The Euro Area: Great Recession or Great Depression?

The Great Depression was a period of severe economic contraction that lasted many years. In the United States real GDP fell every year from 1929 to 19

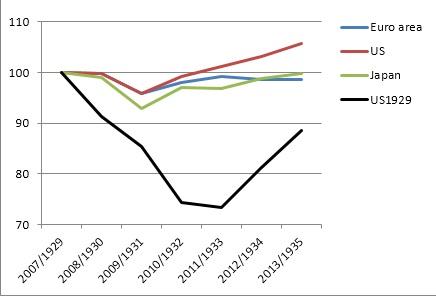

The Great Depression was a period of severe economic contraction that lasted many years. In the United States real GDP fell every year from 1929 to 1933, when it reached only 73 percent of its 1929 level. Starting in 1934 the recovery was quite rapid, with GDP reaching its 1929 level in 1936. By contrast the Great Recession has been much milder (see Figure 1a). In the US GDP only contacted from 2007 to 2009, when it fell to only 96 percent of its 2007 level. Recovery was quick, with GDP already surpassing its 2007 level by 2011. In the euro area, unfortunately, the situation has been less favorable. Although the initial contraction was similar to what happened in the US, recovery has been slower. In 2013, euro area GDP will still be below its 2007 level.

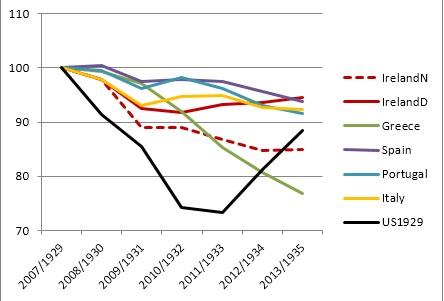

Inside the euro area, the situation is particularly alarming in Greece, Ireland, Italy, Portugal and Spain (see Figure 1b). In the last three countries, the term recession rather than depression is appropriate, but recession is severe: GDP will continue to decline in 2013 while will still remaining above 90 percent of the 2007 level. By contrast, in Greece the term recession is not appropriate. The country is clearly in depression: GDP continues to decline sharply and will reach barely 77 percent of its 2007 level in 2013. This is worse than in the US at a similar stage in time during the Great Depression. The situation of Ireland depends on whether one looks at GDP or GNP (for the other countries GDP and GNP are very similar). GDP fell till 2010 but has grown steadily since 2011. On the other hand, Irish GNP has declined severely since 2007 and although it will stabilize in 2013 it will be worse than in the US at a similar point in time during the Great Depression.

So yes, perhaps the financial crisis in the euro area is over but GDP in the crisis countries (and GNP in Ireland) still has some way to go before it returns to its pre-crisis level. This is surely a depressing situation.

Figure 1a – Real GDP of the Euro area, Japan and US (2007=100) and the US (1929=100)

Figure 1b - Real GDP of the GIIPS (2007=100) and the US (1929=100)

Data source: AMECO, European Commission.

Note: IrelandD (N) stands for Ireland’s GDP (GNP).