The impact of Brexit on the Irish energy system – pragmatism vs. principles

Brexit promises pain for Ireland that could be cut off from the EU internal market and be left exposed to market instability in the UK. Georg Zachmann

Ireland is the EU member state that will be most impacted by Brexit. A particular case in point is the energy sector. Currently the Irish electricity and gas markets’ only physical connections are with the UK. So, after Brexit, these Irish markets would not be connected with the EU anymore. This has material implications.

Adverse effects for Irish gas customers

Currently, Ireland imports about half of its gas consumption through the UK (the rest is produced domestically). While there is no reason to believe that these gas flows will be stopped after Brexit, there might be three possible adverse effects for Irish gas customers:

- The liquidity of the UK gas wholesale market (NBP) might suffer from falling under different regulations compared to its EU counterparts. This might translate into more volatile and somewhat higher prices. As Irish gas prices will remain tied to the UK gas market, this would also affect Irish consumers.

- The risks for Irish consumers would increase, as EU solidarity rules – which imply that the UK would have to prioritise Irish household gas consumption over UK industrial consumption in a supply crisis situation – would cease to apply (but the 1993 protocol between the network operators on dealing with gas emergencies on either island would remain untouched by Brexit).

- The likely most important implication of Brexit is that Ireland will be unable to continue to participate in the development of the common gas market once it is no longer connected to the EU. Being outside of this large, liquid and competitive market will not only imply higher and more volatile gas prices, but it will also affect the investment decisions of gas companies in Ireland (as access to the large EU market is an anchor of regulatory stability).

Adverse effects for the Irish electricity sector

The same considerations apply for the electricity sector as for the gas sector. While the trading volume in electricity is smaller (as electricity is largely generated and consumed domestically), the long term implications for this sector are likely even bigger than for gas. Electricity markets are complex markets based on thousands of pages of rules on the obligations of individual players and the specifications of the traded products. The EU is rolling out a market design to all its member states to ensure the joint optimisation of the EU electricity system. That is, if the wind is blowing stronger in Portugal, a gas-fired power plant in the Netherlands might be signalled to reduce its production. If the UK is unable to stay in the internal market, Ireland would also be decoupled from it. Given the increasing role of renewables in the EU as a whole, and the unique wind patterns on the Irish West coast in particular, situations in which Ireland might want to export or import large volumes of cheap electricity on short notice will become more frequent. Consequently a decoupling of Ireland from the internal electricity market could imply a greater need to invest in the back-up capacity in Ireland, lower revenues for wind power exports, and hence more volatile and higher electricity prices for consumers.

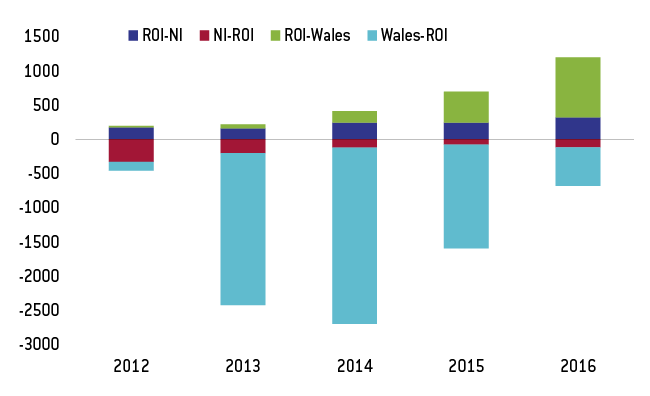

Source: Bruegel based on UK Government (2017).

The special case of Northern Ireland

However, the reliance of the Republic of Ireland on the UK is only one side of the story. On the other hand, Northern Ireland may also be significantly affected by Brexit. Northern Ireland imports electricity and gas from the Republic of Ireland and this dependency is set to increase as several power plants in Northern Ireland are expected to close. Furthermore, both parts of the Irish island share a Single Electricity Market (SEM), which is supposed to be further integrated with the EU internal electricity market. If Northern Ireland would have to leave this joint Irish electricity market, it would be too small to sustain a functioning electricity market with multiple competing suppliers and different types of plants for different demand situations. Hence, Northern Ireland is at risk of losing the benefits of a competitive electricity market and at the same time requires expensive extra capacity to ensure secure supplies.

Conclusion

Current discussions suggest that the UK will leave the internal energy market because of matters of principle on both sides: On the one hand the EU does not want to accept a special treatment of trade in specific sectors (“no cherry-picking”), while on the other hand the UK does not want to be bound by EU institutions that are crucial for the functioning of this market. The complex case of the Republic of Ireland might offer the UK and the EU27 an opportunity to still achieve this first-best solution. The EU might argue that accepting full internal energy market membership of the UK is the price to pay for allowing the Republic of Ireland to fully benefit from the EU internal energy market. At the same time the UK might find the loss of sovereignty that comes with accepting the EU internal energy market rules acceptable in order to ensure competitive energy supplies in Northern Ireland. The rest of the UK would also certainly benefit from being in the internal energy market. This mutual dependency between the UK, the Republic of Ireland and Northern Ireland can be a credibility device for both sides, which might help convince investors of the stability of the arrangement by which the UK stays inside the EU internal energy market.