The liquidity quandary

The risk connected to the normalisation of the liquidity condition in the Eurozone exists. It should therefore be acknowledged and its impact assessed

Last week, the eyes of the world were pointed at the US, where government shutdown had started among stalling discussions on the debt-ceiling rise. Nevertheless, the attention of (some) Europeans was briefly captured by an article in the FT, reporting that the European Banking Authority (EBA) would be considering the option to “penalise” banks reliant on ECB liquidity when running the next round of stress tests in 2014. EBA initially declined to comment, but on the next day the press reported a statement by the chairperson Enria, according to which “the EBA [had] not discussed the treatment of the LTRO in any future stress test and does not see its role in making assumptions about possible monetary policy actions.” Concerning the next stress test, “[…] as yet, no final decision on methodological aspects has been made”. The statement was largely interpreted as a denial of the rumour and European eyes quickly turned back in the direction of Washington. Perhaps a little bit too quickly, because the liquidity quandary is likely to become a prominent issue in the near future.

A liquidity update

Over the last two years, banks across the Eurozone have become increasingly reliant on the Eurosystem’s lending facilities. In the attempt to cope with the crisis’ “unconventional times”, the ECB has implemented numerous policy measures to enhance the banking system’s access to liquidity. The interest rate was lowered to historical minima, liquidity started to be allocated with a full-allotment procedure (in which demand determines supply), collateral requirements were eased in several waves and eventually two extraordinarily long-term refinancing operations with maturity of 3 years were conducted, in late 2011 and early 2012.

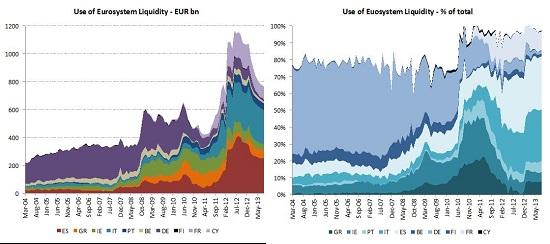

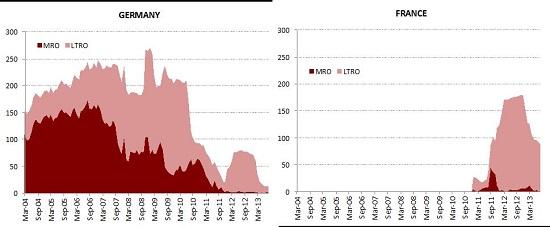

Figure 1 – Use of Eurosystem liquidity by country

Source: ECB and National Central banks

By summer 2012, the total amount of liquidity injected by the ECB via Main and Longer-Term Refinancing Operations had reached EUR 1.2 trillion. 71% of the total was concentrated in Greece, Ireland, Italy Portugal and Spain (Figure 1), with Spanish and Italian banks accounting alone for more than 50% of the whole outstanding (34% and 23% respectively).

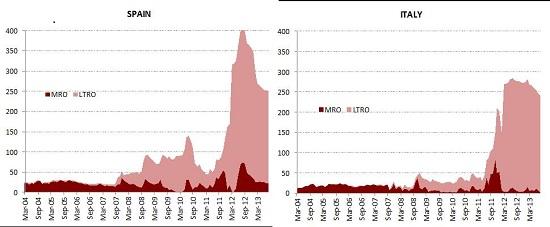

Figure 2 – Eurosystem Liquidity: Spain and Italy

Source: National Central banks

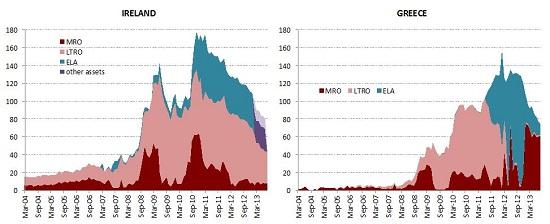

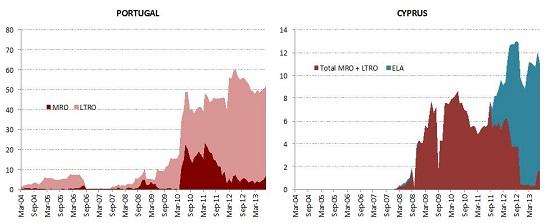

These numbers do not include the Emergency Liquidity Assistance (ELA), used in several countries to provide funds to solvent banks that exceptionally and temporarily could not access normal Eurosystem operations. In the absence of transparent statistics on ELA[1], estimates suggest the existence of a limited outstanding amount in Greece, where ELA had spiked after the Private Sector Involvement operation but has been considerably reduced since September 2012. Irish ELA was sizable, but it has been reduced by some 25bn earlier this year in the context of the promissory note deal on IBRC[2]. Belgium also made use of ELA –limited to a short period at the time of the bailout of Dexia – and recent rumour suggest Portugal had been using it too (but statistics are not detailed enough to confirm). The outstanding ELA in Cyprus is instead known to be large and has replaced almost entirely normal central bank liquidity (Figure 4).

Figure 3 – Eurosystem Liquidity: Ireland, Greece, Portugal and Cyprus

Source: National Central banks. Reference date for ELA for Greece and Ireland is end-2006

The situation is specular in the North of Europe. German banks – which relied even significantly on central bank’s liquidity in the early phase of the financial crisis – have been reduced quickly their borrowing since 2010, when private capital started to leave the south of Europe flying northbound in the search for safety. Data for France is only available from 2010 on, but it shows clearly that the reliance on Eurosystem liquidity spiked in the summer of 2011, when US Money Market Funds – to which French were particularly exposed – are reported to have massively withdrawn from Europe[3].

Figure 5 – Eurosystem Liquidity: Germany and France

Source: National Central banks

The announcement of the OMT in September 2012 seems clearly to have marked the inversion of a trend almost everywhere across Europe. There are however significant differences across countries and the comparison of Italy and Spain is striking in this respect. Spain, which was the most reliant on ECB funds, is also the country where the drop in outstanding central bank liquidity has been the most sizable. The same does not old for politically-troubled Italy, where reliance on Eurosystem’s liquidity has remained almost at the same level of summer 2012.

Stigma vs. Risk

Over the last two years European banks have been granted exceptional access to Central Bank liquidity at exceptionally easy conditions. Data shows clearly that they have made large use of it, although unevenly across Europe. This liquidity waterfall has been essential in preventing a complete collapse of the Eurozone financial system, at a time when the interbank market had frozen up and financial fragmentation was becoming the new normal of the Economic and Monetary Union. However, it also implies non-negligible risks going forward.

Central bank liquidity is exceptionally cheap, but when banks will have to start replacing it with alternative funding sources this could be expensive. Euribor rates have recently started to rise, although very slowly, pointing to a tightening of borrowing conditions on the interbank market that could continue as long as banks pay back the LTRO funds. ECB’s President Draghi himself hinted at this risk recently, on the occasion of a European Parliament hearing, when he pointed out that “while repayment of central bank credit is certainly a sign of normalization, the resulting reduction in excess liquidity can reinforce upward pressures on term money market rates". To the extent that Euribor rates are used as a reference benchmark by banks, a significant rise could translate into tightened borrowing conditions for the private sector which could have an impact on the recovery at a moment in which banks’ lending is still depressed and the gap in terms of lending rates between North and South has not been reabsorbed. Part of the reason why lending is subdued has also to do with the fact that banks used LTRO funds to engage in a carry trade on domestic government bonds, which last year were being massively off-loaded by foreign investors. As a result, banks’ holding of sovereign bonds have reached new heights almost everywhere in Europe. This not only exposes banks to the weakness of their sovereigns – inducing the “vicious circle” that has emerged as the most characteristic feature of the euro crisis – but it also raises challenges on how to deal with the resulting large government debt portfolios now that interest rate conditions started normalising.

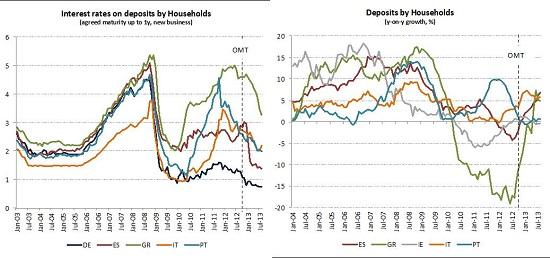

Concerning alternative sources of funding, trends in retail deposits have improved even impressively in the South, turning positive after the introduction of the OMT in September 2012, (Figure 7 shows as an example the evolution of Households’ deposits) but the interest rates that banks in the South are paying on those deposits is still higher than in Germany, and significantly higher than the rate at which they can borrow from the ECB. Debt issuance has started to revive recently as well, but it will likely take some time for things to get back to normal on that side.

Source: European Central Bank

The ECB introduced in January 2013 the option for banks to repay LTROs funds earlier, which can potentially help smooth the impact of liquidity re-absorption over time and avoid the “cliff effect” on funding costs, feared by several market participants. But it has potentially negative side effects as well. Early repayment is ultimately a way for banks to give a reputational signal, as banks that reimburse the fund earlier will be perceived as stronger. The risk is therefore twofold. Relatively weaker banks could be tempted to return funds earlier than it would be optimal from their individual perspective, in the attempt to avoid the “stigma” of keeping central bank liquidity on their balance sheet at the time stronger banks return it. If funding costs were to rise as a result of LTRO repayments, those banks that are the weakest - and cannot afford returning liquidity early - would also end up facing relatively tougher financing condition when having eventually to substitute central bank liquidity (and the impact on them could be more significant). On top of this, the LTRO phase out is going to happen in at the time of the ECB's preliminary supervisory exercise. The ECB has all the interest in conducting it in a rigorous and tough manner, and it should, because this exercise will constitutes the basis for the ECB’s reputation as a supervisor. But this also implies that the exercise could turn out to be an additional factor of stress for banks.

In conclusion, the risk connected to the normalisation of liquidity condition in the Eurozone exists. It should therefore be acknowledged and its impact assessed, but the way this should be done without the assessment being counterproductive is by no means obvious. To start with, reliance on central bank liquidity is uneven across countries. Over the last months, banks have returned in total around 350bn of the first LTRO, of which almost 90bn came from Spain (the largest borrower), 84bn from France and 59bn by Germany, followed at a long distance by Italy and Ireland, with 28bn and 27bn respectively. After these reimbursements, banks in Greece, Ireland, Italy, Portugal and Spain still accounted for as much as 550bn at the end of August, whereas German banks had already repaid almost all the (limited) funds borrowed under the second LTRO. In these circumstances, it is hard to see how it would be possible to square the circle between assessing the potential liquidity risk ahead for banks and avoiding (if the results were to be published) the formalization of an already latent stigma effect that the ECB itself has been constantly fighting over the last year. The ECB’s supervisory assessment will –according to the preliminary guidelines published today – address “key risks in the banks’ balance sheets, including liquidity, leverage and funding”, but the text is still vague on this point, which will be challenging and tricky from a communication point of view. For sure, particular attention should be devoted by the EBA and the ECB to avoid conveying potentially contradictory messages, in this year of transition. And it will also be crucial to dispel concerns about the fact that liquidity would be available in case it's needed – as ECB’s President Draghi recently suggested.

Download the underlying data on use of Eurosystem liquidity by country.

[1] The ECB has however published recently the guidelines of how ELA works, available here: http://www.ecb.europa.eu/pub/pdf/other/elaprocedures.en.pdf?29948d8a86e0bc67f16acbc995f8909b

[2] In February 2013 the Irish government liquidated IBRC and the (related) outstanding amount of ELA was reduced by EUR 25 bn, collateralised by promissory notes. The residual amount (around 10bn) corresponds to liquidity collateralised by IBRC’s assets (see Boyer and Lemangnen for detailes). The financial statement of the Central Bank of Ireland clarifies that on the occasion of the liquidation assets recorded under “Other claims on EA credit institutions denominated in euro” (where ELA is now recorded) where reclassified under two other balance sheet items. He figure here reports the increase in these two other items on the occasion of the reclassification.

[3] Not all Central Banks provide these statistics (in particular the Dutch National central Bank does not).