Unanswered FAQs on Research and Innovation

What is the impact of research and innovation policies in Europe? Which policies better address the EU2020 challenges? The SIMPATIC Collaborative

What is the impact of research and innovation policies in Europe? Which policies better address the EU2020 challenges? The SIMPATIC Collaborative Research Project tries to answer these questions by providing policy makers with a comprehensive and operational toolbox for analysis. The 2nd annual conference held in The Hague on April 2-4 brought together several top class economists and experts on evidence-based policy analysis and impact assessment of research and innovation policies. SIMPATIC scholars, leading keynote speakers, discussants, and panel members got together to examine some of the key issues in the field of innovation policy. Here is an overview of the answers provided.

Why support Research & Innovation (R&I)?

Economic literature already provides a theoretical justification for government support to R&D. Whenever the social rate of return of a project is higher than the private rate of return, the government should intervene to prevent the firm from investing below what is socially optimal.

Nevertheless, public funds should attract private investments rather than substitute them, and this is a subject of empirical scrutiny. Most of the answers given at the Conference provided evidence of complementarity between public and private investments. For example, Jacques Mairesse, of the UNU – MERIT and CREST/ENSAE, presented a study evaluating the 2008 reform of R&D tax credits in France. The models showed that the reform had a positive and significant effect on R&D capital and investment, which are higher in the long run by about 13% than they would have been without it.

John Lester, Executive Fellow at the School of Public Policy of the University of Calgary, also warned that some countries are at risk of excessive subsidization. For instance, subsidy rates can be as high as 30% or 40% in different OECD countries, while simulation results suggest that for rates higher than 25% or 35%, the net economic benefits are likely to become negative.

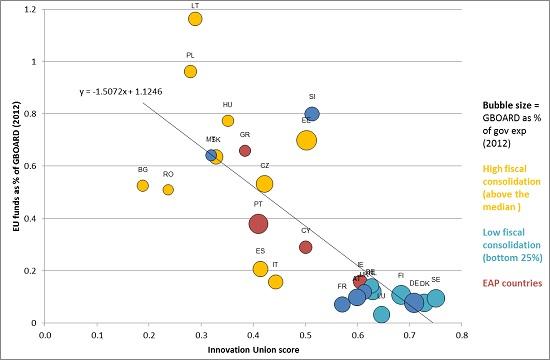

From a macroeconomic perspective, Reinhilde Veugelers, Senior Fellow at Bruegel, pointed out that additionality effects can also occur at the country level. Indeed, the EU budget for R&I (both Framework Programme (FP) funds and parts of the Structural Funds) can complement national budgets. Since this holds especially for innovation lagging countries with lower public R&D budgets and high fiscal consolidation pressure, the EU budget can serve as a mechanism to ease the public R&D divide in Europe.

EU funds and Innovation Union score. Figure presented by R. Veugelers. Source: Bruegel calculations on the basis of EUROSTAT.

Another central question concerns the relationship between R&D, growth, and employment: what are the effects of public investment in R&D on GDP and employment? Answering this question requires the adoption of sophisticated models. SIMPATIC’s researchers performed this exercise to assess the impact of the European Commission’s FP7 2013 budget allocation of €8bn. Using the NEMESIS model, they estimated that the total cumulative extra GDP amounts to €75bn after 15 years, and €86bn after 20 years, while the extra jobs created amount to 38,000 after 15 years.

A more specific question concerns the opportunity to heavily invest in renewables. Can the EU economy get a first-mover advantage from pioneering strong climate action? Leonidas Parousos, Senior Researcher at ICCS-NTUA, presented simulation results up to 2050 using the GEM-E3-RD model. The analysis showed that the first-mover advantage can develop if three conditions are met:

- the European internal market is sufficiently large and unified to allow for achieving a large part of learning by doing potential for clean energy technologies;

- ambitious greenhouse gas emission reduction targets are eventually adopted by other regions of the world, thus allowing the development of a large market for such technologies;

- spillovers are sufficiently small or at least delayed to enable the retention of competitive edge for a period of time.

An additional contribution on this debate was provided by Georg Zachmann, Research Fellow at Bruegel, who questioned the current policy on renewable technologies, which seems to favour rapid deployment over R&D. The author contended that a more balanced mix between deployment and R&D could be more economically efficient.

When is the support to R&I critical?

There are two reasons that make research and innovation policies increasingly relevant today. The first is contingent to the crisis. The second is related to the structural changes of our economy.

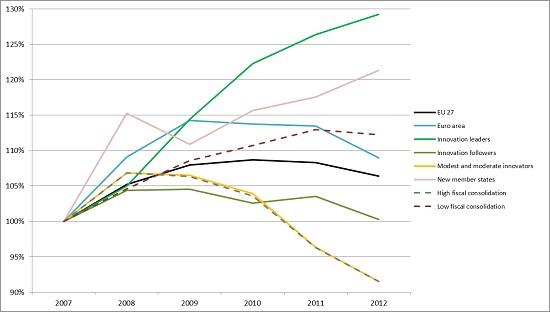

First, in times of crisis there is a need to assess the value of each euro of public money invested. Therefore, the opportunity to invest in research and innovation is under scrutiny. EU countries reacted quite differently to the crisis. Veugelers noted that, overall, innovation leaders tended to increase their expenditure in R&D, while innovation laggards cut their budgets during the crisis, thus contributing to increase the divide between the two groups.

As Luc Soete, Rector Magnificus of Maastricht University, pointed out, countries under the strongest budgetary pressures appear to have consolidated their public spending most in areas where cuts in public spending raised the least immediate opposition but affected growth primarily in the long term. The euro-crisis has brought about a research and innovation divide within the EU likely to perpetuate itself. Therefore, we are witnessing the emergence of “submerging” economies (Paul Collier) within the EU, with the crisis affecting their long term capacity to invest in human resources and R&I and, as a result, causing a brain drain of their most talented youngsters to the rest of Europe or abroad.

GBOARD trends (base 2007) – aggregates. Figure presented by R. Veugelers. Source: Bruegel calculations on the basis of EUROSTAT.

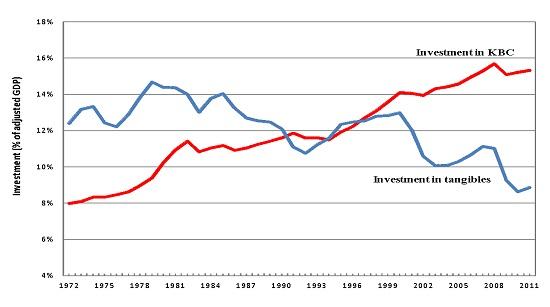

Second, the fundamental characteristics of our economy are rapidly changing and this evolution requires new policy tools. Knowledge is becoming the main asset of firms and industries, surpassing physical capital. As Dirk Pilat, Head of the Science and Technology Policy Division of the OECD, highlighted, investment in knowledge-based capital (KBC) is growing in importance and accounts for over half of all business investment in several OECD countries.

Business investment in KBC and tangible assets in the United States (% GDP, 1972-2011). Source: Corrado et al. (2012).

Such investments are often key to creating value and enabling differentiation. However, the development of investments in KBC needs policies that acknowledge the peculiarities of this type of assets. Policies to strengthen framework conditions are often essential. Indeed, well-functioning product, labour, and capital markets, as well as bankruptcy laws that do not overly penalise failure, can raise the expected returns to investing in KBC. Other policy improvements are required in areas such as the intellectual property rights system. Moreover, strategies to develop skills that match the new knowledge-based environment are also needed.

How to support R&I?

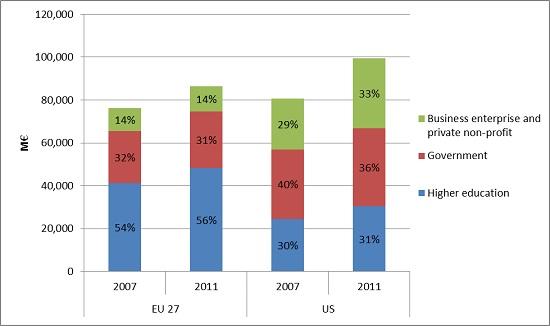

Government support to R&D occurs in three main sectors: higher education, government, and business enterprise and private non-profit. In 2011 the latter accounted for 14% of the total EU intervention in R&D.

Government financed gross expenditure in R&D by sector of performance: EU-27 and US. Figure presented by R. Veugelers. Source: Bruegel calculations on the basis of EUROSTAT.

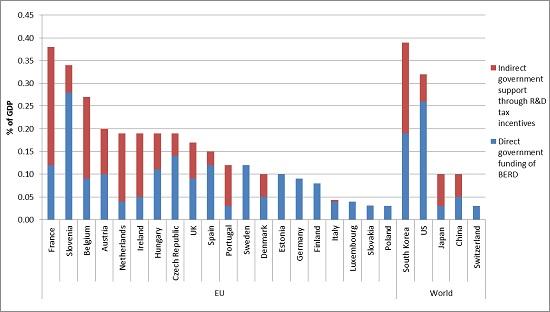

Direct government funding of business R&D and tax incentives for R&D, 2011. Figure presented by R. Veugelers. Source: OECD (2013).

There is great heterogeneity among countries about how business R&D is supported. Some countries use only direct subsidies (e.g. Germany), while others resort mostly to tax incentives (e.g. France). Which instrument works better?

The advantage of direct subsidies is that they allow governments to target projects with the highest social returns. However, government’s ability to select these kinds of projects is questionable and should be constantly assessed.

Concerning tax credits, Pierre Mohnen, Professor at Maastricht University and UNU MERIT, highlighted that these are simple to claim and allow firms to choose their own R&D projects. The disadvantages are that firms must be able to finance R&D projects up-front, and must obtain positive taxable income in order to benefit from the credits. These two problems may be particularly severe for SMEs. Moreover, Pilat argued that higher R&D tax incentives tend to benefit incumbent firms, leading to a less dynamic distribution of firm growth. Therefore, R&D tax incentives might be primarily subsiding incremental innovations amongst incumbents, as opposed to new to the market innovations associated with young entrepreneurial firms. This problem can be particularly severe given the critical role that young firms play in net job creation. It follows that tax credit policies should be designed in order to provide more favourable tax incentives for young firms.

Moreover, as Bronwyn Hall, Professor at Maastricht University and University of California, Berkeley, explained, R&D is only one of the many inputs that contribute to generating innovation: the determinants of innovation can be found in the supply and demand sides, as well as in the institutional environment. A successful innovation policy should therefore consider the whole innovation ecosystem and provide the best framework conditions.

Finally, the panel chaired by Otto Toivanen, Professor at K.U.Leuven and CEPR, with Vincent Verouden, Deputy Chief Economist in the competition directorate of the European Commission; Jeroen Heijs, Dutch Ministry of Economic Affairs; and Petri Lehto, Ministry of Employment and the Economy of Finland, highlighted how innovation policies should be subject to systematic ex post evaluations in order to ensure that economic efficiency is maintained. For this purpose, state of the art evaluation methodologies should be applied in order to deal with the ever increasing complexities of innovation policies.

Where to support R&I?

Given the increasing integration of European economies and the correlated increasing relevance of international spillovers, many of the benefits from an improved innovation policy will be reaped at the EU level. It follows that the EU should continue to coordinate the efforts towards the 2020 targets.

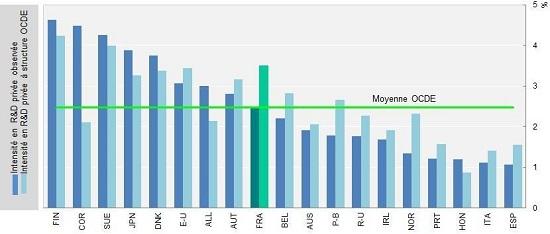

However, a smart innovation policy has to consider the industrial peculiarities of individual countries. For example, Frederique Sachwald, Head of the Business R&D Unit at the French Ministry of Higher Education and Research, showed that the ranking of EU countries according to R&D intensity can vary considerably by correcting the estimates for the sectorial compositions of the countries. This variation is due to the different optimal R&D intensities across sectors.

R&D intensities correcting for sectorial composition. Figure presented by F. Sachwald. Source: OECD.

Therefore, as Soete noted, the heterogeneity of Europe’s regions requires local smart specialization strategies that reflect their absorptive capacity and regional characteristics.

Contribution by Michele Peruzzi is gratefully acknowledged.