National policies are the best protection against euro-area financial fragmentation risks

An analysis of German-Italian spreads under five Italian governments shows that the gap was biggest when Italian policies worried markets most.

The risk has increased of ‘fragmentation’ in the transmission of monetary policy in the euro-area, now that the European Central Bank has started increasing interest rates. Fragmentation refers to interest rates in different countries in the monetary union reacting differently when the ECB revises its interest rate. Fragmentation risk is measured by the differences in the yields of bonds issued by peripheral countries and those issued by core countries. The spread between the yields of Italian and German bonds has become a particular focus of attention.

The ECB has put in place a tool, the Transmission Protection Instrument (TPI), which can be activated when national policies are judged adequate by the ECB Governing Council but the spread remains excessive. While the TPI should protect against fragmentation, it could also obscure the critical issue: whether the countries concerned pursue growth-fostering and fiscally-sound policies, while avoiding any doubts about their wish to remain in the euro area.

By looking at Italy, we show that a national government that announces credible growth-enhancing measures and prudent fiscal measures, while maintaining a collaborative attitude towards European institutions, creates positive expectations on the part of investors about the safety of their investments. This reduces the perception of risk around that government’s bonds, and therefore the spread. The reverse also applies.

The effect of national policies on the spread

Of course, if all euro-area countries consistently followed sound policies and therefore were in equally solid financial situations, there would be no fragmentation risk. There is a reason why fragmentation risk is greater for financially weaker countries, including Italy, Spain, Portugal and Greece, but not for financially stronger countries, such as the Netherlands and France. Ireland has shown it is possible to graduate from the former to the latter category.

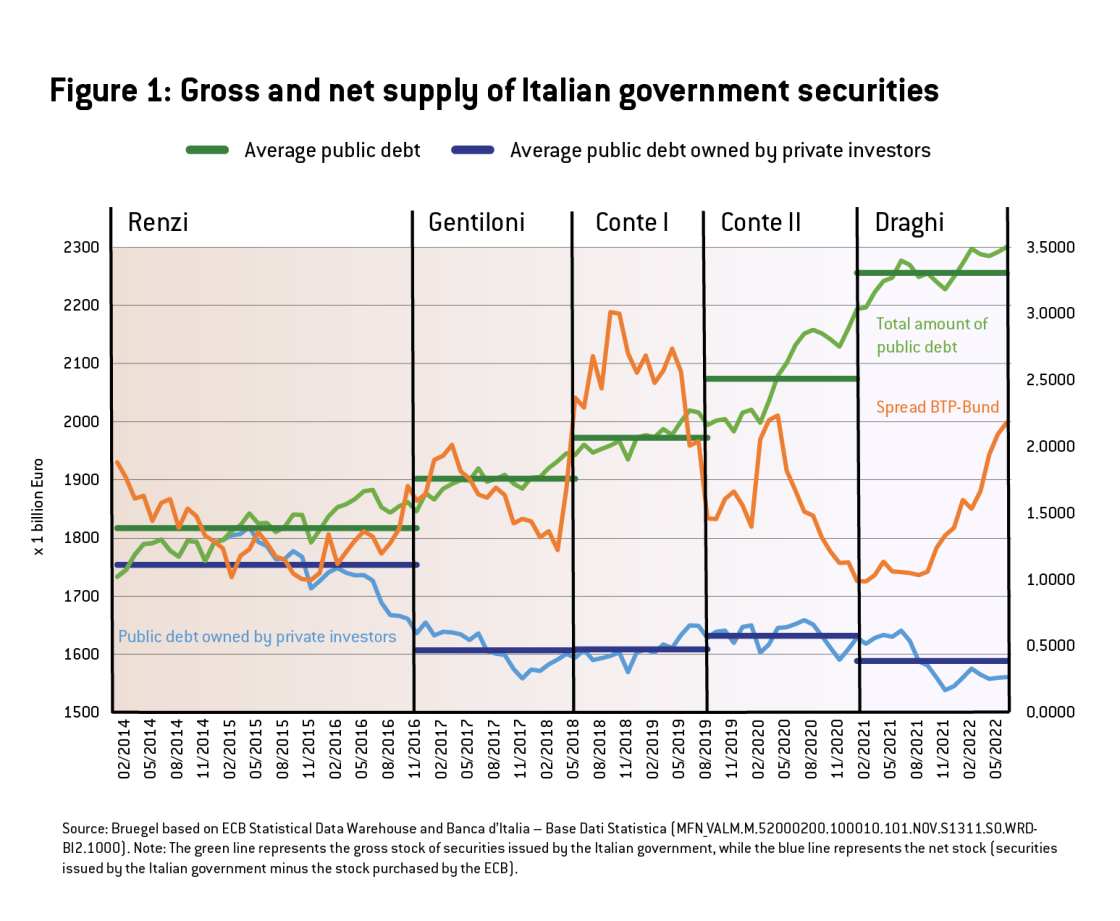

The importance of national policies in this context can be assessed by looking at the experience of the five previous Italian governments: Renzi-Padoan (from 22 February 2014 to 7 December 2016), Gentiloni-Padoan (from 13 December 2016 to 24 March 2018), Conte-Salvini-Tria (Conte I, from 1 June 2018 to 20 August 2019), Conte-Gualtieri (Conte II, from 9 September 2019 to 26 January 2021), and Draghi-Franco (from 17 February 2021 to 20 July 2022) (note: gaps between start and end dates relate to administrations remaining in caretaker roles until new governments took over).

Figure 1 and the first row of Table 1 show the average spreads in yield of Italian bonds relative to German bonds under each of the five governments. The average spread during the Conte I government was almost 100 basis points (bp) higher than the spread of about 150 bp points prevailing on average under the other governments. Given Italy’s high indebtedness, this translated into additional interest rate expenses of more than €20 billion per year, equivalent to more than 20% of Italy’s education expenses, or about 12% of health expenses (average values from 2012 to 2021). A higher spread also means a higher cost of credit for families and firms, undermining economic activity.

Of course, some of the changes in the average spread shown in the first row of Table 1 should be attributed to changes in ECB support given to Italy. One form of support was ECB purchases of Italian government bonds. Figure 1 shows that although the gross supply of government securities increased steadily from less than €1.8 trillion at the beginning of the Renzi government to about €2.3 trillion at the end of the Draghi government, ECB purchases led to a fall in the net supply of bonds to the private sector during the Renzi government. Subsequently, Italian government securities held by private investors remained roughly unchanged at around €1.6 trillion since the ECB bought practically all new issuance. A higher supply of bonds to the private sector therefore does not explain the higher spread during Conte I.

ECB support can also be measured using a ‘shadow interest rate’, which attempts to capture the overall stance of ECB monetary policy, including its various asset purchase programmes. The shadow rate declined continuously from about -0.6% at the beginning of the Renzi period, hit bottom at about -8% during the pandemic, and subsequently reversed sharply, to roughly -0.7% in August 2022. The second row of Table 1 shows an estimate of what the average spread in each period would have been if the shadow rate had been zero throughout (see the Annex). In that scenario, the spread difference between Conte I and the preceding and following governments would have been even higher, over 100 bp.

Thus, neither the gross supply of government bonds nor the amount corrected for ECB measures explain the higher spread in the Conte I period. The remaining possible reason is market expectations about future government policies and thus future bond demand and supply: the market will demand higher spreads if it fears a government will not pursue growth-enhancing and fiscally prudent policies and will possibly raise the idea of exit from the euro area, engendering redenomination risk.

Proxies for market expectations

While market expectations about government policies cannot be observed directly, we can look at proxies, in particular, the attitude of the different governments to:

- The European Union and its economic guidance, and

- The balance between aggregate demand and supply-enhancing policies.

Table 2 summarises our reading of relevant quotes from the introductions of economic and financial policy statements made by the five Italian governments.

Table 2 shows that the Conte I government took an antagonistic attitude towards EU institutions (‘Italy first’ policy) and prioritised demand rather than supply-enhancing policies. In addition, strong statements from leaders of the parties supporting the government led the market to fear Italy would exit the euro (see for example interviews with Five Star Movement founder Beppe Grillo and with Matteo Salvini, who was subsequently deputy prime minister). The other four governments pursued, instead, a cooperative approach with the EU institutions and gave more weight to supply policies, taking structural measures. In particular, the Draghi government, while responding to the COVID-19 shock with very expansionary fiscal policies, managed to reassure markets and avoided effects on the spread because its policies were considered necessary, temporary and in line with EU guidance. In addition, the Draghi government started to implementvigorously the supply-oriented, growth-increasing programme adopted under the Next Generation EU initiative. Of course, as was the case for the other governments, ECB purchases also helped contain the spread.

Market expectations about government policies are therefore a plausible candidate to explain the higher spread during the Conte I government. Not surprisingly, it is not only actual supply of and demand for bonds that determine the spread, but also expectations about supply and demand.

Making direct comparisons between the changes in the spread brought about by the different policies of the five Italian governments and the effects of ECB purchases is fraught with difficulties. The effect of national policies on spreads is gradual, while ECB purchase announcements have immediate though not necessarily long-lasting effects. A ballpark conclusion is that ECB measures reduced, on average, the spread by about one fifth (see here and here). Arguably the most successful ECB measure against spreads, then ECB President Draghi’s “whatever it takes” statement on 26 July 2012, reduced on an intraday basis the 10-year Italian bond yield from around 6.35% to 6%, ie by about 7% of the prevailing spread, which was around 4.85% By the end of 2012, the spread versus Germany had reduced by about 40%. These effects are well within those that occurred, in the opposite direction, during the Conte 1 government.

Annex

We estimated what the average spread under each of the five Italian governments would have been if the shadow rate had been zero using the following equation:

st=∑5k=1 (5akDk)+bit+ut

Where Dk is dummy for the k governments (k from 1 to 5), st is the spread, it is the shadow interest rate and ut is an estimation error. All coefficients have the expected signs and are statistically significant at the 1 percent level. The bottom row of Table 1 shows the fitted values for st during the five periods, with it set to zero.