Can China Change?

Director Jean Pisani-Ferry takes a look at the economic situation in China and examines whether China's growth can be rebalanced and whether the Chinese government will participate fully in global governance.

The concept has stuck in the mind ever since Robert Zoellick, president of the World Bank, and his chief economist Justin Lin came up with it in April. The core of the world economy is not the overpopulated G20, nor an outdated G7, but the ‘G2’ of the US and China. Whether it is the relaunch of the Sino-American economic dialogue or the recent visit of Barack Obama to China, all the evidence seems to support the inference that the co-pilot’s seat in the global economy, which Europeans were still deciding how to divide up between themselves, has now been bagged by China.

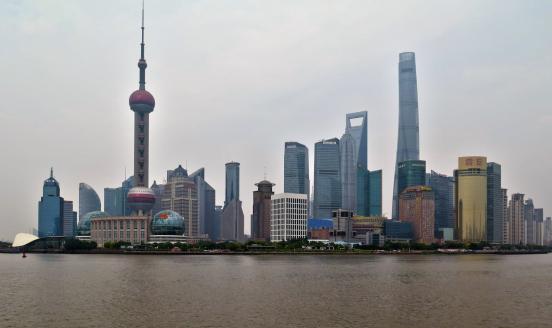

China has a legitimate claim. It already weighs in at eight percent of global GDP, and at more than 12 percent in a unified price system. Thanks to a large-scale recovery plan in 2009, China’s increase in output will more than offset the drop in that of the G7. And the signs are that it will overtake the US in the coming decade and become the world’s leading economic power.

But two major question-marks remain. The first and more immediate one concerns the rebalancing of China’s growth. The second and longer-term issue relates to its willingness to participate fully in global governance.

It is a well-known fact that growth in the noughties was, at bottom, based on a Faustian pact: the insatiable appetite of the US consumer guaranteed demand, the tireless labour of the Chinese worker provided the supply and at the same time the latter agreed to lend without limit to the US consumer so that he could continue consuming. Until 2007 US domestic demand thus accounted for close to one fifth of global growth, essentially as a result of soaring consumption. China was the mirror image, as growth was increasingly based on exports and investment: between 2000 and 2007 the share of consumption in Chinese GDP dropped from 45 percent to 35 percent, or half the ratio of US consumption to GDP.

In looking for a substitute for the impoverished US consumer, the eyes of the world are now turned towards China. But the 2009 recovery plan relies on the traditional levers of public investment and corporate credit, which are not sustainable. Nothing of substance has yet been done to stimulate consumption through measures to alter the distribution of income (indeed the share of GDP going to profits has gone up by 10 percentage points in 10 years, largely thanks to state enterprises), or by creating a social security system which would remove the need for households to provide for their own pensions and health insurance. On the contrary, far from taking leave of state mercantilism, the crisis has revived old reflexes and stifled previous (and limited) efforts reduce subsidies to business and to establish a body of labour law.

Management of the exchange rate is emblematic here. Allowing the renminbi to appreciate, even by small steps as in the period 2005-2008, amounted to boosting consumers’ purchasing power and helping the economy to adjust. However, preserving a fixed link with the dollar and letting the renminbi follow the dollar down, as has been the case since autumn 2008, has served to perpetuate the outward-looking stance of the economy. Although it is in China’s own interest, and in spite of pressure to do so, the Chinese

leadership has so far failed to make a move in this direction. As long as it does not, any durable rebalancing of the global economy will not happen.

As for the full participation of China in global governance, there is no certainty of this either. True, Beijing has a seat at the G20 table and in the technical groups hammering out the economic and financial rules of the game. But it is one thing to occupy one’s seat and to defend one’s interests and quite another thing to assume joint responsibility for strategic choices relating to the climate, exchange rates, financial regulation and international trade. This is what the West now expects of China, and what China is clearly loath to do. Its leaders are quick to point out that China is a developing economy and, posturing aside, it is true that no country in modern times has ever been both so powerful and yet so poor. More specifically, China sorely lacks expertise in international economic diplomacy, does not have experience of the constant shuttling between international negotiations and national debate which is the bread-and-butter business of Europe, and is still an opaque and largely secretive polity. China therefore has grounds to be suspicious of a flattering, but above all binding, offer.

These questions must be resolved urgently, and the stakes are not inconsiderable. If China fails to adjust its growth and does not start to assume its new responsibilities, it is to fear that the exceptional world spirit of international cooperation which has marked the management of the crisis may not last much longer.

The column was published in the French newspaper Le Monde (30 Nov) and the German financial daily Handelsblatt (30 Nov).