Fact of the week: Not one European city in the top 10 for tech talent

Two recent LinkedIn analyses show some interesting facts about work-related migration in the 21st century and how this reshapes the world’s economic e

Two recent LinkedIn analyses show some interesting facts about work-related migration in the 21st century and how this reshapes the world’s economic environment. The data shows that European countries tend to be net losers from migration of skilled workers and that they lag behind the US and especially India in the ranking of cities able to attract tech talents.

There are some long-lived and recurrent questions in economics. For example, where, how and why do workers migrate? which countries are successful in attracting skilled talents? who is gaining and who is losing from the brain train around the world?

In the age of big data, these questions can find interesting answers from the social networks. In particular, from a business-focused one such as LinkedIn, which has access to career data for more than 300 million professionals. It goes without saying that the analysis is seen “through the lens of LinkedIn data”. This means that the sample is limited to people having a LinkedIn profile - which could imply some degree of self-selection. But insights are very interesting.

A first analysis looks at job-related migration between November 2012 and November 2013, trying to understand which countries gained and lost from this migration, as well as what the characteristics of the LinkedIn members that decided to relocate their careers are. LinkedIn’s Lindsay Ahearne determined the geographic movements of the members in the sample by looking at every new position that was added to their LinkedIn profiles between November 2012 and November 2013, limited to those that included a regionally specific location different from the one of the previously held position. Individuals were also grouped according to their different skills (to identify the skill categories that could be found uniquely among movers), industries and business functions (to determine those that are most likely to move).

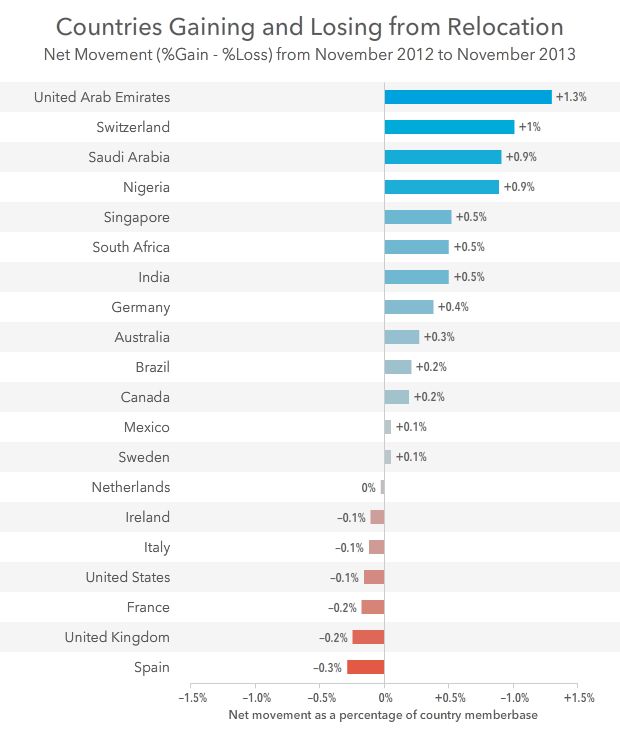

This work yields an insightful ranking of countries, ordered in terms of the net inflows of workers registered over the period between November 2012 and November 2013 (figure 1).

As a percentage of the total country workforce, the United Arab Emirates is the country that experienced the biggest inflow (75% of which is found to come from outside the Middle East). Somewhat unsurprisingly, LinkedIn profiles reveal that these immigrants were mostly architects and engineers. Top gainers from relocation include two Gulf countries (UAE and Saudi Arabia); two European countries (Switzerland and Germany); Nigeria and South Africa; India and Singapore.

The effect of the European crisis is strikingly evident. Among EU countries, Germany had a net gain of 0.4% of total labour force, with more than 60% of inflows coming from another European country. Ireland, Italy, France and especially Spain registered negative balances, of -0.1%, -0.1%, -0.2% and -0.3% respectively. Concerning Spain, LinkedIn data show that 60% of emigrants remained within Europe while 20% moved as far as to Spanish-speaking countries in Latin America.

In terms of skills uniquely identified in movers, Math, Science, Technology and Engineering seem to play a particularly important role. In terms of industries, movers are found to work mostly in media and entertainment; professional services; oil and energy; government, education and non-profit but most importantly, technology-software.

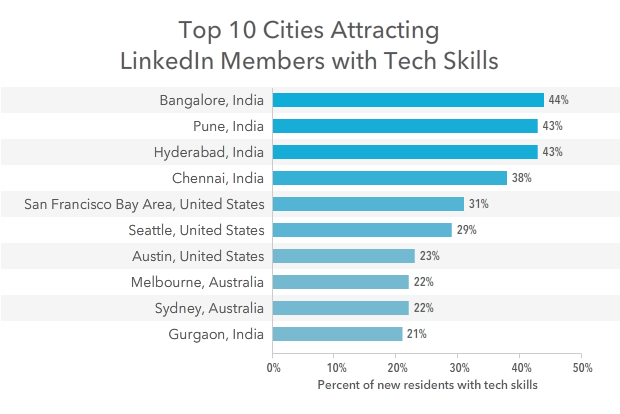

Which lead us to a different but related LinkedIn analysis, looking at what are the 21st century’s technology “hotspots”, which are successful in attracting migrants with tech skills. Sohan Murthy looked at cities that saw at least 10,000 new residents between November 2012 and November 2013, and computed the percentage of new residents with technology skills.

The results (figure 2) are quite striking. Five out of ten cities attracting people with tech skills (especially IT infrastructure and system managements; Java development and web programming) are located in India, including the first four of the list. San Francisco only comes fifth, followed by two other US cities and two Australian.

No European city at all makes it to the list. For the 52 cities looked at in the study, the median percentage of new residents with tech skills was 16%, or just under 1 in 6; in many of the Indian cities, its more than double that figure. European cities are the real laggards: the percentage of new residents with tech skills was 18% in Berlin, 15% in Paris, 13% in Madrid and 11% in Paris.

The trend obviously mirror the Indian ongoing technology boom, in a still rather “virgin” environment. Kunal Bahl - founder of Snapdeal, a wannabe Indian Amazon - told USA Today in 2011 that India offers huge opportunity “because there are no mature companies, like Google and Microsoft, over there. The feeling is like in the U.S. in 1999."

But there may be more to that.. Research by Vivek Wadhwa (Stanford) revealed that half of Silicon Valley start-ups were launched by immigrants, many of them educated in US top universities. But he also noticed that "for the first time, immigrants have better opportunities outside the U.S." because, among other things, of rather strict immigration laws and California's steep cost of living. Bahl himself, who studied in the US and spent some time working at Microsoft, reportedly wanted to initiate his company in the US but eventually went back to India because of visa problems.

And this is also why the tech industry - at the (by now almost) desperate search for engineers - is supporting the introduction of specific “start-up visa” for high-skilled workers in the US. The insights provided by this data is particularly important in the context of the recent discussions on the US immigration reform, but it is not without implications for Europe, which is at the bottom of the ranking as far as attracting tech talent is concerned.

From that position, the US looks far ahead, but the new really hot tech hotspot are not even in sight.

Details about the sampling methodology used is provided in the two LinkedIn analyses here and here.