Unity in power, power in unity: why the EU needs more integrated electricity markets

Electricity market integration has substantial benefits that will improve the resilience and enable the transition of Europe’s energy system

The energy crisis that started in 2022 reminded European governments of the resilience provided by relatively well-integrated European electricity markets, which have been painstakingly built-up over several decades. European Union leaders thus decided to reverse a creeping energy renationalisation and to invest in completing the internal market.

However, there are some indications that this momentum is being lost, with different EU capitals taking different lessons from the energy crisis, at a time of unprecedented investment needs in generation and grids across the EU.

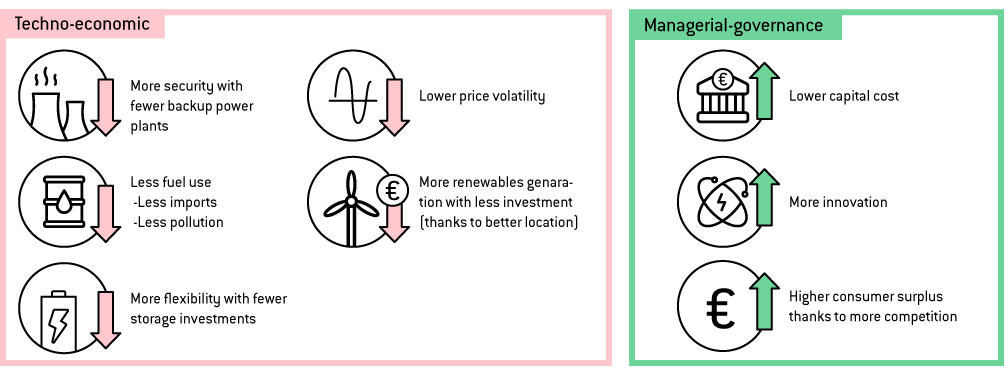

The multiple benefits of enhanced EU energy-market integration should be emphasised. ‘Techno-economic’ benefits can be secured from optimising the design and operation of several national electricity systems jointly, rather than individually. These benefits will increase massively with higher shares of renewables and include less fossil-fuel burn and less volatile short-term prices, cost savings through harnessing regional renewables advantages, reduced need for expensive back-up capacity and flexibility, and enhanced resilience to shocks.

In addition, greater energy-market integration will trigger benefits of a more managerial-governance related nature, though these are harder to quantify. They include benefits in terms of competition, innovation and credibility, which are particularly useful in the electricity sector, which typically faces rather long investment times and high degrees of concentration in purely national markets.

Further market integration requires substantial political investment. Governments will need to deal with significant distributional effects within and between countries. Experience has shown that domestic political constraints in this respect are often numerous and difficult to overcome.

Therefore, achieving the benefits of integration will require a vision on what degree of integration is feasible and desirable, and how to properly implement and govern it. It will also require an honest acknowledgement of the implications and costs of not pursuing greater integration.

Conall Heussaff skillfully organised the process of bringing the paper together. Conall Heussaff and Ben McWilliams did a lot of the heavy lifting on data analysis and designing the figures. Very useful comments by Leonardo Meeus are gratefully acknowledged. All authors contributed in a personal capacity and not on behalf of their institutions. Christian Zinglersen is thanked for his comments and for reviewing the paper and suggesting revisions.

1 Introduction

The energy crisis of 2022, triggered by Russia’s invasion of Ukraine, posed a massive challenge to Europe’s integrated energy markets. Exceptionally high gas prices drove up the cost of gas-fired power plants, on top of which, France’s nuclear fleet, a crucial component of the western European electricity system, suffered unprecedented outages

1

Benjamin Mallet, ‘France nuclear watchdog questions timing of some EDF reactors checks’, Reuters, 16 March 2023, https://www.reuters.com/business/energy/france-nuclear-watchdog-seeks-f….

. In addition, a record drought caused much-reduced hydropower output. The market system needed to respond to this shock by allocating scarce power across a constrained European network and by incentivising sufficient demand reductions.

Yet the European Union’s internal electricity markets performed remarkably well. Marginal price signals

2

In other words the wholesale price, determined by the cost of the most expensive unit of power needed to fully meet demand.

indicated where cross-border flows should go without the need for political negotiation. France, for example – which for years had been a massive net exporter of power – became a beneficiary of significant electricity imports. High prices also helped push down demand across the continent for both electricity and gas (Çam and Alvarez, 2023; McWilliams and Zachmann, 2023).

Against this background, one might think that most EU capitals would agree that the benefits of preserving and strengthening the EU’s integrated electricity markets are clear.

Alas, that is not necessarily the case. Many national interventions and proposals have been brought forward that distort Europe’s electricity market and risk moving it towards a more fragmented system

3

For example, the ‘inframarginal revenue cap’, Spain and Portugal’s Iberian exception, Germany’s exploring of preferential prices for industrial consumers, France advocating contracts-for-difference to reduce electricity costs for only certain consumer categories, or reduction in transmission capacities mooted in countries including Norway and Poland.

. This is a far cry from the mid-1990s, when Europe set up the internal energy market to reduce cost, pollute less and increase reliability (European Commission, 1995; European Commission, 1996).

Europe now faces a decisive political-crossroads moment in its future energy system, linked to how the lessons from the energy crisis are interpreted.

- One lesson might well be that each government needs more national tools at its disposal, to be able to intervene more in their home markets, even if this proves distortive to neighbours, and to become more nationally energy self-sufficient. In other words, more national, less together.

- Alternatively, we argue that Europe can build on the experience of EU countries in getting through the crisis together. Adding the missing tools to properly coordinate investments across borders and ensuring (as well as assuring) the efficient functioning of such a significantly more integrated system will make the energy transition much more affordable and will strengthen Europe’s future competitiveness substantially. So: more together, less each on their own.

Which of these two lessons EU countries ultimately draw from the crisis is in our view Europe’s imminent political crossroads moment. The answer will determine the EU’s energy and likely also industrial policies for the coming decade and beyond.

More specifically, the choice is between letting the internal energy market go off-course as each country individually tries to avoid perceived obstacles in the bumpy road towards climate-neutrality, driving the system increasingly towards inefficient fragmentation; or trying to stem the seemingly constant stream of domestic-focused national interventions to achieve an investable, more resilient and cost-efficient European electricity market.

Several studies point to significant benefits of greater energy-market integration across the EU:

- Newbery et al (2016) explored the benefits of optimising the use of interconnectors to increase efficiency of energy trading, finding that maximising the potential of shared balancing across borders could be as high as €3.9 billion per year (at the time the study was done).

- In an assessment of the EU wholesale electricity market design, ACER (2022) found the welfare gains delivered by cross-border trade, facilitated by the EU’s integrated electricity markets, to be roughly €34 billion in 2021 alone. Most likely they were even higher during the 2022 energy crisis.

- The Regulatory Assistance Project, a think tank, estimated that the annual benefits from fully integrating Europe’s electricity markets could reach €43 billion in 2030 (Baker et al, 2018).

- An open source modelling study estimated that cross-border interconnection could reduce system costs by 25 percent compared to a counterfactual scenario (Brown et al, 2018).

Analyses have typically focused on specific types of benefits from integration (such as gains from joint dispatch), and have treated the European electricity system as being in a steady state. The complex reality, however, is that integration provides multiple benefits (some techno-economic and some managerial-governance related). Some of these benefits will be particularly valuable in systems that experience rapidly growing electricity demand, less reliance on imports from non-EU suppliers and rising shares of variable renewables.

The type and scale of benefits from enhanced energy-market integration changed structurally in recent years for two reasons:

First, the energy crisis demonstrated the need for the European energy system to be more resilient against external shocks. The REPowerEU strategy, a plan to wean the EU off Russian energy supplies (European Commission, 2023), is explicit in these aims. It states that “REPowerEU is about rapidly reducing our dependence on Russian fossil fuels by fast forwarding the clean transition and joining forces to achieve a more resilient energy system and a true Energy Union.” To become more resilient and less dependent on external supplies, European energy markets must become more integrated. Or put differently, greater independence requires more interdependence.

Second, with the REPowerEU strategy, the EU plans to scale up the share of renewables from 23 percent in 2022 (based on Eurostat data) to 42.5 percent in 2030, with the ambition to actually reach 45 percent. A 42.5 percent share of renewables in the entire energy system translates into more than two-thirds of electricity generated from renewable sources (European Commission, 2022). This implies in turn that the EU will need to increase the share of renewables in electricity generation by about 60 percent to 70 percent within the next seven years, a period during which overall electricity demand is projected to increase significantly. In short, the EU will face something close to a renewables uptake explosion.

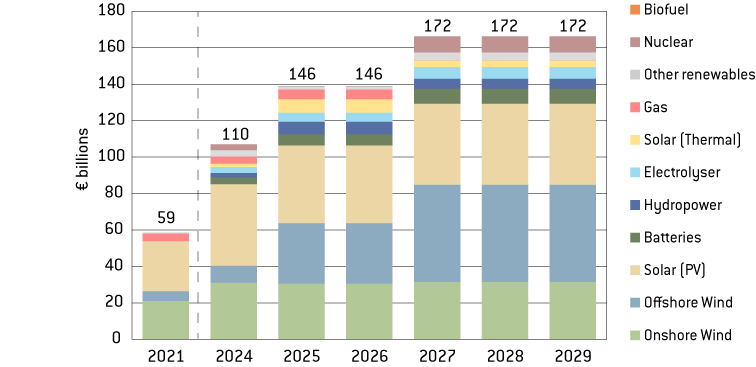

Massive investment will need to happen during the next decade. Electricity generation and storage investments alone might double to about 1 percent of EU GDP every year (Figure 1). Inefficiencies in scaling technology combinations, locational choices or sequencing would waste valuable capital and labour resources in all EU countries. The extra costs involved in relatively misguided/inefficient investments will fall on taxpayers or on the state budget that must underwrite certain projects. This very visible cost may endanger the social acceptance of the energy transition. As this investment spree must start immediately, the benefits of a more integrated European energy system need to be revisited now.

Figure 1: Planned annual electricity supply investments are becoming macroeconomically significant

Source: Bruegel based on ENTSO-E, JRC, NREL, IRENA and Scope. Note: The approximation is based on planned national increases in capacities for each technology and corresponding technology-specific investment cost estimates. EU GDP is approximately €15 trillion, meaning that electricity generation and storage investment could exceed 1 percent of total GDP by 2030.

2 Techno-economic benefits of more integrated internal energy markets

Significant techno-economic benefits can be secured from optimising the design and operation of several national electricity systems jointly, rather than individually. The value of these benefits will increase with higher shares of renewables. Benefits (detailed below) include less fossil-fuel burn and less volatile short-term prices, cost savings through harnessing regional renewables advantages, reduced need for expensive back-up capacity and flexibility, enhanced resilience to shocks and lower grid investments (Figure 2).

Figure 2: Benefits of market integration

Source: Bruegel.

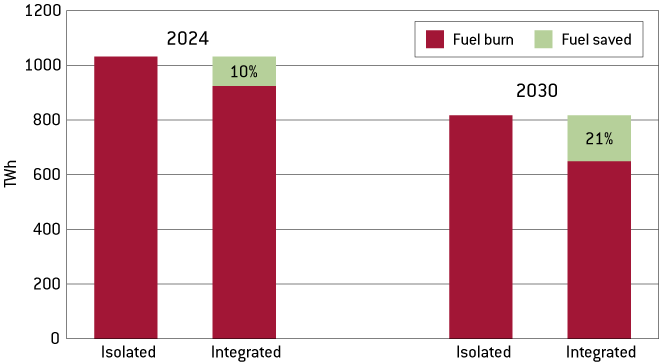

2.1 Less fossil burn and less price volatility

If gas-fired power plants in the Netherlands can be stopped because abundant wind power in Poland can displace their generation, use of natural gas and thus gas prices in the EU will be reduced. Less gas will also reduce carbon emissions and emission allowance prices. The fuel savings from trade are substantial (Figure 3) and are set to increase with higher shares of renewables. The main reason for such synergies is that wind, solar, hydro and electricity demand patterns differ across Europe. Hence, with sufficient interconnection capacities, hours in which renewables generation is low and demand is high in one place can be met by importing low-cost renewables from regions with different demand and supply patterns.

Figure 3: Theoretical benefits from moving from isolated systems to an EU system

Source: Bruegel based on ENTSO-E. Note: This is a highly simplified computation, based on EU countries’ 2030 plans with purely deterministic supply and demand curves and assuming weather patterns for a fixed historical year (1982). A substantial share of the indicated fuel savings will already materialise in the current imperfect market, and an unbound system is neither realistic nor efficient. Hence, this figure illustrates an upper boundary of operational efficiency gains. The three island countries (Ireland, Malta, Cyprus) were left out of the analysis as they are at present not connected the continental electricity system.

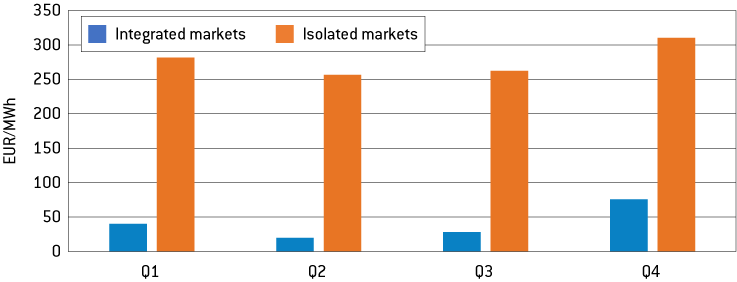

Moreover, in larger markets electricity prices become much less volatile (Figure 4). This is to be welcomed in hourly markets, but is even more valuable in longer-term markets, where it reduces risk for investors (see section 3).

Figure 4: Price volatility in integrated and isolated markets in 2021

Source: ACER (2022). Note: Price volatility was calculated as the unweighted average of the standard deviation of day-ahead wholesale prices in the different EU bidding zones. The price volatility figures in isolated markets were derived from a counterfactual modelling scenario in which cross-border trade between countries that participate in the short-term European electricity markets was reduced to zero. The integrated markets scenario is based on historical data.

2.2 Exploitation of regional resources

Solar, wind and hydro resource availability differ widely in different countries. Moreover, public resistance to geothermal projects, carbon capture and storage, nuclear plants, wind turbines or other technologies tends to be much less of an issue in sparsely populated areas (eg nuclear in Finland).

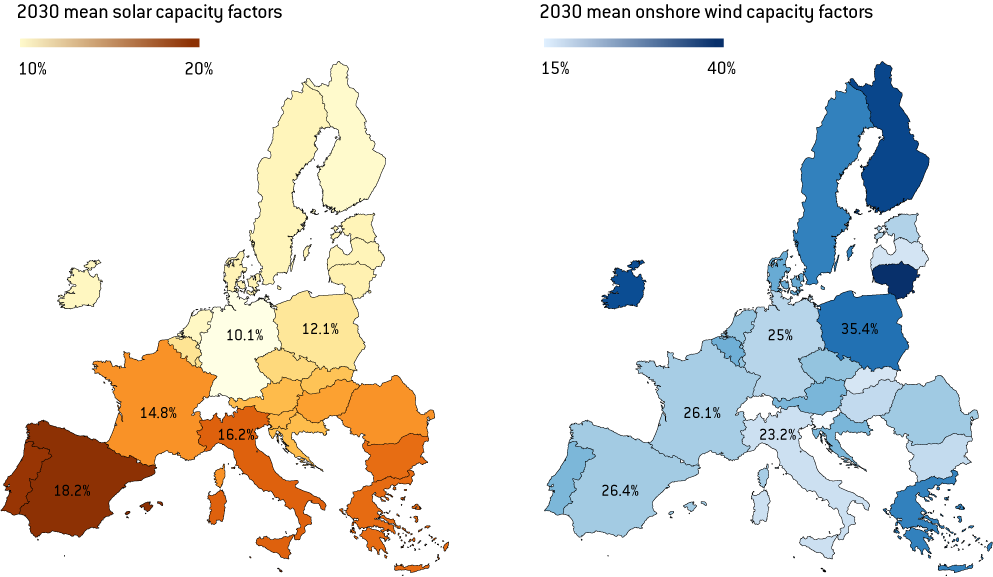

Figure 5: Solar and wind potential in Europe

Source: Bruegel based on ENTSO-E’s European Resource Adequacy Assessment. Note: ‘Capacity factor’ refers to electricity produced at realistic wind or solar conditions, relative to the amount produced if the plants would in each hour have operated at their peak capacity. The figures are based on the assumptions for installed renewable capacities in 2030 reported to ENTSO-E.

In addition, planning and building a meshed offshore grid in the North Sea and, potentially, the Baltic Sea could increase security of supply and maximise the utilisation of available renewable generation capacities (Consentec, 2023).

2.3 Sharing backup capacity reduces the total back-up investment need

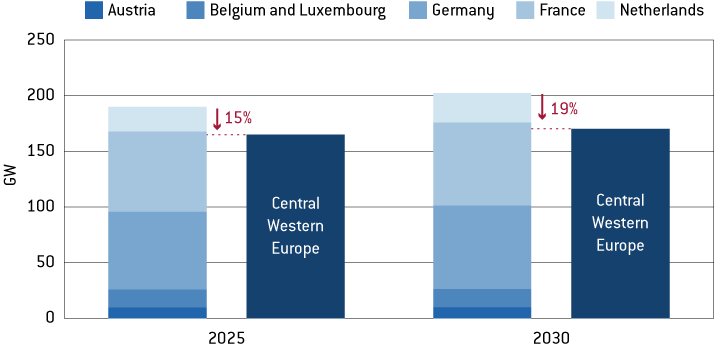

Another major benefit of integration would be the reduction in demand for backup capacities, which are needed to ensure secure electricity supply during periods with low availability of variable renewable electricity generation. Compared to isolated markets, an integrated energy market would need 19 percent less back-up capacity in 2030 (Figure 6), with our estimates suggesting this could reach savings of more than 50 gigawatts of back-up generation capacity in 2050

4

This refers to the differences in residual demand (load minus renewables and nuclear generation) in the integrated and entirely self-sufficient scenarios. This higher residual demand can be roughly interpreted as the capacity needed for dispatchable power plants (including demand reduction and storage). This capacity need is about 15 percent higher in the self-sufficient or enclosed system.

. Hence, the amount of back-up capacity needed in a system dominated by renewable generation will be much lower if EU countries cooperate in the dimensioning and the provision of such a system.

Figure 6: Need for dispatchable capacities, countries alone vs countries cooperating

Source: langfristszenarien.de. Note: Sum of non-synchronous peak residual loads (highest hourly demand not met by renewables and nuclear alone) vs regional synchronous peak load in six countries of central and western Europe.

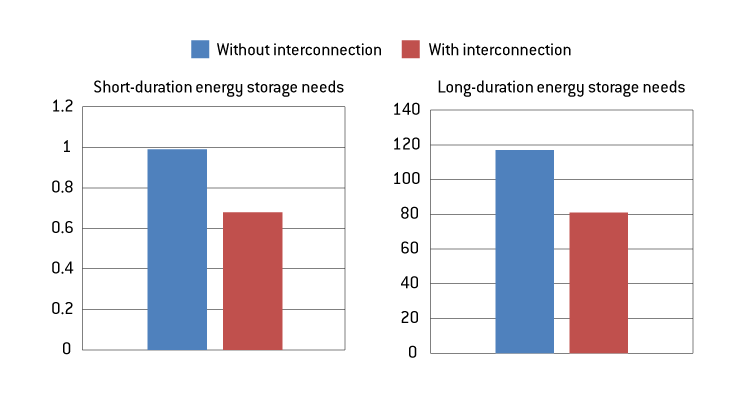

Furthermore, cross-border trade between EU countries reduces the investment needs in other technologies needed to support renewables. Roth and Schill (2023) found that interconnection reduces the optimal energy capacity need for electricity storage by 31 percent for a fully renewable central European power system (Figure 7). The paper showed that this reduction is mainly driven by limited synchronicity of available wind-power generation across countries. Whereas there is a high correlation of solar generation patterns within Europe (ie when the sun shines, it often shines at roughly the same time across a larger land mass), studies such as Monforti et al (2016) have found wind power to be significantly less correlated, resulting in more benefits from interconnection than would otherwise have been the case. With wind power most likely being the most important renewable power generation technology at least in northern and central Europe, extending and efficiently utilising cross-border transmission capacities will allow for those synergies to be maximised and the system to be designed more efficiently. Trinomics and Artelys (2023) found that regional cooperation between countries in northern and central Europe can reduce the need for flexibility investments by up to 20 percent. Thereby, in absolute terms, the benefits of integration increase with more renewables increasing the value of domestic and foreign flexibility in the system.

Figure 7: Installed storage capacity aggregated over 12 central European countries for 100% renewable energy scenarios, with and without interconnection

Source: Bruegel based on Roth and Schill (2023).

2.4 Enhanced system resilience

Beyond the ‘normal’ fluctuations in weather and demand discussed in the previous section, energy systems are also vulnerable to unpredictable external shocks. These external shocks may be triggered by the supply side (eg unavailability of power lines

5

For example, on 8 January 2021, a substation in Croatia caused a split across Europe for roughly an hour. The pooling of various reserves across the continent brought full synchronisation back again (ENTSO-E, 2021).

, power plants or fuels), the demand side (eg an economic crisis) or other external factors (such as extreme climate events or disruptions in supply chains). Individual shocks typically do not affect all EU countries similarly. Extreme climate events, such as droughts, the long-lasting absence of wind and solar power or cold spells, often only affect some parts of the EU. Moreover, energy mixes and demand patterns differ between countries. As a result, integrating electricity markets enables individual shocks to be smoothed. The mitigating effect from energy-market integration will be greater if the shock is local. However, even if the shock impacts to some extent the EU as a whole (for example, a widespread shortage of natural gas), the aforementioned factors still mitigate the worst consequences of this shock at a lower cost overall, compared to a situation of isolated national markets. At the extreme, letting markets identify the cheapest demand reduction potential across the entire EU would be substantially cheaper than forcing some unfortunate countries to resort to extremely expensive measures while others continue with close to business-as-usual demand patterns.

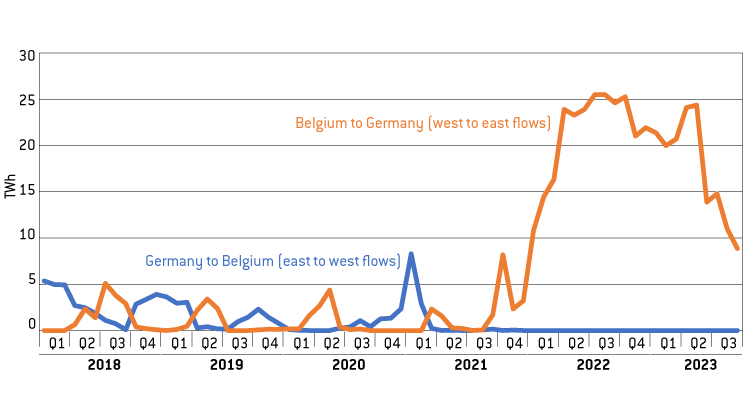

Box 1: Internal energy market resilience: three case studies

Belgian nuclear: In early winter 2018-2019, widespread outages in nuclear power plants in Belgium led to a local shortage of electricity generation

6

Decrease in nuclear production (Q4 2018 vs. Q4 2017): 2500 MW. Source: ENTSO-E Transparency Platform.

and threatened security of electricity supply. The Belgian transmission system operator (TSO) and neighbouring TSOs maximised Belgian import capacity

7

Increase in Belgian net imports (Q4 2018 vs. Q4 2017): 6000 MW Source: ACER (2022).

and thus more than offset the unavailability of nuclear power plants.

Figure 8: Germany became a huge importer of gas during the energy crisis

Source: ACER.

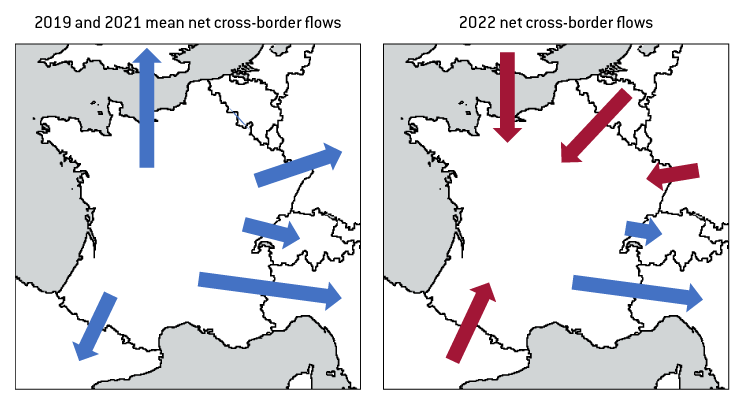

French nuclear: Corrosion issues led to many French nuclear reactors going offline for many month in 2021/2022, causing a short-fall of 81 TWh of nuclear generation, worth almost 20 percent of French demand in 2022. The EU’s internal electricity market was vital in allocating scarce electricity supply across Europe. France, historically a net electricity exporter, imported a significant share of its electricity from neighbouring countries (Figure 9) as many of its nuclear power plants became unavailable.

Figure 9: France became a huge importer of electricity during the energy crisis

Source: Bruegel based on ENTSO-E’s Transparency Platform. Note: The length of the arrow is directly proportional to the amount of electricity imported or exported.

These three examples indicate that, all else being equal, more integration increases the resilience of each of the connected power systems.

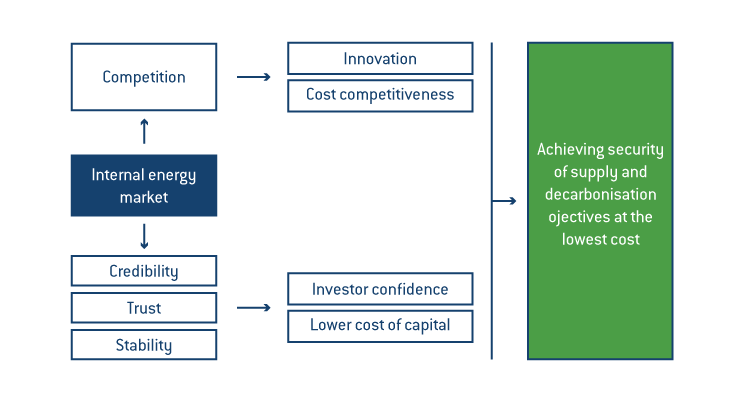

3 Managerial-governance related benefits of more integrated internal energy markets

Internal energy market integration brings further benefits in terms of competition, innovation and credibility, which are perhaps harder to quantify than the economic benefits but are nevertheless quite substantial.

The EU’s internal electricity markets contribute to the overarching goal of creating an integrated economic space within the European Union, where the benefits for EU citizens and businesses bolster the European political project of collaboration and peace

8

Schwab (2023) argued that a fair European electricity market with free choices of location of energy-intensive sectors can drive efficiency and even encourage cohesion.

. On the one hand, the broader internal market requires that electricity regulation is not used by EU countries to distort the playing field in favour of their electricity-consuming companies. On the other hand, because of its technical characteristics, integrating electricity markets requires more than ensuring the absence of typical tariff and non-tariff barriers (see section 4 on the complexities of market integration).

The EU’s internal electricity markets encourage competition among participants. This is particularly useful in the electricity sector, which typically faces rather high degrees of concentration in purely national markets

9

Due to substantial scale effects, path dependencies of state-owned incumbents, natural monopoly characteristics of the networks and resulting complex national regulation, it is a market in which entry barriers can be significant and concentration is often high.

. As a result, integrating national markets into a larger European one substantially enhances competition.

Just as in other markets (Desmet and Parente, 2010), this competition helps drive down cost, improve quality and spur technological advancements. Moreover, creation of a larger, more predictable market governed by common rules aimed at achieving energy policy goals of climate protection, security of supply and energy justice, engenders more credibility and trust among market participants, who also benefit from strengthened governance, independent regulatory authorities and unbundled market operators.

More regulatory certainty within a wider economic area underpinned by adequate pricing of externalities, and at the same time creating a conducive environment for renewable energy, amplifies investor confidence and lowers the cost of capital for clean technologies, which in turn is the main factor driving clean-tech cost competitiveness, thus reducing the cost of the energy transition.

Figure 10: Management/soft benefits of the internal energy market

Source: Bruegel.

3.1 Competition fostering innovation and consumer surplus

One of the primary benefits of the internal energy market is to stimulate competition between energy-market participants. Cross-border energy trade fosters a more dynamic marketplace, encouraging companies to strive for efficiency and cost-effectiveness. As competition intensifies, companies are compelled to innovate, seeking technological advancements and operational improvements to gain a competitive edge. A bigger, more uniform market also increases the expected profits from scaling-up better solutions, hence encouraging companies to innovate more. This can be expected to be seen in many innovative digital solutions that drive demand-side flexibility and contribute to faster and cheaper integration of variable renewable energy sources

10

The harmonisation of EU grid connection codes, for example, could encourage innovation and scaling of demand-response technologies, such as system-friendly charging of electric vehicles.

. Harmonisation of grid connectivity standards across the EU and national targeting of the many local barriers that inhibit the uptake of demand response and the participation of smaller distributed assets will contribute to further resilience and efficiency of power markets in the EU (ACER, 2023).

More competitors in a bigger European market also means less market power for individual companies. This drives down producer margins, to the benefit of consumers and the whole European economy.

3.2 Trust in institutions

The EU’s internal energy markets bring further economic advantages by addressing the importance of credibility and trust in the energy sector. A unified and integrated market fosters reliability and predictability, both in market operation and achieving the desired level of security of supply, as well as in rules and regulations. As the market expands, it becomes more transparent and increases resilience in the face of sudden shocks or disruptions, improving everyday reliability and providing a framework for swift and coordinated action in the event of a crisis. More integration in the EU energy market, likely accompanied by further coordination in overall system planning and financing, also gives a sense of stability when it comes to the overall direction of EU energy and climate policy, because wider EU goals are more likely to be achieved. This transparency, resilience and stability, in turn, enhances the trust of consumers, investors and other market participants that make long-term investments in energy infrastructure. This trust is particularly important for enabling the development of large, critical energy-infrastructure projects such as offshore wind networks or the green hydrogen sector.

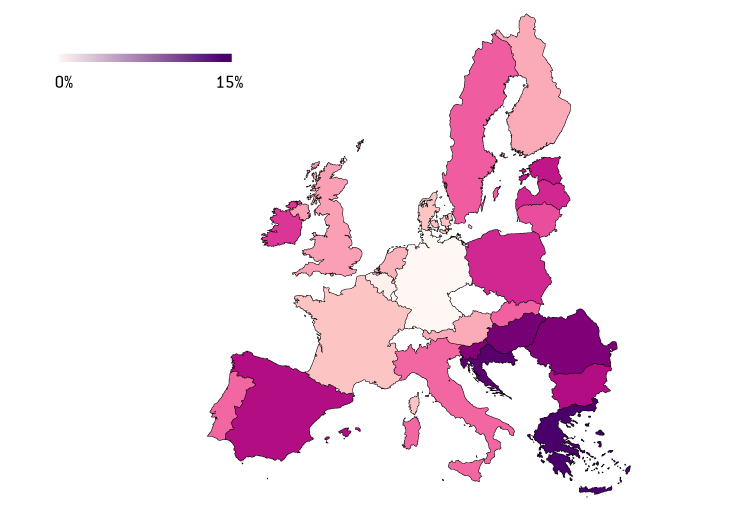

3.3 Lower cost of capital

The cost of capital for energy-sector investments varies significantly across Europe (see Figure 11 for renewable technologies), for reasons including different regulatory environments and risks, access to finance and country risk.

Figure 11: Cost of capital for onshore wind across Europe

Source: Bruegel based on Steffen (2020). Note: The figures presented are the weighted average cost of capital (WACC) at 2017 interest rates.

EU policymaking safeguards reduce the risk of ad-hoc or retroactive changes in EU regulations and enable investors to challenge unjustified national measures. More generally, by reducing regulatory hurdles and supporting competitive markets, EU law tends to improve confidence in overall market functioning. A more stable regulatory framework thus reduces the risk premium associated with the risks of regulatory intervention.

EU policymaking also provides visibility about long-term energy transition goals (up to 2050), with binding intermediate targets. The EU framework also requires member states to provide more visibility and predictability about their national energy transition pathways, eg through national energy and climate plans (NECPs). This visibility provides more confidence that demand for renewable energy sources and clean, flexible assets will continue growing, supporting the scaling up (and related cost reductions) of the underlying supply chains.

Thanks to the greater liquidity and lower volatility, the risk premiums for investors related to volatile market revenues therefore decrease in larger markets.

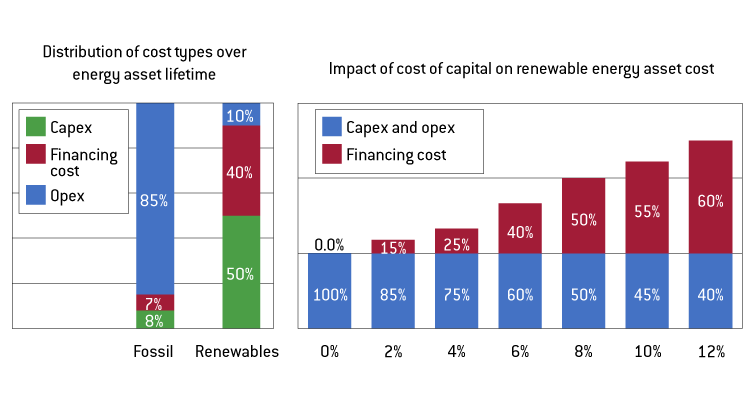

Reducing the cost of capital will be crucial to reduce the energy cost in a system with an increasing share of fixed cost (Figure 12).

Figure 12: Capital cost reduction is key for bringing down energy-system cost in systems with high shares of nuclear and renewables

Source: Steffen (2020)

4 The complex path to integration

Energy-market integration is not a binary choice between either having 27 disconnected power systems or having one joint electricity market

11

Throughout the paper, we assume that electricity supply (not the networks) is organised through markets. In a world with omniscient and benevolent public servants and without uncertainty, an optimal European electricity system could be publicly planned and run. However, we believe that the complex task of managing hundreds of thousands of employees and serving millions of customers is better organised through competing profit-oriented companies, and that the financing needs for supply side investments worth around 1 percent of GDP every year (see Figure 1) will be difficult to mobilise from public budgets.

in which national borders play absolutely no role. Cross-border lines and multilateral electricity trading arrangements in Europe have existed for more than 100 years (Zachmann, 2013), though the EU’s internal electricity market is less than 30 years old. Moreover, EU countries continue to trade electricity with non-EU countries that are not part of the internal electricity market, including Switzerland, Morocco and the United Kingdom. Even within the EU, electricity trade arrangements can have very different levels of intensity. Thereby, the benefits of more integration typically coincide with stronger distributional effects and less national control over electricity-system choices. For illustrative purposes we distinguish between six degrees of market integration:

- Enclosed national systems (autarky);

- Idiosyncratic arrangements: commercial contracts between electricity market players in different countries, such as Morocco and Spain;

- Linked markets for short-term products: interfaces between national markets, such as hourly spot markets for next-day electricity delivery, such as UK-EU spot trading;

- Linked markets for long-term products: interfaces between national markets allowing foreign participants to compete for long-term products, such as French bidders participating in Germany’s capacity mechanism;

- Joint markets for short-term products: shared market institutions with identical rules in all pooled countries, such as the NordPool spot market;

- Joint market for specific [?]: shared market institutions with identical rules in all pooled countries; for example, single European auctions for electricity from renewable sources.

As in the EU about a dozen main electricity wholesale products are traded, sometimes only within countries, sometimes across borders, sometimes within certain regions but never across the entire Union, the current system resembles a complex and dynamic jigsaw.

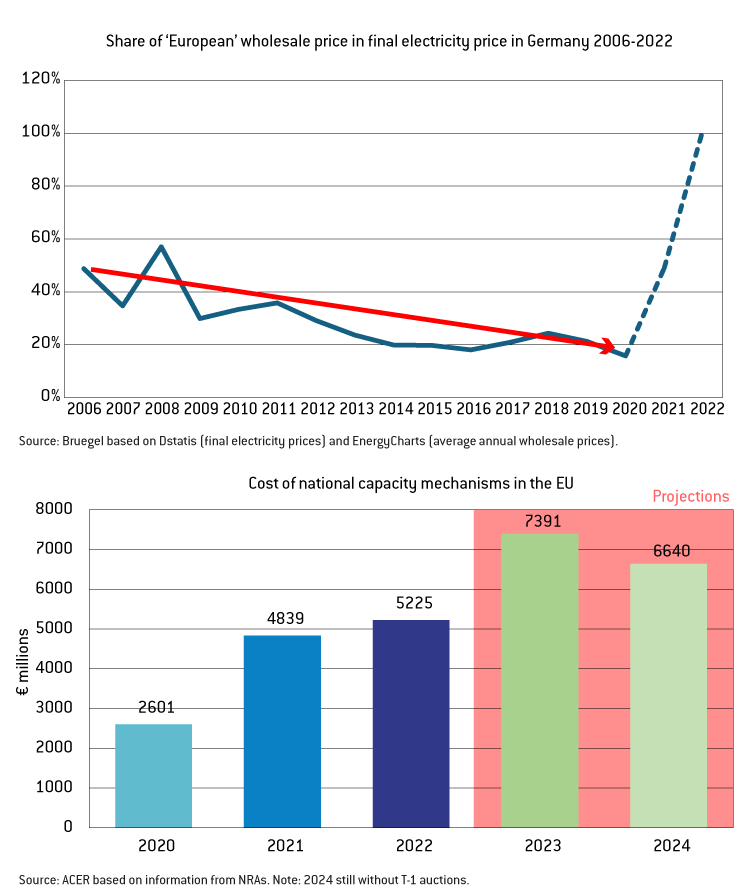

In the last decade, integration in short-term markets

12

Complex linking tools such as regional market coupling were rolled out successfully and likely helped in alleviating the impact of the energy crisis.

has improved substantially, while the relative impact of short-term markets on final electricity bills has decreased. The share of wholesale prices in final energy prices in Germany, for example, declined from around 50 percent before 2010 to less than 20 percent before the energy crisis (Figure 13). One reason was that currently predominantly national instruments for investments, such as ubiquitous renewables support schemes and increasingly capacity mechanisms, gained in importance

13

On the one hand, the cost of these national long-term instruments increases final prices; on the other hand these national tools reduce scarcity in the wholesale market and hence European wholesale prices.

.

Figure 13: Short-term market revenue increasingly supplemented by other revenue streams, including national support

The likely contribution of at times heavy-handed national investment instruments to a decrease in wholesale prices across the EU is one example of how national and European, market and non-market, and short- and long-term instruments interact. Hence, coordination across borders is needed, even if only very shallow/specific forms of energy-market integration are chosen. Currently, increasingly sophisticated national measures proliferate, with responsibilities spread out over national ministries, regulators, market operators and transmission and distribution system operators. The EU electricity market design reform

14

For details, see Council of the EU, ‘Electricity market reform’, https://www.consilium.europa.eu/en/policies/electricity-market-reform.

of 2023 encouraged some simplification and harmonisation, but EU countries will likely maintain ample leeway to pile up national instruments and micro-manage the development of their power systems.

It seems straightforward that a coordinated system of more consistent instruments would produce clearer guidance and hence reduce uncertainties, and thus reduce capital costs.

As we outline above, the benefits from more market integration can be very substantial. This raises the question of why, if market integration is so beneficial, more progress has not been made in the past?

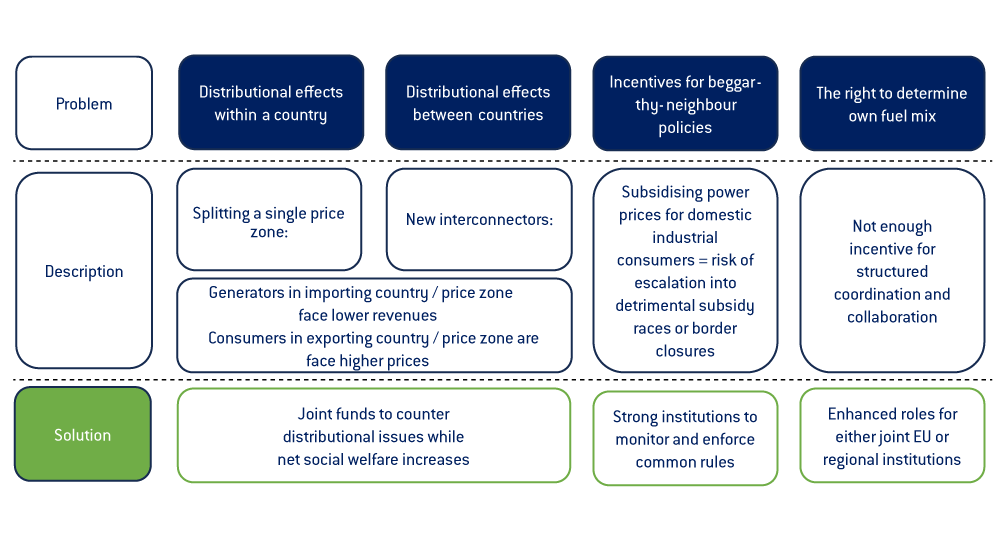

First, power system choices are not just about efficiency of the electricity system, but also about political cultures (state vs. market delineation), technology preferences (eg regarding nuclear or rooftop solar), and regional and industrial policy. Most importantly, distributional effects within a country strongly shape its preferences for certain market set-ups

15

One example is the single German bidding zone, which is seen as inefficient by virtually all energy economists, but is politically very hard to change because of the expected substantial distributional effects within Germany.

. Generators in one country might lose if a new transmission line makes supplies from cheaper foreign competitors available to consumers. At the same time, consumers in the exporting country might complain about increasing prices if ‘their’ cheap power is sold abroad.

Second, power-system choices also have distributional effects between countries. Some countries might fear that others get more of the benefits of integration, and even on aggregate, a few countries might worry that they will lose out from an unmitigated internal market

16

For example, in the current system in which domestic consumers pay for much of the renewables, back-up and grid investments, allowing this ‘subsidised’ electricity to be exported might be a net loss for the country.

.

Third, in specific market situations, countries have strong incentives for beggar-thy-neighbour policies. For example, subsidising electricity for domestic industrial consumers (to outcompete firms located in other member states) can escalate into detrimental subsidy races or border closures, with limited (or even detrimental) consequences for the global competitiveness of EU industry.

And fourth, the European Treaties (Art. 194 of the Treaty on the Functioning of European Union) guarantee each member state the right to determine its fuel mix. While not at odds with increasingly ambitious renewable energy targets decided at EU level over the years, this provision anchors the notion that certain fundamental choices ultimately rest with each member state.

Hence, moving ahead on market integration will require sufficient redistributive tools (to deal with the first two points raised above)

17

Some joint funds might make sense as distributional effects are dynamic and state-dependent in nature.

, a good level of trust between partners and institutions to monitor and enforce common rules (to avoid the problems mentioned in the third point above), and for member states to adopt and accept more structured coordination and collaboration, inevitably bringing with it enhanced roles for either joint EU or regional institutions (arguably getting to the heart of the political balance alluded to in the fourth point above) (Figure 14).

Figure 14: Distribution issues and solutions

Source: Bruegel.

These are profound policy questions with structural economic, financial and social consequences, meaning they merit further political discussion.

5 Conclusion

The 2022 energy crisis highlighted the resilience, and thus also the security benefits, of relatively well-integrated EU electricity and gas markets. But paradoxically, the crisis also accelerated the pre-existing trend of fragmentation, rather than leading to more coordinated solutions. To achieve ‘more independence through more interdependence’, this trend needs to be reversed.

Electricity market integration has substantial benefits that will be instrumental to improving the resilience and enabling the transition of Europe’s energy system. When done jointly, substantially less capital needs to be invested in additional power plants, and less fossil fuel needs to be burned than if each EU country optimises its system domestically. Moreover, the cost of the invested capital will be lower in a consistently regulated and predictable European market, and consumers would reap more of its benefits.

The time to put this fundamental political discussion on the table is now, especially since Europe is facing massive electricity-system investments, with greater risks of lock-in of more expensive, less-efficient choices, should member states opt for the more fragmented approach. Moreover, the current coordination arrangements, based on creating a joint European short-term market, have been gradually losing impact as national long-term instruments have become the dominant signal for investment. Hence, inaction at EU level implies member states might be forced to take back more control to safeguard their energy-policy objectives, potentially setting in motion a ‘death spiral’ for the internal energy market, reducing rather than enhancing all the benefits it has already delivered.

That said, pursuing further market integration requires substantial political investment, namely that governments tackle the significant distributional effects within and between countries. Experience has shown that domestic political constraints in this respect often are numerous and rather entrenched. Hence, moving ahead without proper discussion among and commitment from EU governments is not credible and might lead to backlash.

As such, achieving the benefits of integration will require a vision of what degree of integration is feasible and desirable, and how to properly implement and govern it. It will also require an honest acknowledgement of the counter-factual: the implications and costs of not pursuing this route.

References

ACER (2022) ACER’s Final Assessment of the EU Wholesale Electricity Market Design, European Union Agency for the Cooperation of Energy Regulators, available at https://www.acer.europa.eu/Publications/Final_Assessment_EU_Wholesale_Electricity_Market_Design.pdf

ACER (2023) Demand response and other distributed energy resources: what barriers are holding them back? 2023 Market Monitoring Report, European Union Agency for the Cooperation of Energy Regulators, available at https://www.acer.europa.eu/sites/default/files/documents/Publications/ACER_MMR_2023_Barriers_to_demand_response.pdf

Baker, P., M. Hogan and C. Kolokathis (2018) ‘Realising the benefits of European market integration’, Regulatory Assistance Project, May, available at https://www.raponline.org/knowledge-center/realising-the-benefits-of-european-market-integration/

Brown, T., D. Schlachtberger, A. Kies, S. Schramm and M. Greiner (2018) ‘Synergies of sector coupling and transmission reinforcement in a cost-optimised, highly renewable energy system’, Energy 160: 720-739, available at https://doi.org/10.1016/j.energy.2018.06.222

Çam, E. and C.F. Alvarez (2023) ‘Europe’s energy crisis: Understanding the drivers of the fall in electricity demand’, Commentary, 9 May, International Energy Agency, available at https://www.iea.org/commentaries/europe-s-energy-crisis-understanding-the-drivers-of-the-fall-in-electricity-demand

Consentec (2023) Ansätze eines Offshore-Stromnetzes in der Ausschließlichen Wirtschaftszone (AWZ), Report for the German Ministry of Economic Affairs and Climate Action, available at https://www.bmwk.de/Redaktion/DE/Publikationen/Energie/ansaetze-eines-offshore-stromnetzes-in-der-ausschliesslichen-wirtschaftszone-awz.pdf?__blob=publicationFile&v=3

Desmet, K. and S. Parente (2010) ‘Bigger is Better: Market Size, Demand Elasticity, and Innovation’,International Economic Review 51(2): 319–33, available at http://www.jstor.org/stable/40784708

ENTSO-E (2021) Continental Europe Synchronous Area Separation on 24 July 2021 Technical Report, European Network of Transmission System Operators for Electricity, available at https://eepublicdownloads.entsoe.eu/clean-documents/SOC%20documents/SOC%20Reports/entso-e_CESysSep_210724_211112.pdf

European Commission (2023) ‘REPowerEU Plan’, COM(2022) 230 final, available at https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52022DC0230

European Commission (2022) ‘Non paper on complementary economic modelling undertaken by DG ENER analysing the impacts of overall renewable energy target of 45% to 56% in the context of discussions in the European Parliament on the revision of the Renewable Energy Directive’, available at https://energy.ec.europa.eu/system/files/2022-06/2022_06_20%20RED%20non-paper%20additional%20modelling.pdf

European Commission (1995) ‘For a European Union energy policy’, Green Paper, January, available at https://op.europa.eu/en/publication-detail/-/publication/f3a9af74-f359-4d06-9361-c0b06f0fbe61

European Commission (1996) ‘An energy policy for the European Union’, White Paper, January, available at https://op.europa.eu/en/publication-detail/-/publication/2a58e5e8-8848-4606-b7d8-1eccb4832988

Monforti, F., M. Gaetani and E. Vignati (2016) ‘How synchronous is wind energy production among European countries?’ Renewable and Sustainable Energy Reviews 59: 1622-1638, available at https://doi.org/10.1016/j.rser.2015.12.318

Newbery, D., G. Strbac and I. Viehoff (2016) ‘The benefits of integrating European electricity markets’, Energy Policy 94: 253-263, available at https://doi.org/10.1016/j.enpol.2016.03.047

McWilliams, B. and G. Zachmann (2023) ‘European natural gas demand tracker’, Bruegel Dataset, available at https://www.bruegel.org/dataset/european-natural-gas-demand-tracker

McWilliams, B., G. Sgaravatti, S. Tagliapietra and G. Zachmann (2023) ‘The European Union is ready for the 2023-24 winter gas season’, Analysis, 10 October, Bruegel available at https://www.bruegel.org/analysis/european-union-ready-2023-24-winter-gas-season

Moll, B., M. Schularick and G. Zachmann (2023) ‘The Power of Substitution: The Great German Gas Debate in Retrospect’, Brookings Papers on Economic Activity, 26 September, available at https://www.brookings.edu/wp-content/uploads/2023/09/6_Moll-et-al_unembargoed_updated.pdf

Roth, A. and W.P. Schill (2023) ‘Geographical balancing of wind power decreases storage needs in a 100% renewable European power sector’, iScience 26(7), available at https://www.cell.com/iscience/fulltext/S2589-0042(23)01151-3

Steffen, B. (2020) ‘Estimating the cost of capital for renewable projects’, Energy Economics 88: 104783, available at https://doi.org/10.1016/j.eneco.2020.104783

Schwab, T. (2020) ‘Energising EU Cohesion : The Renewable Energy Transition Powers Up Lagging Regions’, Bertelsmann Stiftung, 5 December, available at https://www.bertelsmann-stiftung.de/en/our-projects/europes-economy/project-news/energising-eu-cohesion

Trinomics and Artelys (2023) Power System Flexibility in the Penta region – Current State and Challenges for a Future Decarbonised Energy System, study commissioned by the Benelux General Secretariat on behalf of the Pentalateral Energy Forum, available at https://www.benelux.int/nl/etude/power-system-flexibility-in-the-penta-region-current-state-and-challenges-for-a-future-decarbonised-energy-system-2/

Zachmann, G. (2013) Electricity without borders: a plan to make the internal market work, Blueprint 20, Bruegel, available at https://www.bruegel.org/book/electricity-without-borders-plan-make-internal-market-work