Dominique Strauss Kahn's Cambridge speech

Dominique Strauss Kahn gave a very interesting speech here in Cambridge on Friday where he presented a “tale of three trilemmas” to understand globali

Dominique Strauss Kahn gave a very interesting speech here in Cambridge on Friday where he presented a “tale of three trilemmas” to understand globalization challenges and how Europe fits in it.

It provided a quite a provocative way of looking at the international monetary system, globalization and Europe all at once and the articulation he sketched offers a thought-provoking framework that I feel compelled to share (maybe a bit parochially because some work by Bruegel is quoted in it).

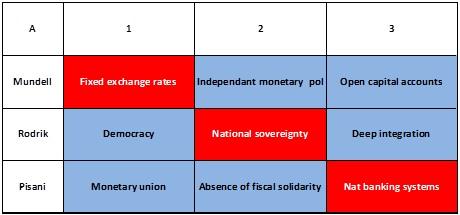

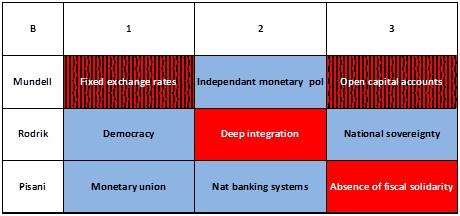

Essentially, DSK revisits the impossible trinity of Mundell-Flemming, explores the antagonistic triangle presented by Rodrik (watch a lecture on the book here) between deep global economic integration, democracy and national self-determination and finally explores a specifically European trilemma presented by Pisani-Ferry between monetary union, fiscal union and financial policy.

DSK concludes by suggesting that this three trilemmas framework presents the following policy trade-offs: flexible exchange rates, roll back of national sovereignty in favour of international economic cooperation and supranational arrangements and finally, and in Europe, the abandon of national banking systems in favour of a mechanism that allows sovereign default and supranational banking resolution.

§ The table A illustrates this particular policy choice to the questions raised by each trilemma but it is also relatively idealistic as DSK points out.

§ Table B is probably a more realistic picture of the word where tinkering with the impossible trinity is widespread (China, India), where national sovereignty is more challenging to forgo than initially thought and so international coordination and supranational efforts remain limited and finally Europe manages slowly but surely to push through a form of fiscal union.

Interestingly, for a former IMF MD and a globalization enthusiast, he ends up conceding that given the limits of international economic policy coordination, taming financial globalization might prove not only necessary but also desirable. This is something that he had already started to push while at the Fund with a major U-turn on the doctrine surrounding capital controls but he seems to take it a step further here.

These conclusions are quite bold: realistic on the fact that flexible exchange rate regimes are unlikely to be imposed every where anytime soon, somewhat pessimistic on the future of international economic policy coordination and hopeful on the ability of Europe to push through a form of fiscal union. There is a case to be made for more pessimist scenario where Europe struggles to move towards a real closer fiscal integration and stays with the current framework to manage fiscal transfers. The question is therefore whether Europe can use the ESM as a stepping-stone towards fiscal union or whether we are bound to settle for this secondary and disruptive way of delivering a more complete monetary union. This question is left without answer…