The IMF Global Financial Stability Report: Restoring Confidence and Progressing on Reforms

Financial reform is a complex business and one needs a good guide to understand what is going on in this field as a consequence of the crisis as well to understand whether we are indeed progressing towards a “safer financial system”. Chapter 3 of the IMF Global Financial Stability Report (GFSR, to be found at: http://www.imf.org/external/pubs/ft/gfsr/2012/02/index.htm) is an excellent tool for this purpose.

The GSFR is indeed more than an illustration of where the pendulum now is between regulation and liberalization. It takes stock of the different initiatives, assesses them against the target to achieve institutions and markets which are more transparent, simpler and less leveraged and identifies the remaining gaps in the definition and implementation of the new measures.

The gist of the reform effort, in the GFSR reading, is to be found in a Pigouvian attempt to impose ”… additional costs on activities that, in the crisis, were shown to be riskier than originally envisaged or had broader systemic effects.” The imposition of taxes on the negative externalities, intrinsic in some actions by financial institutions, should indeed lead us to a “safer financial system”.

Three hurdles stand in the way to the Promised Land:

1. Reforms are not complete as yet, also because their pace is slowed down by the fear of aggravating the currently vulnerable economic conditions. In particular, long transition periods are often chosen and crisis management policies, as necessary as they are, are often counterproductive for longer-term reform. The increased importance of central banks in the functioning of financial systems, complementing intermediation in the money market, carrying out critical activities in some bond markets and offsetting cross-countries capital flows, is particularly noted in this respect. While the Report goes out of its way to recognize the need of these interventions to avoid further damages to the global economy, it stresses that they could have negative side effects if they would last for too long;

2. Reforms are well intentioned but experience shows that unintended consequences are the rule rather than the exception when dealing with an imaginative, resourceful, influential and rich financial sector. Two specific dangers in this respect are highlighted by the GFSR: new rules could end up favouring the shadow-bank sector and/or further fostering the concentration of activity in institutions too important too fail, which have the resources and the economies of scale to deal with, or even circumvent, new regulations;

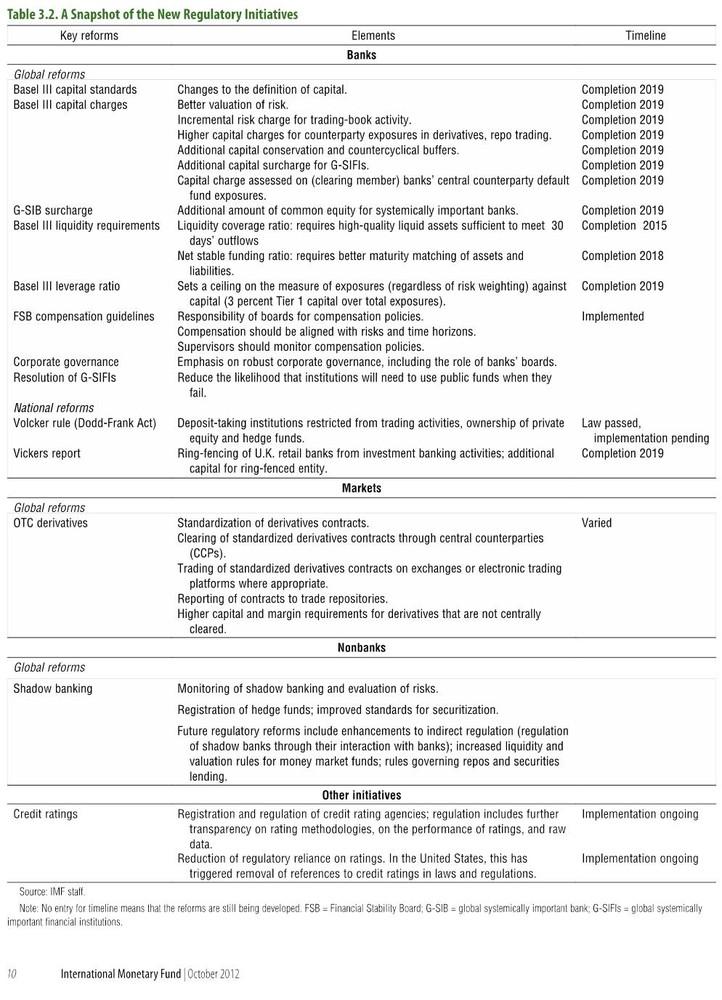

3. It is difficult to bring the interaction of different initiatives into a holistic assessment. Table 3.2 of the GFSR, which lists of all the on-going activities in the area of financial regulation, makes indeed awesome reading. For convenience, here is the table showing the large number of reform initiatives, which could not even include the just recently issued proposals of the Liikanen Expert Group.

One should then not be surprised that the GFSR does not conclude on a positive note on whether we have indeed progressed towards a safer financial system. Its conclusion is rather that “A number of financial structure indicators … suggest that financial systems are not safer than before the crisis.” Indeed the measures carried out in the report show that there is still too much complexity in the financial system, that there is excessive concentration in banking markets and that the “too important to fail” phenomenon is far from being dealt with. Indeed, in this area, the GFSR fears perverse incentives may come from some of the current measures.

The areas were further action is needed are highlighted by the GFSR: first, direct restrictions may be needed when a change of incentives is not sufficient, second, the so-called shadow banking sector should be better regulated; third, further progress on recovery and resolution planning for large institutions is needed; finally enhanced supervision, sustained by sufficiently determined political will, is of the essence. In conclusion policy makers and regulators have a long and difficult task ahead of them. The pendulum has to move somewhat further, in the view of the GFSR.

The GFSR does also contain, however, good news, so much more welcome because unexpected: financial globalization has withstood, overall, the crisis. The fear of a “re-domestication” of financial markets is not supported by the GFSR measurement of the degree of globalization in financial matters. The GFSR, however, recognizes that damage to financial integration in the euro area was brought about by the crisis, as discussed in a recent Bruegel debate.