The Listing Act: no more than a minor boost to EU equity markets

Streamlining of the company listing process is welcome, but more fundamental reform is needed to revive the European Union’s flagging equity markets.

There is a growing sense of unease around the trends in European primary equity markets. The number of listed companies has been declining and continues to decline, and initial public offerings by European firms are now regularly done in the United States.

This is the opposite of what European Union regulators want. They emphasise regularly that public equity should play a bigger role in funding innovative companies, and would allow a variety of retail and institutional investors to share in the risks and growth of the corporate sector.

Capital raised on European equity markets in 2022 was the lowest since 1995, at only €89 billion (Suarez, 2023). First-time public offerings (IPOs) are a diminishing subset of this total and within the EU amounted to only €16 billion (more than half of which was accounted for by one large transaction in Germany). Equity issuance on so-called junior markets, where small and medium-sized enterprises (SMEs) benefit from a lower regulatory burden, fell by roughly two-thirds, while the volume of new listings is now minuscule.

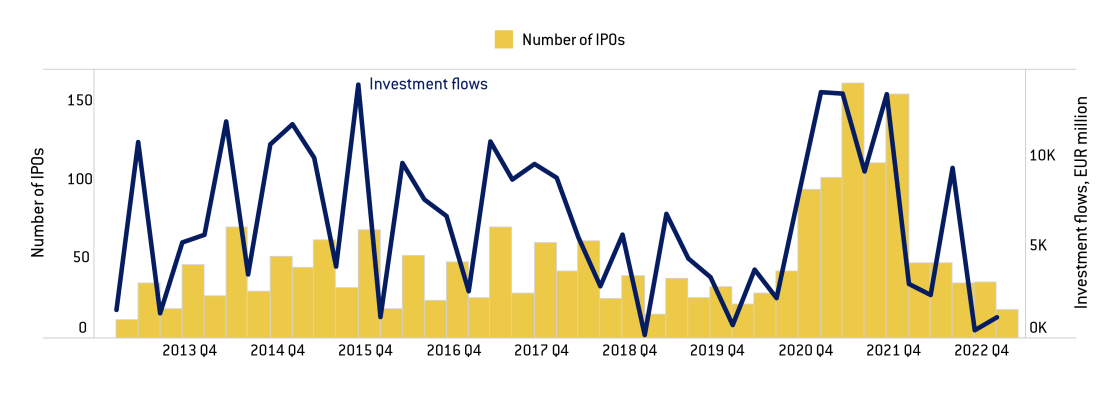

The rebound in primary listing activity in 2021 following the COVID-19 pandemic appears to have been transient. Volumes of capital raised and the number of transactions in IPOs seem to have reverted to the more lacklustre levels of previous years. Meanwhile, equity markets in the US and Asia have grown, both relative to the size of the respective economies and compared to global markets overall.

Private equity investors, which do little to foster the benefits of market liquidity and suffer from other shortcomings (Lehmann, 2020a), continue to step into the fold. Notwithstanding the disappointing issuance volumes in EU public equity markets, private equity investments registered their second-highest level ever, at €130 billion 1 See https://www.investeurope.eu/research/activity-data/. , while fundraising broke a new record.

Figure 1: IPO volumes and number of firms newly listed on European exchanges

Source: Federation of European Exchanges.

Reducing barriers to ‘going public’

Eight years on from the publication of the EU’s capital markets union plan, and despite the undoubted progress with several legislative projects, the role of EU equity markets seems in fact to have diminished. This ongoing eclipse of public equity, and of the listed company itself, has several important ramifications for the European economy, and is now the focus of new regulation in both the EU and the United Kingdom.

The European Commission in December 2022 proposed a reform of the regime that governs the listing of companies, including a ‘Listings Act’ 2 See European Commission press release of 7 December 2022, https://ec.europa.eu/commission/presscorner/detail/en/ip_22_7348. . This is inching forward in the legislative process and has been promoted as a step to revive activity in EU primary equity markets. In essence, the proposed measures seek to make life as a listed company more attractive for owners, while reducing red tape and other administrative burden involved in the listing process itself and easing disclosure and other obligations on listed companies, in particular for SMEs. Concretely:

- The Commission proposed a new directive that would allow so-called multiple-voting right shares in smaller companies. This is particularly useful where existing owners seek to preserve privileged rights while gaining access to equity capital in the public markets.

- Smaller firms would benefit from revisions to the EU’s main capital markets law (MiFID II), as requirements on brokers to charge for investment research would be eased for smaller firms. These so-called ‘unbundling’ provisions were designed to stem conflicts of interest in brokerage firms, which did not distinguish between the costs of trading and research.

- The listing process itself is to become less costly with a reduction in disclosures required in a prospectus at the time of an IPO. Smaller firms would be encouraged to list and the information that needs to be disclosed in subsequent rounds of capital raising (secondary listings) would also be streamlined.

- Once firms are listed, the requirements on disclosing possible insider information held by owners and managers would also be streamlined. This would simplify the regime in the EU Market Abuse regulation of 2014.

The Commission’s initiative proceeds in parallel with a similar reform of the listing regime in the UK, which has also seen a decline in listings. Unlike in the EU, competitiveness is a secondary objective in the mandate of UK financial regulators. A proposal issued by the Bank of England in early May essentially envisaged easing post-issuance requirements on listed companies, lowering listing requirements and integrating two market segments (standard and premium), thereby relaxing corporate governance requirements somewhat 3 See UK Financial Conduct Authority press release of 3 May 2023, https://www.fca.org.uk/news/press-releases/fca-proposes-simplify-rules-…. . UK rules on dual-class shares could also become more liberal for a limited period following an initial listing.

Trade-offs

In making the listing process more efficient, the Commission’s proposals would compromise on some of the concepts that have underpinned capital markets rulemaking since the financial crisis. A report for the Commission suggested that excessive requirements for disclosure and investor protection explained the relative absence of SME IPOs and called for a much greater differentiation of listing rules by issuer size (Fernandez et al, 2021).

Given the scarcity of listings, most of the compromises in the proposed Listing Act seem justified by the objective of attracting companies into the public market and boosting market liquidity, in particular where such changes benefit SME listings. For instance, the amendments to the prospectus rules, which govern what information is published at the time of a firm’s listing, should not materially reduce information obtained by investors (documents need to observe a 300-page limit). Companies that are already admitted to trading are to be given a more straightforward path to raise additional capital in secondary issues. This should come at minimal risks to investors because such companies are likely to have been covered by industry research already. The changes embodied in the proposed Listing Act, therefore, suggest a sensible emphasis on ‘proportionality’ in pre- and post-listing requirements. This should facilitate market liquidity and market access for smaller issuers.

Containing insider dealing and protecting investor rights have been key objectives in capital market regulation. Experience suggests that EU rules on insider dealing in the 2014 Market Abuse Regulation have been particularly problematic for smaller companies, where management and ownership functions are more often intertwined, and where it may be more difficult to identify what amounts to insider information and who holds it. For these companies, streamlined requirements for disclosure and identification of insiders seem justified, also because national supervisors will be given extra powers to spot market manipulation.

More problematic, however, may be the proposal for greater leeway for issuers in defining multiple types of shareholder rights, when they list on the dedicated SME equity markets for the first time. This of course comes at some cost to investor rights and the principle of ‘one shareholder one vote’. National authorities will have greater discretion in applying this clause, likely reflecting local corporate governance traditions. This could be particularly helpful in under-developed capital markets, such as in central and southeastern Europe where the depth of SME equity markets is extremely limited (see Lehmann, 2020b). In these markets, a listing may become more attractive for owners that seek to retain privileged control rights within a public company, though the definition of such rights and shareholder tiers will come at the cost of further fragmenting the single market.

The CMU agenda that lies ahead

Overall, the Commission’s proposal seeks to design rules that are consistent across the various national markets, and which will make listing more attractive, in particular to smaller companies. It also seeks to reflect the underdevelopment of markets in several EU states and their different corporate governance traditions. In this effort it perhaps heeds calls for a market development that is more bottom-up or led by national prerogatives, and which aims at a ‘polycentric’ CMU. Safeguarding such long-standing concepts in regulation such as transparency, investor protection and market integrity has worked for now, but may be more difficult if such variety is accommodated more broadly.

Yet, the proposed Listing Act implements largely technical changes, which by themselves will do little to instil new dynamism in EU equity markets. A listing regime that is less onerous for smaller companies will be supportive of market liquidity, but much more is needed to foster secondary market liquidity and cross-border holdings, the two central objectives of the CMU agenda.

There remain other major structural barriers to market liquidity, including:

- Inadequate funding of promising start-ups and other growth companies, which constrains firms in the pre-IPO phase and incentivises listing elsewhere;

- Lack of sufficient institutional capital in public markets, specifically from pension and insurance funds;

- Tax and corporate governance rules, which remain largely national prerogatives and continue to fragment markets and undermine liquidity, including because of long delays in recouping withholding tax on cross-border holdings;

- An often inefficient and fragmented post-trade clearing and settlement infrastructure.

Moreover, the discretion and role of national market supervisors has if anything been elevated, and little has been done to streamline procedures within the European Securities and Markets Authority (ESMA), or expand its resources.

The CMU strategy flags only some of these barriers. The next European Commission in 2024 will need to revisit this. EU countries will need to back any revised strategy more fully, recognising the central role the CMU could play in addressing Europe’s various financing shortfalls, and boosting its growth and sustainability plans.

References

Fernandez, E., H.J. Friedrich, O. O'Gorman, G. Huemer, L. Mazanec, J.G. Nieto-Márquez, L. Österberg, L. Plattner, M. Plejić, A. Vismara (2021) Empowering EU Capital Markets- Making listing cool again, Final report of the Technical Expert Stakeholder Group on SMEs, available https://ssrn.com/abstract=3858732

Lehmann, A. (2020a) ‘Private equity and Europe’s re-capitalisation challenge’, Bruegel Blog, 17 September, available at https://www.bruegel.org/blog-post/private-equity-and-europes-re-capitalisation-challenge

Lehmann, A. (2020b) ‘Emerging Europe and the capital markets union’, Policy Contribution 2020/17, Bruegel, available at https://www.bruegel.org/policy-brief/emerging-europe-and-capital-markets-union

Suarez, J. (2023) AFME ESG Finance Report Q4 2022 and Full Year 2022, AFME/Finance for Europe, available at https://www.afme.eu/publications/data-research/details/afme-esg-finance-report-q4-2022-and-full-year-2022