Deferred tax credits may soon become deferred troubles for some European banks

The EU Commission is reportedly collecting evidence on the use of so-called deferred tax credits (DTCs) in banks in Greece, Portugal, Spain and Italy, to see whether some recent regulatory changes and recognition practices constitute hidden state aid. Here I review what these instruments are, and why the issue is important.

Legislation enabling DTAs to be transformed into deferred tax credits (DTCs) means that they are not contingent on future profits, and can be counted as capital regardless of whether the bank makes a profit or a loss.

Deferred Tax Assets (DTAs) are instruments that may be used to reduce the amount of future tax obligations. Normally, DTAs are contingent on profits: they can only be used if a bank generates enough taxable profit to give rise to a tax bill to offset their use.

Basel III treats DTAs differently, depending on how much they can be relied upon when needed to help a bank absorb losses. The value of DTAs that rely on future profitability can only be realised to the extent that a bank actually generates taxable profits in the future. The Capital Requirement Regulation (CRR) therefore requires that these DTAs be deducted from CET1, subject to a phase-in transition.

However, several countries in the South of the Euro area have introduced legislative changes that enable DTAs to be transformed into a different instrument - deferred tax credits (DTCs) - that are not contingent on future profits, and can be counted as capital regardless of whether the bank makes a profit or a loss. This practice is what the Commission is now looking into.

Source: ECB

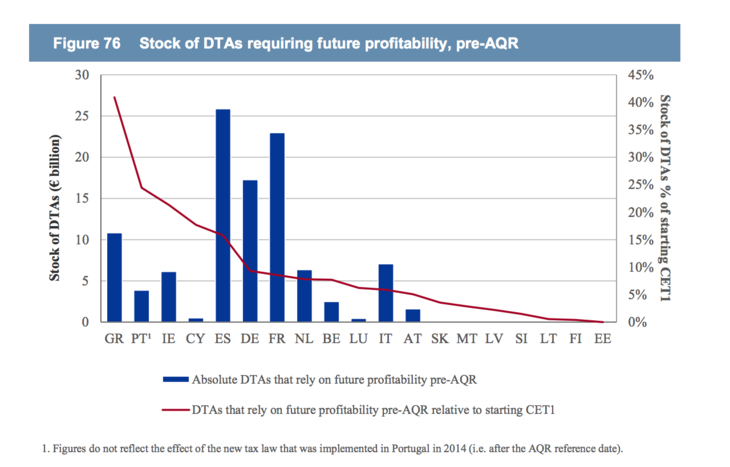

Figure 1 shows the stock of DTAs that rely on future profitability held by banks at the starting point of the Asset Quality Review (AQR). The aggregate stock prior to the comprehensive assessment amounted to around EUR 105.6 billion, equivalent to around 10.6% of aggregate CET1 starting capital. Greece and Portugal stand out as extreme cases, where DTAs are equivalent to more than 40% and 25% of pre-AQR Common Equity Tier 1 (CET1) capital.

While country-level differences in absolute stocks of DTAs may be driven to a significant extent by the size of the banks, the differences in DTA relative to CET1 indicate divergent recognition practices.

While country-level differences in absolute stocks of DTAs may be driven to a significant extent by the size of the banks, the differences in DTA relative to CET1 indicate divergent recognition practices. And since the recognition of DTAs depends on an assessment of the probability of banks to generate sufficient taxable profits in the future, these must have been different as well.

The ECB report conducts an exercise dividing the DTA stock by an estimate (from the baseline scenario of the stress test) of future annual tax expenses. By doing this, it is possible to determine an approximate number of years of profits that a bank would need in order to realise the full value of its profit-linked DTAs. This gives a prima facie indicator of how strict the practices on DTA recognition have been.

The result is that for 75 banks (the majority), the stock of profit-linked DTAs held would be equivalent to 5 years or less of annual tax expenses, but for some individual institutions, realizing the full value of all the DTAs held would require baseline taxable profits generated over significantly more than 10 years. At the same time, 31 participating banks are not projected to make any profit during the stress test baseline scenario, but they still hold around EUR 15.7 billions of DTA stock, suggesting that recognition practices may have been very lenient in some cases.

This should already help clarify why DTAs are not a perfectly transparent instrument and why CRR suggest they should be excluded by the definition of CET1.

For some banks in the South of the Euro area, which generated big losses during the crisis and hold a significant amount of DTAs relative to their core capital, this would have been problematic.

Article 39.2 of the Capital Requirement Directive (CRD IV) has provided a sort of escape clause, as it states that deferred tax assets would still be accepted as capital, if they were transformed on a mandatory and automatic basis into a tax credit and, in specific cases, replaced with a direct claim on the government.

This is probably the reason why several countries in the South of the Euro area have introduced legislative changes that enable the transformation of DTAs into deferred tax credits (DTCs). The difference, as said, is that DTCs are not contingent on future profits, and they could be called upon regardless whether the bank makes a profit or a loss. Banks would get a discount on tax if they make a profit, or a payment form the government, if they end up making a loss.

The WSJ reports that Spain and Italy had already introduced these changes by December 2013, while Portugal and Greece have passed laws more recently before the ECB’s AQR and stress tests. DG competition is now questioning whether this amounts to hidden (and illegal) state aid, as the government of countries where these instruments have been counted as capital could be called upon to back those DTCs.

The change from DTAs to DTCs allows the instruments to still count as capital, but the counterpart to that is a further strengthening of the negative bank-sovereign link.

The change from DTAs to DTCs allows the instruments to still count as capital, but the counterpart to that is a further strengthening of the negative bank-sovereign link. DTCs are in fact quite reliant on government intervention if the bank does not actually realise profits. The Greek variation on the theme is a good example of that. Reuters reported that the law initially required that if a bank calling on the DTC as capital failed to produce profits in the future, the government should provide the equivalent of the tax refund in GGBs (thus potentially strengthening the impact of government troubles on the banks), but the EBA asked Athens to amend the law so that the government contribution would need to be in cash (thus potentially strengthening the impact of banks troubles on the government coffers).

A conclusion by the Commission that the conversion of DTAs into DTCs constitutes illegal state aid could wipe out a part of what has been counted as capital in those banks that have been relying extensively on the instrument. This could have potentially harmful consequences, especially in the case of Greece, where the use of these instruments seems to have been more extensive, the situation of the government finances seems to be more precarious and banks are experiencing significant liquidity issues.

More generally, regulators do not think profit-linked DTAs are high quality enough to be counted as capital, and it is hard to dispute that the main achievement of the conversion into DTCs is to qualify these instruments by strengthening the link between the banks and their sovereigns. Easing this link is one of the most important objectives of the regulatory initiatives undertaken over the last years, including the creation of a single supervisor. There seems to be no evident reason why this effort should not be continued now.

Read more: