When will the European Union finally get the budget it needs?

The EU budget needs radical reform, but certain conditions must be in place for it to succeed.

Even 20 years ago, the European Union’s budget was being described as a “historical relic” (Sapir et al, 2004). It remains outdated and is not fit to face the EU’s current policy challenges: the green and digital transition, wars in Ukraine and the Middle East, and migration, among others.

In addition, much more is now expected from the EU than previously. Member countries ask the EU to help find solutions to old and new problems. Future enlargement, which could bring the EU to 35+ members, will further increase demands on the budget.

To meet expectations and tackle current and future challenges, the EU budget thus needs radical reform, on both the revenue and expenditure sides.

Like any other budget, the EU budget can be analysed through: (i) its size, (ii) its composition, and (iii) its contribution to macroeconomic stability. For political, institutional and legal reasons, the EU has had been adjusting the budget at the margin, without major changes to any of these areas:

- The EU budget has remained at 1 percent of EU GDP since the end of the 1980s (about €160 billion to €180 billion annually). Only in response to the pandemic was EU expenditure expanded in an unconventional way, through the creation of the Recovery and Resilience Facility (RRF), the core of the NextGenerationEU (NGEU) post-pandemic recovery programme. The RRF is outside the Multiannual Financial Framework (MFF, the EU’s seven-year budget cycle), and is scheduled to expire in 2026.

- In terms of composition, the share of budget that goes to the Common Agricultural Policy and cohesion funds has eroded gradually but the structure has remained broadly unchanged. Legal and institutional loopholes have been exploited to adjust the budget, but in an ad-hoc fashion, rather than systematically.

- The EU budget notoriously falls short in its contribution to cyclical stabilisation, in part because of its small size and the fear that countries would not create sufficient fiscal space if they knew the EU would come to the rescue in the event of a negative shock. Most of these concerns are misplaced, as they could be addressed through appropriate criteria to be eligible to benefit from EU support. However, it is debatable whether limited political capital should be invested upfront in creating a central stabilisation instrument.

It is time to overhaul the EU’s public finances, though for this to be done, certain political and institutional conditions are necessary.

Embracing a European public goods logic

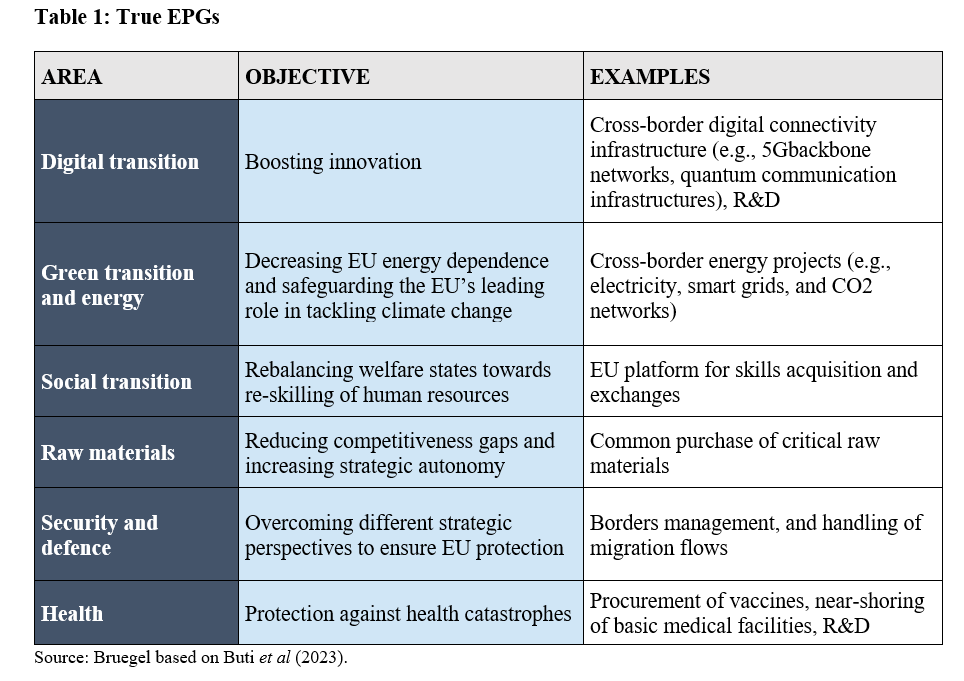

A reformed budget should embrace a European public goods (EPGs) approach, meaning that it should focus on spending in areas where the EU can bring real added value. EPGs can be classified into ‘true’ EPGs that are financed and delivered at EU level, and projects pursuing EU priorities financed by the EU, but for which delivery is done at national level (Buti and Papacostantinou, 2022).

In the true EPG category, projects should in principle be politically less contentious than other forms of EU spending, for at least two reasons. First, they undercut arguments about juste retour, or net balances, according to which each EU country tends to subtract how much money it contributed to the EU budget from how much it got back, without considering wider impacts of spending. Second, true EPGs would remove the risk of moving to a ‘transfers union’. Hence, spending on true EPGs should reduce tensions between ‘creditor’ and ‘debtor’ countries.

Identifying true EPGs should rest on the theory of public goods and the economics of fiscal federalism, taking into account the specific features of the EU institutional system 1 For a seminal contribution, see, Fuest and Pisani-Ferry (2019). Buti et al (2023) specifiedthat the requirements for defining an EPG are less strict than what the theory of public goods would dictate: the list in Table 1 includes also imperfect and mixed public goods. . Table 1 shows examples 2 These broadly correspond to the European priorities identified by the informal European Council in Versailles in March 2022. .

Financing and delivering true EPGs could rely on existing EU programmes, which would be revamped and refocused on cross-country projects. For example, some parts of the REPowerEU plan to reduce dependence on imported fossil fuels could support common initiatives at EU level; the same applies to other parts of NGEU, including the Connecting Europe Facility, InvestEU and the Horizon Europe research initiative. If reformed to allow financing with EU resources and devoted to EU-wide interventions, the Important Projects of Common European Interest would offer a very useful tool as part of a reformed EU industrial policy (Tagliapietra et al, 2023).

The second broad category of expenses involves transfers to EU countries: financed at EU level but delivered at national level. Cohesion policies and some parts of the Common Agricultural Policy take the biggest chunks of the EU budget. Increasing their effectiveness is vital to pursue the goal of cohesion. Rethinking the approach could build on the experience with the RRF, in particular its focus on both reforms and investments in exchange for financial support, and its performance-based approach. EU programmes involving transfers to member countries should be designed in line with these two aspects, moving where possible from an output-based to an outcome-based approach to make sure that such projects really make a difference and do not only focus on intermediate objectives (see Darvas et al, 2023).

Credible revenues

The credibility of such spending programme would rely on the robustness of EU revenue. Currently, several so-called own resources fund the budget, including customs duties, a small share of value-added tax receipts, a levy on non-recycled plastic packaging waste and contributions from countries based on their gross national incomes (GNI; this last one is not really an ‘own’ resource).

Traditionally, spending has driven revenue. When new priorities arose, new spending was agreed and the necessary revenue found, usually through adjustments to the GNI-based resource. However, a reformed EU budget supplying EPGs cannot rely on the good will of EU countries. New, permanent revenue needs to be part of the equation.

The European Commission has proposed several future own resources (European Commission, 2023):

- Levies from the EU carbon border adjustment mechanism (CBAM), in force since October 2023 but will generate resources only from 2026;

- Revenues from sale of emissions allowances from 2024 (and from and new emissions trading system for transport and buildings from 2028);

- A contribution computed based on corporate profits, temporarily from 2024 and ultimately replaced by a charge on part of the profits of large corporations once a new EU tax base is in place (the Business in Europe: Framework for Income Taxation, or BEFIT);

- A share of the revenues from the re-allocation of taxing rights to some of the profits of the world’s largest companies under the so-called Pillar One of the international tax deal brokered by the Organisation for Economic Co-operation and Development, if and when it is finalised.

Given its European features, the resource based on corporate income taxation appears a promising option, provided that a political consensus can be found in support of the Commission proposal. More broadly, the green and digital transitions provide a new set of ‘European public bads’ (EPBs)

3

Definition courtesy of Heather Grabbe.

that need to be taxed and can provide revenue. Some levies on environmental ‘bads’ (eg non-recycled plastic packaging and carbon emissions) are already enacted or under consideration, but one could think imaginatively about matching true EPGs and EPBs.

The other side of the financing coin is represented by bonds issued by the European Commission, the amount of which has grown rapidly since 2020, reaching a stock of over €400 billion. Since the start of monetary tightening, interest rates on EU bonds have increased relative to national debt (Claeys et al, 2023). As to the former, the issuance since January 2023 of single branded EU-Bonds rather than separately labelled bonds (“unified funding approach”) should help increase their liquidity. But the latter is more important: the key issue is that investors and markets do not see the EU as a permanent bond market player with its bonds backed by a credible stream of revenue. Therefore, the two sources of financing are linked inextricably

4

Although, legally, borrowing can be considered as an ‘own resource’, as argued bySteinbach (2023), the credibility of the EU budget revenue rests on real own resources.

: credible own resources would make common EU bonds more attractive by ensuring that there are no doubts over repayment.

The ‘triple-T’ conditions

Will such an ambitious reform of the EU budget become a reality? Three conditions need to be in place to move towards a new fiscal equilibrium in the EU: trust, threat and time – the ‘triple-T’ (Buti and Fabbrini, 2023). These apply also to the reform of the EU budget.

First, credible, enforceable (and enforced) fiscal rules are a prerequisite for trust among EU countries, and between them and EU institutions. Second, a shared perception of an internal or external threat can push countries to cross red lines and to allocate more resources to the EU level. Finally, time is needed so that national policymakers can internalise the advantages of supranational solutions provided by a reformed EU budget.

The response to the pandemic showed how European solutions might prevail. Trust was fostered by the nature of the shock, which could not be attributed to national policy mistakes. The response was substantial and decisive, although tempered by NGEU’s temporary nature and focus on transfers rather than on common projects.

The response to the pandemic also benefitted from unique political and institutional conditions, including a German chancellor not seeking re-election, a French president with a strong European focus and a high probability of re-election, and a new European Commission with a strong mandate to pursue a green new deal. Favourable political conditions are crucial because it is difficult to believe that an ambitious reform of the EU budget could happen without freeing MFF adoption from vetoes exercised by individual countries. Moving to majority voting on the EU budget would represent a key step in rebuilding trust (Manifesto, 2023). The forthcoming European elections campaign provides the opportunity for such a crucial debate.

References

Buti, M., A. Coloccia and M. Messori (2023) ‘European Public Goods’, VoxEU, 9 June, available at https://cepr.org/voxeu/columns/european-public-goods

Buti, M. and S. Fabbrini (2023) ‘The Political Determinants of Fiscal Governance in the EU: Towards a New Equilibrium’, Politics and Governance, 11(4): 112-21

Buti, M. and G. Papacostantinou (2022) ‘European Public Goods: How we can supply more’, VoxEU, 31 January, available at https://cepr.org/voxeu/columns/european-public-goods-how-we-can-supply-more

Claeys, G., C. McCaffrey and L. Welslau (2023) ‘The rising cost of European Union borrowing and what to do about it’, Policy Brief 12/2023, Bruegel, available at https://www.bruegel.org/policy-brief/rising-cost-european-union-borrowing-and-what-do-about-it

Darvas, Z., L. Welslau and J. Zettelmeyer (2023) ‘The EU Recovery and Resilience Facility falls short against performance-based funding standards’, Analysis, 6 April, Bruegel, available at https://www.bruegel.org/analysis/eu-recovery-and-resilience-facility-falls-short-against-performance-based-funding

European Commission (2023) ‘An adjusted package for the next generation of own resources’, COM(2023) 330 final

Fuest, C. and J. Pisani-Ferry (2019) ‘A primer on developing European public goods’, EconPol Policy Report 16, ifo Institute, available at https://www.ifo.de/en/publications/2019/working-paper/primer-developing-european-public-goods

Manifesto (2023) ‘The European Union at the time of the New Cold War: A Manifesto’, VoxEU, 4 October, available at https://cepr.org/voxeu/columns/european-union-time-new-cold-war-manifesto

Sapir, A., P. Aghion, G. Bertola, M. Hellwig, J. Pisani-Ferry, D. Rosati ... P.M. Smith (2004) An Agenda for a Growing Europe: The Sapir Report, Oxford University Press

Steinbach, A. (2023) ‘How can the EU issue debt to finance EU public goods’, Bruegel Newsletter, 15 September

Tagliapietra, S., R. Veugelers and J. Zettelmeyer (2023) ‘Rebooting the European Union’s Net Zero Industry Act’, Policy Brief 15/2023, Bruegel, available at https://www.bruegel.org/policy-brief/rebooting-european-unions-net-zero-industry-act