s Financial Survey and Statistics Bureau published a report in February 20121, in which it presented both short- and long-term roadmaps for capital account liberalisation; the report also drew parallels with the experiences of other countries, and acknowledged that the time was ripe to accelerate liberalisation of the capital account.

The State Administration of Foreign Exchange (SAFE) announced a plan to “liberalise the capital account in an orderly manner” in a press release; top officials, including Xie Ping, Vice President of the China Investment Corporation (CIC) and Guo Shuqing, Chairman of the China Securities Regulatory Commission (CSRC) and a strong candidate for the next governorship of the PBOC, repeatedly emphasised the need for, and the importance of, such moves. In September 2012, the PBOC published the 12th Five-year Plan to Enhance and Reform Financial Industry jointly with three major financial supervisory authorities and the SAFE, which set out the order and principles of capital account liberalisation and emphasised coordination with financial market liberalisation and internationalisation of the renminbi.

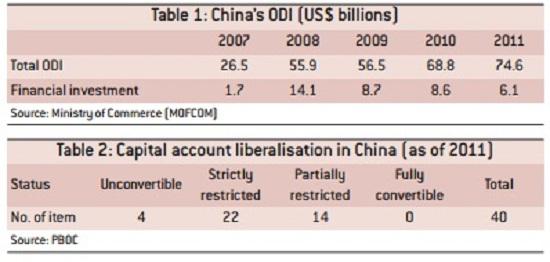

China seems keen on capital account liberalisation amid soaring overseas investment by Chinese businesses and financial institutions, and the quickening pace of the renminbi's internationalisation in the wake of the global financial crisis. Between 2007 and 2011, China’s ODI (outward direct investment) almost tripled from US$ 26.5 billion to US$ 74.6 billion (Table 1). And the government acknowledged that capital account liberalisation would be a prerequisite for internationalisation of the renminbi, and would also facilitate the implementation of the New Development Strategy to shift the focus of the growth strategy from exports to domestic demand over the mid-to-long term.

Moving towards capital account liberalisation, the Chinese government emphasises a step-by-step approach to minimise FX market instability. Currently (Table 2), China completely bans transaction in four out of 40 items on the capital account (by IMF criteria) including foreigners’ issuance and trading of derivatives within China; it partially allows 14 items including investment by Qualified Domestic Institutional Investor (QDII) and Qualified Foreign Institutional Investor (QFII). The country plans to gradually liberalise the capital account, lifting restrictions item-by-item.

Meanwhile, the 12th Five-year Financial Plan mapped out plans to a) start with deregulation of direct investment; b) expand convertibility in equity market through liberalisation of domestic capital markets and foreign stock investment; c) ease regulation and reform the supervisory system on overseas borrowing; and d) gradually allow individuals’ transactions on the capital account.

Additionally, the PBOC introduced both short- and long-term road maps to ensure sufficient demand from the real economy, and to start with capital account liberalisation in areas with fewer risks. Easing regulation on direct investment would be a short-term task (1~3 years), and deregulating commercial finance with relatively less risk would be a mid-term task (3~5 years). In the asset market (real estate, equity and bond), a long-term task will be implemented over five to ten years by first liberalising bond issuance and parceling-out, and allowing non-residents’ domestic transactions.

The Chinese government sees that poor external debt management was largely responsible for the financial and fiscal crises in East Asia and the euro area. Thus, it is likely to maintain close supervision over external debts. Various control/supervisory measures will be maintained over in- and outflows of convertible FX, and the government will intervene in case of market shocks or if excessive short-term, speculative capital inflows are detected.

Against this background, Korea should make efforts to share its experiences with China, and establish strategies to deal with the advancing capital account liberalisation in China. Both countries are extensively analysing related experiences, and sharing information would help to enhance bilateral financial cooperation, and better foresee the movements of the Chinese capital market. Korean financial institutions should pay closer attention to the areas of early capital account liberalisation (eg FDI and trade finance) that will have immediate impact on the market, and should explore how to respond to the forthcoming changes.