How I learned to stop worrying about TARGET2 and love the ECB

There always comes a time we have to face our past. For economists, it often happens when updating data long left sitting in a remote corner of o

There always comes a time we have to face our past. For economists, it often happens when updating data long left sitting in a remote corner of our desktops

There always comes a time we have to face our past.

For economists, it often happens when updating data long left sitting in a remote corner of our desktops.

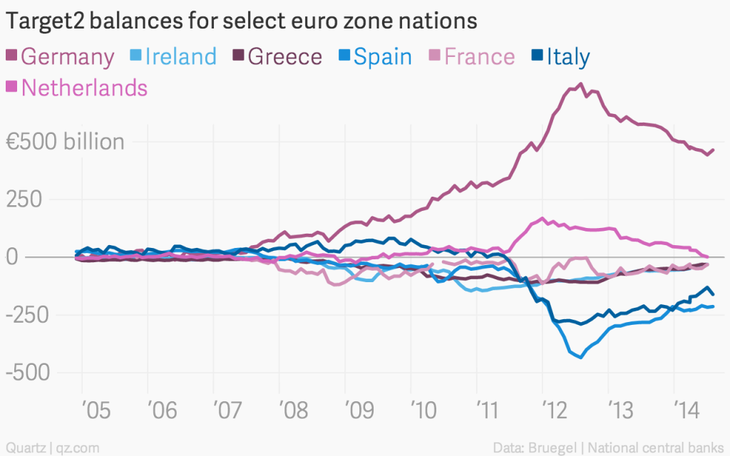

It happened to me recently. I refreshed an old chart and suddenly realized how—and why—an issue that spooked economists and financial markets alike back in 2011 and 2012 has faded so far into the background.

During the height of the European financial crisis, economists and journalists eagerly followed the latest updates on a mysterious-sounding data series known as TARGET2, which needed to be unearthed from the depths of the websites of each and every national central bank in the euro area.

In 2012, roughly €2.5 trillion worth of transactions were made on the TARGET2 system each day

TARGET2 stands for Trans-European Automated Real-time Gross settlement Express Transfer. (It is the second iteration of the system, thus the “2.”) Essentially, this a European Union payment system used by large institutions—mostly banks—to make large, cross-border euro-denominated payments throughout the course of the day. These are large amounts of money. In 2012, roughly €2.5 trillion worth of transactions were made on the TARGET2 system each day.

In practice, during the crisis the system worked more as a transfer system between countries that were seeing capital flow into or out of the country.

Here’s how it worked. Imagine a CFO at a corporation in say, Spain, back in 2011 when the crisis was intensifying. Yields on Spanish government debt were rising as markets were starting to lose confidence. There were serious doubts about the possibility that Spain might be forced to request an EU/IMF assistance program. The CFO became reasonably nervous about the safety of the bank where her company kept its money. So she decides to move the company’s account to a stronger bank in, say, Germany.

She directs her Spanish bank to transfer the company’s money, say €100 million, to the new German bank. This implies to opposite things: Deposits at the Spanish bank go down by €100 million, and deposits at the German bank go up by €100 million.

Now, like all banks, the Spanish bank doesn’t have that company’s €100 million just sitting around in a vault somewhere. (Banks make money by lending out deposits.) And the CFO of our company, most likely, is not the only one who had the brilliant idea to move money to safety. So the Spanish bank probably finds itself in a situation where its deposit base is naturally shrinking.

Deposits at the Spanish bank go down by €100 million, and deposits at the German bank go up by €100 million

But still, assets and liabilities on bank balance sheets must match. That means the Spanish bank must raise the money it needs to send to the German bank, if it wants to avoid raising additional doubts about its solvency. If such doubts grow unchecked, they could trigger a full-on bank run. Now, in normal times the Spanish bank could borrow needed cash cheaply and easily from other banks. But 2011 and 2012 were not normal times.

The interbank market—where banks lend money to one another—was basically frozen. The Spanish bank might have come up with the money by selling assets, such as the bonds or other investments the bank owned. But that would have taken too long. And borrowing from depositors was not an option. Remember, this was a situation where depositors were pulling money out of the bank, not depositing more in.

So what is to be done? Luckily for the banks in the euro zone countries that ended up under highest stress, the European Central Bank had a solution. The ECB would provide cheap, long-term loans in exchange for collateral, via its Longer-Term Refinancing Operations (LTROs). The ECB launched two extraordinary version of these operations (on December 2011 and February 2012 ) offering to lend cash for three years. European banks jumped on the offer, borrowing roughly €1 trillion (paywall).

Through this program the ECB essentially acted as a conduit between countries that were experiencing constant outflows and those where capital was constantly flowing in, in search of safety.

This is reflected in the chart. Countries where banks were constantly borrowing from the ECB—the actual system through which the money was transferred in LTROs was our old friend TARGET2—such as Greece, Ireland, Portugal, Italy and Spain were net borrowers of the Central Bank’s liquidity. As a result the accumulated a TARGET2 deficit vis à vis the ECB.

Through this program the ECB essentially acted as a conduit between countries that were experiencing constant outflows and those where capital was constantly flowing in, in search of safety

On the other hand, banks in countries like Germany were receiving large flows of that safety-seeking cash. As it started to pile up, these German banks didn’t see a lot of good places to immediately invest it. (After all the European economy was in turmoil.) So they simply started to deposit their excess reserves at the ECB—again using our TARGET2 payment system—driving their account TARGET2 balance at the ECB into a giant surplus.

And that’s how things continued to develop until 2012.

Since then, things have changed dramatically. Why?

Well, the most clear development came in August 2012, when the ECB announced it was willing to buy government bonds on the secondary market, if the country asked for help, via a program known as outright monetary transactions (OMT). The possibility of a buyer like the ECB, which had theoretically bottomless pockets—although there were some constraints on the maturities of securities it said it would buy—stopped the European government bond selloff in its tracks.

Over the next few years, prices for European bonds issued by troubled countries rose sharply, dissipating some of the doubts about the immediate solvency of the banking systems in those countries. The return of confidence eased concerns of depositors and other lenders, making it easier and cheaper for those banks to raise money.

Banks that saw deposit outflow, such as our imaginary Spanish bank, were better able to raise the money they needed. They therefore returned some or all of the money they borrowed from the ECB. In other words, conditions have been normalizing. (Although this is happening very slowly and we are still far from pre-crisis balance.)

So, is that it? Problem solved?

While short-term issues of financial stability have improved markedly, the wild ride of TARGET2 balances in recent years highlights a new problem for the ECB

Not exactly. While short-term issues of financial stability have improved markedly, the wild ride of TARGET2 balances in recent years highlights a new problem for the ECB. As I recently pointed out here, the ECB’s approach to unconventional monetary is ultimately outside the central bank’s control, because it is driven by banks’ demand for (and decision to reimburse) the money created by the central bank. In other words, during the worst phase of the crisis, the ECB effectively outsources the central bank’s balance sheet management to banks in the private sector.

Why is this a problem? You need only look at the recent readings of dangerously low inflation in the euro zone to understand why. If the ECB truly wants to keep the risk of falling into a Japanese-style deflationary trap at bay, it must act decisively to expand its balance sheet—as the US Federal Reserve did—on its own.

Featured in

This article has been republished with permission from Quartz.