Chart of the week - Economic convergence in the euro area: on apprend de ses erreurs

Economic commentators are rightly worried about the different activity developments between the “core” and the “ periphery” of Europe, with the former in acceptable conditions and the latter in recession. There are, however, other macroeconomic developments worth of notice, with a fairly different, and more positive, message.

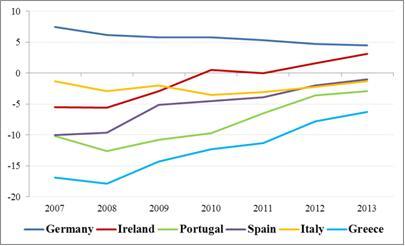

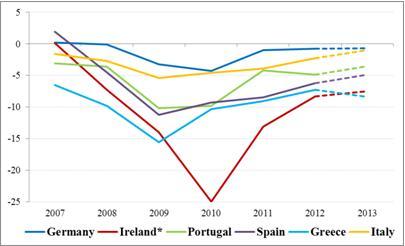

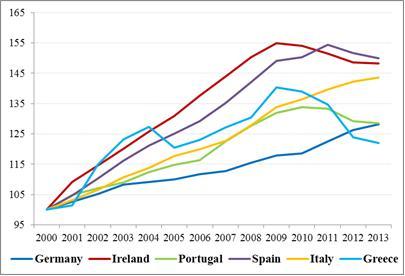

The charts below show on-going convergence towards balance of three important macro-economic indicators for Germany, Ireland, Portugal, Spain, Italy and even for Greece: current account balances, unit labour costs and fiscal deficits.

Current accounts are moving towards balance, from below in the case of Greece, Spain, Italy and Portugal (Ireland is already moving into surplus) and from above in the case of Germany.

Current account balance in selected euro area countries (% of GDP)

Source: EC European Economic Forecast Spring 2012

Fiscal balances are mostly moving towards a more sustainable zone, albeit with difficulty in the case of Greece.

Fiscal balance in selected euro area countries (% of GDP)

* Actual figure for Ireland 2010 is -31.2%

Source: EC European Economic Forecast Spring 2012

Nominal unit labour costs are mostly going down (with the exception of Italy) in the periphery and up in Germany, even if the gap between the level of Germany and that of the other countries is still large.

Nominal unit labour costs, whole economy (2000 = 100)

Source: Eurostat, EC European Economic Forecast Spring 2012

Of course convergence is on-going and far from being completed, the picture indeed would be different is one would look at “stock” variables instead of flow variables like the one shown above. Furthermore adjustment fatigue is visible in many places. There is no doubt, however, that the process of correcting serious imbalances has started. Perseverance can complete it.