Euro area adjustment in a low inflation environment

Inflation in the euro area remains low. Eurostat’s most recent figures show that inflation in the monetary union remained unchanged at 1.6 %

Inflation in the euro area remains low. Eurostat’s most recent figures show that inflation in the monetary union remained unchanged at 1.6 % in July compared to the same month a year ago. This post analyses price developments in a bit more detail to assess underlying inflation pressures. Feasibility of relative price adjustment in the monetary union is also considered.

Point estimates for overall inflation in a given month can give a misguided picture of price pressures because (i) overall inflation includes volatile food and energy prices and does not account for tax hikes included in fiscal consolidation programmes; (ii) short-term price developments might not be sustained.

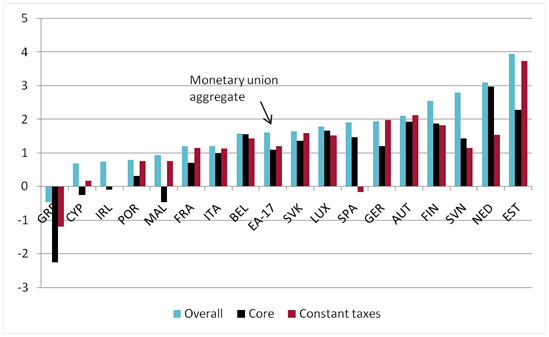

To account for the first concern, Figure 1 compares the most recent figures for overall inflation, core inflation (stripping food, energy, alcohol and tobacco) and inflation holding taxes constant.

Figure 1: Alternative year-on-year inflation measures in July 2013.

Source: Bruegel based on Eurostat.

Note: For Ireland the ‘constant taxes’ inflation measure is not available.

Core inflation and inflation holding taxes constant were lower than overall inflation in all countries. Indeed the alternative measures indicate underlying inflation of only slightly above 1 % in the euro area. Individual countries rank fairly consistently according to the gravity of their economic situation. From the group of Southern economies, only Spain had a higher overall inflation rate than the euro area aggregate in July. But this is only because of tax increases in the country – Spanish inflation is the second lowest if taxes are kept constant.

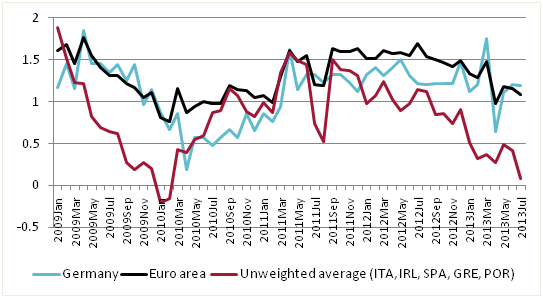

As one data point does not constitute a trend, Figure 2 plots the evolution of year-on-year core inflation.

Figure 2: Evolution of core inflation (2009Jan–2013Jul).

Source: Bruegel based on Eurostat.

Core inflation in the euro area was fairly steady at 1.5 % from April 2011 onwards after the initial downward shock from the 2009 financial crisis. However, since mid-2012 core inflation has been trending downwards. This decline has been especially pronounced for the hardest-hit countries.

ECB’s own explanations for aiming to close to 2 % inflation include the desire to “provide a sufficient margin to address the implications of inflation differentials in the euro area. It avoids that individual countries in the euro area have to structurally live with too low inflation rates or even deflation.” However, the Greek overall price index has exhibited deflation since March 2013 and core inflation has been continuously negative since May 2012 (in year-on-year terms). Overall, inflation in the euro area is clearly below the 2 % target and this renders adjustment more difficult.