Assessing China’s post-Brexit globalisation strategy

As the world comes to terms with the result of the UK's Brexit referendum, what will it mean for China? The authors suggest that the short-term impact

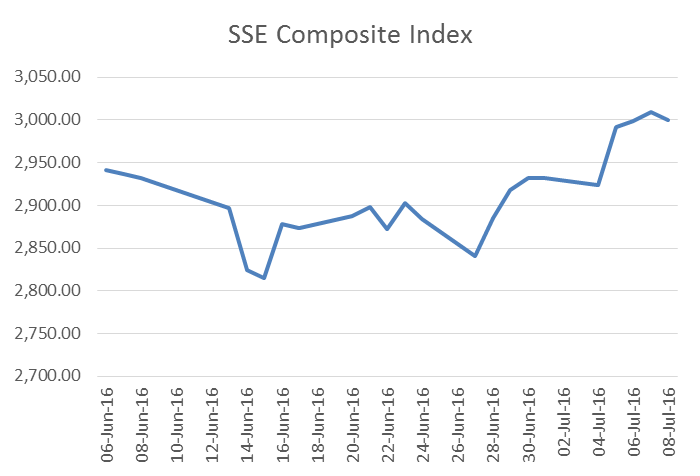

The United Kingdom’s Brexit referendum has brought about economic turmoil not only in Europe, but throughout the world. China is no exception. Following the referendum, China’s Shanghai Stock Exchange Composite Index dropped and the Chinese yuan depreciated against the US dollar (Figure 1). However, the impact in China has been mild compared to other regions of the world. This can be partially explained by China’s still limited financial exposure to the rest of the world because of capital controls.

Figure 1: The impact of Brexit on China’s stock market and the yuan

Source: CEIC database

In any event, financial variables pick up immediate effects but what matters is the longer term. The question really is whether Brexit will affect China’s globalisation strategy and, if so, how. China is the EU’s second largest trading partner and a major exporting competitor, and also an increasingly important source of investment. Among the EU countries, the UK has been an important economic partner for China. David Cameron and Xi Jinping visited each other in 2014 and 2015, with the two sides issuing in 2015 a joint declaration on Building a Global Comprehensive Strategic Partnership for the 21st Century. China no doubt views the UK as an important gateway into extending economic cooperation with the EU. If Brexit isolates the UK’s economy from the EU, China’s globalisation strategy would then be expected to be affected, at least in relation to the EU. Against this backdrop, we make an initial assessment of the impact of Brexit on China’s globalisation strategy. It is worth noting that our assessment is based on the status-quo scenario. We assume that the UK and the EU will reach an agreement in terms of their economic cooperation that will not be too different from the existing situation. In other words, we exclude for the purposes of our assessment the possibility that Brexit might bring about a much closer integration of the EU, or conversely, a fragmentation. Our analysis provides only a baseline assessment of China’s reaction to Brexit.

Impact on international trade

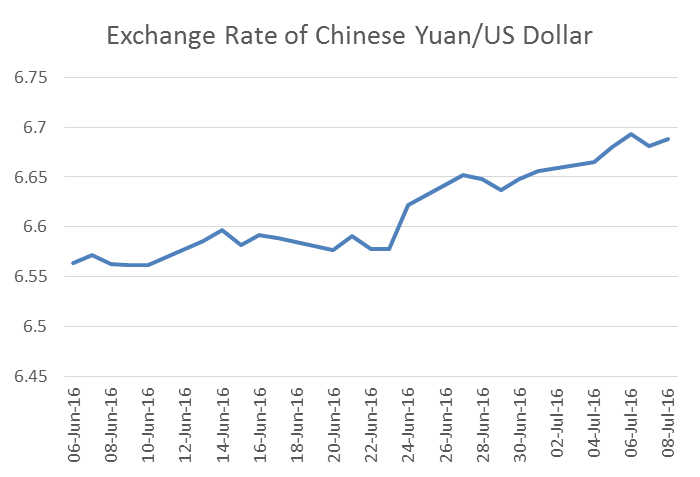

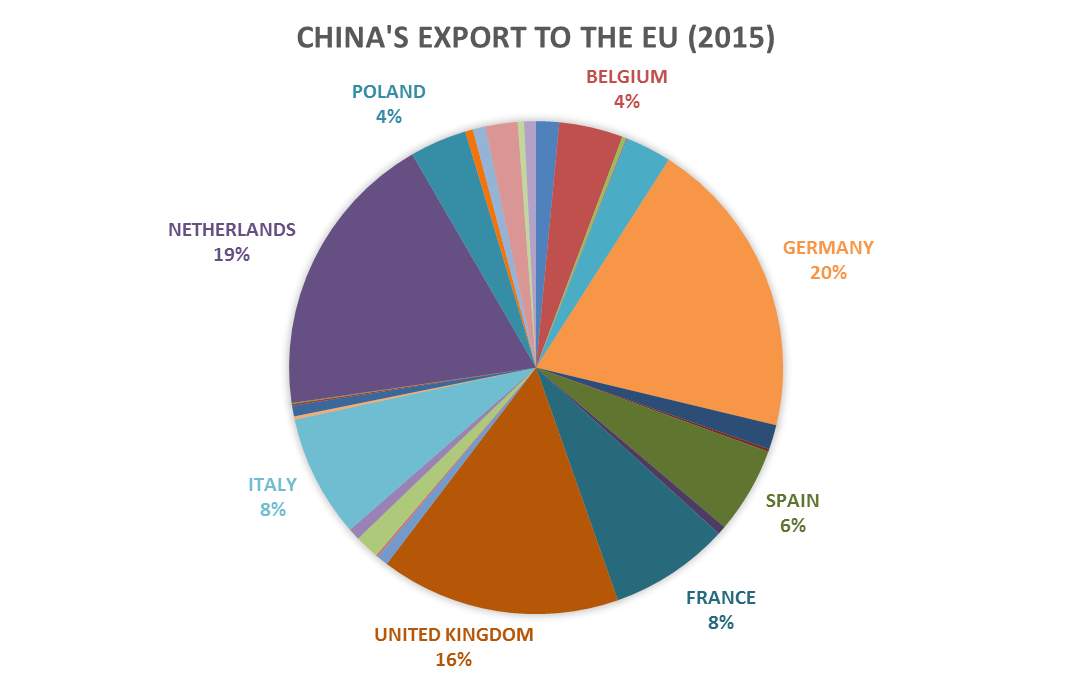

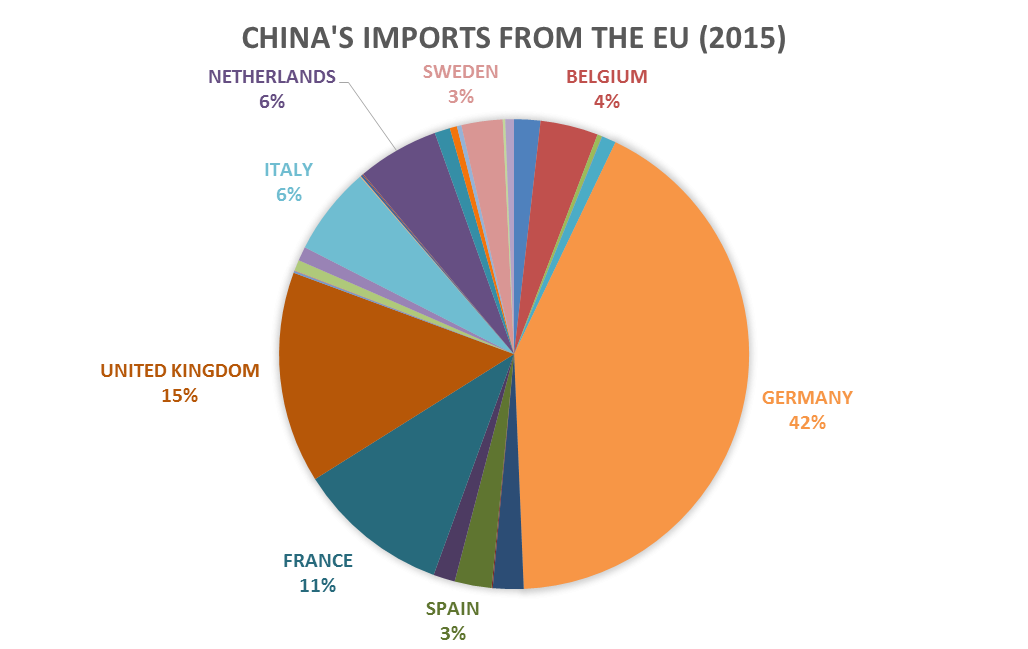

Brexit will have only a limited short-term impact on China’s trade with both the EU and the UK. There are concerns that Chinese enterprises are likely to switch their exports from the UK to other EU countries following Brexit. Actually, the distribution of China’s foreign trade with the EU is broad based. China’s five largest trading partners in the EU – Germany, the UK, the Netherlands, France and Italy – constitute 73 percent of China’s EU trade. The UK is second in this ranking, with of 15.3 percent of China’s total trade with the EU, reflecting the UK’s economic weight within Europe. The UK’s position in both exports and imports is quite balanced. In 2015, 16.7 percent of exports from China to the EU were destined to the UK compared to 20 percent to Germany; meanwhile, 15 percent of the EU’s exports to China were sourced from the UK compared to 42 percent from Germany (Figure 2). The UK is also an important provider of services to China. Figure 3 shows that Denmark, Germany, France and the UK captures the most gains from trade in services with China, within which the UK also plays an important role.

Figure 2: China’s foreign trade with the EU countries

Source: Bruegel and Eurostat. Note: Only countries with a trade share of 3 percent or more are labelled in the figure.

Undoubtedly, the UK is one of China’s most important EU trading partners. But to what extent does China’s trade with the UK hinge on the UK’s position in the EU, and would thus likely be affected by Brexit? The answer depends the proportion of China’s exports to the UK that are finally destined for other EU countries. Though such data is not readily available, we can provide a rough estimate by calculating the correlation of China’s exports to the UK and the UK’s exports to the EU.

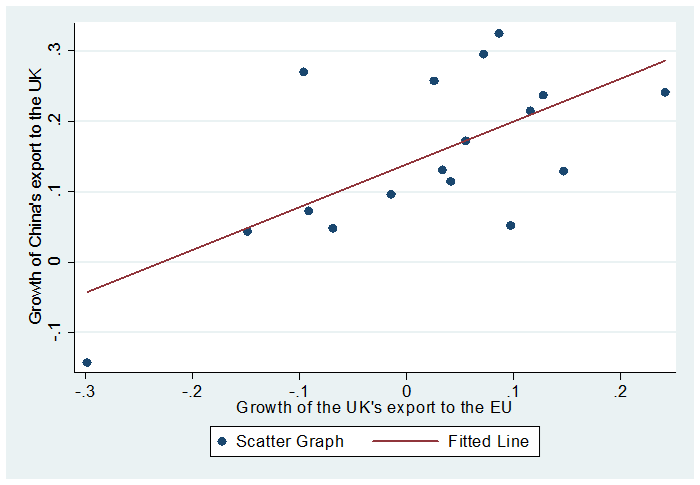

Figure 4 shows that the growth rate of the UK’s exports to other EU countries is positively associated with the growth rate of China’s trade with the UK. Quantitatively, a simple ordinary least square regression exercise shows that a rise in the growth rate of China’s exports to the UK by 1 percent leads to 0.6 percent increase in the growth rate of the UK’s trade with other EU countries. With this estimate we can make a back-of-the-envelope calculation that, given that the UK’s exports to the EU have increased at an annual rate of 1.38 percent, China’s exports to the UK are estimated to have increased by 0.09 percent as a result. As the estimated share only accounts for 0.58 percent of China’s exports to the UK, the effect would be very limited.

Furthermore, considering that the weighted average tariffs applied to goods imported to the EU are already as low as one percent, there is little room for further reductions in trade costs between the EU and the UK. It is therefore unlikely that Brexit would significantly alter China’s trade with the UK or other EU countries. More generally, since our baseline scenario includes a trade agreement between EU and UK, we doubt there will be major changes in trade flows between China and the EU/UK.

Figure 4: The correlation between China’s exports to the UK and the UK’s exports to the EU

Source: Bruegel

Note: trade data is sourced from IMF DOT database. We run a simple ordinary least square regression on the growth rate to avoid the unit-root issue.

In the long run, though, Brexit might slow down China’s free trade agreement negotiation process with the EU. This is because the UK is currently pushing for the deal from the EU side. In fact, despite China’s long-standing proposal to the EU for a free trade agreement, the EU still has major concerns over a possible agreement and has set a number of preconditions. Table 1 shows that, there are now only two non-EU European countries – Iceland and Switzerland – with a free trade agreement with China. In addition, a trade agreement between China and Norway is still under negotiation.

In the meantime, the relationship between China and the UK has entered what has been labelled a ‘golden era’. During David Cameron’s visit to China in 2013, the UK advocated a free trade agreement with China despite general opposition from other EU countries. This reflects the fact that the UK, with a comparative advantage in high-tech services, has a greater incentive to establish a free trade agreement with China.

China also views the trade relationship with the UK as a gateway to enhance trade cooperation with the EU. In the 2015 China-UK Joint Statement, the two countries explicitly stated that they “support the early conclusion of an ambitious and comprehensive China-EU Investment Agreement, and call for the swift launch of a joint feasibility study for a China-EU Free Trade Agreement”. Now following the Brexit vote, not only does the UK lose its attraction as China’s gateway into Europe, but China also needs to choose another country to break through into the EU market. China’s objective of pursuing a free trade agreement with the EU is expected to face more resistance.

Table 1. China's regional trade agreements (RTAs)

| 1. Existing RTAs | Nature | Date concluded | |

| China-New Zealand FTA | Bilateral-developed country | Apr-08 | |

| China-Singapore FTA | Bilateral-developed country | Oct-08 | |

| China-Iceland FTA | Bilateral-developed country | Apr-13 | |

| China-Switzerland FTA | Bilateral-developed country | Jul-13 | |

| China-Korea FTA | Bilateral-developed country | Jun-15 | |

| China-Australia FTA | Bilateral-developed country | Jun-15 | |

| China-Chile FTA | Bilateral-developing country | Nov-05 | |

| China-Pakistan FTA | Bilateral-developing country | Nov-06 | |

| China-Peru FTA | Bilateral-developing country | Apr-09 | |

| China-Costa Rica FTA | Bilateral-developing country | Apr-10 | |

| Mainland and Hong Kong Closer Economic and Partnership Arrangement | Domestic | Mar-03 | |

| Mainland and Macau Closer Economic and Partnership Arrangement | Domestic | Mar-03 | |

| China-ASEAN FTA | Multilateral | Nov-14 | |

| China-ASEAN FTA Upgrading Protocol | Multilateral | Nov-15 | |

| 2. RTAs under negotiation | Negotiations | ||

| began from | |||

| China-Norway FTA | Bilateral-developed country | Sep-08 | |

| China-Georgia FTA | Bilateral-developing country | Dec-15 | |

| China-Maldives FTA | Bilateral-developing country | Dec-15 | |

| China-GCC(Gulf Cooperation Council) FTA | Multilateral | Jul-04 | |

| Regional Comprehensive Economic Partnership, RCEP | Multilateral | May-13 | |

| China-Japan-Korea FTA | Multilateral | Aug-13 | |

| 3. RTAs under consideration | Joint feasibility study began from | ||

| China-Columbia FTA Joint Feasibility Study | Bilateral-developing country | May-12 | |

| China-Fiji FTA Joint Feasibility Study | Bilateral-developing country | 2015 | |

| China-Moldova FTA Joint Feasibility Study | Bilateral-developing country | Jan-15 | |

| China-NePal FTA Joint Feasibility Study | Bilateral-developing country | Mar-16 | |

| China-India Regional Trade Arrangement Joint Feasibility Study | Multilateral | 2003 | |

Source: China FTA Network, Natixis.

Impact on investment

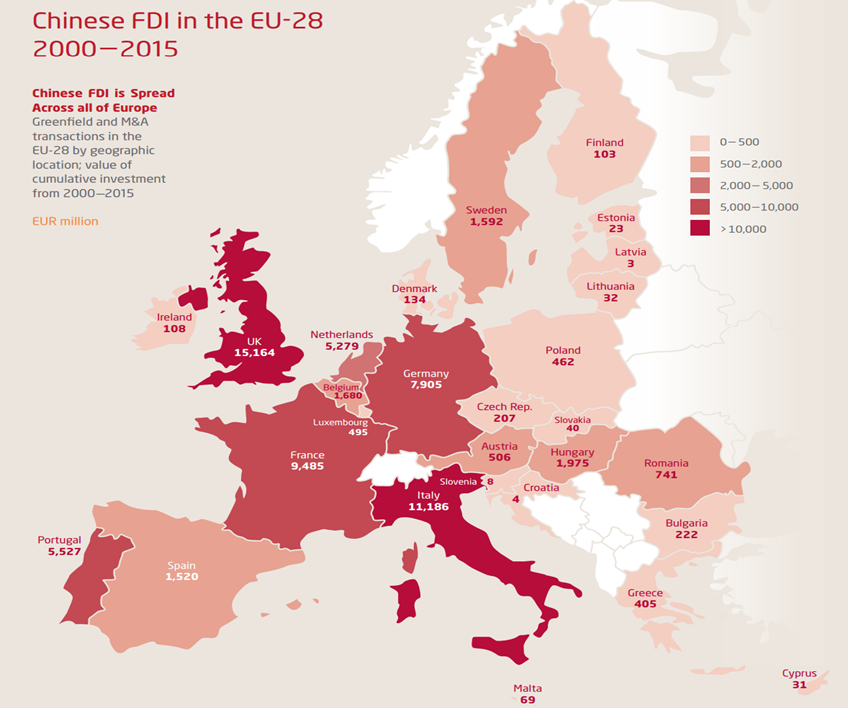

Brexit is expected to reduce Chinese investment in the UK but open up opportunities for other EU countries. Chinese investment was initially targeted at Africa, Latin America and other developing economies, but over the past few years it has gradually switched towards the developed countries including the EU. Figure 5 shows that Chinese investment in the UK from 2010-2015 reached €15.16 billion, making the UK the number one EU destination for Chinese overseas direct investment[1]. Furthermore, the two parties reached 59 agreements with a total value exceeding €54 billion during Chinese president Xi Jingping’s five-day visit to the UK in October 2015. However, the UK is not the only investment hub via which China enters the EU market. Italy, France and Germany also take an important share of China’s investment in the EU.

In other words, despite its advantages in financial services and language, the UK’s ability to attract foreign investment is likely to be substituted by other EU countries. Once the UK loses its access to other EU markets after leaving the EU, it will also give away its advantage as a Chinese investment hub in Europe. In the same vein, as London loses part of its share of financial operations related to the EU, other cities such as Paris and Frankfurt should increase their capabilities as financial centres, with each probably specialising in different issues.

Figure 5: Chinese investment in the EU (2010-2015)

Source: Thilo Hanemann and Mikko Huotari (2016) A New Record Year for Chinese Outbound Investment in Europe: A Report by MERICS and Rhodium Group

China’s real estate investment in the UK should slow down, at least in the short run. One of the most important components of China’s investment in the EU is commercial real estate. Most Chinese corporations have opted for London for their EU headquarters. In 2015, Ping An Insurance and Tai Kang Life, two of China’s major insurance companies, successfully bid for real estate projects in London, with a total value exceeding $5 billion. After Brexit, as the trade and investment uncertainties between the UK and other EU countries have risen, China’s investment in the UK real estate market can be also expected to decline.

RMB internationalisation strategy

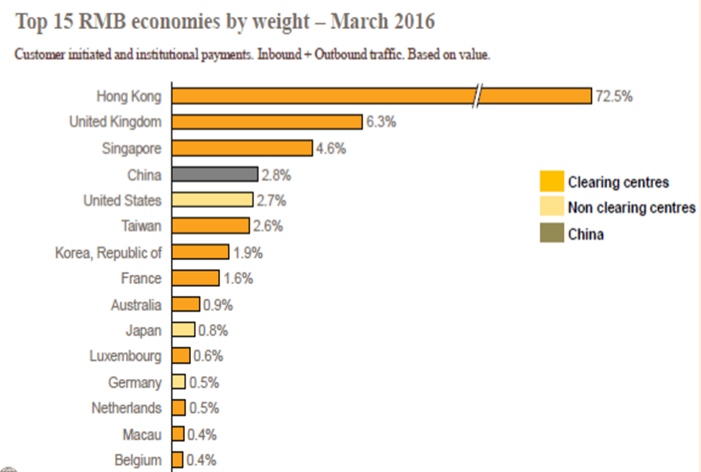

London will lose part of its attractiveness to China as an offshore renminbi centre for Europe. London is now the second largest renminbi offshore market after Hong Kong, and has the largest renminbi pool in Europe (Figure 6), accounting for 6.3 percent of all offshore transactions using the Chinese currency as at March 2016. The UK’s position in offshore RMB market reflects European companies’ increasing business transactions with China and London’s position as a gateway to Europe, which makes it an ideal city for offshore trading in renminbi.

In recent years, China and the UK have stepped up their economic and financial dialogue, reaching agreements on a number of projects, including various measures to cement London’s position as a renminbi clearing hub. However, with the UK leaving the EU, the UK will also lose its critical access to other EU markets, making it less attractive to Chinese financial investors. As such, China will have to adjust its global renminbi strategy and might need to relocate at least part of its offshore market to other cities such as Paris and Frankfurt. Luxembourg is, of course, also a good candidate.

Figure 6: RMB offshore transactions by countries

Source: Hudson Lockett, ‘UK becomes second-largest offshore RMB clearing centre’, Financial Times, 28 April 2016

International student communication

The large flow of Chinese students to the UK is not likely to be affected by Brexit. The UK has long been the main destination for Chinese students in the EU. Figure 7 shows that more than 50 percent of Chinese students studying in the EU are in the UK. As English is the only major foreign language in China, language barriers will make the international students less likely to switch their education destination from the UK to the other countries. Furthermore, in the short run, the depreciation of sterling can only help. However, the effect is expected to be temporary because the depreciation will probably reverse and, even if does not, the depreciation should to a great extent pass on to prices.

All in all, and under the assumption that no major changes occur in the EU (no further integration or disintegration), China’s economic relationships with the UK and EU should not be severalty affected by Brexit in terms of trade and exchange of students. However, Chinese investment in the UK and the role of London as Europe’s only relevant offshore renminbi centre might be reduced. Other cities should gain ground in continental Europe at London’s expense.

[1] The number we use is sourced from the MERICS report by Hanemann and Huotari (2016) as shown in Figure 5. It is larger than the Chinese official statistic for China’s outward foreign direct investment (OFDI) in the UK, but it is well known that the official number is affected by measurement error caused by the major role of offshore centres as intermediaries for OFDI.