Income inequality hardly changed during the COVID-19 pandemic

Contrary to expectations, there was no widespread increase in either within-country or global income inequality during the pandemic

When the COVID-19 pandemic hit in 2020, several analysts predicted increases in within-country inequality. For example, Furceri et al (2022)

1

The first version of the paper was prepared in 2020.

showed that major epidemics over the past two decades have raised income inequality. They warned that in the absence of long-lasting supportive policies to protect the vulnerable, the COVID-19 pandemic would increase inequality significantly.

Stantcheva (2022) summarised early research on the impact of the pandemic on inequality. She concluded that COVID-19 had exacerbated inequalities in various ways, with differing impacts on income, consumption, savings, job losses, opportunities for remote work, genders, regions, sectors and occupations, among others. The overall employment impact of the pandemic was less severe than what happened after historical recessions (thanks to massive fiscal support packages), but there seemed to be an adverse distributional impact: less-educated workers, who tend to be poorer than better-educated colleagues, suffered far worse than others from COVID-19-related job losses during the first half of 2020 (Darvas, 2020; Darvas, 2021).

These findings suggested an increase in income inequality, but what does more recently available data show in terms of income-distribution developments in 2020 and 2021, both within and across countries?

Within-country income inequality

The most recent version of the Standardised World Income Inequality Database (SWIID) of Solt (2020) includes Gini coefficients

2

Data from SWIID version 9.6 of December 2023. The Gini coefficient is a summary measure of income inequality and ranges from zero (everybody earns the same) to one (one person earns everything). It is often multiplied by 100. Some researchers prefer other income inequality indicators, such as the income share of people at the bottom and at the top of the income distribution. I have found that such income shares have a high correlation with the Gini coefficient across countries at a point in time and across years for a particular country.

for 84 countries (accounting for 73 percent of the world population) for both 2020 and 2019, 74 countries (52 percent of the world population) for 2021, and 30 countries (21 percent of the world population) for 2022.

The are two main income concepts for inequality measurement: market income and disposable income. Market income is defined as pre-tax and pre-transfer income, while disposable income adds transfers (from various sources: government, private donors, non-profit organisations) and subtracts income taxes

3

Note that market income can also be influenced by the government via, for example, minimum wage policies, while taxes can also influence how much gross income a company pays to its employees. See Solt (2020) for a discussion.

. Market income inequality went up in 23 countries in 2020 compared to 2019. In another 23 countries, there was no change, and in 38 countries inequality actually fell. Thus, contrary to expectations, COVID-19 did not result in widespread income inequality increases. The number of countries with falling inequality after redistribution (disposable income inequality) was even slightly higher at 43. This suggests that redistribution might have reduced the adverse inequality effects of the pandemic.

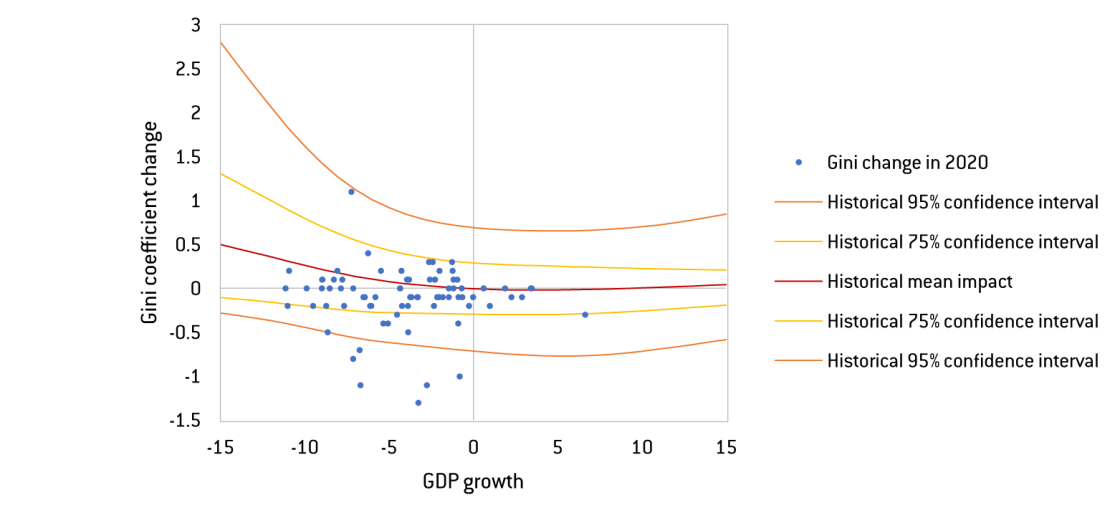

Figure 1 shows the association between the change in GDP and disposable income inequality. It compares the historical association from 1960-2019 with 2020 developments. The solid lines indicate my estimates

4

See Darvas (2021) for the methodology.

based on 1960-2019 data: the dark red line shows the mean impact; the yellow lines show the historical 75 percent confidence interval, and the light red lines show the historical 95 percent confidence interval. The line for the mean impact shows that in times of positive growth, the average change in inequality was zero, while at times of negative growth, inequality increased on average. The confidence intervals confirm that deeper recessions were more likely associated with rising inequality, though there were some occasions when inequality declined, even in deep recessions. The blue dots show actual data for 2020 for 80 of the 84 countries with available data, for which GDP change ranged between -15 to +15 percent in 2020.

Figure 1: The association between GDP growth and Gini coefficient change: 2020 compared to 1960-2019

Source: Bruegel based on version 9.6 of the Standardised World Income Inequality Database (SWIID) of Solt (2020) for the Gini coefficient, and the October 2023 IMF World Economic Outlook database for 2020 GDP growth. Note: The Gini coefficient is measured on the 0-100 scale. The 2020 values of four countries are not included in the figure because they suffered from a GDP drop of more than 15 percent. Inequality changed in these countries by -0.2, 0, 0, +0.1 – well below the historical mean association.

While most of the 2020 developments in different countries (the blue dots in Figure 1) are within the historical 75 percent confidence interval, the bulk are located below the historical mean value. These findings suggest that 2020 growth/inequality developments were, in most cases, in line with historical developments, but a GDP decline tended to be associated with a lesser inequality increase than seen historically, or even with an inequality decline. Out of 84 countries with available data, there were eight for which the inequality decline was outside the 95 percent historical confidence interval, signalling highly unusual developments.

What could explain the relatively limited impact of falling GDP in 2020 on inequality? The massive fiscal stimulus packages adopted in the wake of the pandemic likely not only dampened the average social impact of the pandemic recession, such as the drop in employment, but were also effective in mitigating the adverse distributional impacts

5

Other factors, including lower incomes for the rich because of falling asset prices and bankruptcies, could have also played a role. Various characteristics of the pandemic recession in 2020 were different from earlier recessions, which might also explain why the income-inequality impact was less adverse than the historical average.

.

Data from four countries with the largest Gini-point increases in market inequality in 2020 – increases of at least one point on a 1 to 100 scale – illustrates this hypothesis. In three of these countries, disposable income inequality increased less than market inequality or even declined, again underlining the effects of redistribution. The four countries are Brazil (market +1.2, disposable -1.3), Colombia (both increased by 1.1), Norway (market +1.2, disposable +0.3) and the United States (market +1.0, disposable -1.1).

Thus, the US was particularly effective in reducing disposable income inequality in 2020, despite an increase in market inequality. The following measures taken by the US likely contributed to this outcome:

- Unemployment benefit schemes (which are otherwise not very generous in the US) were extended, including, for the first time, to freelancers and gig workers;

- A lump-sum payment of $1,200 was made to Americans earning up to $75,000, a reduced amount to those earning from $75,000 to $99,000, and an additional $500 per child;

- The Paycheck Protection Program for small and medium-sized companies (loans with interest rates of just 1 percent, which can be forgiven if companies do not fire workers);

- Additional healthcare spending;

- Tax credits for retaining employees.

In the EU, the largest increase in market inequality was in Italy, by 0.6 Gini points, while disposable income inequality went up only by 0.1, also reflecting the effect of redistribution.

In the world’s two most populous countries, China and India, income inequality marginally declined in 2020 (market -0.2 and disposable -0.1 in China; both fell by 0.1 in India).

Pandemics and recessions might prove to have delayed effects on income inequality, as demonstrated by Furceri et al (2022). Nevertheless, available data for 2021 does not suggest a delayed general increase. In 2021, market inequality went up in 15 countries (out of the 74 for which data is available), while in 25 it remained unchanged and in 34 it fell. Some redistributive policies might have been ended since there were more countries – 22 – where disposable income inequality increased in 2021. Still, the countries where disposable income inequality was unchanged (23) and declined (29) outnumber those that experienced an increase

6

There are too few observations for 2022. Nevertheless, I note that income inequality went up in less than a third of the 30 countries for which data is available.

.

On the other hand, fiscal support measures likely played a role in the inflation surges of 2021-2022, and inflation might impact the poor more adversely than the rich. As fiscal support measures implemented during the pandemic and in response to the subsequent energy price shock are gradually withdrawn, income inequality might pick up.

Thus, income inequality went up only in about a quarter of the 84 countries for which 2020 data is available

7

In some other aspects, poorer people suffered more than richer people in 2020. For example, Ashraf (2020) found a strong negative association between COVID-19 infections and deaths and socio-economic circumstances.

, despite good reasons to think the effect might have been more severe – such as recessions often increasing income inequality, and a higher rate of job losses during the COVID-19 pandemic among poorer, less-educated workers than among their richer, well-educated counterparts.

European and global income inequality

Income inequality is usually measured at the country level. This has a clear rationale since social policies that redistribute from the rich to the poor are predominantly implemented at the country level.

However, other reference groups can be considered, both narrower and broader than a country. For example, people might be interested in their relative income position in their close neighbourhood. Comparison of incomes with people in other countries is also relevant, including in the European Union, which has common social priorities. Broader, global income inequality is also a relevant concept

8

Income inequality indicators for the whole world are not available from official sources, while Eurostat’s inequality indicators for the EU are inappropriate, because Eurostat’s EU-wide and euro-area-wide indicators are weighted averages of country-specific indicators. However, inequality indicators for a broader group cannot be calculated as a weighted average of subgroup indicators partly because of the differences in average income in different countries and partly because of differences in within-country income distributions. Note that US income inequality indicators are not calculated as a weighted average of indicators from the 50 US states and Washington DC, but by pooling together income data from all households living in the US and calculating income inequality indicators from this pooled distribution. See Darvas (2019) for a discussion of the problems with Eurostat’s EU-wide and euro-area-wide income distribution indicators, and with estimating income inequality indicators for groups of countries. A number of other institutions and academics also estimate global and regional inequality indicators incorrectly.

.

Predictions were also made about changes in global income inequality during the pandemic. Deaton (2021) and Adarov et al (2022) hypothesised that global income inequality likely increased in 2020, while Darvas (2021) suggested relatively small increases in global income inequality.

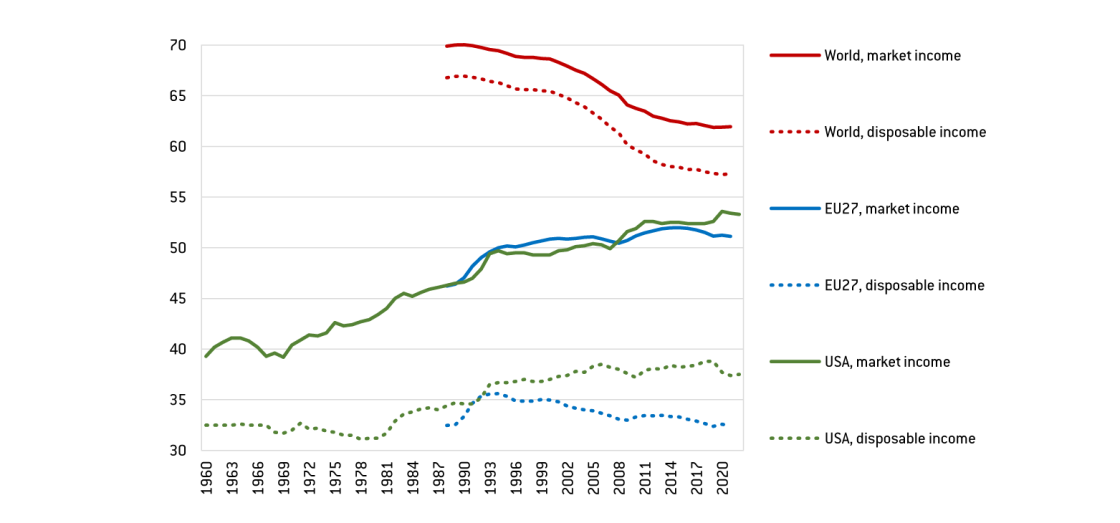

In fact, calculations of global income inequality using the most recently available data suggest that global income inequality remained practically unchanged in 2020: market inequality increased by a mere 0.03 Gini points (when Gini is measured on a 0-100 scale) compared to 2019, while disposable income inequality declined by 0.11 Gini points in 2020 (Figure 2)

9

Data is available in Bruegel’s global and regional Gini coefficients dataset: https://www.bruegel.org/dataset/global-and-regional-gini-coefficients.

. There were minor increases in 2021 (0.03 in market inequality and 0.06 in disposable income inequality).

In the EU, there was also a small increase in overall income inequality in 2020: 0.20 Gini points for disposable income – contrary to scenarios presented in Darvas (2021), which hypothesised larger within-country inequality increases based on the historical association between GDP growth and inequality changes.

Figure 2: Global, European and US income inequality

Source: Bruegel for world and EU27 inequality; version 9.6 of the Standardised World Income Inequality Database of Solt (2020) for the US. Note: World inequality is calculated for 145 countries representing 96 percent of the world population. However, 2020 within-country inequality data is available for 84 countries (73 percent of the world population), and 2021 data is available for 74 countries (52 percent of the world population). For those countries for which 2020 or 2021 data was not available, I assumed unchanged within-country income inequality. EU27 inequality refers to the current 27 EU members over the full sample period. Data for the US is available for 1960-2022; data for the world and the EU27 is available for 1988-2021.

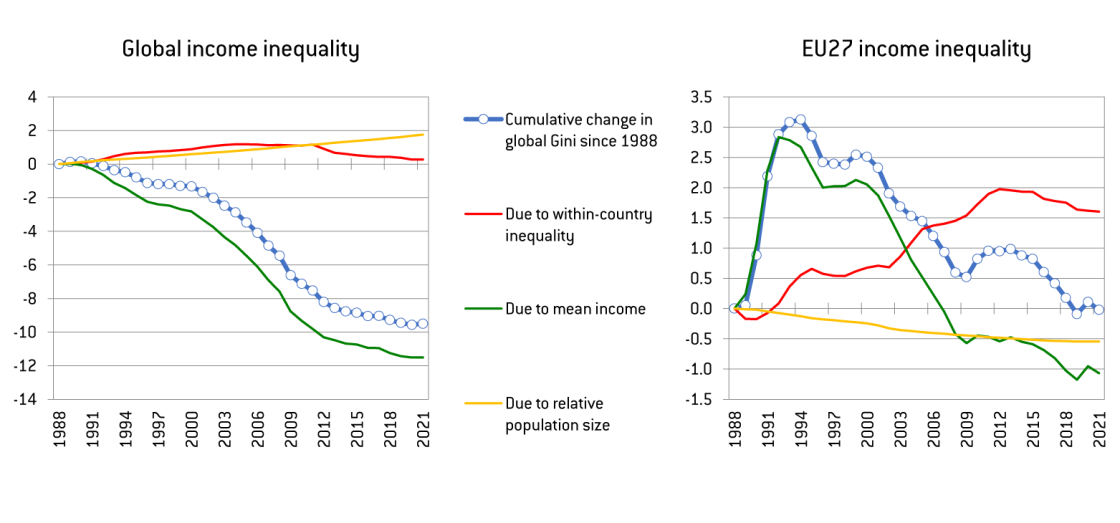

Figure 3 depicts the components of disposable income inequality changes using the novel method developed by Darvas (2019)

10

The method is composed of the following steps. First, I fixed the national Gini coefficients at their 1988 levels and calculated the change in the global Gini coefficient from 1988 to 1989 using these constant national Gini coefficients and the actual values for income and population. The difference between this counterfactual estimate and the estimate using actual data for all three key variables indicates the impact of changes in within-country inequality on changes in the global Gini coefficient from 1988 to 1989. Next, I fixed the 1989 values of national Gini coefficients and estimated the impact of changes in within-country inequality on changes in the global Gini coefficient from 1989 to 1990, and so on. When all yearly impacts from 1989 to 2021 were calculated, I chained the annual impacts to each other. The impacts of mean income and relative population size were calculated analogously.

.

Figure 3: Deconstruction of the change in global and EU Gini coefficients of disposable income inequality, 1988-2021

Source: Bruegel. Note: see the note to Figure 1.

The convergence of mean incomes has been the main driving force in the reduction in global inequality from the early 1990s; this impact accelerated in the early 2000s and flattened out more recently. The pandemic did not change this trend. The increase in within-country inequality up to 2010 increased global inequality only slightly. Since then, within-country inequality declines have reduced global inequality somewhat. Countries with higher inequality have gradually gained larger shares of the world population, which in itself, has steadily increased global inequality. Yet the global inequality-reducing impact of mean income convergence has been the dominant factor, and thus global inequality declined from the early 1990s up to the pandemic, and global inequality remained practically unchanged in 2020 and 2021.

The components of changes in EU27 inequality show different patterns over the past three decades (Darvas, 2018). In 2020, the first year of the COVID-19 pandemic, EU-wide inequality increased somewhat before falling back marginally in 2021. The main driver of these developments was the divergence of mean incomes – largely arising from larger-than-average GDP declines in southern European countries in 2020, an effect that partially reversed in 2021. Within-country inequality increases did not contribute to EU-wide inequality developments during the pandemic.

Summary

Contrary to the expectations of many researchers, including myself, recently available indicators do not show an increase in within-country income inequalities in 2020 in three-quarters of the 84 countries for which 2020 inequality indicators are available. This is good news but also puzzling. Deep recessions in the past often increased income inequality. While average employment declines in 2020 were muted by massive fiscal support packages, poorer, less-educated workers suffered from job losses, while richer, highly-educated workers did not face job losses in many countries. It seems that the massive fiscal stimulus packages adopted in response to the pandemic did alleviate adverse distributional consequences. The limited within-country inequality increases did not exert upward pressure on global inequality, while relative GDP growth developments kept global inequality unchanged.

Further research should examine which components of the fiscal stimulus packages were most effective in containing the adverse distributional impacts.

References

Adarov, A., A. Cojocaru, S. Kilic Celik and A. Narayan (2022) ‘Impact of COVID-19 on global income inequality’, chapter 4 in World Bank, Global Economic Prospects, available athttp://hdl.handle.net/10986/36519

Ashraf, B.N. (2020) ‘Socioeconomic conditions, government interventions and health outcomes during COVID‑19’, Covid Economics 37: 141-162, available athttps://cepr.org/file/9334/download?token=DrWFtBko

Darvas, Z. (2018) ‘European income inequality begins to fall once again’, Bruegel Blog, 30 April, available at https://www.bruegel.org/blog-post/european-income-inequality-begins-fall-once-again

Darvas, Z. (2019) ‘Global interpersonal income inequality decline: the role of China and India’, World Development 121: 16-32, available at https://doi.org/10.1016/j.worlddev.2019.04.011

Darvas, Z. (2020) ‘COVID-19 has widened the income gap in Europe’, Bruegel Blog, 3 December, available athttps://www.bruegel.org/blog-post/covid-19-has-widened-income-gap-europe

Darvas, Z. (2021) ‘The unequal inequality impact of the COVID-19 pandemic’, Working Paper 2021/06, Bruegel, available at https://www.bruegel.org/working-paper/unequal-inequality-impact-covid-19-pandemic

Deaton, A. (2021) ‘COVID-19 and Global Income Inequality’, Working Paper No. 28392, National Bureau of Economic Research, available at http://www.nber.org/papers/w28392

Furceri, D., P. Loungani, J.D. Ostry and P. Pizzuto (2022) ‘Will COVID-19 Have Long-Lasting Effects on Inequality? Evidence from Past Pandemics’, The Journal of Economic Inequality 20: 811–839, available at https://doi.org/10.1007/s10888-022-09540-y

Solt, F. (2020) ‘Measuring Income Inequality Across Countries and Over Time: The Standardized World Income Inequality Database’, Social Science Quarterly 101(3):1183-1199, available at https://doi.org/10.1111/ssqu.12795

Stantcheva, S. (2022) ‘Inequalities in the times of a pandemic’, Economic Policy 37(109), 5-41, available at https://doi.org/10.1093/epolic/eiac006