Don’t look only to Brussels to increase the supply of safe assets in the European Union

A sufficient supply of safe assets denominated in euros is critical if the European Union is to achieve a full banking and capital markets union.

Executive summary

A sufficient supply of safe assets denominated in euros is critical if the European Union is to achieve full banking and capital markets union while fostering the euro’s international role. The European debate on developing the supply of safe assets has so far focused on the possible creation of a common safe asset. This has tended to underplay the potential contribution of sovereign assets. Expanding the supply of national safe assets, notably through the gradual implementation of fiscal and growth-oriented structural policies in euro-area countries, leading to upgrading of their sovereign ratings, provides a promising, and perhaps more feasible, option. An upgrade to triple A of those euro-area countries that are currently rated double A could produce substantially more safe assets than most common safe asset proposals, including those based on the development of ‘synthetic’ safe assets.

There has been a remarkable increase in the share of supranational assets in the stock of euro-based safe assets since 2008, reflecting downgrades in sovereign ratings and the EU’s financial responses to the euro-area crisis and the pandemic. However, safe assets in euro remain dominated by those issued by euro-area governments.

Although common safe assets have certain advantages over national safe assets, reflecting their built-in risk diversification properties, there is currently not much political appetite for such proposals. Meanwhile, sovereign safe assets already offer many of the advantages of common safe assets.

Sound fiscal policies and growth-stimulating reforms, which are in any case desirable, should be implemented to improve the credit ratings of euro-area sovereigns. This might not be politically feasible in the short-term, given the difficult economic environment currently faced by the EU, but it should be a key component of the EU’s medium-term safe asset strategy. Should the political consensus be found to create a common safe asset, such an asset could be incorporated into the euro area’s existing safe asset system, reinforcing its positive effects.

The views expressed in this document are solely those of the authors. The authors thank Annika Eriksgaard and Jeromin Zettelmeyer for their valuable comments

1 Introduction

Europe’s Economic and Monetary Union (EMU) is still in development, meaning it is not perfect yet. One important issue on which further work is needed is ensuring an adequate supply of safe financial assets denominated in euros. This is critical for three important undertakings: completing the banking union, furthering the capital markets union, and strengthening the international role of the euro.

The European debate on developing the supply of safe assets, eg of high credit-quality bonds (typically those enjoying a triple A or just below credit rating), has so far focused on the possible creation of a new common safe asset. This focus has tended to underplay the potential contribution of sovereign safe assets 1 Claeys (2018) is an exception, arguing that “making all euro-area sovereign bonds safe again – and for good – remains the most desirable way to increase the supply of safe assets and avoid intra-euro-area flights to safety during bad times”. . We argue that expanding the supply of national safe assets, notably through the gradual implementation of fiscal and growth-oriented structural policies leading to the upgrade of euro-area sovereign ratings, provides a promising and perhaps more feasible avenue to increase the supply of European safe assets. We show, in particular, how upgrading to triple A those EU countries that are currently rated double A could produce substantially more safe assets than most proposals aimed at creating a new a European common safe asset, including those based on the development of ‘synthetic’ safe assets. In the current European and global economic context, with debt ratios at historically high levels, interest rates rising sharply and economies drifting towards recession or stagnation, this might sound like wishful thinking. But we argue that there is a realistic path for many countries currently rated double A to reach triple A status over the medium term, if appropriate strategies are put in place.

We discuss first why an adequate supply of safe assets is critical for completing EMU. We then quantify the current supply of euro-denominated safe assets. This quantification distinguishes between safe assets issued by euro-area countries and those issued by EU supranational institutions. We then outline a possible strategy to increase the supply of safe assets in the EU, focusing on the relative contributions that national and supranational/common assets could make, while acknowledging that the two are not perfect substitutes, even when they share the same creditworthiness.

2 An unfinished monetary union: the case of safe assets

The EU’s banking union process has resulted so far in the move of supervision and the partial consolidation of resolution from the national to the European level. However, together with the limited advances made on achieving a common framework guaranteeing bank deposits, the so-called bank-sovereign ‘doom loop’ still stands in the way of a complete banking union. Several regulatory proposals have been put forward to deal with the doom loop by reducing the excessive exposure of euro-area banks to domestic government debt, but banks still remain heavily biased towards their home sovereigns, thus creating a risk for the whole euro area. Some proposals are price-based while others are quantity-based (eg based on exposure limits). Some aim at limiting concentration in a single sovereign; others at reducing credit risk 2 ESRB (2015) and Basel Committee on Banking Supervision (2017) discussed different policy options for regulatory reform aimed at addressing sovereign exposures. Véron (2017) proposed the introduction of sovereign concentration charges (a price-based approach) to encourage the diversification of banks’ government bond portfolios across national jurisdictions. . But, as highlighted by Alogoskoufis and Langfield (2017), these reform proposals may not, in all cases, tackle both concentration and credit risks. Attempts to reduce concentration might actually increase overall risk, in effect replacing the domestic doom-loop problem by another type of financial instability risk, namely international contagion risk.

Addressing these problems has been one of the main motivations behind proposals to create a European common safe asset. Some of the most recent proposals, notably those of Brunnermeier et al (2011 and 2017) and ESRB (2018), which led to the European Commission’s sovereign bond-backed securities (SBBS) proposal (European Commission, 2018) 3 SBBS would be backed by a portfolio of euro-area government bonds; see https://finance.ec.europa.eu/banking-and-banking-union/banking-union/so…. , have focused on the creation of a synthetic safe asset. Other common safe-asset proposals have taken different approaches. However, there has been limited political appetite so far for these types of proposal and questions have been raised about their implementation (Claeys, 2018).

Substantial progress could be made in addressing the doom loop if the supply of euro-area sovereign safe assets was boosted

While the creation of a common safe asset might provide a first-best solution, substantial progress could already be made in addressing the doom loop if the supply of euro-area sovereign safe assets was boosted. This could be achieved by pursuing sound policies conducive to the upgrade to triple A of euro-area governments that are already close to that rating category. If this were accompanied by a more general improvement of ratings among countries that are still far from triple A, the risk of international contagion and sudden stops could also be substantially mitigated.

A second dimension of EMU, where an increased supply of safe assets could play a catalytic role, is the capital markets union, a project underway since 2014. This initiative was partly a response to the euro-area crisis, which led to a partial reversal of the cross-border integration that had been achieved in the previous decade. Some progress has been made since then, but the very fact that the European Commission felt the need to relaunch the process in September 2020 and again in February 2021 shows that a genuine capital markets union still has not been attained. Indeed, the Commission recognised in its 2020 action plan that “Europe has for decades struggled to make its capital markets work as one, and to a large degree still has 27 capital markets, some fairly large, and quite a number rather small” (European Commission, 2020).

The European capital market lags significantly behind that of the United States, both as a share of the total financial system and in terms of indicators of depth, liquidity and efficiency. The United States has a developed securities market that also funds activities that are typically not well served by banks, including innovative enterprises and risky long-term investments. Compared to the US capital market, another glaring missing element in the euro area has been the lack of an adequate supply of safe assets (Lanoo and Thomadakis, 2019). Treasuries remain, by contrast, the backbone of the US financial market, providing an extremely liquid security, the basis for pricing assets all along the yield curve and a reliable collateral. A market as sophisticated, liquid and efficient as the one for US government securities remains a distant prospect in Europe. Still, increasing the supply of safe assets denominated in euro could promote financial integration and risk-sharing within the euro area, thus helping to further correct the reversal of integration triggered by the euro-area sovereign debt crisis, and support the development of deeper and more liquid security markets in the euro area.

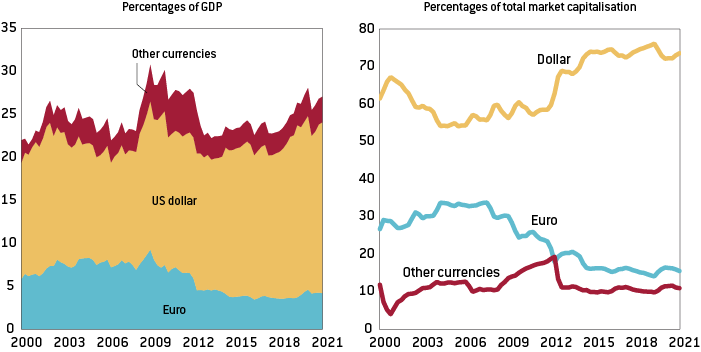

The limited supply of safe assets from EU issuers has negative consequences also beyond EU borders, as it has aggravated the shortage of such assets at global level 4 For the debate on the global shortage of safe assets, see, for example, Caballero et al (2017). . The euro accounts for a much lower share of the global supply of triple A assets (both public and private) than the dollar (Figure 1). More significantly, most of the decline in the global stock of safe assets witnessed since the global financial crisis has been explained by the decline in euro-denominated assets, mainly reflecting the credit downgrades suffered by a number of euro-area sovereigns (Temprano Arroyo, 2022, pp. 16-17). Because the world suffers from such a shortage of safe assets, if the EU managed to supply part of the world’s unsatisfied demand for such assets, it could both increase the international attractiveness of the euro and help alleviate the global safe-asset problem.

Figure 1: Market capitalisation of AAA assets

Source: Bruegel based on Bloomberg, IMF. Note: The Bloomberg Global Aggregate – AAA Index includes a series of triple A fixed-income securities issued by treasuries, other government-relating institutions and corporations. Quarterly data.

Since 2008, the attitude of EU authorities towards the international role of the euro has changed from a neutral policy, which was still influenced by the cautious attitude of the Bundesbank (Papadia and Efstathiou, 2018), to one that actively promotes this role. Of course, the international use of a currency depends on a host of factors, but there is significant consensus that the lack of an adequate supply of euro-denominated safe assets is a key constraint on its international development. Again, the comparison with the contribution of US safe government securities to the dollar’s global role is telling. The increase in safe assets issued at EU level in response to the pandemic, in particular under the NextGenerationEU (NGEU) instrument, goes in the right direction but is not quantitatively sufficient (nor sufficiently durable in time) to mark a decisive step in the euro’s international status (Claeys and Wolff, 2020; Temprano Arroyo, 2022). A more comprehensive strategy, including the deepening of EMU, is needed.

3 The sources of safe assets: a quantitative assessment

Euro-denominated public safe assets in the EU can be issued by euro-area governments and by EU supranational institutions, including the European Commission, the European Investment Bank (EIB) and the European Stability Mechanism (ESM), which has now also integrated the European Financial Stability Facility (EFSF).

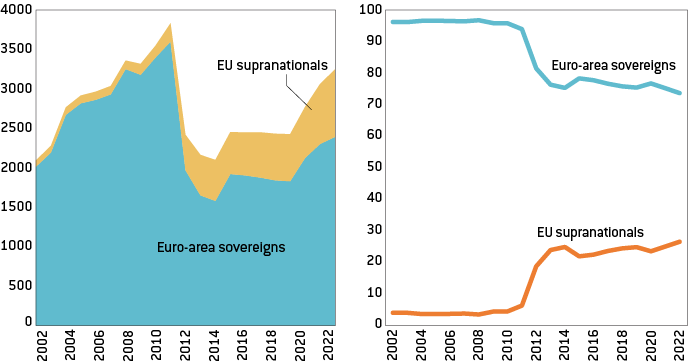

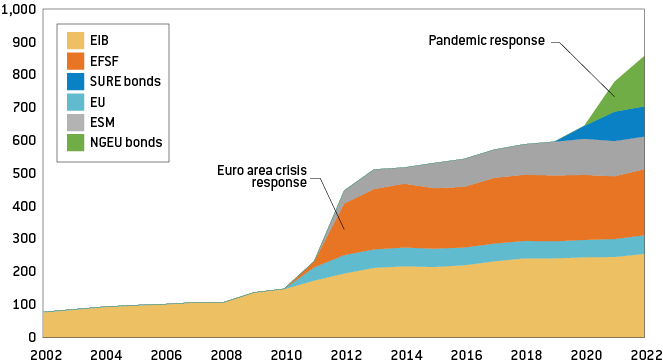

While the supply of euro-denominated safe assets remains dominated by those issued by euro-area governments, there has been a remarkable trend towards an increase in the share of supranational assets in the outstanding stock of euro-based public triple A assets. The share of supranational bonds in the stock of euro-denominated safe assets has gone up from only 3 percent in 2008 to 26 percent in August 2022, a phenomenal increase (Figure 2).

Figure 2: Sovereign versus supranational safe assets in euro, 2002-2022

Source: Bruegel based on European Commission, ESM, EIB. Note: For 2022, the chart shows: end of August data for supranational assets; and for sovereign assets, projections for end-2022 based on the European Commission medium-term debt projections (European Commission, 2022a).

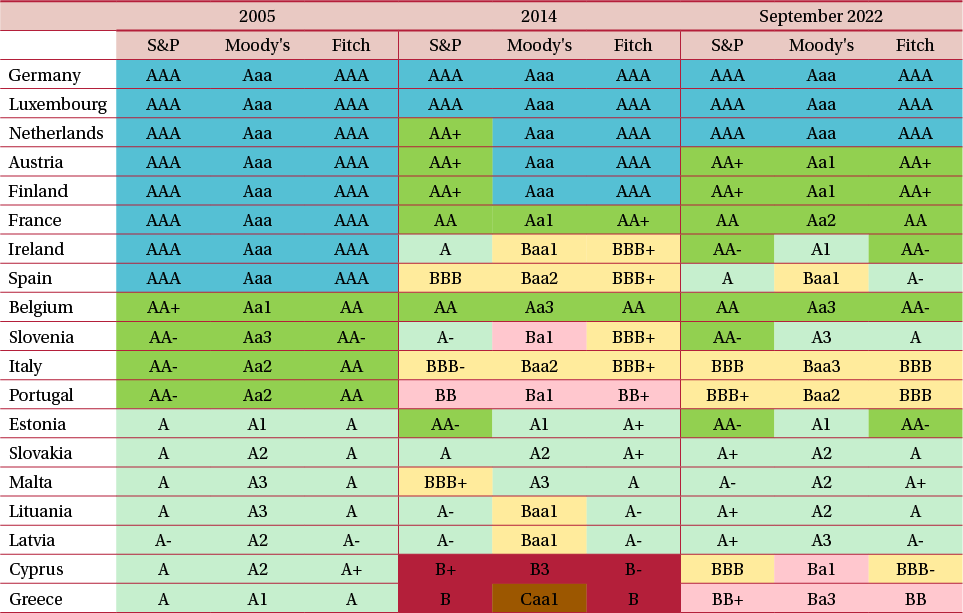

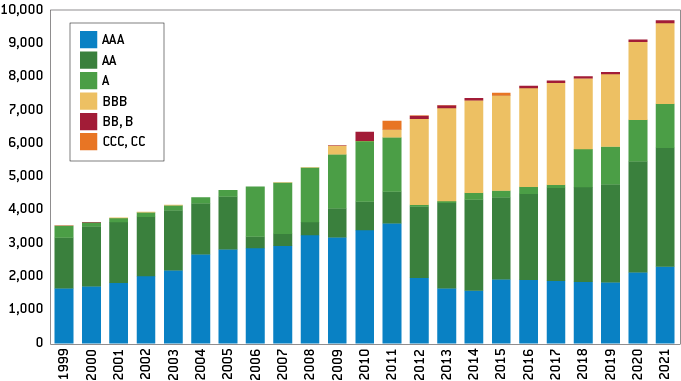

This reflects two separate developments. The main factor is that credit downgrades during the euro-area crisis reduced the number of triple A-rated euro-area treasuries from eight to only three: Germany, Luxembourg and the Netherlands (Table 1). Figure 3 illustrates the overwhelming effect this has had on the supply of sovereign safe securities in euro.

Second, the issuance of supranational bonds increased sharply in response to the euro-area crisis, as the Commission and the ESM put in place emergency packages funded by the newly created financial stabilisation facilities, and as the EIB accelerated its international borrowing. There has also been, though at a much lower level, a significant increase in the issuance of bonds to fund Macro-Financial Assistance (MFA) operations outside the EU, in particular to support Ukraine after the Russian annexation of Crimea in 2014, and Jordan and Tunisia, following the Arab Spring. Since 2020, supranational issuance has been boosted again by the EU’s response to the COVID-19 pandemic, notably through the issuance of SURE (Support to Mitigate Unemployment Risks in an Emergency) 5 SURE and NGEU are both temporary financial facilities created by the EU in 2020 in response to the COVID-19 pandemic. Under SURE, the European Commission can borrow up to €100 billion during 2020-2022 to help EU countries finance short-term work schemes in order to limit the impact of the COVID-19 crisis on jobs and workers’ income. Under the NGEU instrument, the Commission can borrow up to €806.9 billion up to 2026 to help EU countries recover from the pandemic, notably by supporting reforms and investments related to the green and digital transitions. For an assessment of the experience with NGEU borrowing, see Christie et al (2021). and NGEU bonds. These issuances have amounted to nearly €290 billion between October 2020 and August 2022, and could reach up to €906.9 billion by 2026. There has also been historically high MFA lending in response to the pandemic and the war in Ukraine. These developments have more than compensated for the fact that, since 2015, there have been no new bail-out programmes under the EU’s internal stabilisation facilities, reflecting the successful resolution of the euro-area crisis.

Table 1: Euro-area sovereign credit ratings

Source: Bruegel based on Standard & Poor's, Moody's, Fitch and Trading Economics.

Figure 3: Stock of euro-area sovereign debt securities (€ billions)

Sources: Bruegel based on Eurostat, S&P and Trading Economics. Note: Includes securities issued by the current 19 euro-area sovereigns.

Figure 4: EU supranational debt denominated in euro (€ billions, end-of-year stocks)

Source: Bruegel based on European Commission, ESM, EIB.

Figure 4 shows the trend in the stock of supranational EU securities, most of which enjoy a triple A rating from the main international rating agencies and can therefore be considered safe assets. It shows a big jump in 2011-2013, coinciding with the euro-area crisis, and again in 2020-2022, coinciding with the pandemic.

While the trends just described illustrate the potential importance of supranational institutions as a source of euro-denominated safe assets, they are also a reminder of the dominant influence of national issuance and, therefore, underline the huge scope for increasing the availability of high-quality assets in euro through the upgrade of sovereign ratings.

4 Policy options

The supply of euro-denominated safe assets can be increased in three main ways 6 Our discussion below does not consider the issuance of euro-denominated securities by triple-A corporations or non-euro area governments, nor the possible contribution of the European Central Bank. But issuance in euro by companies is partly dependent on the depth and liquidity of the euro area’s capital markets and on the status of the euro as international currency, both of which would be impacted favourably by an increased availability of public sector-issued safe assets. For the implications of the ECB’s asset purchase programmes for the supply of euro-area safe assets, see Eichengreen and Gros (2020). :

- More issuance at EU level, including through the possible creation of a common safe asset;

- More issuance at national level from countries with the highest credit ratings;

- Credit upgrades for countries with sub-triple A ratings.

This section examines the potential contribution of each of these sources of safe assets.

4.1 More issuance at EU level

There are two different approaches to expanding the issuance of safe assets at EU or euro area level. The first and most obvious one is to boost bond issuance by existing EU supranational institutions and facilities, or to create new supranational facilities funded through international borrowing. The second option brings us back to the academic and policy debate of the past decade on the creation of a European common safe asset. We look at each of these two approaches in turn.

Increased issuance by EU supranational institutions and facilities

The EU increased supranational issuance when it created the EFSF and ESM in response to the euro-area crisis, and the SURE and NGEU instruments in reaction to the pandemic. As noted in section 3, EU supranational borrowing has increased rapidly over the last 10 years and its share in the stock of total euro-denominated assets has risen markedly. The SURE and NGEU facilities, if fully used, could put into the market a volume of new safe assets comparable to those that could be created under some of the best-known common safe asset proposals (Temprano-Arroyo, 2022, pp. 27-29). But with the euro-area sovereign debt crisis over, there is not in the foreseeable future a clear need for new programmes funded under the EU’s macroeconomic stabilisation facilities. And with the COVID-19 crisis seemingly under control in Europe, there is currently not much political inclination to make the SURE or the NGEU instruments permanent.

More fundamentally, the expansion of supranational borrowing must be backed by prudent national fiscal policies. All supranational facilities are, in one way or another, ultimately guaranteed by EU countries, requiring tight common control over national fiscal policies. Without such control, a rapid expansion of supranational borrowing could result in the downgrade of the supranational entities managing those facilities. It is thus of paramount importance to ensure the creditworthiness and high-quality ratings of the sovereign guarantors behind these facilities.

A possible source of increased supranational issuance of safe bonds by the EU stems from the need to provide financial support to Ukraine, which faces huge macroeconomic stabilisation and reconstruction needs. The World Bank, the government of Ukraine and the European Commission (2022), in their needs assessment study published on 9 September 2022, estimated that the cost of the war in terms of reconstruction and recovery needs amounted, as of 1 June 2022, to $349 billion, or more than 1.6 times the GDP of Ukraine. This estimate is probably on the low side as it does not take into account the impact of Russia’s more recent strategy to redouble attacks on energy and other critical civilian infrastructure. But it helps illustrate the orders of magnitude involved.

In response, the Commission has proposed two unprecedented packages of MFA loans – of up to €9 billion and up to €18 billion – to help cover Ukraine’s short-term funding needs in 2022 and 2023, respectively, the first of which has already been partly disbursed (European Commission, 2022a and 2022b). The Commission has also proposed the creation of a new facility, to be called RebuildUkraine, to address Ukraine’s longer-term reconstruction needs (European Commission, 2022a). While the details of this new facility remain to be spelled out, it could potentially lead to the issuance of a new type of supranational bonds in euro. If one adds to this the expected continued issuance of MFA bonds in support of Ukraine and other neighbouring countries affected by the war, and increased bond issuance in euro by the EIB and the EBRD to fund the reconstruction of Ukraine, it is hard to escape the conclusion that addressing the consequences of the war is likely to lead, sooner or later, to a significant increase in EU supranational bond issuance.

However, such an increase in supranational issuance to support Ukraine is unlikely to remedy, on its own, the scarcity of euro-denominated safe assets. Although Ukraine’s financing needs are very large in terms of its GDP, their potential implications for the issuance of EU supranational bonds should not be exaggerated. Even if the EU covered as much as half of Ukraine’s currently estimated reconstruction needs (or about €175 billion), this would only amount to a fraction of the maximum net issuance allowed under the NGEU and SURE programmes. Only a larger EU financial initiative, perhaps aimed at dealing with the economic fallout of the energy crisis, or at ramping up EU defence expenditure, might require the issuance of bonds at an order of magnitude comparable to the NGEU facility, but such initiatives for now are not being discussed 7 On whether the war in Ukraine and its ramifications for energy security, defence expenditure and macroeconomic stabilisation within the EU call for a new NGEU instrument or the partial reallocation of its funds, see Sapir (2022). .

Creation of a ‘European common safe asset’

Another approach to increasing the supply of safe assets at EU level would be the creation of a European common safe asset. The academic and policy debate around this intensified after the global crisis and, in particular, the euro-area crisis, and was largely motivated, as noted, by the desire to break the doom loop between sovereigns and domestic banks, which had exacerbated the euro-area sovereign debt crisis. The debate, which resulted in a proliferation of plans, has moved over time from proposals involving some degree of debt mutualisation to proposals not requiring the provision of explicit debt guarantees 8 Good surveys of the literature on creating a common European safe asset are provided by ECB (2020; pp. 103-121) and Leandro and Zettelmeyer (2019), who conducted a comprehensive evaluation of several of the proposals. For the early proposals, see Claessens et al (2012). . In recent years, it has focused on the possible creation of a synthetic safe asset by either a European public debt agency or by the private sector under an appropriate regulatory framework. These proposals, exemplified by the European Safe Bond (ESBies) proposal of Brunnermeier et al (2011 and 2017), and the related European Commission SBBS proposal, are based on the pooling by a public entity or by private financial intermediaries of a standardised diversified portfolio of European sovereign bonds and their subsequent tranching into securities of different seniority, with the most senior tranche (the ‘ESBies’) acting as a safe asset. These and others, including Bénassy-Quéré et al (2018) and Algoskoufis and Langfield (2018), have advocated combining the introduction of a euro-area wide safe asset with regulatory reform aimed at stimulating the diversification of bank’s sovereign exposures.

But although the Commission’s SBBS proposal was endorsed (although in a somewhat modified manner) by the European Parliament (European Parliament, 2019), the EU Council has never discussed it. And although other safe asset proposals, including the so-called E-bond proposal (see, in particular, Giudice et al, 2019) are arguably less sensitive to the criticisms that made SBBS unpopular (Claeys, 2018), there is for the time being, as noted, not much political interest in reactivating this debate. Common safe asset proposals are, therefore, unlikely to provide for some time a realistic means of boosting the supply of euro-denominated safe assets.

4.2 Increased issuance by triple A euro-area sovereigns

Triple A euro-area countries could in theory provide a significant source of additional euro-denominated safe assets if their borrowing needs were to increase. Indeed, this is exactly what happened because of the national fiscal responses to the COVID-19 crisis. Temprano Arroyo (2022), using the European Commission’s medium-term debt projections, showed that triple-A rated countries will account for more than one third of the cumulative increase in the nominal value of euro-area public debt by 2032, compared to pre-pandemic projections. This is explained by the large size of the German economy, which accounts for about 80 percent of the euro area’s triple A sovereign debt and 20 percent of all euro-area sovereign debt, and also by the fact that Germany and, to a lesser extent, the Netherlands were among the euro-area countries that made stronger counter-cyclical use of fiscal policy during the pandemic, which contributed to a more pronounced deterioration in their fiscal balances and debt dynamics. By 2026, the last year in which net debt can be issued under the NGEU instrument, the supply of debt assets by the three triple-A euro-area governments is expected to be about €1.1 trillion larger than previously projected. This is somewhat larger than the NGEU and SURE instruments combined, which illustrates the important potential contribution of triple-A countries to efforts to boost the supply of euro-area safe assets.

That said, it would obviously be a misguided policy prescription to recommend that triple-A countries increase their deficits and debt issuance simply to boost the supply of euro-area safe assets. Their fiscal soundness is a key factor behind their triple-A status and, more generally, behind investor confidence in the stability of the euro area and the strength of the EMU architecture. Fiscal expansion in top-rated countries could also threaten the triple-A ratings of EU supranational institutions because of the explicit and implicit guarantees these countries provide. Moreover, excessive reliance on the safe assets of a few euro-area countries would create an undesirable concentration of bank exposure on a limited number of sovereigns.

The right way to expand the supply of sovereign safe assets in the euro area is not a shift to fiscal profligacy by the so far fiscally prudent countries but, rather, fiscal consolidation and growth-oriented supply policies by sub-triple A governments. To this third and key potential source of safe assets we now turn.

4.3 Credit upgrades of sub-triple A euro area sovereigns

The most promising approach for expanding the supply of euro-denominated safe assets, particularly for as long as the pre-conditions to develop a common safe asset are not satisfied, is to implement a strategy leading to the upgrade to triple A of countries that are currently immediately below that rating category. These rating upgrades would require ambitious fiscal-consolidation policies over the medium term, plus structural reform strategies supporting faster GDP growth. Faster growth would contribute to better debt dynamics, both by helping to generate fiscal revenues and by bringing down debt-to-GDP ratios through the denominator effect.

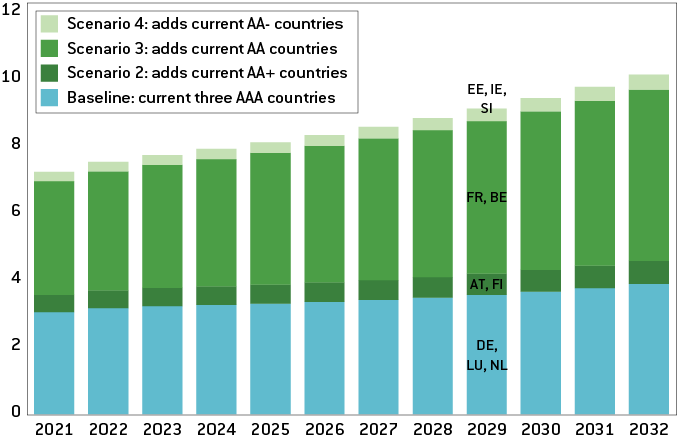

The potential effect of credit upgrades on the supply of safe assets is huge. Figure 5 displays several credit-rating scenarios to illustrate this point, using Commission medium-term debt projections for euro-area countries (European Commission, 2022c) 9 The use of the Commission’s public debt projections overstates somewhat the actual level of tradeable safe assets as it includes not only debt securities but also other types of debt. But the former account on average for about 80 percent of total debt; trends in total public debt are therefore a good approximation to trends in debt securities. . The bottom of the chart shows the baseline scenario, in which only Germany, Luxembourg and the Netherlands continue to enjoy the triple-A credit standing. Scenario 2 shows what would happen if Austria and Finland, the two countries that currently have AA+ (or Aa1) ratings, i.e. the credit rating that is only one notch below triple A, regained triple-A status. For these two countries, an upgrade to triple A seems within reach. Scenario 3 further adds Belgium and France, currently rated AA by at least one of the three main rating agencies, to the group of triple-A countries. Finally, scenario 4 assumes that Estonia, Ireland and Slovenia, currently rated AA- by at least on agency manage to get upgraded to triple A. Given the challenging economic and debt situation currently experienced by euro-area countries, none of these upgrades seems easy. But they all look feasible over the foreseeable future, provided the appropriate policies are put in place. In that respect, it should be recalled that four of these seven countries (Austria, Finland, France and Ireland) already enjoyed triple-A status before the global financial crisis.

Under the most plausible of the scenarios, entailing upgrades of Austria and Finland from AA+ to AAA, safe assets would be €0.6 trillion higher than the baseline by 2026, the last year of net issuance under NGEU, and €0.7 trillion higher than the baseline by 2032. An amount of €0.6 trillion would equal two thirds of the maximum net issuance allowed under NGEU. The addition of Belgium and France, two AA countries with very large debt stocks, to the triple-A category (scenario 3) would increase safe assets by an extra €4.1 trillion by 2026, and by an extra €5.1 trillion by 2032.

If all other double-A rated euro-area countries were also upgraded to the triple-A group, safe assets would be €5 trillion higher by 2026 and €6.2 trillion higher by 2032, compared with the baseline. This is five and seven times larger, respectively, than the maximum issuance of bonds under the NGEU and SURE facilities combined.

If the five countries that are currently rated A+, A or A- by at least two of the main rating agencies, and have not been rated above that level by any of them, were to reach one day the triple-A level, it would inject an additional €2.3 trillion of euro-denominated safe assets by 2032, implying an overall increase of €8.5 trillion in the stock of safe assets compared to the baseline. However, this is a scenario that for now seems distant and improbable, and is not shown in Figure 5.

Figure 5: Supply of euro-area sovereign safe assets under different rating scenarios (€ trillions; end-of-year)

Sources: Bruegel based on European Commission medium-term debt projections (European Commission, 2022c), Standard & Poor's.

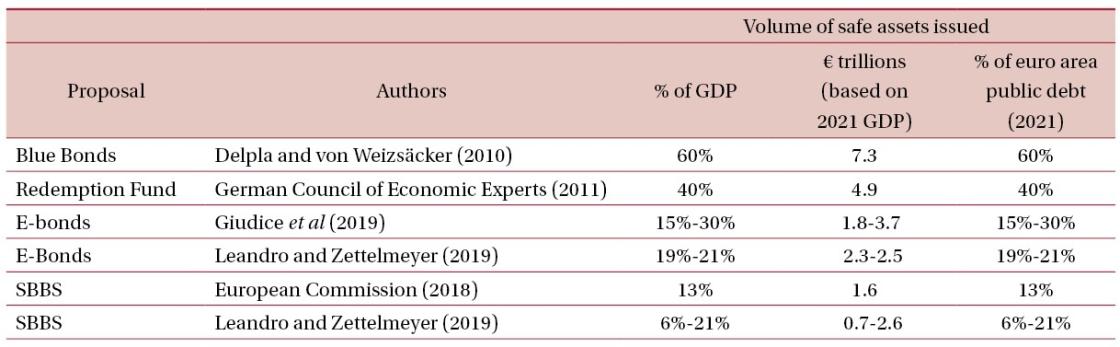

These potential increases in safe assets also fare well in comparison with those estimated by some of the best-known proposals for a new European common safe asset, which are summarised in Table 2. These proposals entail an issuance volume of common safe assets, scaled up using the euro area’s 2021 GDP, ranging between €0.7 trillion, for certain variants of the SBBS proposal, and €7.3 trillion, for the Blue Bonds proposal (Delpla and von Weizsäcker 2010), with most proposals yielding a volume of common safe assets within the €1.5 trillion to €3.7 trillion range. Even the most cautious of the upgrade scenarios mentioned above would be close to the lower bound of this range, while other scenarios would expand the supply of euro-based safe assets well above the upper bound of that range.

Table 2: Estimated impact on the supply of safe assets of selected common safe asset proposals

Source: Bruegel. Note: Shares over GDP and over public debt coincide in 2021 because the euro area's debt-to-GDP ratio was exactly 100% in that year. In the European Commission's SBBS proposal, actual issuance depends on the instrument's attractiveness for the market. The table shows the estimate based on steady-state scenario considered in the documentation accompanying the proposal.

The positive effects of an upgrade of some euro-area countries to the triple-A level would be enhanced if it was accompanied by an improvement in the ratings of those that are still below the double A credit category (including Italy, Portugal and Spain), even if it is not realistic to assume that they can reach the triple-A notch in the foreseeable future. Improved ratings among those countries would help reduce the risk that a regulatory reform aimed at decreasing the home bias in banks’ portfolios has the unintended consequence of increasing overall credit risk and instability. It would also limit the risk of disruptions within the euro-area government bond markets caused by sudden capital flights from vulnerable to safe countries.

Beyond this, the upgrade of sovereign ratings would also have positive spillovers on the quality and attractiveness for investors of the safe assets issued by supranational institutions, through the system of explicit or implicit guarantees from EU countries 10 This would be welcome given the yield spread between safe assets issued by EU supranational institutions and those issued by Germany (Bonfanti and Garicano, 2022). .

Although the potential impact of sovereign credit upgrades on the availability of safe assets is huge, the key question is whether they are realistic in current circumstances. Fiscal consolidation and growth-promoting structural reforms are key tenets of the EU’s economic policy strategy over the medium term, as imbedded in the European Semester process, with the Stability and Growth Pact at its core. And the institutional framework to achieve those goals is expected to be strengthened by the ongoing review of the EU’s economic governance framework 11 In November 2022, the Commission proposed an overhaul of the EU’s economic governance framework to strengthen debt sustainability while enhancing sustainable and inclusive growth through investment and structural reforms. The new framework, which will emphasise “net primary expenditure” as the key fiscal indicator, will provide EU countries with greater flexibility in setting their fiscal adjustment paths. The objective is “to reduce high public debt ratios in a realistic, gradual and sustained manner.” At the same time, the new framework will strengthen the enforcement mechanisms. See European Commission (2022d). . But, it might not be realistic or even advisable to try to redouble fiscal consolidation to produce credit upgrades when euro-area economies have been buffeted by the pandemic and the Ukraine war. The combined impact of these two shocks on growth, inflation and interest rates has derailed previous debt-reduction trajectories, raising concerns about debt sustainability in several countries. Trying to achieve short-term progress in improving credit ratings in this context would seem unrealistic. In fact, significant efforts might be required just to avoid a deterioration of ratings in some countries.

Sovereign credit upgrades have substantial potential to boost the supply of euro-denominated assets

The analysis above highlights that sovereign credit upgrades have substantial potential to boost the supply of euro-denominated assets. How fast euro-area countries can achieve those improvements in ratings is a different matter, and will undoubtedly have to take into account the circumstances they face. Over the medium term, however, boosting the supply of national safe assets through policies supporting the upgrade of sovereign ratings should be a key part of a strategy to expand the supply of safe assets, and it could actually prove easier to do politically than other options for increasing safe assets examined here

4.4 National and supranational/common safe assets are not perfect substitutes

It might be argued that reinvigorating the supply of sovereign safe assets is not the best solution because supranational or common safe assets are superior, reflecting their built-in risk diversification properties. Indeed, supranational or common safe assets offer banks and international investors additional diversification advantages, stemming from the amalgamation of the risks of different euro-area economies.

The economic literature has emphasized, as noted, the advantages of common safe assets over national safe assets for addressing the doom-loop problem, especially when combined with appropriate changes in the regulatory treatment of sovereign exposures. Reducing the excessive home bias in banks’ portfolios by simply replacing national government securities with other euro-area sovereign securities would address the doom loop but maybe not, as underlined by Alogoskoufis and Langfield (2018), other types of instability, in particular international contagion risk. A common safe asset would also help mitigate the risk of sudden capital flights within the euro area (Brunnermeier et al, 2011 and 2017). There might also be transitional advantages: a shift in euro-area banks’ portfolios towards a supranational or common asset is likely to cause less disruption in national bond markets than a shift towards a few national safe bond markets. Moreover, an approach in which euro-area banks are encouraged to hold massive amounts of the bonds of just a few highly-rated euro-area treasuries might not be politically acceptable, as the latter could be seen to benefit disproportionately from efforts to reduce the home bias in banks’ portfolios.

Similarly, for international investors, supranational assets in euros might be particularly attractive because they provide them with an exposure to the euro area rather than to individual member countries. This allows them to diversify risk in a simple manner, reducing the information and transaction costs associated with building a diversified portfolio of euro-area national government bonds. This should enhance the positive impact of an increased supply of safe assets on the euro’s international role, compared with the effect of an equivalent amount of national safe assets.

That said, an expansion of sovereign safe assets would already bring, as noted, many of the advantages of safe assets. It would facilitate the diversification of banks’ portfolios across national jurisdictions, thus lessening the risk of a vicious circle between banks and sovereigns. And, if accompanied by general improvements in the ratings of sub-triple A euro-area countries, any increase in contagion and credit risk that could result from such diversification would be mitigated. Moreover, as argued by Véron (2017), the diversification of bank holdings of government securities across countries would also facilitate the introduction of a common deposit insurance scheme, another key aspect of the banking union project. Indeed, for as long as the home-bias problem persists, there will always be the suspicion that deposits protected by a European deposit insurance scheme could be used by banks, under moral suasion by their home-country government, to increase excessively their exposure to domestic public debt. Increased cross-country investment by financial institutions in sovereign safe assets would also stimulate financial integration, risk-sharing and the development of deeper safe asset markets, thus helping achieve the capital markets union. In sum, even though national safe assets might be a second-best solution, they would help strengthen the EU’s banking and capital markets unions.

Broader and more liquid markets for national safe assets would help prop up the global role of the euro

Broader and more liquid markets for national safe assets would also help prop up the global role of the euro, especially given that many foreign investors, including central banks, continue to show a preference for national safe assets, some of which are perceived as even safer than supranational ones, which makes them appealing despite their lower yields. Supranational assets, by contrast, are seen as combining the creditworthiness of all the members of the EU or the euro area and, as such, as a somewhat riskier investment. This is illustrated by their persistent yield spreads over German bunds and by the slight downgrade of credit ratings some EU institutions suffered during the euro-area crisis. Common synthetic assets might also be regarded as less safe than the best-rated euro-area sovereign bonds for as long as they do not entail risk sharing among euro-area countries (De Grauwe and Ji, 2018).

In sum, while supranational or common safe assets have certain advantages over sovereign assets, the latter can bring many of the benefits of the former and have also certain appeal of their own. Although they are not perfect substitutes, they can be complementary. There is therefore a case for bolstering the supply of both sovereign and supranational or common safe assets. Should the political consensus be eventually found to create a common safe asset, such an asset could be incorporated into the euro area’s existing safe-asset system, reinforcing its positive effects.

5 Conclusions

The expansion of the supply of euro-area safe assets remains critical for completing EMU, in particular for achieving full banking and capital markets unions and fostering the euro’s global role. The policy options to increase the supply of safe assets examined in section 4 present different quantitative potential and different implementation difficulties. More issuance at national level from triple-A countries meets an obvious limit in the tension between increasing issuance, which would go hand-in-hand with more expansionary fiscal policies and higher public debt, and the need of issuing countries to maintain their highest credit rating. And of course subjugating fiscal policy to the supply of safe assets would be clearly suboptimal.

More issuance by EU supranational institutions provides an appealing alternative and has in fact become the main source of creation of safe assets in the EU since the euro-area crisis. But its prospective size is also limited by insufficient progress towards common control of fiscal policies and towards fiscal consolidation at national level. Large supranational issuance while fiscal positions are weak in several euro-area countries risks generating moral-hazard problems and could end up harming the credit ratings of supranational institutions. The creation of a new common euro-area asset could avoid, depending on the proposal chosen, some of the drawbacks of the other options, but there does not seem to be at present political support for this approach, while doubts remain about its implementation.

Finally, rating upgrades of sub-triple A countries are not easy to implement politically because they may require unpopular fiscal measures to cut budget deficits, and structural reforms to enhance sustainable growth. However, these policies would bring benefits well beyond the rating upgrades that they would produce. Moreover, this third option could well yield the largest increases in the supply of euro-denominated safe assets.

The most promising strategy would be a two-handed approach, consistent with the complementary nature of national and supranational safe assets. First and foremost, sound fiscal policies and ambitious growth-stimulating reforms – which are in any case desirable – should be implemented by euro-area sovereigns to improve their credit ratings. This might not be politically feasible in the short-term, given the difficult economic environment currently faced by the EU, but it should certainly be a key component of a medium-term strategy to foster the supply of safe assets denominated in euros. Second, the resulting increase in the supply of national safe assets should be complemented with an adequate supply of supranational assets through the existing facilities or through new ones to be created, possibly in the context of the financial response to the Ukraine war and its ramifications for the EU.

While experts and European policy makers have tended to focus in recent years on the second option, and previously on the possible creation of a new common safe asset, the first option has so far received too little attention, notwithstanding its huge potential. We believe it is time to redirect the debate towards the large contribution that sovereign rating upgrades could make to the supply of euro-denominated safe assets, not least given the additional benefits that the required policies would bring.

References

Alogoskoufis, S. and S. Langfield (2018) ‘Regulating the Doom Loop’, Working Paper Series 74, European Systemic Risk Board

Basel Committee on Banking Supervision (2017) ‘The Regulatory Treatment of Sovereign Exposures’, Discussion Paper, Bank for International Settlements

Bénassy-Quéré, A, M.K. Brunnermeier, H. Enderlein, E. Farhi, M. Fratzscher, C. Fuest ... J. Zettelmeyer (2018) ‘Reconciling Risk Sharing with Market Discipline: A Constructive Approach to Euro Area Reform’, CEPR Policy Insight No. 91, Centre for Economic Policy Research

Bonfanti, G. and L. Garicano (2022) 'Do financial markets consider European common debt a safe asset?' Bruegel Blog, 8 December, available at https://www.bruegel.org/blog-post/do-financial-markets-consider-european-common-debt-safe-asset

Brunnermeier, M.K., L. Garicano, P.R Lane, M. Pagano, R. Reis, T. Santos, S. Van Nieuwerburgh and D. Vayanos (2011) ‘ESBies: A Realistic Reform of Europe’s Financial Architecture’, VoxEU, 25 October, available at https://cepr.org/voxeu/columns/esbies-realistic-reform-europes-financial-architecture

Brunnermeier, M.K., S. Langfield, M. Pagano, R. Reis, S. van Nieuwerburgh and D. Vayanos (2017) ‘ESBies: Safety in Tranches’, Economic Policy 32(9): 175 -219

Caballero, R.J., E. Farhi and P.O. Gourinchas (2017) ‘The Safe Assets Shortage Conundrum’, Journal of Economic Perspectives 31(3): 29-46

Christie, R., G. Claeys and P. Weil (2021) ‘Next Generation EU borrowing: a first assessment’, Policy Contribution 22/2021, Bruegel

Claessens, S., A. Mody and S. Vallée (2012) ‘Paths to Eurobonds’, IMF Working Paper WP/12/172, International Monetary Fund

Claeys, G (2018) ‘Are SBBS Really the Safe Asset the Euro Area is Looking For?’ Bruegel Blog, 28 May, available at https://www.bruegel.org/blog-post/are-sbbs-really-safe-asset-euro-area-looking

Claeys, G. and G.B. Wolff (2020) ‘Is the COVID-19 crisis an opportunity to boost the euro as a global currency?’ Policy Contribution 11/2020, Bruegel

De Grauwe, P. and Y. Ji (2018) ‘How Safe is a Safe Asset?’ CEPS Policy Insights 2018-08, Centre for European Policy Studies

Delpla, J. and J. von Weizsäcker (2010) ‘The Blue Bond Proposal’, Policy Brief 2010/03, Bruegel

Eichengreen, B. and D. Gros (2020) Post-COVID-19 Global Currency Order: Risks and Opportunities for the Euro, Study for the European Parliament’s Economic and Monetary Affairs Committee, Directorate-General for Internal Policies

ESRB (2015) Report on the Regulatory Treatment of Sovereign Exposures, European Systemic Risk Board

ESRB (2018) Sovereign Bond-Backed Securities: a Feasibility Study. Volume I: Main Findings, report by the ESRB High-Level Task Force on Safe Assets, European Systemic Risk Board

European Central Bank (2020) Financial Integration and Structure in the Euro Area

European Commission (2018) ‘Proposal for a Regulation of the European Parliament and of the Council on sovereign bond-backed securities’, COM(2018) 339 final

European Commission (2020) ‘A Capital Markets Union for people and businesses – new action plan’, COM(2020) 590 final

European Commission (2022a) ‘Ukraine Relief and Reconstruction’, COM(2022) 233 final

European Commission (2022b) ‘Proposal of a Regulation of the European Parliament and of the Council establishing an Instrument for providing support to Ukraine for 2023 (macro-financial assistance +)’, COM(2022) 597 final

European Commission (2022c) ‘Fiscal Sustainability Report 2021, Volume I and Volume II’, Institutional Paper 171, Directorate General for Economic and Financial Affairs

European Commission (2022d) ‘Orientations for a reform of the EU economic governance framework’, COM(2022) 583 final

European Parliament (2019) ‘Legislative Resolution of 16 April 2019 on the proposal for a regulation of the European Parliament and the Council on sovereign-backed securities’, P8_TA(2019)0373

German Council of Economic Experts (2011) Assume Responsibility for Europe, Annual Report 2011/2012

Giudice, G., M. de Manuel Aramendía, Z. Kontolemis and D. P. Monteiro (2019) ‘A European Safe Asset to Complement National Government Bonds’, MPRA Paper No. 95748, Munich Personal RePEc Archive

Lanoo, K. and A. Thomadakis (2019) Rebranding Capital Markets Union: A Market Finance Action Plan, CEPS-ECMI Task Force Report, Centre for European Policy Studies

Leandro, A. and J. Zettelmeyer (2019) ‘Creating a Euro Area Safe Asset without Mutualizing Risk (Much)’, Working Paper 19-14, Peterson Institute for International Economics

Papadia, F. and K. Efstathiou (2018) ‘The Euro as an International Currency’, Policy Contribution 25/2018, Bruegel

Sapir, A. (2022) ‘Does the War in Ukraine Call for a New Next Generation EU?’ Bruegel Blog, 17 May, available at https://www.bruegel.org/blog-post/does-war-ukraine-call-new-next-generation-eu

Temprano Arroyo, H. (2022) ‘The EU´s Response to the COVID-19 Crisis: A Game Changer for the International Role of the Euro?’ European Economy – Discussion Paper 164, Directorate-General for Economic and Financial Affairs, European Commission

Véron, N. (2017) Sovereign Concentration Charges: A New regime for Banks’ Sovereign Exposures, Study for the European Parliament’s Economic and Monetary Affairs Committee, European Parliament, Directorate-General for Internal Policies

World Bank, Government of Ukraine and European Commission (2022) Ukraine: Rapid Damage and Needs Assessment, August