Is the oil price-GDP link broken?

Oil prices fell to a 12-year low at the beginning of 2016. We find that the drop in the past two years was primarily driven by expectations. In fact,

By February 2016, the price of oil had fallen to about 30 USD —from about 100 USD per barrel in 2014. There are three possible causes: real changes in supply, real changes in demand and changes in expectations regarding the future oil demand-supply balance.

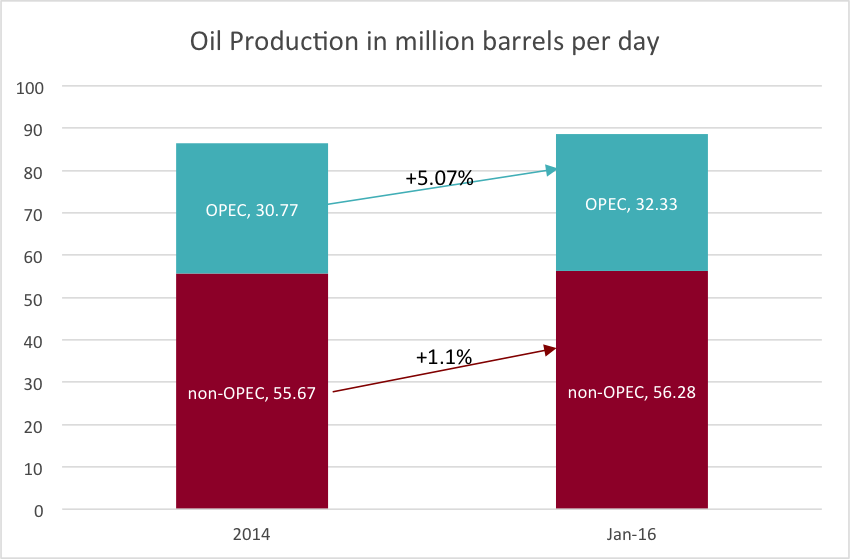

Oil supply continued to increase in 2015, as US shale oil production was more resilient than previously thought, and countries like Iran returned to the market. In addition, OPEC, a cartel of oil exporters, is not restricting supply. As a result, at the end of 2015, oil production had increased by about 3 percent compared to the 2014 average: from 86 to 88.5 million barrels per day. The International Energy Agency foresees that the world will be “awash in oil” in the near future[1]. This increasing supply put downward pressure on oil prices.

Figure 1: oil production 2014 vs. January 2016 in million barrels per day

Source: OPEC

Currently aggregate demand is sluggish. Growth in emerging market economies is slowing and macroeconomic risks in developed countries persist. This reduces oil demand and hence puts additional pressure on oil prices. Finally, price developments are not only explained by changes in real demand and real supply, but also by market actors’ expectations about the future demand-supply balance.

The impact of lower oil prices on the EU economy depends on the relative importance of these three drivers. We find that in the last three years about 12% of the oil price decrease can be attributed to a fall in aggregate demand and 15% to an increase in current oil supply. 73% of the price drop can be attributed to expectations about the oil demand and supply balance. This is the finding of an analysis based on Kilian (2009), where we decompose oil price shocks into these three elements by estimating a structural VAR model in which the oil price reacts - with some delay - to changes in monthly oil supply and a measure of economic activity. Essentially, we update the analysis of Kilian and apply it to the EU economy.

Figure 2: Aggregate oil price shocks from 2000 until 2016

Source: own calculation

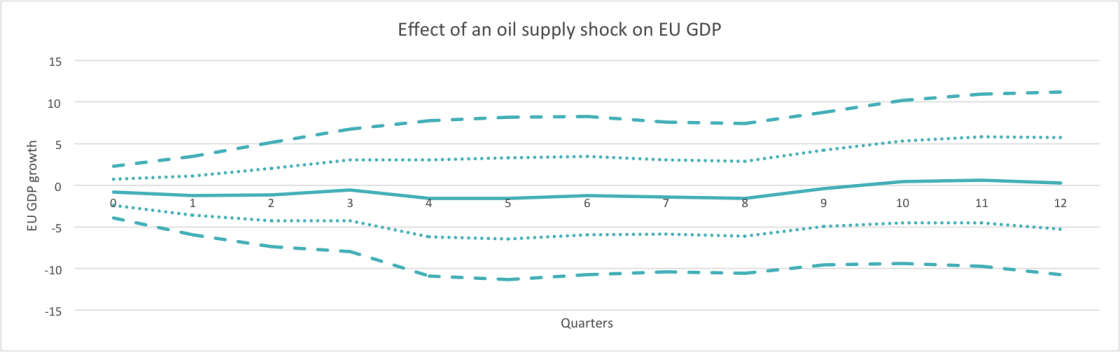

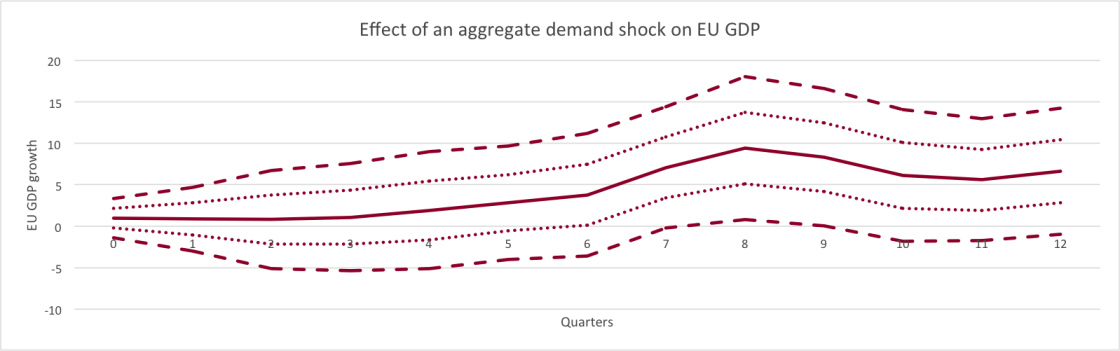

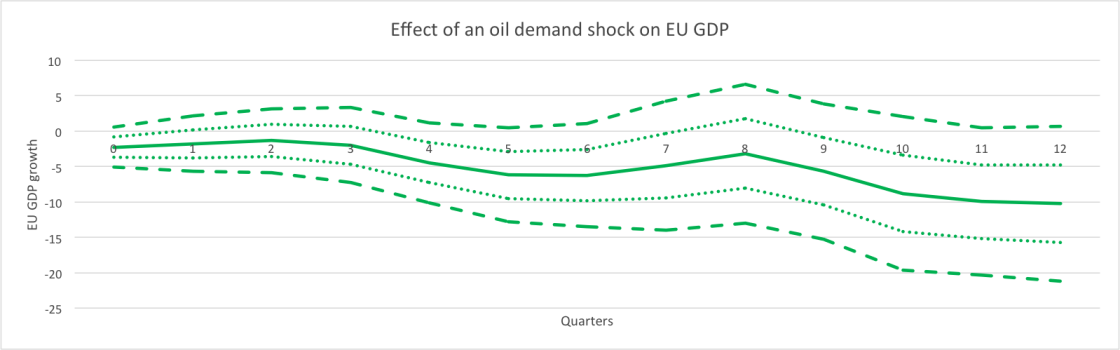

What does this imply for the EU economy? Past experience has shown that the three components have structurally different impacts on the economy (see graph):

- A supply shift has no significant impact on EU GDP within the following three years. Hence, the impact of increasing supply in 2015/2016 should not boost GDP.

- Higher aggregate demand, that also caused oil prices to rise, let to even higher GDP 18 month later. Hence, the lower aggregate demand that caused oil-prices to decrease in 2014 and early 2016 should have a depressing effect on GDP – while the positive demand shock identified for 2015 should have an inflating effect on GDP. Overall, the magnitude of the negative aggregate demand shock should prevail.

- Finally, expectations regarding the future oil demand-supply balance which drove down oil prices used to have a positive impact on GDP. Consequently, the observed lower oil prices, which are primarily driven by such expectations, might well be a good sign for the EU economy.

Figure 3: Effect of oil price shocks on EU GDP growth; GDP is measured in USD, seasonally adjusted and expressed in log differences

Source: own calculations

Note: relative q-o-q percentage change of GDP due to a 1 percent change in oil price due to a supply/demand/expectation shock. The solid lines correspond to pint estimates; dotted and dashed lines identify one- and two- standard error bands, respectively.

The most striking result of this decomposition is that the role of expectations has dramatically increased since 2008. The data imply that that it is very unlikely (less than 5% probability) that oil prices after 2008 are driven by the same combination of factors as before 2008. In fact, expectations regarding the future oil demand-supply balance seem to have become the main driver of oil price changes. This would be consistent with a hypothesis that oil markets are becoming more detached from observable supply-and-demand fluctuations (one possible explanation being loser monetary policy).

In conclusion, the observed drop in oil prices should have a slightly positive in pact on the EU economy. However, this prediction presumes that past relations between oil demand, oil supply, oil prices and GDP still hold. In fact, the structural increase in the importance of expectations in oil price formation raises doubts about the stability of these past relations. The true impact of the oil price drop therefore remains to be seen — and could prove disappointing in the end.

Very helpful comments by Zsolt Darvas are gratefully acknowledged. All remaining mistakes are the author’s sole responsibility.