The next step of the Belt and Road Initiative: Multilateralisation with Chinese characteristics

The increasingly broad objective of China's Belt and Road Initiative has attracted the attention not only from the BRI members, but also from other ma

Regardless of the attitude towards President Xi Jingping’s grand plan for China’s global expansion - namely the Belt and Road Initiative (BRI) - the world is eyeing the second BRI Summit to be held on 26-27 April in Beijing. Two years after the first BRI Summit, which was greeted with enthusiasm by the developing world, things have changed rather quickly.

Since President Xi Jinping first introduced the concept of One Belt One Road in late 2013, shortly after his arrival to power, China has invested massively in infrastructure projects to enhance connectivity among neighboring countries. Although the BRI is only five years old, China has expanded aggressively in many countries. Beyond China’s actions and the world’s response, the objective of the Belt and Road Initiative seems to have evolved. From a more economic-oriented goal of facilitating export of China's excess capacity through increased trade connectivity, it has become a soft power tool with a large part of the infrastructure projects considered strategic. The increasingly broad objective of President’s Xi’s global plan has attracted the attention not only from the BRI members, but also from other major players such as the United States and the European Union.

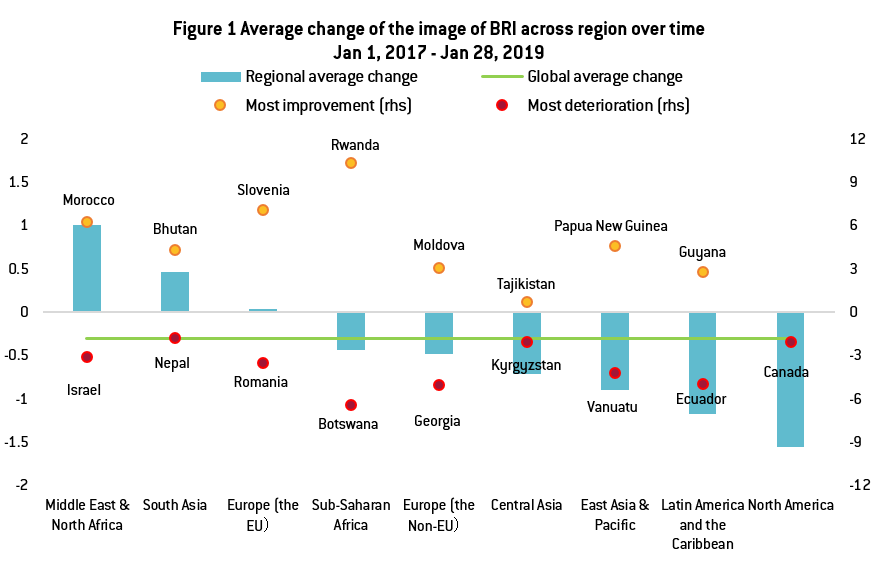

In a recent empirical analysis, using big data on millions of media outlets globally, we find that the sentiment toward the Belt and Road Initiative had been generally positive from its early stages, although it varies widely across countries[1]. However, a closer look at the media after the first BRI Summit shows a clear worsening of the Belt and Road’s image globally (Figure 1). The exceptions are the Middle East and North Africa. The worsening image of BRI is definitely a wake-up call for China in its pursuit of a successful strategy to increase soft power globally.

Our analysis suggests some of the reasons for the worsened image of the BRI. The first and most evident seems to be trade. Countries appear wary of an imbalanced trade pattern and excessive dependence on Chinese imports. In addition, debt dynamics in recipient countries could be an issue. On the whole, China may have been piling up too many objectives under the BRI cover, some of which could be inconsistent. Replicating China’s internal way of doing business - i.e. relying on China’s own resources and materials with a clear favour of state capitalism - in the overseas markets has been questioned.

While keeping state-owned companies busy with BRI projects may be appealing from an economic perspective, it only exacerbates foreign concerns, weakening China’s international image. Most of the recipient countries welcome infrastructure financing from China, but also expect transparency and fair competition. The latter is at odds with China’s existing strategy.

The fact that the BRI is backfiring is not only demonstrated in its worsening image globally, but also by the announcement of alternative proposals both by the US, through the Indo-Pacific Strategy with Australia, India and Japan, and the European Union, in the form of its EU-Asia Connectivity Plan. The US confronts mainly the geopolitical aspects of the BRI, as it focuses on the political and military coordination among states in the Indo-Pacific region through the Quadrilateral Security Dialogue (QUAD). The European Union’s response, on the other hand, is clearly narrower, focusing on the economics behind the BRI, in particular on physical connectivity. Beyond the Indo-Pacific Strategy, the US-led trade war could also be seen as an economic response to China’s rise, not only domestically, but also in other countries through BRI.

Although the response seems painful for China, it is not a completely disastrous as it provides an opportunity for the big country to learn how to acquire international soft power. In fact, such backlash offers China an opportunity to shift from its earlier BRI strategy to a more sustainable one. China seems to be realising that creating confrontation with the US might not be a winning strategy in spite of the economic benefits. Given the diminishing returns on investment, China needs to expand in the overseas markets. Against this backdrop, the next step for China’s Belt and Road is definitely to take a more flexible and open pathway to building its soft-power image.

To that end, China has recently made a number of strategic changes regarding the BRI, which have probably remained unnoticed given the much more low-key approach. First, China has sharply increased the number of countries signing memorandums of understanding (MOUs) from the original 63 to 126. The key is to make the Belt and Road less targeted to ease the West’s geopolitical concerns about this project. Second, China is trying to use a more multilateral framework to push the BRI, i.e. the Asian Infrastructure Investment Bank (AIIB). Such multilateral framework retains Chinese characteristics, allowing China to keep ultimate control of key projects, but at the same time offers room for other developed countries to get involved, especially the European countries and Korea. In other words, China is willing to make compromises and share benefits with other countries, but it ultimately strives to preserve the BRI’s non-Western model.

[1] Alicia García-Herrero and Jianwei Xu, 2019, “Countries’ perceptions of China’s Belt and Road Initiative: A big data analysis”, Bruegel Working Paper. https://bruegel.org/wp-content/uploads/2019/02/WP-2019-01final.pdf