The European Union’s carbon border mechanism and the WTO

To avoid any backlash, the European Union should work with other World Trade Organisation members to define basic principles of CBAM.

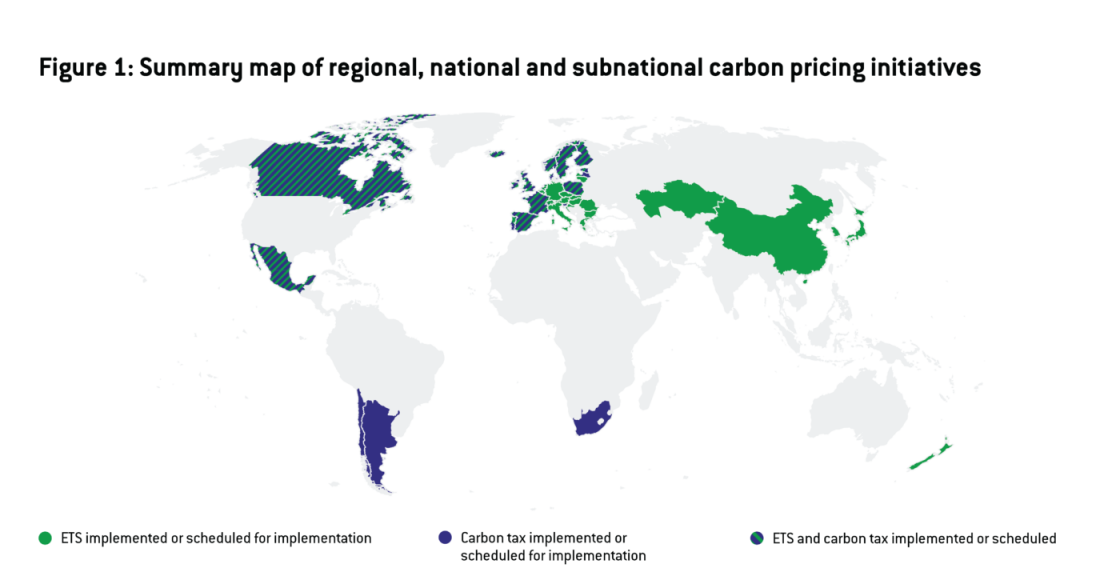

According to the World Bank’s Carbon Pricing Dashboard, as of April 2021, 45 countries had in place national or supra-national carbon pricing schemes, in the form of either an emission trading system (ETS) or a carbon tax. Although existing schemes still only cover 18.8% of global greenhouse gas emissions, the international appetite for carbon pricing is clearly on the rise. Ten of the G20 countries already implement such schemes and, at their 9-10 July meeting in Venice, G20 finance ministers adopted a communiqué encouraging, for the first time and “if appropriate, the use of carbon pricing mechanisms”.

In the map, countries/jurisdictions with an ETS are shown in green, those with a carbon tax are shown in blue, and those with both an ETS and a carbon tax are shown in green/blue shading.

The European Union’s ETS, originally set up in 2005, operates in the 30 European Economic Area (EEA) countries – the 27 EU countries plus Iceland, Liechtenstein and Norway – some of which also apply national carbon taxes. According to the World Bank, the EU ETS currently covers 3.2% of global emissions.

So far, carbon pricing schemes only cover carbon emissions produced within the jurisdictions that operate these schemes. For instance, the EU ETS only applies to carbon emissions from production in the 30 EEA states, and Japan’s carbon tax only applies to carbon emissions from production in Japan.

The fact that carbon pricing schemes are implemented only in a limited number of countries, and with different levels of carbon prices between these countries, has long raised the fear of carbon leakage, namely the possible transfer of carbon-intensive activities away from countries with high carbon prices that would not only be detrimental to economic activity in these countries but could also increase global emissions. To avoid carbon leakage and level the playing field, it has long been argued that countries need to extend their carbon pricing schemes to emissions by producers located outside their borders but exported into the jurisdictions that operate such schemes. To this day, however, no national or supra-national jurisdiction has implemented a carbon border adjustment mechanism (CBAM), which would make up for the difference between its domestic carbon price and the carbon price in countries with a lower (or no) carbon price.

If adopted by the European Council and the European Parliament, the EU CBAM proposed last week by the European Commission would, therefore, be a first worldwide.

There are two main reasons why, prior to the proposed EU CBAM, no jurisdiction has introduced legislation to extend its domestic carbon pricing scheme to emissions produced outside its own territory.

First, the effective price of carbon emissions applied to tradeable products has so far been generally very low under most existing carbon pricing schemes. For instance, under the EU ETS, the effective carbon price paid by producers of manufactured products covered by the ETS (such as cement, chemicals or iron and steel) was essentially zero, since they received free allocations of emission permits. It was neither necessary nor possible, therefore, to impose a CBAM on similar products imported into the EU since, by definition, a CBAM is an adjustment meant to equalise the price of carbon between domestic products and imports.

The second reason is that a CBAM may not be compatible with the rules of the World Trade Organisation (WTO), and even if it is, it may not be politically acceptable to foreign trading partners, who could retaliate. This is what happened in 2012, when the EU decided to introduce a CBAM for the aviation sector, triggering a political backlash from powerful foreign countries (including Brazil, China, India, Japan, Korea, Mexico, Nigeria, Russia and the United States) that led to de facto withdrawal of the measure by the EU.

So how does the proposed EU CBAM score on these two issues and what are the chances that it will actually see the light of day?

The EU CBAM will only apply initially to a limited number of carbon-intensive products: cement, iron and steel, aluminium, fertilisers and electricity. For these products, free ETS allowances for EU producers will be reduced by 10% each year from 2025, resulting in their complete phase out by 2035, while the CBAM on imports will be gradually phased in at the same rhythm so it will only apply to the proportion of emissions that do not enjoy free allowances.

The CBAM will apply to imports at the price of carbon determined by the EU ETS system through auctions, which is expected to rise over time as free allowances, initially only in the five sectors listed above and later also in other import-competing sectors already subject to the EU ETS (including ceramics, glass, paper and other chemicals), are phased out. Given that the EU carbon price is currently already above €50 per tonne of CO2, it can probably be safely assumed that the effective price of carbon paid by EU producers in import-competing sectors subject to EU ETS will gradually rise to at least €50 by 2035, which is likely to generate carbon leakage in these countries and, therefore, justify the introduction of the CBAM.

Having established that the phase out of free ETS allowances will substantially increase the price of carbon faced by import-competing carbon-intensive producers in the EU, and therefore that the parallel phasing in of the CBAM is justified to avoid carbon leakage, we can now turn to the second issue and examine whether the proposed EU CBAM risks creating legal and political conflicts with third countries, and potential retaliatory measures.

Legal scholars agree (see here and here) that WTO rules in principle allow WTO members to adjust their ETS systems for imports as the EU CBAM proposes to do. Whether or not the EU CBAM complies with WTO rules is therefore down to its actual implementation and in particular whether it meets a double non-discrimination test: non-discrimination between domestic and foreign suppliers, and non-discrimination between foreign suppliers.

The EU CBAM purports to treat EU and foreign suppliers equally since they would both be paying the same price for their embedded carbon emissions for products sold in the EU – by purchasing ETS allowances for the former and CBAM certificates for the latter. Foreign suppliers would be entitled to claim a reduction against the CBAM for any carbon price paid in the country of production (which is not rebated or in other way compensated for upon export). Hence, suppliers from countries with carbon pricing schemes would be able to handle the CBAM administrative costs relatively painlessly. The situation would be different for suppliers from countries that implement carbon reduction policies through means other than carbon pricing. Whether this would be regarded by some of these countries as discrimination in terms of WTO law remains to be seen.

One accusation of discrimination that cannot be levelled against the Commission proposal is that it will exempt certain countries from the CBAM. Except for Iceland, Liechtenstein and Norway, which belong to the EU ETS, and Switzerland, which has an ETS linked to the EU ETS, the EU CBAM will apply to all countries. With respect to Switzerland, the explanatory memorandum accompanying the Commission CBAM proposal (pp 26-27) states that exemptions “could be granted to countries who have in place a carbon pricing system that imposes a carbon price at least equivalent to the price resulting from the EU ETS on products subject to the CBAM. In practice… such an approach may be considered for countries with an ETS linked to the EU ETS (e.g. Switzerland).” However, this statement raises a question about the meaning of ‘equivalence’ envisaged by the Commission. Switzerland’s carbon pricing scheme is equivalent to the EU’s scheme is two ways: like the EU, Switzerland has an ETS, and its ETS is linked to the EU ETS. Hence there is equivalence in systems and in carbon prices. But what about a country that also has an ETS, which is not linked to the EU ETS but nonetheless imposes a carbon price which is the same or even higher than the EU ETS, or another country that uses a carbon tax instead of an ETS, which also imposes a carbon price equal to or higher than the EU ETS?

The flipside of non-discrimination between third countries (with the exception of Iceland, Liechtenstein, Norway and Switzerland) is that developing, and even least-developed countries will be subject to the same EU CBAM as more advanced countries, despite the principle of common but differentiated responsibilities enshrined in the Paris Agreement. One way to reconcile the EU’s obligation under both the WTO and the Paris Agreement would be to seek a WTO waiver permitting the exemption of developing or least-developed from the EU CBAM, or similar CBAMs that may follow the EU CBAM.

Both sets of issues – potential discrimination between countries with and without carbon pricing schemes, and lack of differentiation in favour of lower-income countries – should be addressed at the multilateral level in the WTO, with the EU seeking to establish with other WTO members a memorandum of understanding on carbon border adjustment mechanisms that would define some basic principles. This would certainly help deflect not only potential legal challenges but also a political backlash against the EU CBAM.

The EU should be congratulated for having put forward a comprehensive response to tackling its own carbon emissions. It has done a service to the world by experimenting with policies that have not been tried elsewhere before, including a CBAM that complements its ETS. But the EU needs to collaborate with other jurisdictions to ensure its CBAM is embedded into a multilateral framework comprising both the Paris and WTO agreements, without which the pursuit of global carbon neutrality would ultimately be in vain.

Recommended citation:

Sapir, A. (2021) ‘The European Union’s carbon border mechanism and the WTO’, Bruegel Blog, 19 July