Nordea’s move to the Banking Union is no surprise

Scandinavian banking giant is moving to Finland. This is not just a flight from increasing taxes and tighter regulation in its current home, Sweden. N

Nordea has announced that its headquarters will move from Stockholm to Helsinki. The bank’s activities are evenly spread across Scandinavia (see Figure 1 below). So it could have chosen any of the four capitals: Copenhagen, Helsinki, Oslo and Stockholm. While senior management is rumoured to prefer the beautiful (and most southern located) city of Copenhagen, Nordea’s board has decided to move to Helsinki. That is no surprise. The official reason given by Nordea is that it wants to enjoy the regulatory framework of the banking union and to facilitate comparisons with its peers in the wider banking union setting. In that way, Nordea avoids the idiosyncrasies of country-level supervision in Sweden or Denmark. However, in my view, Nordea is also looking for the European fiscal backstop offered by the banking union.

The stability of a banking system ultimately depends on the strength and credibility of the fiscal backstop. While large countries can still afford to resolve large banks on their own, small and medium-sized countries have difficulties providing a credible fiscal backstop to any global banks they host. While Nordea is one of the smallest among the so-called global systemically important banks, it is still too large for Sweden. Moreover, earlier this year Nordea converted its country subsidiaries in Denmark, Finland and Norway into branches of the Swedish parent bank to streamline its operations (see here on branch and subsidiary structures). In this new branch structure, the full burden of a potential bail-out would fall on the home country, namely the Swedish government.

Table 1 shows that the fiscal costs of a severe systemic crisis could amount to 11.8% of Swedish GDP, if the government needed to recapitalise the largest three banks. In earlier work, we calculated an indicative hurdle rate for fiscal costs of 8% of GDP. Below that rate, countries were able to resolve a financial crisis without external assistance during the global financial crisis. Above that hurdle rate, countries needed external support from the International Monetary Fund or the European Stability Mechanism. So Sweden cannot provide a credible fiscal backstop to Nordea. The Swedish government has proposed tax increases and extra regulation for its large banks. Also the United Kingdom and Switzerland, with potential fiscal costs above the hurdle rate of 8% of GDP, have adopted policies to downsize their banking system.

Table 1: Potential fiscal costs for major countries, 2015 (as a % of GDP)

In response to higher tax and regulation burdens in Sweden, Nordea considered various other locations. What were the relocation options for Nordea? Figure 1 shows that Nordea’s banking operations are evenly spread across the four Scandinavian countries. Norway and Finland are slightly smaller and Denmark slightly larger at 28% of total operating income and 35% of total assets. Presuming that Nordea would prefer to stay within the EU, it could thus choose between Denmark and Finland. As indicated earlier senior management is said to have a preference for Copenhagen, which is also home to most of Nordea’s business. Nevertheless, Nordea has chosen Helsinki. The ECB as central supervisor of the single supervisory mechanism has no prior requirements and will treat Nordea bank as any other banks within the regulatory framework.

Figure 1: Geographic spread of Nordea

The choice of Nordea for Finland in the banking union is no surprise. Denmark would face the same problem as Sweden in providing a credible fiscal backstop to Nordea. By contrast Finland, as member of the banking union, has indirect access to the European Stability Mechanism (ESM) in the case of a severe sovereign or banking crisis. While the Single Resolution Fund is still being built up and the Council has not yet decided to provide a credit line from the ESM to the Single Resolution Fund, the ESM already provides for indirect recapitalisation of banks in case a country faces a banking crisis.

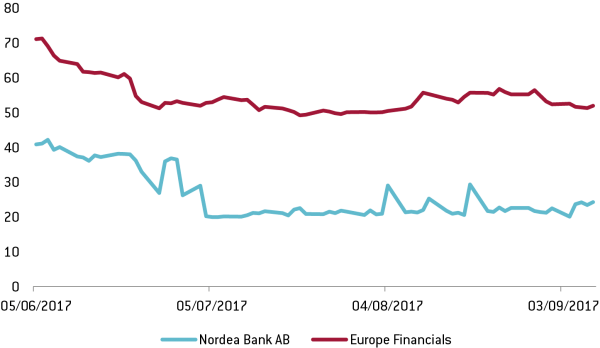

An improved fiscal backstop would suggest lower funding costs. Figure 2 shows that the spread on 5-year credit default swaps (CDS) for senior debt for Nordea AB has indeed gone down in comparison to a group of 30 European financials in anticipation of the relocation decision.

Figure 2: Credit spread on 5-year senior bonds of Nordea AB compared to European Financials

So if banks can move to the banking union, should countries also be looking to join? Non-euro-area member states can join the banking union through the mechanism of close cooperation set out in the SSM Regulation. This would give access to single supervision and single resolution, including the single resolution fund (which can operate as a multi-currency fund). Given the cross-border banking linkages between EU member states, it is plausible that most, if not all, non-euro-area member states might join the banking union at some future stage. In early July 2017, both Denmark and Sweden indicated they would consider such close cooperation by 2019. With the upcoming Brexit, outs will be even more isolated in the European Union. The outs might thus feel a stronger urge to join the major banking system of the banking union.

Nordea decided not to wait for the outcome of the political debate. First, there is substantial political uncertainty that the respective governments can convince their parliament. Second, such close cooperation would start at the earliest in two years time. All in all, Nordea’s choice to relocate its headquarters to Helsinki clearly shows that the banking union is a source of strength.

Ironically, it is also a move back to its original location. In the 1990s, Nordea merged four banks in Sweden (Nordbanken), Finland (Merita Bank), Denmark (Unibank) and Norway (Christiania Bank og Kreditkasse) into one bank. The parent bank of the new banking group Nordea was originally located in Helsinki. In 2003, Nordea moved its headquarters to Stockholm.