The Achilles heel of Europe?

When badly designed, the regulation of service and network sectors risks creating barriers to the entry of new competitors or reducing the incentives

When badly designed, the regulation of service and network sectors risks creating barriers to the entry of new competitors or reducing the incentives of incumbents to compete, with detrimental effects on productivity and consumers’ welfare. These risks seem particularly tangible in many European countries as EU policy makers have made liberalisation in these sectors one of the structural reforms most often recommended to Member States to achieve sustainable growth in the long term. For example, the European Commission recommended reforms in one or more of these sectors for 14 out of 28 EU members in 2014 and 17 out of 27 in 2013. Targeted countries include growing economies like Germany and Austria and struggling ones like Greece and Italy. While these countries certainly start from very different regulatory conditions, is it true that the services and networks regulations are an Achilles heel for the whole Europe?

The Product Market Regulation (PMR) indicators of the OECD can be used to track reform progress across time and jurisdictions and compare services and networks regulations with a number of other policy settings that influence competition in product markets. We can therefore determine if the results for individual countries share an EU-wide pattern involving the areas of interest.

In practice, the indicators are compiled through the assessment of many detailed regulatory practices that could restrict competition while not necessarily being helpful for the purposes of the regulation. For instance, in domains like professional services the regulation aims at guaranteeing the quality of suppliers but it is sometimes implemented in ways that arbitrarily limit their number, thus hampering competition. The indicators are produced for 18 categories or sub-components, among which two are of interest here: ‘barriers to services sectors’ (i.e. entry barriers in professional services, freight transport services and retail distribution) and ‘barriers to network sectors’ (i.e. entry barriers in gas, electricity, water, rail, air passenger transport, road freight transport, telecoms). The indicators range on a scale from 0 to 6 where low figures point to less restrictive regulations and high figures to more restrictive ones. The 18 categories are aggregated in 7 components and 3 pillars.

To rank regulations at EU level, we simply average the indicators from 20 EU countries for which data are available for 2013. In addition, we capture heterogeneity across countries through the standard deviation. These new indexes are shown in Table 1 below. As it can be seen, barriers in the services sectors receive an aggregate 3.48 points, the highest on the board and also much higher than the overall PMR index, as low as 1.30 points. Barriers to networks sectors also seem high (2.33). Interestingly, services regulations also seem more restrictive than the administrative burdens for corporations (1.62 points) and the license and permits system (2.77), two other targets in the reforms' agenda. Looking at indicators heterogeneity, it can be seen that barriers in the service sectors and barriers in network sectors have a standard deviation of 0.71 and 0.42 respectively, i.e. the 6th and the 14th highest among the 18 categories. These dispersions do not look particularly high, especially if compared to the magnitude of these indicators with respect to the other categories. Thus, it seems that barriers in service and network sectors are consistently high in EU countries. However, it should be stressed here that homogeneity of the scores is no guarantee of homogeneity of the rules. The OECD Economic Survey of the European Union offers a discussion on the matter.

Table 1 – Product Market Regulation in EU countries

Source: based on OECD.

A further confirmation of the above comes from the regulation scores of the EU countries whose overall regulatory stance is more conducive to competition, i.e. Austria, Denmark, Germany, the Netherlands and the United Kingdom (PMR index below 1.25). As it can be seen from Table 2 below, these regulations look slightly less restrictive than the EU average and yet obtain higher scores with respect to the country-specific PMR index – at least one point – and are regularly ranked among the 5 most restrictive of the 18 categories, with the only exception of barriers in network sectors in the United Kingdom. This suggests that national services regulations are restrictive from the point of view of the countries that have better regulations in general.

Table 2 – Barriers in the services and networks sectors in selected EU countries

|

Barriers in the services sectors |

Barriers in the networks sectors |

PMR index |

||

|

Austria |

indicator |

4.04 |

2.47 |

1.17 |

|

rank |

1st |

4th |

||

|

Denmark |

indicator |

2.69 |

2.22 |

1.22 |

|

rank |

3rd |

5th |

||

|

Germany |

indicator |

3.65 |

2.34 |

1.21 |

|

rank |

2nd |

5th |

||

|

Netherlands |

indicator |

2.34 |

2.62 |

0.91 |

|

rank |

2nd |

1st |

||

|

United Kingdom |

indicator |

2.99 |

0.97 |

1.09 |

|

rank |

3th |

7th |

Source: based on OECD

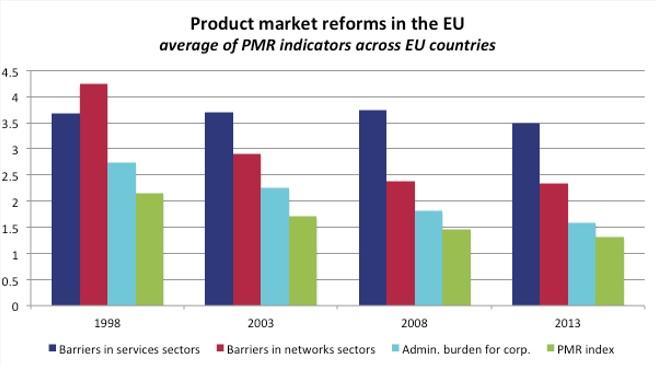

Four releases of the PMR indicators also allow tracing reform paths since 1998. As way of comparison, indicators for barriers to services and to networks, administrative burdens for corporations and the PMR index for EU countries are shown in Figure 1. To guarantee comparability the indicators are averaged across all EU countries for which data is reported in all vintages (16 countries). The displayed trends suggest that, in aggregate, product market regulations have become considerably more competition-friendly during the past 15 years: the average PMR index fell from 2.16 to 1.31, while indicators for networks regulation and administrative burden dropped by 1.90 and 1.16 respectively. Only reforms in service sectors seem to have stagnated over the considered period. But was the reform process homogeneous across countries? In fact, while it is true all countries improved their overall regulatory stance and, in particular, substantially liberalized the network sectors, reforms in the services seem to have had divergent outcomes across Europe. The United Kingdom is the country that moved more clearly towards more pro-competitive rules, with a drop of about 1.5 points. Reform efforts are also noticeable in Denmark and Greece (–1 and – 0.9). However, in 9 countries the change was well below one point and can be considered marginal with respect to the ample room for improvement. For instance, in Germany and Finland the score remained broadly stable. Even more surprising is the outcome of 4 countries – Belgium, Ireland, Hungary and Czech Republic – where in fact the score deteriorated between 1998 and 2013 (up to + 1.4).

Figure 1

Source: based on OECD.

To summarize, the OECD PMR indicators suggest that:

- barriers in service and network sectors seem to be restrictive of competition throughout the EU in 2013, while in particular looking restrictive from the point of view of the countries whose overall regulatory stance is more conducive to competition;

- networks regulations were substantially improved in all EU countries during the 1998-2013 period, following a widespread enhancement in product market regulation;

- services regulations were only marginally improved in 9 EU countries, substantially improved in 3 countries and worsened in 4 countries over the same period.

Notwithstanding the macroscopic nature of the analysis and the focus on long-term patterns, some considerations can be drawn from the results. First, regulation in network and service sectors is an area where rules seem to have a large space for improvement. The EU rightly suggests national governments to prioritize country-specific problems but should also assess the options to tackle EU-wide competition issues as a whole. For example, according to the OECD the EU framework in network sectors like telecoms and energy should foster more cooperation between national regulators. In professional services a complex overlap of heterogeneous provisions across the EU makes it hard for operators to compete in different markets. Thus, forcing the recognition of common standards looks like a warranted intervention.

Second, it seems that services reforms are not always implemented with the intention of making the sector more competitive. In comparison with other regulatory domains, this observation seems to be peculiar of these industries. Perhaps the reasons are connected with political economy’s considerations: governments may worry that pro-competitive rules are in conflict with other objectives, or their liberalizations may raise the opposition of incumbents.