A new governance framework to safeguard the European Green Deal

This policy brief sets out policy proposals to enhance governance in order to safeguard EU decarbonisation.

Executive summary

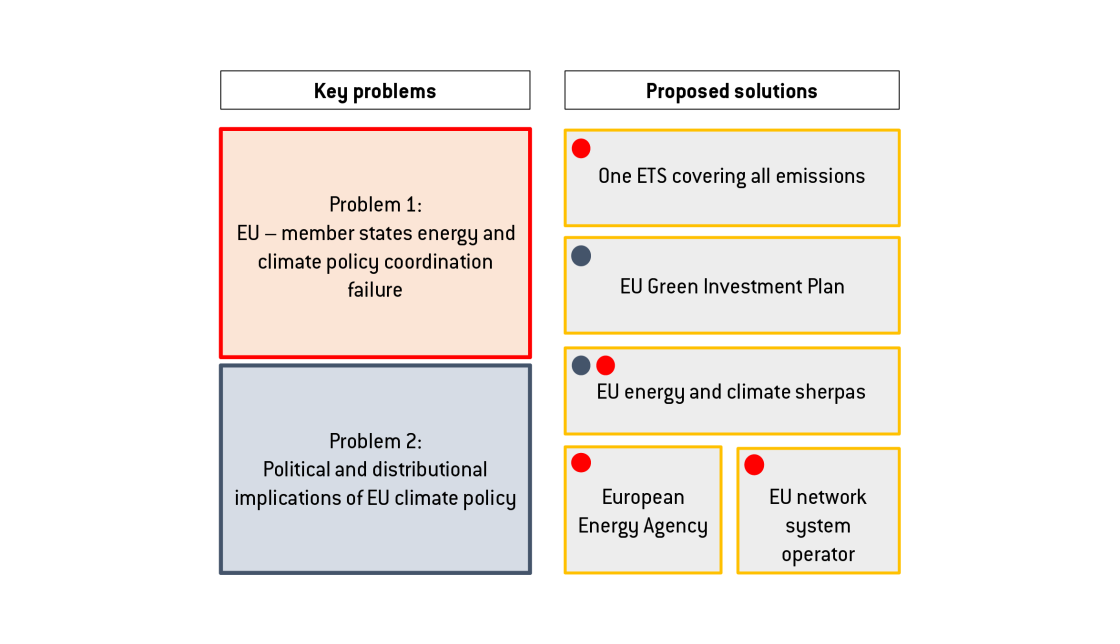

With the European Green Deal, the European Union adopted ambitious climate targets and a wave of legislation to reach them. But implementation will be politically challenging, in particular because the Green Deal has not upgraded the EU’s energy and climate governance framework. We propose five priorities for governance reform:

- All emissions should be made subject to emissions trading. By 2030, separate emissions trading systems (ETS) will cover industrial emissions and buildings/transport emissions, representing three-quarters of all territorial emissions. A third ETS should be created for sectors not yet covered and the emission control mechanisms should be unified by 2040.

- Preparations should start for an EU Green Investment Plan. This should ensure that after pandemic recovery funding ends in 2026, EU green grants remain at least at the current level of €50 billion per year (0.3 percent of GDP). Making up the annual shortfall would require new EU resources amounting to €180 billion between 2024 and 2030, but this will be important to tackle the political and distributional problems the EU will increasingly face. In addition, currently discussed EU economic governance reforms should be amended to allow countries with public debt exceeding 60 percent of GDP but with sustainable public finances to reduce debt at a slower pace, on the condition that additional emissions-reducing investments are made.

- A European Energy Agency should be established. This would provide unbiased reference points for policy evaluation and preparation. It would not have decision-making powers but would gather and make available data for decision-making, maintain open modelling tools, and independently assess EU and member-state policies.

- Energy and climate governance should be elevated to heads of state and government level to increase policy coordination and political ownership. Special European summits would be organised at least once a year, with preparations done by EU energy and climate sherpas.

- Transmission network development and operation should be driven by European cost minimisation. An European independent network system operator would be able to ensure that existing cross-border transmission is used optimally, also with a view to fostering investment.

The authors are grateful to Giovanni Sgaravatti for the excellent contribution provided during the preparation of this paper. They are also grateful to Conall Heussaff and Ben McWilliams for their research support, and to the participants in an April 2023 workshop held at Bruegel to discuss this issue. This version has benefitted from insightful comments by Fabrizio Balassone, Miguel Gil-Tertre, Erica Hope, Selma Mahfouz, Zoltan Massay Kosubek, Thomas Pellerin-Carlin, André Sapir, Kurt Vandenberghe and Jeromin Zettelmeyer. Financial support from the European Climate Foundation is gratefully acknowledged.

1 Introduction

The European Commission under Ursula von der Leyen has successfully pivoted the European Union towards climate neutrality. With the European Green Deal, the EU has set clear and ambitious climate targets for 2030 and 2050 and, to reach them, has adopted a wave of legislation. Hundreds of billions of euros in EU green funding have been mobilised. While the COVID-19 pandemic and Russia’s invasion of Ukraine showed that the climate crisis is not the only major challenge for Europe, the von der Leyen Commission has made major efforts to tap green opportunities as part of the management of these crises. The investment plan to address the pandemic – NextGenerationEU – emphasised climate-relevant investments, while the REPowerEU plan to minimise reliance on energy imports from Russia has focused on rollout of green alternatives.

Nonetheless, difficulties lay ahead for the green transition in Europe. Meeting the EU’s climate-change mitigation goals will require EU countries to take increasingly challenging decisions in the next few years (Box 1). Unfortunately, the actions they take are unlikely to be commensurate with the common climate-neutrality ambition, for two reasons.

The first is a coordination failure. The main climate targets have been set at EU level while essential policies – particularly energy policies – remain largely national. The result is that collective action is likely to be insufficient. Second, reaching the climate targets requires profound changes to lifestyles and will have distributional consequences that could lead to a political backlash. This is already happening. Ahead of the 2024 European elections, more and more voices are speaking out in support of a slowing down of the decarbonisation process 1 For example, on 12 July 2023, the European People’s Party voted against a nature restoration law in the European Parliament, indicating that the conservatives are taking a more negative attitude towards ambitious environmental rules ahead of the European elections. In summer 2023, opposition to German plans to ban the sale of gas boilers grew stronger. In Italy, polling has shown that 45 percent of respondents believe the EU targets are too ambitious, compared to 22 percent who believe they are correct; see https://twitter.com/you_trend/status/1680862213286899713. . Some recent national elections in EU countries, including Italy, Finland and Sweden, have seen a strengthening of voices critical of ambitious domestic climate polices, to the extent that the survival of the current consensus on climate neutrality within the European Council cannot be taken for granted.

Box 1: EU decarbonisation will become more challenging

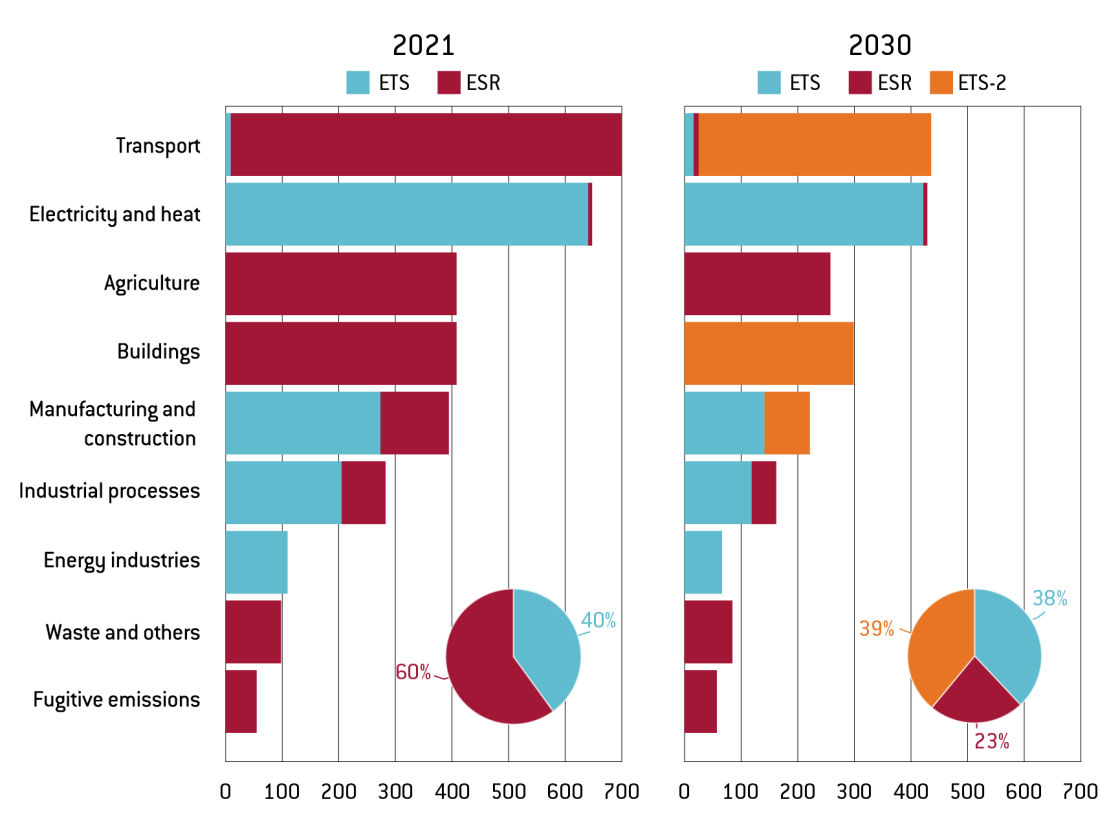

Over the last decade, most greenhouse gas emissions reductions in the EU happened in sectors covered by the EU emissions trading system (ETS), most notably in the power sector. In non-ETS sectors such as transport and buildings, emissions reductions were relatively small (Figure 1). By 2030, to meet EU targets, ETS emissions will have to drop by 35 percent compared to 2022, while emissions from buildings and transport should be reduced four times faster than in the past decade.

This will likely have two consequences. First, the distribution between EU countries of the costs of decarbonisation will change as decarbonisation has to move swiftly towards harder-to-abate sectors. Second, decarbonisation will affect households unequally: the burden of complying with the new regulations by set deadlines (for example, the phase-out of fossil fuel cars by 2035) will be high for low-income households of course, but also for middle-income households, for which renovating property or buying an electric car could require investment of about a year’s income (Pisani-Ferry and Mahfouz, 2023). Policies that have the effect of requiring these investments could easily trigger resistance if they are not properly designed and explained.

Figure 1: Emission reductions 2011-2021 by sector

Source: Bruegel based on IPCC emissions data.

While the first problem can in principle be solved through better coordination between the EU and its members – including better common institutions – the second would be present even in an EU organised as a federal state. These problems are therefore conceptually distinct. At the same time, they are related: political resistance happens mostly at the national level, which further weakens incentives to make the required national efforts.

The EU energy and climate governance structure contains elements that seek to address these problems. But these do not go far enough. The governance structure needs to be enhanced to do the job. In this Policy Brief, we first provide an overview of the development and legal foundation of EU energy and climate change mitigation policy 2 We do not focus on climate change adaptation policy, which requires a dedicated analysis; see, for instance, Lenaerts et al (2022). . Section 2 describes the EU energy and climate governance structure. Section 3 discusses why this structure’s shortcomings. Section 4 sets out policy proposals to enhance governance in order to safeguard EU decarbonisation.

2 EU energy and climate policy: historical development and legal foundation

Though EU energy and climate policies are strongly interdependent, the basic principles of their respective governance regimes at the EU level differ:

- Energy policy choices are a national prerogative. Justifications for EU involvement mainly derive from requirements arising from the functioning of the internal market;

- Climate policy is a common policy of the EU. Restrictions to its scope derive from the limitations of its instruments and from the requirement that the prerogatives of EU countries in the field of energy be respected.

The reasons for this misalignment and the fundamental governance problem it creates, can be found in the historical evolution of the European integration project.

Energy cooperation played a prominent role in the early days of the European integration process. With the creation of the European Coal and Steel Community in 1951, Europe’s founding fathers decided to integrate coal – the main energy resource of the time – and steel industries into a single common market. In 1957 the European Atomic Energy Community (Euratom) was created, with the original purpose of developing nuclear energy and distributing it to its member states. However, after this initial strong push, efforts to integrate Europe’s energy policy lapsed until the 1990s, when the process of liberalisation of European electricity and gas markets started. EU energy policy momentum really started to gather steam in 2015, when the Energy Union initiative followed Russia’s annexation of Crimea and the related gas security-of-supply fears in Europe. Security of supply became even more pressing in 2022, intensifying calls for more integrated EU energy policy.

By contrast, climate policy was largely born European, and has remained a key EU competence. The Single European Act of 1987 added environmental provisions to the European Treaty, allowing the Council of the EU and European Parliament to make environmental laws on the basis that countries face similar environmental problems and pollution often crosses borders 3 Moreover, the growth of the Single Market raised concerns about competition distortions resulting from different environmental policies at national level. The Single European Act aimed to minimise these distortions by adopting European rules for environmental protection (Delbeke and Vis, 2016). .

However, the Single European Act introduced a strong caveat: pushed by fossil fuel-rich countries, the EU agreed a provision affirming that the Union would not interfere with national policies to exploit domestic energy resources. This provision remains part of the EU Treaty (Box 2).

Box 2: The legal foundations of EU energy and climate policies

Energy policy

Under the Treaty on the Functioning of the European Union (TFEU), energy and climate are shared competences, meaning that the EU and its member countries can exercise their authority concurrently in these policy areas. As in all shared competence areas, EU institutions play an important role in proposing climate and energy policies and in adopting laws. EU countries meanwhile define the EU’s overall political direction and priorities, and negotiate and adopt laws together with the European Parliament.

The TFEU establishes the core objectives of EU energy policy (Art 194): ensuring the functioning of the energy market, ensuring security of energy supply, promoting energy efficiency and energy saving and the development of new and renewable forms of energy, and promoting the interconnection of energy networks. It also reaffirms that such EU measures shall not affect an EU country’s right to determine the conditions for exploiting its energy resources, its choice between different energy sources and the general structure of its energy supply.

Based on the provisions in Article 194, the EU has developed its energy policy through several core laws, including the Renewable Energy Directive (EU 2018/2001) and the Energy Efficiency Directive (EU 2018/2022). It is interesting to note that during the energy crisis of 2022, several initiatives were adopted based on the provisions of Article 122, as happened during the euro crisis.

Climate policy

The TFEU emphasises the importance of integrating environmental protection into the definition and execution of EU policies and activities, with the ultimate goal of promoting sustainable development (Article 11). Specifically, the EU is required to safeguard and enhance environmental quality, encourage the responsible use of natural resources, and spearhead international initiatives to address regional and global environmental issues, especially climate change (Article 191). Additionally, while EU countries are responsible for financing and executing environmental policies, this does not diminish the role of the EU in taking appropriate measures (Article 192[4]).

The EU over time has developed its climate policy in accordance with these provisions, enacting significant laws, including the Directive on the establishment of the Emission Trading System (2003/87/EC), the Council Decision endorsing the Paris Agreement (EU 2016/1841), the Regulation on the governance of the Energy Union and Climate Action (EU 2018/1999) and the Regulation laying down the framework for achieving climate neutrality by 2050, commonly known as the European Climate Law (EU 2021/1119).

In 1990, the Intergovernmental Panel on Climate Change’s first summary report sparked discussions in the European Council on climate change. EU leaders agreed to stabilise by 2000 greenhouse gas emissions at 1990 levels. This target led to discussions on common policies to achieve emissions reductions. However, EU countries failed to agree on an energy chapter to be included in the 1992 Maastricht Treaty, because of the eagerness of member states to preserve their sovereignty over energy policy choices. Lacking a clear mandate on energy policy, and after a failed attempt to introduce a European carbon tax in the 1990s (Delbeke and Vis, 2016), the EU adopted soft energy-policy instruments including targets for energy efficiency and renewable energy. In parallel, it also started to steer the continent’s energy profile through competition policy, in which the European Commission is the central EU authority. In the late 1990s, the First Energy Package was adopted, starting the process of liberalisation of the electricity and gas national markets.

The then-European Community also began formulating strategies to meet the targets of the Kyoto Protocol, to which it was party. The European Climate Change Programme (ECCP) was launched in 2000, leading to the introduction of the first renewable energy sources (RES) Directive in 2001, and of the European emissions trading system (ETS) in 2005. In 2009, a new renewable energy directive was adopted. But as the TFEU, which entered into force the same year, made energy a shared competence, this directive was the last EU legal document setting binding targets for the deployment of RES at the national level. All subsequent laws on RES deployment, published in 2018, 2021 and 2023, have set (increasingly ambitious) RES targets for the EU as a whole.

The 2015 Paris Agreement was a turning point for EU energy and climate policy development (Figure 2). In November 2018, the European Commission published the long-term vision ‘A Clean Planet for all’, which proposed climate neutrality by 2050 as the EU’s central climate goal, and which first showed potential pathways to get there.

Figure 2: The long journey of EU energy and climate policy

Source: Bruegel.

In 2019, the European Commission then pivoted the EU towards climate neutrality with the introduction of the European Green Deal. Under this flagship initiative, the EU has adopted the European Climate Law – an economy-wide framework law for the green transition – and has tightened sectoral emission reduction targets. It has also triggered a wave of legislation to strengthen existing EU climate and energy policy instruments (including the ETS, emissions standards for cars and renewable energy and energy efficiency targets) and create new ones (such as a second emissions trading system covering buildings and road transport, and the world-first carbon border adjustment mechanism). Finally, the EU has mobilised hundreds of billions of euros in climate funding through a series of newly-established facilities (see Table 1 in the next section).

3 The EU’s climate and energy governance structure

3.1 Climate governance

The most effective tool to reduce emissions in the EU is undoubtfully the ETS, an EU-managed and regulated scheme for carbon emission allowance trading for the most-emitting sectors: electricity and heat generation, energy-intensive industries and aviation within the European Economic Area 4 From 2024 the ETS will expand to shipping. . The ETS covers about 40 percent of total EU emissions, with about half of the allowances handed out for free to companies and the remainder auctioned. From 2026, free distribution of ETS allowances will be gradually phased out over nine years. In parallel a carbon border adjustment mechanism will be introduced, under which importers of specified products from countries where the price of carbon is lower than in the EU will be required to acquire carbon certificates.

The remaining 60 percent share of EU emissions not covered by the ETS, including emissions from agriculture, road transport, buildings and waste, is governed by the Effort Sharing Regulation (ESR). This gives EU countries binding binding targets for non-ETS emissions reductions. ESR sectors so far have not achieved the same level of emissions reduction seen in ETS sectors 5 In 2020, emissions in ESR sector were only 16 percent lower than in 2005, against 41 percent for ETS sectors. In 2023, a new ESR emission reduction target of 40 percent by 2030 compared to 2005 levels was set. . From 2027, the ESR will be complemented by a second emissions trading system (ETS-2) for buildings, road transport and process heat, accounting for a quarter of total EU emissions. ETS-2 will thus push the share of EU emissions covered by emissions trading from 40 percent to 77 percent in 2030: a de-facto increase in the Europeanisation of climate policy (Figure 3).

Figure 3: 2021 EU emissions and 2030 EU targeted emissions by sector and scheme

Source: Bruegel based on EEA and European Commission. Note: the emission reduction factors used were -62 percent for ETS sectors (compared to 2005 emissions), -43 percent for sectors covered by the ETS-2 (compared to 2005) and -40 percent for the remaining ESR sectors.

Up to 2030, the emissions covered by the ETS-2 will remain part of the ESR, meaning that if the companies subjected to the ETS-2 in one country on aggregate acquire and use more allowances than the country’s ESR target, the country still needs to meet its overall ESR target (Rickels et al, 2023). This could lead to two levels of inter-country trade in these sectors: one between companies subject to the ETS-2, and one among governments subjected to the ESR.

The introduction of the ETS-2 will make Europe’s climate policy more credible as companies fall under a relatively clear compliance regime 6 Penalties will be imposed for each tonne of emissions for which a covered installation fails to surrender an emission allowance. . The ETS-2 will be a tool to mechanically translate a tougher climate target into a tightening cap and, all other things being equal, increase the ETS carbon price for all countries. For example, the volume of new EU ETS allowances must shrink by 4.4 percent per year – the so-called linear reduction factor 7 The linear reduction factor defines the annual decrease of allowances provided to the market either via free allocation or via auctions. The annual reduction was increased from 2.2% per year by the so-called Fit for 55 package, which increased the EU’s 2030 emissions reduction target from 40 percent to 55 percent, compared to 1990. See Council of the EU press release of 25 April 2023, https://www.consilium.europa.eu/en/press/press-releases/2023/04/25/fit-…. . Putting a substantial share of ESR emissions under a Europe-wide emission trading scheme is a significant improvement over the ESR alone, compliance with which is checked by (1) monitoring National Energy and Climate Plans (NECPs) and providing recommendations to member states on the sectors where more effort is needed; (2) European level sector-specific regulations, such as emissions standards for cars; and (3) the obligation for non-compliant countries to buy emission reductions from over-compliant countries. As (1) and (2) often only work with a significant time lag and involve uncertainty, and (3) only works when the EU on aggregate is compliant, the ESR alone cannot guarantee compliance.

3.2 Energy governance

While EU climate policy is being increasingly Europeanised, EU energy policy remains highly fragmented. EU policies must strike a balance between necessary action to pursue jointly determined goals (ie ensuring the functioning of the energy market, security of supply, promoting energy efficiency and renewable energy, and interconnection of energy networks), and the Treaty requirement to preserve the right of EU countries to determine their own energy mixes. This has led to a complex web of responsibilities on the strategic and operational levels.

On the strategic level, EU countries have agreed to pursue some high-level targets on energy efficiency (a 36 percent reduction in final energy consumption by 2030 relative to projections), renewables (a 42.5 percent share in EU energy consumption by 2030) and electricity interconnectedness (at least 15 percent by 2030). These targets have been updated and revised several times. In the current set-up, the renewables targets are implicitly broken down into differentiated national targets, while the energy efficiency targets are only binding at European level.

To ensure compliance, a Governance Regulation (Regulation (EU) 2018/1999) adopted in December 2018 introduced National Energy and Climate Plans (NECPs). In these, EU countries outline the policies and measures they plan in order to contribute to the EU climate and energy targets. The European Commission assesses NECPs, and may issue recommendations for improvement. But the consequences of EU members not delivering sufficient action at national level to contribute to the achievement of EU energy and climate objectives remain untested. Infringement procedures can only be initiated in cases of procedural misconduct, such as failures to deliver NECPs and long-term strategies on time. To enforce the actual energy targets, a softer approach is taken. If a shortfall is identified in an NECP, policy recommendations may be issued to steer the country towards measures that will lead to reaching its targets. If it becomes clear that a country is off track, provisions within the Governance Regulation make it possible for the Commission to require that country to implement additional measures to close the gap. However, it is not clear if and how this would be eventually done.

Moreover, the NECP process was also designed to promote coordination between EU countries – especially at regional level. EU countries are supposed to carry out consultations with each other and with stakeholders, but mostly fall short of doing this. In practice, the process ends up being quite dry and technocratic and risks being a box-ticking exercise 8 Arguably, a more holistic reading of the Governance Regulation would complement the planning and reporting requirements with other minimum national governance standards, eg national climate neutrality targets, independent scientific advisory boards (whose outputs can provide opportunities for national debate), and access to justice requirements, to create a stronger national mission mindset and context in which to develop the plans. , possibly also because the European Commission has not insisted on an effective process 9 This is the general consensus that the authors found in numerous conversations with national and EU policymakers, and energy and climate policy experts. .

At the operational level, the main lines of the market policy framework might be set at the EU level, but national governments, regulators, energy transmission system operators (TSOs) and energy companies 10 While the largest of these energy companies typically operate across Europe and the globe, they have a strong home bias. Many are actually state-owned. do the actual implementation. Some EU coordination processes between these parties exist, but they remain weak. Coordination of national energy policies is managed through a number of regulatory forums. The Agency for the Cooperation of Energy Regulators (ACER) provides ongoing coordination for national regulators. However, ACER does not have a strong role in setting policy. ENTSO-E and ENTSOG aim to improve cooperation between national electricity and gas TSOs, respectively, but do not have any formal responsibility for managing the energy system. Again, the possibility for tension between national energy sovereignty and EU-level efficiency is clear.

3.3 New funds to support the green transition and tackle its social and distributional implications

The European Commission under Ursula von der Leyen has understood the importance of scaling up EU funds for the green transition, also to tackle the social and distributional implications of decarbonisation and thus make the process both socially fair and political sustainable.

In follow-up to the European Green Deal plan, the Commission published in January 2020 a proposal for a European Green Deal Investment Plan, with the objective of mobilising the investments required to reach the EU 2030 climate and energy goals. The plan mainly entailed a reshuffling of the EU budget to increase green spending, thereby leveraging about €1 trillion in green investment over ten years (Claeys and Tagliapietra, 2020).

Presented a few weeks before the outbreak of the COVID-19 pandemic in Europe, the European Green Deal Investment Plan was quickly replaced by the Recovery and Resilience Facility (RRF) – the main part of NextGenerationEU – which included a 37 percent minimum threshold of climate investment in its substantial firepower (€723 billion, of which €338 billion in grants).

Unlike the broader European Green Deal Investment Plan, the Just Transition Fund was not killed by the pandemic. Endowed with around €20 billion for 2021-2027, the fund aims to help alleviate the socio-economic costs of the green transition in the most negatively affected territories. The fund aims to support the economic diversification and conversion of the territories concerned, by financing activities such as the up-skilling and reskilling of workers, job-search assistance, the creation of new local firms, environmental rehabilitation and the transformation of carbon-intensive installations.

Table 1: Newly-established EU climate-related financial facilities

|

Fund |

Amount (€ billions) |

Theoretical climate action share |

Timeline |

Main focus |

Beneficiaries |

|---|---|---|---|---|---|

|

Recovery and Resilience Facility |

338 in grants (723 in grants + loans) |

37% |

2021-2026 |

Implement reforms and investments to deliver the twin transition (digital and green) |

All EU countries (but bias in favour of least-developed and most crisis-affected ones) |

|

Innovation Fund |

40 (from EU ETS) |

100% |

2020-2030 |

European industries |

All EU industries subjected to the ETS |

|

Modernisation Fund (1 and 2) |

20 + 25.8 (from EU ETS) |

100% |

2021/2024-2030 |

Energy systems and energy efficiency |

10 least-developed EU countries |

|

Just Transition Fund |

20.3 |

100% |

2021-2027 |

To help alleviate the socioeconomic costs of the transition for the most negatively affected regions and people |

All EU countries (but biased towards those most affected by closure of coal mines and sectoral transition) |

|

Social Climate Fund |

65 |

100% |

2026-2032 |

To cushion citizens and companies from the consequences of extending the ETS system to the building and road transport sectors |

All EU countries |

Source: Bruegel based on European Commission. Note: the RRF is the centrepiece of NextGenerationEU, the EU’s post-pandemic economic recovery plan; the Innovation Fund is the EU’s main programme for the deployment of net-zero and innovative technologies in ETS sectors; the Modernisation Fund is designed to help EU countries in their transitions to climate neutrality by modernising their energy systems and improving energy efficiency, using ETS revenues; the Just Transition Fund is implemented under the overall framework of cohesion policy, which is the main EU policy to reduce regional disparities and to address structural changes in the EU; the Social Climate Fund will provide funding to member states to support investments in increased energy efficiency of buildings and granting improved access to zero- and low-emission mobility and transport.

Finally, in the context of the creation of the ETS-2 covering buildings and road transport, the Commission also created a Social Climate Fund amounting to €65 billion for 2026-2032. This is intended to cushion citizens from the consequences of ETS-2. The fund will thus be used to provide temporary direct income support to vulnerable households to shield them from the higher energy costs likely to be induced by ETS-2, while also providing incentives for the uptake of green alternatives (such as electric cars and heat pumps) by low- and middle-income households. Being funded by the revenues of the ETS-2, this fund might become a textbook example of how to do “carbon dividends” (Akerlof et al, 2019).

4 Why the current governance structure is not ‘Fit for 55’

11 Fit for 55 refers to the EU strategy to reduce emissions by 55 percent by 2030 compared to 1990; see https://www.consilium.europa.eu/en/policies/green-deal/fit-for-55-the-e….

EU energy and climate governance can be regarded as having three pillars:

- Pillar 1: European emissions trading to coordinate decarbonisation in most sectors.

- Pillar 2: NECPs to coordinate decarbonisation in the remaining sectors and to somewhat coordinate energy policy.

- Pillar 3: EU financial support to address the social and distributional implications of EU climate policy.

While this structure is rational, it is insufficient to sustain the deep decarbonisation trajectory the EU will face in the coming years. Each pillar suffers from shortcomings.

4.1 Pillar 1: The shortcomings of the ETS

Carbon prices impact different EU countries differently, because of their differing starting conditions. This cannot be resolved ex ante through the initial allocation of ETS allowances as the distribution of decarbonisation costs between countries is uncertain and varies over time. Moreover, the joint ETS makes explicit that under-delivery by one country will requires greater efforts in other countries to meet the joint targets.

At worst, this might generate incentives for national policies with adverse spill-overs. Suppose one country devises policies and subsidies to help emitters 12 Or sectors that produces emitting appliances, such as fossil-fuelled vehicles, turbines or heating systems. to continue operating, in order to save local jobs, preserve industrial structures or help consumers. The carbon budget used up by the supported emitters is then not available for other emitters which potentially face much higher abatement costs 13 This is not fundamentally different from the standard free-rider problem, namely, that the costs of mitigation are individual while the benefits are collective. But in the standard problem, the benefits are pushed into the future, while the ETS means that the benefits of effective national action are immediately felt in the carbon price. . Richer EU countries might thus defer decarbonisation by incurring some domestic fiscal cost, but would also increase carbon prices for everyone 14 The ESR might under some conditions protect against the risk of richer member states pushing building and transport emissions abroad. EU countries that are net importers of ETS-2 allowances will have to buy very scarce ESR units from other member states. But this only holds as long as the ESR emissions that are not under the ETS-2 are close to or above the targets. .

The introduction of the ETS-2 will also amplify distributional concerns within each country, as the households most affected by the new carbon price on road transport and buildings will likely be those in the lower part of the income distribution, for whom energy represents a higher share of expenditure and who often lack the means to make the required shift (for example by buying an electric car or heat pump). To mitigate this risk, the price of carbon on the ETS-2 market will initially be capped at €45/tonne 15 The ETS-2 has a price stability mechanism under which, if the allowance price exceeds €45 per tonne over two consecutive months, market supply will be increased by releasing an additional 20 million allowances from a separate section of the Market Stability Reserve created for this purpose. , but this might still be high for some consumers, while not being enough to trigger the required decarbonisation.

Finally, the increased Europeanisation of climate policy that the ETS-2 will bring about will also increase the risks of blame being levied against ‘Brussels climate ambition’, if not accompanied by measures to strengthen national ownership of climate action. In short, while the ETS and the ETS-2 are key enablers to achieve climate targets, it is important to make sure they are rooted in strong political ownership at national level.

4.2 Pillar 2: The shortcomings of NECPs

NECPs remain largely a bureaucratic exercise without substantial impact on the formulation and implementation of national energy policies. As a compliance device that ensures that national decarbonisation efforts stack up, the NECP process is too weak (see section 3.2). As a coordination device it is dysfunctional.

The lack of established energy-policy coordination tools became starkly evident during the 2022 energy crisis. Lack of policy coordination over past decades had left Europe with a poorly diversified energy system that lacked sufficient redundancies and cross-border connections. During the crisis, it was largely thanks to the internal market, which dispatched the scarce resources available across Europe very efficiently, that nowhere in the EU did the lights go out. Much ad-hoc coordination at the highest political level was needed to obtain the policy commitments (including on gas storage filling, maintaining cross-border connections and energy saving) needed to underpin proper market functioning in face of a rather asymmetric shock.

The choice EU countries face now is between returning to national systems with higher aggregate costs 16 The cost of an inefficiently coordinated system can be quite high. Hydrogen produced from solar in Germany can cost almost twice as much as in Spain, which has about twice as many solar hours as Germany. If Slovakia, for example, needs to build hydrogen plants and batteries to store electricity, rather than benefitting from flexibilities in the wider European system, these costs can also be substantial. Moreover, shared resources such as the North Sea offshore potential (the targeted 300 GW of offshore wind generation capacity by 2050 corresponds to five times the current French nuclear capacity and would exceed the existing windpower capacity in the entire EU) require sincere cooperation. or engaging in institutionalised coordination with reliable rules. The latter would enable a system in which resources are shared across the continent, requiring less costly back-up capacities and making use of the cheapest available resource at any given moment. But making countries invest in renewable resources that might end up being consumed in other countries will require a robust institutional set-up and fair compensation schemes 17 This challenge is increased because asymetric shocks can be expected (eg from global fuel markets, the changing climate or economic and political developments in EU countries) in what might be a bumpy transition. .

Finding a reliable EU energy-policy coordination process will be essential for the future success of EU decarbonisation.

4.3 Pillar 3: The shortcomings of EU green financing

The RRF represents by far the largest source of EU grants for the green transition. Countries have allocated most of these funds (around 60 percent of their total planned green spending) to decarbonisation of buildings and transport (Lenaerts and Tagliapietra, 2021). But the RRF will end in 2026, leaving a major gap in EU funding for the green transition.

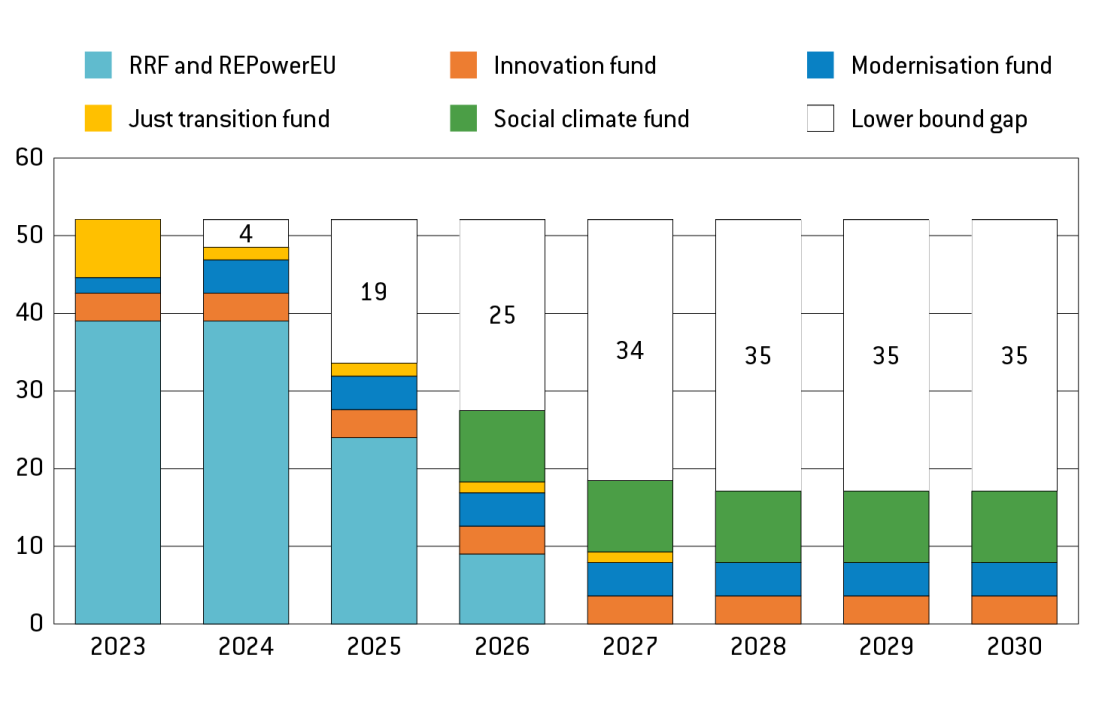

Climate-dedicated grants from the RRF, the Innovation Fund, the Modernisation Fund and the Just Transition Fund (Table 1) amount to around €50 billion per year. With the phase-out of the RRF and the phase-in of the Social Climate Fund in 2026, this level will decrease to slightly less than €20 billion per year. The phase-out of the RRF will thus leave a gap that can be estimated at €180 billion between 2024 and 2030 (Figure 4).

Figure 4: EU climate grants: the sharp post-RRF decline (€ billions)

Source: Bruegel based on the European Commission (2020a) and Baccianti (2023). Note: All numbers are in current prices. The split of RRF and REPowerEU funding by year was done using Carrión Álvarez’s estimates (2020).

While both the Just Transition Fund and the Social Climate Fund are important initiatives, they alone will be insufficient to address the investment needs, and the related political and distributional problems that the EU will increasingly have to face as decarbonisation enters sectors like buildings and road transport, affecting much broader groups in society. The green funding gap that the end of the RRF will cause will thus become a major obstacle to the Green Deal. The current €50 billion per year represents around 0.3 percent of EU GDP, a level we consider to be the bare minimum for the EU to play a significant role in leveraging investment by EU countries and the private sector. The context is that the additional annual investments to achieve the EU 2030 climate target are estimated at 2 percent of GDP, with the public investment share estimated to range between 0.5 percent and 1 percent of GDP (Box 3).

Box 3: Green investment requirements to achieve the EU 2030 climate target

Country-level information on additional green investment requirements to achieve the EU 2030 climate target remains incomplete, inconsistent and characterised by large disparities across countries. At best, some NECPs provide general estimates of the amount of investment needed to reach the 2030 targets, without specifying how such estimates were calculated, which makes it impossible to assess their reliability (European Court of Auditors, 2023).

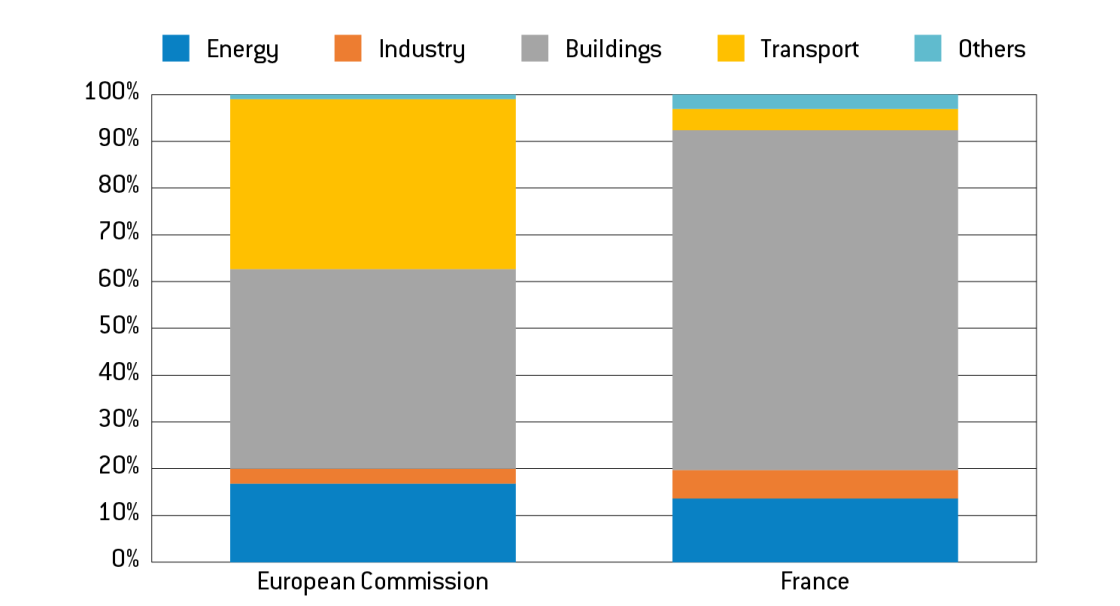

From an EU perspective, the European Commission estimates that achieving the target would require additional investment in energy and transport systems (compared to investment levels from 2011-2020) of about 2 percent of GDP annually (Table 2, Panel A). This 2 percent figure is broadly in line with the main findings of Pisani-Ferry and Mahfouz (2023) for France (Table 2, Panel B). This is also in line with global estimates by IEA, IRENA, BNEF (Lenaerts et al, 2021) that reaching climate neutrality by mid-century will require additional investments in energy and transport systems amounting to roughly 2 percent of GDP in addition to usual energy investment levels (Lenaerts et al, 2021).

Table 2, Panel A: European Commission estimate of annual additional investment requirements to achieve 55% emissions reduction target by 2030 – MIX scenario

|

European Union* |

|

France |

|

|---|---|---|---|

|

Power grid |

34.2 |

Energy |

9 |

|

Power plants |

25.6 |

Agriculture |

2 |

|

Industry |

11.3 |

Industry |

4 |

|

Residential |

106.3 |

Residential |

21 |

|

Tertiary |

46 |

Tertiary |

27 |

|

Transport |

129.6 |

Transport |

3 |

|

Other |

3.4 |

|

|

|

Total |

356.4 |

Total |

66 |

|

% GDP |

2 |

% GDP |

2.3 |

Source: European Commission (2020a) and Pisani-Ferry and Mahfouz (2023). Note: the transport component of the Commission estimate is broadly in line with another Commission recovery-related estimate for the transport sector (European Commission, 2020b).

There is, however, significant variation in the sectorial allocation of the additional investment requirements (Figure 5). Two stand out: the share of transport is much bigger in EU estimates than in French estimates, and the share of buildings is much larger for France than for the EU. The first can be explained by the French estimate assuming that total numbers of new vehicles registrations will diminish significantly as a consequence of a shift to other modes of transport, whereas the European Commission estimate does not include this assumption. The difference in the buildings shares results from the assumption of more extensive renovation of buildings in the French case.

Figure 5: Share of additional investment requirements by sector, European Commission and French estimates

Source: Bruegel based on European Commission (2020a) and Pisani-Ferry and Mahfouz (2023.

Another question relates to the share of total investment that must be borne by public finances.

On the basis of past data, EIB (2021) estimated the public share of green investment to be around 25 percent. However, by adopting a granular approach and providing estimates for each category of investment, Pisani-Ferry and Mahfouz (2023) estimated this share to be higher for France. The difference between the two estimates can be ascribed first to different structures (the share of the public sector is larger in France), and second to Pisani-Ferry and Mahfouz (2023) taking a more granular approach than the EIB. In total, Pisani-Ferry and Mahfouz estimated the share of investment that ultimately falls on public finances to be 50 percent in an optimal scenario.

Based on these two different exercises, we can thus estimate future annual public investment for the green transition to range between 0.5 percent and 1 percent of GDP.

5 Policy proposals

A radical overhaul of the EU climate and energy governance would require a Treaty change, which is likely to be out of reach in the foreseeable future. After the 2024 European elections, under the new European Commission, this governance framework will thus need to be enhanced within the scope of the current Treaty.

The framework should be made fit for purpose by:

- Progressively bringing all emissions under the ETS system to create an efficient and effective compliance mechanism.

- Preparing for an EU Green Investment Plan, which should ensure that EU green grants remains at the current level after the RRF is phased out.

- Taking energy and climate governance to heads of state and government level. NECPs should take a real role in policy coordination and Special European summits should be be added to the regular institutional calendar. These would be organised at least once a year and would be prepared by a group of EU energy and climate sherpas.

- Establishing a European Energy Agency that would provide an impartial data, monitoring and knowledge infrastructure for energy-policy decisions.

- Creating an independent independent network system operator entrusted with the task of identifying bottlenecks in the energy network and making proposals for improvement.

Figure 6: EU climate and energy governance: key problems and proposed solutions

Source: Bruegel. Note: Red dots indicate that the proposed solutions would help solve problem 1, while blue dots refer to solutions that would help solve problem 2.

5.1 The future of the ETS

With the ETS and ETS-2 covering three-quarters of its territorial emissions by 2030, the EU will need to act in the next institutional cycle to ensure that by 2030-35 it has a consistent compliance device for all emissions (including proper treatment of negative emissions). This could, for instance, be done by building an ETS-3 for agriculture, waste, land use, fugitive and negative emissions. While the next institutional cycle will be mainly about implementation of ETS reform and ETS-2 early roll-out, it will be important to explore how an ETS-3 can be established by 2030-35. The three systems might then converge later, with unification by 2040.

In the short term at least, ETS-2 18 There is a mechanism that increase the number of allowances, if ETS-2 allowance prices exceed €45/tonne – less than half of the current ETS price. and ETS-3 won’t primarily be revenue-raising devices. Proceeds from the sale of allowances are likely of secondary importance, especially in comparison to current receipts from fossil-fuel taxation. What matters, however, is that all sectors should be gradually brought under the same umbrella.

5.2 An EU Green Investment Plan

A new EU Green Investment Plan amounting to €180 billion between 2024 and 2030 is needed to maintain the current level of EU green grants and provide a solid response to political and distributional problems related to the transition. As we have discussed, €50 billion in grants each year would correspond to an EU contribution of 0.3 percent of GDP, which we consider to be a bare minimum. For the EU to contribute 0.5 percent of GDP, the size of the EU Green Investment Plan would need to be about €400 billion between 2024 and 2030 19 That is, €180 billion plus the remaining 0.2 percent of the EU GDP annually from 2024 to 2030. .

To fund such a plan, the EU has three main options: i) Direct more ETS (and, proportionately, ETS-2) revenues to the EU level, as previously suggested by Fuest and Pisani-Ferry (2020); ii) Undertake new EU joint borrowing, which would be fully justified from a legal and procedural perspective, given that the green transition is an EU public good requiring a one-off fiscal effort (Martin et al, 2022); iii) Go for a mix of the previous two options. Each of these options would have its own distributional implications for EU countries, so the decision on which approach to take is political.

This discussion is related directly to the debate on reform of EU fiscal rules. In the currently ongoing EU economic governance reform, provisions should be introduced that will make it possible for states with public debt in excess of 60 percent of GDP, but with sustainable public finances, to reduce debt more slowly on the condition that additional emission-reducing investments are made.

In terms of expenditure, the Green Investment Plan should be structured differently from the RRF. First, funds should not primarily be pre-allocated nationally. Currently, the Modernisation Fund targets only 10 countries and the Just Transition Fund predominantly focuses on Poland, Germany, Spain and Eastern European countries. Meanwhile, almost none of the projects supported by the Innovation Fund are in the post-2004 enlargement EU countries. Only the Social Climate Fund will be more widely distributed across Europe.

Second, projects should fit the EU strategy, rather than being a collection of national shovel-ready projects. EU funds should be used to tackle the increasing distributional implications of climate policy across Europe, to ensure the political viability of the process 20 In this regard, it will be important for the EU to update its long-term climate strategy (Duwe et al, 2023). . This includes supporting projects that, overall, allow for a more efficient decarbonisation pathway, but create visible losers (eg transmission lines) who need to be compensated for the pathway to get enough political support.

Third, EU funding could be linked to climate and energy governance. Conditions should be attached, such as minimal national governance structures being in place, for countries to access EU funds, so that all EU members have at least some supporting structures to guide and manage their transition. This could help avoid a multi-speed transition across the EU.

5.3 European energy and climate sherpas

The green transition represents a truly transformative process for the European economy and society. Governing this process requires a holistic approach that goes well beyond the traditional scope of energy and climate policy. From fiscal to social policy, from agriculture to industrial policy, a wide range of policy levers must be operated coherently to steer this transformation. This needs to happen with strong coordination between the EU and its members, which is needed also to fix the political and distributional problem.

As discussed, the current governance system centred on NECPs is not fit for purpose. Regional and European coordination of NECPs should be made mandatory in a meaningful way; data from the energy agency (section 5.4) can provide an impartial starting point. One step further would be to add to the 2018 Governance Regulation minimum standards of national climate governance. This could be inspired and informed by what some countries have done in establishing national climate laws (Germany, France and Spain, among several others), which also include legally binding climate neutrality targets, even before 2050 in some cases (Ecologic Institute, 2023). This would allow the upcoming review of the Governance Regulation (to be adopted by the European Commission in the first quarter of 2024) to be used to ‘level up’ governance standards and help to avoid a multi-speed transition.

Furthermore, in the upcoming institutional cycle, leaders should take charge as they did for the euro crisis and the energy crisis. During the 2022 energy crisis, the EU assembled a strong policy response to the emergency, thanks in part to informal gatherings of national sherpas preparing the technical ground for policy decisions at both Energy Councils and European Councils. Inspired by this difficult but overall positive experience, and by governance models such as those adopted for the G7 and the G20, we propose the establishment of a permanent group of European Energy and Climate Sherpas delegated by national leaders 21 In the energy field, the work of Coreper I is prepared by the ‘Mertens Group’. This group helps to form an initial idea of the positions that the various member state delegations will take at the Coreper meeting. . This informal group would meet on a regular basis and help steer the necessary political compromises to duly implement the EU energy and climate policy objectives. The sherpas should be supported by the recently established European Scientific Advisory Board on Climate Change 22 See https://climate-advisory-board.europa.eu/. , as the independent scientific advisor.

5.4 A European Energy Agency

Reliable and consistent data must underpin policy choices on energy and climate. Without good data, Europe’s green transition will be harder to achieve. Good data and publicly-available information are needed to assess the impact of planned policies, to evaluate current frameworks, to plan infrastructure, to assess national and regional plans and to identify priorities. In the absence of good public data, special interests find it much easier to lobby for suboptimal approaches. However, energy data is not currently available in a timely way or at the level of granularity, reliability and consistency needed for informed policymaking.

The problem is not so much that public authorities, companies, research institutions and associations do not currently provide data, but that they produce an inconsistent patchwork of only partly documented data points, which they upload in their own formats and onto their own platforms. Consistent data on the deployment of renewables is still best obtained from business associations, while, for example, standard energy and emission price data that can be used for analytical purposes must be purchased, cross-border gas and electricity flow data requires querying an interface designed for experts, and energy-demand data is only made available very late and at unnecessarily low granularity. This creates high barriers to a meaningful discussion of energy policy measures. Meanwhile, the lack of open reference models of Europe’s energy system with national granularity prevents objective exchanges.

Net-zero indicators for structural change are needed to drive the green transformation in a clear manner. Laudable initiatives from research bodies and NGOs 23 For example, the the recently established European Climate Neutrality Observatory, https://climateobservatory.eu. try to fill the gap, and the European Commission itself has taken first steps to deliver a mapping of existing data tools and a roadmap for better energy data in the EU 24 The Commission has launched a ‘better data’ initiative engaging with the different bodies publishing relevant data to deliver a mapping of existing data tools and a roadmap for better publicly accessible energy data in the EU. . But since so much is at stake for so many in the green transition, a devoted institution is needed. A new European Energy Agency could perform this task. It could mirror the European Environment Agency and its mandate to deliver knowledge and data to support Europe’s environment and climate goals. Its mission would be to inform and guide Europe’s transition to net-zero in a transparent, consistent and authoritative way.

5.5 An independent network system operator

The development and operation of Europe´s electricity system is organised through a complex interplay of public, private European and national players. The convoluted processes and narrow interests of individual national stakeholders result in the inefficient usage of transmission lines and, more importantly, too little new cross-border transmission capacity. In the past decades, improvements in cross-border dispatch and system planning were achieved by designing better interfaces between national systems. But as this required agreement from all stakeholders, important steps – such as allowing for wholesale power prices to differ within countries if internal networks are congested – did not materialise. Mergers between neighbouring system operators, which were seen as an avenue for progress, did not succeed either 25 The takeovers of West German TSO Transpower, and of East German TSO 50Hertz by the Dutch TSO TenneT, and by the Belgian TSO Elia in 2010, did not markedly improve cross-border planing and dispatch. .

A new approach is thus needed to create an independent, European, technical agency with a full system overview to initiate network development plans in line with top-down modelling and to ensure optimal dispatch in the joint system: an independent network system operator 26 Similar concepts are being pursued in the US, and are discussed in a review of electricity market arrangements in the United Kingdom (Tam and Walker, 2023). . Such an independent system operator would not own the (different national) networks, nor would it own the lines that it recommends building. But it would be incentivised to ensure the lowest cost dispatch in the whole European system and to point national regulators to which transmission extensions they should encourage (possibly as competition between incumbent network owners and new merchant competitors). Such efficiency-driven operation and planning will reduce the cost of operating the network and will also provide much clearer long-term guidance on the development of the system to investors on the production, storage and demand side, thereby reducing the risk and encouraging more efficient investments.

6 Conclusion

The EU has embarked on no less than a green industrial revolution – but one driven by policy rather than technology and innovation. Even if the benefits it brings outweigh the costs, possibly even in strict economic terms, this transformation will entail significant disruption. Some assets will lose value, some jobs will be destroyed, some regions will suffer. Competitiveness will be challenged. The macroeconomic implications of the transition to carbon neutrality may turn out to be temporarily negative. This changeover can only succeed if it commands broad enough support, which in turn requires that equity considerations be put at the forefront of the policy agenda. This concern must be a priority for each and every member state, but also for the EU as a whole.

And the risks are increasing for the green transition in Europe. Ahead of the 2024 European elections, more voices are being raised calling for a slowing down of the process, driven by fears about possible trade-offs between decarbonisation and industrial competitiveness, and by fears about costs for families and businesses. National elections have tended to strengthen these voices, to the extent that the survival of the existing consensus within the European Council cannot be taken for granted.

In this less-auspicious political climate, the next European Commission will have to implement the green roadmap to which the EU is now legally committed.

The Commission deserves praise for having identified early on the risks that could threaten the transition to a carbon-free economy, and the EU deserves praise for having put in place instruments to address them. However, the current governance framework falls short. The EU cannot afford to have a grand climate and energy strategy and at the same time lack implementation tools. This would endanger the whole decarbonisation process, particularly in a less-auspicious political climate. To make the governance framework fit for ever-greater climate ambition and for the renewed challenges Europe faces, there should be more centralisation (for the ETS) and more incentives to ensure EU countries act in accordance with the common plan. Beyond direct energy and climate benefits, doing this would also unlock significant benefits for other EU policy goals, including innovation, industry, competitiveness, nature protection, digital and health.

There is little space for mistakes as stakes are too high. The EU cannot get trapped in a vicious cycle in which member states agree on ambitious EU energy and climate policy targets in Brussels, receive revenues from climate instruments such as the ETS or the RRF, and then, back in national capitals, blame Brussels for disruptive energy and climate targets – or simply do not implement them. This course of action would risk significantly slowing down, if not derailing, Europe’s green transition.

[1] For example, on 12 July 2023, the European People’s Party voted against a nature restoration law in the European Parliament, indicating that the conservatives are taking a more negative attitude towards ambitious environmental rules ahead of the European elections. In summer 2023, opposition to German plans to ban the sale of gas boilers grew stronger. In Italy, polling has shown that 45 percent of respondents believe the EU targets are too ambitious, compared to 22 percent who believe they are correct (Quorum and YouTrend, 2023).

[2] We do not focus on climate change adaptation policy, which requires a dedicated analysis; see, for instance, Lenaerts et al (2022).

[3] Moreover, the growth of the Single Market raised concerns about competition distortions resulting from different environmental policies at national level. The Single European Act aimed to minimise these distortions by adopting European rules for environmental protection (Delbeke and Vis, 2016).

[4] From 2024 the ETS will expand to shipping.

[5] In 2020, emissions in ESR sector were only 16 percent lower than in 2005, against 41 percent for ETS sectors. In 2023, a new ESR emission reduction target of 40 percent by 2030 compared to 2005 levels was set.

[6] Penalties will be imposed for each tonne of emissions for which a covered installation fails to surrender an emission allowance.

[7] The linear reduction factor defines the annual decrease of allowances provided to the market either via free allocation or via auctions. The annual reduction was increased from 2.2% per year by the so-called Fit for 55 package, which increased the EU’s 2030 emissions reduction target from 40 percent to 55 percent, compared to 1990. See Council of the EU press release of 25 April 2023, https://www.consilium.europa.eu/en/press/press-releases/2023/04/25/fit-for-55-council-adopts-key-pieces-of-legislation-delivering-on-2030-climate-targets/.

[8] Arguably, a more holistic reading of the Governance Regulation would complement the planning and reporting requirements with other minimum national governance standards, eg national climate neutrality targets, independent scientific advisory boards (whose outputs can provide opportunities for national debate), and access to justice requirements, to create a stronger national mission mindset and context in which to develop the plans.

[9] This is the general consensus that the authors found in numerous conversations with national and EU policymakers, and energy and climate policy experts.

[10] While the largest of these energy companies typically operate across Europe and the globe, they have a strong home bias. Many are actually state-owned.

[11] Fit for 55 refers to the EU strategy to reduce emissions by 55 percent by 2030 compared to 1990; see https://www.consilium.europa.eu/en/policies/green-deal/fit-for-55-the-eu-plan-for-a-green-transition/.

[12] Or sectors that produces emitting appliances, such as fossil-fuelled vehicles, turbines or heating systems.

[13] This is not fundamentally different from the standard free-rider problem, namely, that the costs of mitigation are individual while the benefits are collective. But in the standard problem, the benefits are pushed into the future, while the ETS means that the benefits of effective national action are immediately felt in the carbon price.

[14] The ESR might under some conditions protect against the risk of richer member states pushing building and transport emissions abroad. EU countries that are net importers of ETS-2 allowances will have to buy very scarce ESR units from other member states. But this only holds as long as the ESR emissions that are not under the ETS-2 are close to or above the targets.

[15] The ETS-2 has a price stability mechanism under which, if the allowance price exceeds €45 per tonne over two consecutive months, market supply will be increased by releasing an additional 20 million allowances from a separate section of the Market Stability Reserve created for this purpose.

[16] The cost of an inefficiently coordinated system can be quite high. Hydrogen produced from solar in Germany can cost almost twice as much as in Spain, which has about twice as many solar hours as Germany. If Slovakia, for example, needs to build hydrogen plants and batteries to store electricity, rather than benefitting from flexibilities in the wider European system, these costs can also be substantial. Moreover, shared resources such as the North Sea offshore potential (the targeted 300 GW of offshore wind generation capacity by 2050 corresponds to five times the current French nuclear capacity and would exceed the existing windpower capacity in the entire EU) require sincere cooperation.

[17] This challenge is increased because asymetric shocks can be expected (eg from global fuel markets, the changing climate or economic and political developments in EU countries) in what might be a bumpy transition.

[18] There is a mechanism that increase the number of allowances, if ETS-2 allowance prices exceed €45/tonne – less than half of the current ETS price.

[19] That is, €180 billion plus the remaining 0.2 percent of the EU GDP annually from 2024 to 2030.

[20] In this regard, it will be important for the EU to update its long-term climate strategy (Duwe et al, 2023).

[21] In the energy field, the work of Coreper I is prepared by the ‘Mertens Group’. This group helps to form an initial idea of the positions that the various member state delegations will take at the Coreper meeting.

[23] For example, the the recently established European Climate Neutrality Observatory, https://climateobservatory.eu.

[24] The Commission has launched a ‘better data’ initiative engaging with the different bodies publishing relevant data to deliver a mapping of existing data tools and a roadmap for better publicly accessible energy data in the EU.

[25] The takeovers of West German TSO Transpower, and of East German TSO 50Hertz by the Dutch TSO TenneT, and by the Belgian TSO Elia in 2010, did not markedly improve cross-border planing and dispatch.

[26] Similar concepts are being pursued in the US, and are discussed in a review of electricity market arrangements in the United Kingdom (Tam and Walker, 2023).

Akerlof, G., R. Aumann, M. Baily, B. Bernanke, M. Boskin, A. Deaton … J. Yellen (2019) ‘Economists Statement on Carbon Dividends’, Climate Leadership Council, available at https://www.econstatement.org/

Baccianti, C. (2023) ‘EU Climate Funding Tracker’, Agora Energiewende, available at https://www.agora-energiewende.de/en/publications/eu-climate-funding-tracker/

Carrión Álvarez, M. (2020) ‘The EU recovery plan: funding arrangements and their impacts’, Funcas Europe, available at https://www.funcas.es/wp-content/uploads/2020/08/The-EU-recovery-plan-funding-arrangements-and-their-impacts1.pdf

Claeys, G. and S. Tagliapietra (2020) ‘A trillion reasons to scrutinise the Green Deal Investment Plan’, Bruegel Blog, 15 January, available at https://www.bruegel.org/blog-post/trillion-reasons-scrutinise-green-deal-investment-plan

Delbeke, J. and P. Vis (2016) EU Climate Policy Explained, Routledge, available at https://www.routledge.com/EU-Climate-Policy-Explained/Delbeke-Vis/p/book/9789279482618

Duwe, M., J. Graichen and H. Böttcher. (2023) ‘Can current EU climate policy reliably achieve climate neutrality by 2050? Post-2030 crunch issues for the move to a net zero economy’, Discussion Paper, Ecologic Institute, available at https://www.ecologic.eu/19160

Ecologic Institute (2023) ‘Climate Framework Laws Info-Matrix’, Ecologic Institute, available at https://www.ecologic.eu/19320

EIB (2021) EIB Investment Report 2020/2021: Building a smart and green Europe in the COVID-19 era, European Investment Bank, available at https://www.eib.org/en/publications/investment-report-2020

European Commission (2020a) ‘Stepping up Europe’s 2030 climate ambition Investing in a climate-neutral future for the benefit of our people’, SWD2020 176 final, available at https://eur-lex.europa.eu/resource.html?uri=cellar:749e04bb-f8c5-11ea-991b-01aa75ed71a1.0001.02/DOC_1&format=PDF

European Commission (2020b) ‘Europe's moment: Repair and Prepare for the Next Generation’, SWD2020 98 final, available at https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52020SC0098

European Court of Auditors (2023) ‘EU climate and energy targets: 2020 targets achieved, but little indication that actions to reach the 2030 targets will be sufficient’, Special Report 18, available at https://www.eca.europa.eu/ECAPublications/SR-2023-18/SR-2023-18_EN.pdf

Fuest, C. and J. Pisani-Ferry (2020) ‘Financing the European Union: New Context, New Responses’, Policy Contribution 2020/16, Bruegel, available at https://www.bruegel.org/policy-brief/financing-european-union-new-context-new-responses

Lenaerts, K. and S. Tagliapietra (2021) ‘A breakdown of EU countries’ post-pandemic green spending plans’, Bruegel Blog, 8 July, available at https://www.bruegel.org/blog-post/breakdown-eu-countries-post-pandemic-green-spending-plans

Lenaerts, K., S. Tagliapietra and G. Wolff (2021) ‘How much investment do we need to reach net zero?’, Bruegel Blog, 25 August, available at https://www.bruegel.org/blog-post/how-much-investment-do-we-need-reach-net-zero

Lenaerts, K., S. Tagliapietra and G. Wolff (2022) ‘How can the European Union adapt to climate change while avoiding a new fault line?’ Policy Contribution 11/2022, Bruegel, available at https://www.bruegel.org/policy-brief/how-can-european-union-adapt-climate-change

Martin, P., J-C. Piris, J. Pisani-Ferry, M. Poiares Maduro, L. Reichlin, A. Steinbach and B. Weder di Mauro (2022) ‘Revisiting the EU framework: Economic necessities and legal options’, Policy Insight 114, Centre for Economic Policy Research, available at https://cepr.org/publications/policy-insight-114-revisiting-eu-framework-economic-necessities-and-legal-options

Pisani-Ferry, J., and S. Mahfouz (2023) Les incidences économiques de l’action pour le climat, France Stratégie, available at https://www.strategie.gouv.fr/sites/strategie.gouv.fr/files/atoms/files/2023-incidences-economiques-transition-climat-rapport-de-synthese_0.pdf

Rickels, W., C. Rischer, F. Schenuit and S. Peterson (2023) ‘Potential efficiency gains from the introduction of an emissions trading system for the buildings and road transport sectors in the European Union’, Kiel Working Paper 2249, Kiel Institute for the World Economy, available at https://www.ifw-kiel.de/fileadmin/Dateiverwaltung/IfW-Publications/Wilfried_Rickels/KWP_2249.pdf

Tam, B. And A. Walker (2023) ‘Electricity Market Reform’, POSTnote 694, UK Parliament, available at https://doi.org/10.58248/PN694