Russian roulette

The possibility that this geopolitical crisis spills over from the Eastern Europe to the (closer) Mediterranean and even the core of the EU cannot to

Read our comments on Ukraine and Russia 'Eastern promises: The IMF-Ukraine bailout', 'Interactive chart: How Europe can replace Russian gas', 'Can Europe survive without Russian gas?', 'The cost of escalating sanctions on Russia over Ukraine and Crimea', 'Blogs review: Wild Wild East' and 'Gas imports: Ukraine's expensive addiction'

Over the weekend, the Ukrainian region of Crimea held a referendum about the option of secession and unification with Russia. Almost 97% of the voters support secession, but the outcome has not been recognized by leaders of the European Union, who on Monday agreed on a first wave of sanctions against 21 officials deemed responsible for the vote.

The Russian response and the following EU moves will determine how the early seeds of this geopolitical crisis will blossom and what the consequences will be on the European economy. This post takes a look at the financial exposure of European banks to Ukraine and Russia, an issue that until now has been relatively less debated compared to trade and energy exposures.

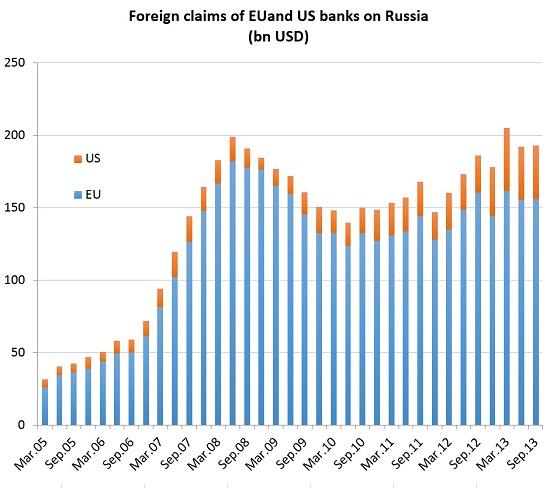

SOURCE: BIS

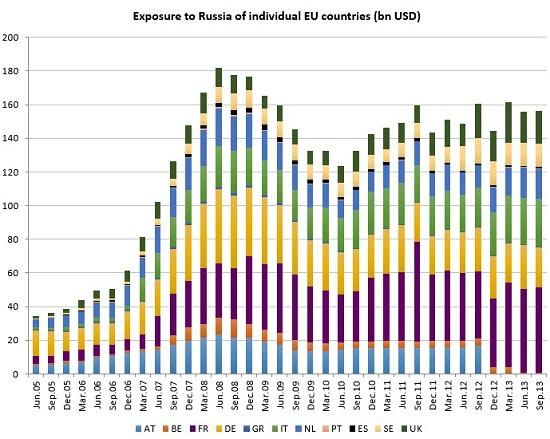

BIS data for September 2013 shows reporting European banks had claims in the amount of $156 billion in Russia, against less than $40 billion of the US (Figure 1). Within the EU, France is certainly the most exposed, at $51 billion (see Figure 3). Italy comes second with $28.6 billion, followed by Germany at $23.7 billion, the UK at $19 billion, the Netherlands at $17.6 billion and Sweden at about $14 billions.

SOURCE: BIS (missing data for Austria in the latest quarters)

Individual bank-level data on operations abroad are not always publicly available, but a recent report by the Economist Intelligence Unit compiled a list of the top 15 banks operating in Russia, finding that Raiffeisen Bank International (Austria) and UniCredit (Italy-Austria) are the European banks that could be more at risk in Ukraine.

Operations in the country are relatively small. Both banks have operations for an amount of 5-5.5bn of USD in assets at the beginning of 2014 and relatively to the size of group assets these figures are very small. According to EIU, the Ukrainian operations constitute about 3% of total assets of the Austrian parent company for Raiffeisen, and less than 0.5% of total assets for Unicredit). BNP Paribas is also present in Ukraine, with operations limited at 3bn USD.

The exposure of European banks to Russia is significantly more sizable. Table 1, taken from the same EIU analysis, shows that Italy, France and Austria have a non-negligible financial stake in Russia. The most exposed is Unicredit Bank, with 24bn USD (or 2% of the total group assets). Rosbank, the Russian subsidiary of French Société Génerale, follows suit with 22bn USD (or 1% of the total group assets). Austrian Raiffaisenbank has Russian operations for 20bn USD, which correspond to a worrying 12% of the total group assets.

Table 1 – Top 15 banks operating in Russia (1st October 2013)

|

Bank |

Ownership |

Total Assets (US $mn) |

|

Sberbank |

Local |

466,792 |

|

VTB |

Local |

148,837 |

|

Gazprombank |

Local |

100,703 |

|

VTB-24 |

Local |

54,547 |

|

Rosselkholzbank |

Local |

53936 |

|

Bank Moskvy |

Local |

51715 |

|

Alfa-Bank |

Local |

42777 |

|

UniCredit Bank |

UniCredit, Italy-Austria |

24,394 |

|

Rosbank |

SocGen, France |

22,375 |

|

Promsvyazbank |

Local |

22,181 |

|

Nomo-Bank |

Local |

22,180 |

|

Raiffaisenbank |

Raiffaisen Bank Int.l, Austria |

20,092 |

|

Bank UralSib |

Local |

13,104 |

|

Moskovsky Kreditny Bank |

Local |

12,639 |

|

Rossiya |

Local |

12,418 |

SOURCE: Economist Intelligence Unit

According to data reported in the New York Times, SocGen Russia made operating income of 239 million euros last year, despite a 41 percent jump in losses from bad debts. The bank said it had 13.5 billion euros of outstanding loans in Russia and deposits of 8.5 billion in the country at the end of 2013. UniCredit said revenues from Russia were 372 million euros in the fourth quarter of 2013, up 80 percent from a year earlier, whereas Raiffaisen made 507 million euros in the first nine months of last year.

European banks operating in Russia could be affected by the present situation in several ways. In the early phase of the Ukrainian crisis, the main worry was that the country could be led to default on its sovereign debt, a significant part of which is held as assets by the banks. At the moment, this scenario seems to be less likely to materialize and markets have reacted positively to the negotiations of a programme with the IMF and Europe.

Nevertheless, the effect of the geopolitical turmoil on the regional financial markets has proved to be potentially large, and the exchange rates have also been volatile recently. The National Central Banks of both Russia and Ukraine had to take significant measures already to counteract the risk of sharp currency depreciation. For European banks operating in the region, devaluation reduces the value of the assets they hold in local currency. Moreover, as pointed out by EIU, the effect on default rates on loans (especially those in foreign currency) could be a significant risk for these banks.

A sensitivity analysis conducted by Morgan Stanley (European Banks: looking at Russia-related risks) suggests that earnings risk would be limited. For 2014, earnings risk is estimated at 7% for Unicredit and 3% for Societé Generale. The impact could raise to 13% and 7% respectively, in a more negative scenario.

The sanctions imposed by the international community are also an element of potential risk, if they were to limit in any way the operations of European banks in the country. The sanctions imposed by the EU today are limited to specific political and military personalities, so are unlikely to affect the general operation of European Banks in Russia. But if the crisis were to intensify and/or if Europe were to introduce stronger and broader-based sanctions, these banks could be affected.

On top of that, an element of potential uncertainty is linked to the role that Russia has had (and can still potentially have) in the management of crisis in Cyprus. Cyprus has benefitted from Russian aid, and the management of (dubious) Russian deposits in the country has been an issue of fierce discussion one year ago, when the banking crisis turned the small island into a geopolitical hot spot.

The possibility that this geopolitical crisis spills over from the Eastern Europe to the (closer) Mediterranean and even the core of the EU cannot to be ruled out. An escalation of the sanctions game could play out against Europe’s financial system.

It’s far from clear which barrel holds the bullet over Ukraine and Crimea.