The Weekender

Dear All,

It’s the last weekend before the first round of the French presidential election and unless the polls are completely wrong, the outcome should be a fairly straightforward second round between Sarkozy and Hollande. Yet the international financial environment has suddenly become more challenging and the new French government will have to move swiftly after the election.

Interestingly, on Monday April 16th, Futures on French OAT will be listed by eurex for the first time since the demise of its former equivalent on the MATIF. The introduction of such a products in this political and financial context is quite baffling. Seeking marginal liquidity gains via derivatives while risking important swings on the actual price of French debt seems disingenuous. Futures contracts can be useful in calm weather to improve liquidity, but in stormy weather, they provide more grip for financial markets participants to move bond prices.

Meanwhile focus is on Spain where worries have increased quite substantially as recent data shows extreme reliance of the Spanish banking system on ECB liquidity. The current situation raises more profound issues about the current European strategy and will call for action soon:

1. ECB and the side-effects of jawboning

2. European Financial Safety nets: the gaps and the future

3. The battle for the soul of the WorldBank

_______________________________________________________________

1. ECB and the side-effects of jawboning

Difficult bond auctions and data from the Bank of Spain showing a jump in reliance on ECB liquidity has increased the sense of tension despite strong budgetary commitments (that appear largely unreachable). My personal feeling is that over the last couple of weeks, the marginal buyer of Spanish debt has probably been irremediably lost.

Against this background, the ECB seems stuck between a rock and hard place and this makes its verbal interventions (mostly performed by Benoit Coeure who is responsible for the SMP) largely inefficient. Indeed, it has now become a market consensus that the SMP doesn’t manage to tame the rise in bond yields and only helps banks moderately. In fact, worse the Greece experience shows that SMP interventions can make the remaining stock of private sector debt marginally more junior (cf. Greek debt held by the ECB via the SMP wasn’t restructured in the PSI).

In addition, even the ECB itself seems to doubt about the effectiveness of the SMP to address challenges faced both by sovereign and banks. The LTRO was precisely designed because of the perceived unsuitability/ineffectiveness of the SMP.

As a result, jawboning/verbal interventions on sovereign debt markets, when deemed incredible by financial markets and by the executive board itself are most definitely incapable of having the desired effects on prices and can actually be costly to the ECB in terms of credibility. In financial markets’ parlance, in order to be credible, the Central Bank needs to be able to put its money where its mouth is.

The ability of the ECB to intervene in sovereign debt market seems to be profoundly intellectually challenged but its ability to intervene on behalf of the EFSF remains and has actually never been used. That being said the nature of these interventions is still unclear and normally ought to be prefunded by the EFSF (which undermines the very usefulness of the ECB acting as an intervening agent for the EFSF). In the absence of a real and credible intervention capacity, the ECB should probably refrain from verbal interventions altogether.

2. European Financial Safety nets: the gaps and the future

The interaction of the ECB with euro area governments has been a source of important institutional changes of the past 18 months. The ECB’s pressure is sometimes quite encouraging, in particular the suggestion made by Jorg Asmussen that the fiscal compact, the 2pac and the 6 packs were all insufficient but had to be seen as important steps on the way to a real fiscal union (see his speech at the INET conference in Berlin last week here).

But there are also less encouraging elements in the pressure that the ECB applies on euro governments. The ECB continues to press governments to reduce deficits with the illusory belief that this will meaningfully improve both financial stability (via the stabilisation of sovereign debt markets) and boost potential growth (see some pretty critical elements by Perroti from the BIS on expansionary fiscal contraction in The “austerity myth”: gains without pain).

The case of Spain illustrates that this overarching focus on fiscal consolidation as a key contributor to financial stability and potential growth distracts from other policies that could be more effective in achieving both. In particular banking sector policies have largely been ignored by euro area policymakers over the last year and the ECB has applied only limited pressure to this effect while the intellectual consensus on this has grown exponentially.

Banking and sovereign crises are intertwined but the prevailing attitude from good willing euro area policymakers seems to consider that there is only one way to disentangle them and that this way involves moving towards some form of fiscal union first. Indeed, the argument goes that even on the banking sector front, the key areas of disagreements are fundamentally of a fiscal nature (burden sharing of restructuring, supranational guarantee of deposits for instance).

I have some sympathy for this argument but I also observe that there is a bigger intellectual convergence on the policies designed to stabilize the banking system and that these could actually precipitate a more mature debate about fiscal union. This is in fact a matter of assembling the horse and the cart in the correct order and I tend to think that there is a growing consensus surrounding banking sector issues now than on fiscal union, which should possibly make us more open minded about reversing the horse and the cart and start with banking sector policies with the aim of improving the nature of the future debate on fiscal union.

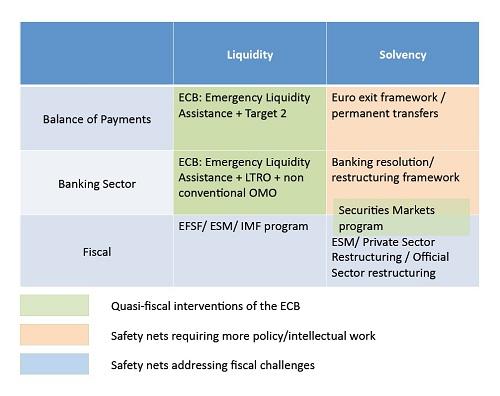

Michiel Blijsma and myself are currently working on a paper on euro area safety nets and have produced the matrix below, which aims to highlight the degree to which we have progressed on some parts of the crisis (the fiscal ones) but where we still need policy and intellectual impetus.

Our tentative conclusion is that much more needs to be done on the banking front: supranational guarantee of deposits, banking resolution/restructuring framework and finally provision of a euro area safe asset and that this will precipitate a deeper discussion about Eurobonds and fiscal union.

Both intellectually and practically speaking, Spain is an important test case. If we stick to the current logic followed by euro area policymakers, we will only deal with Spain –possibly through a form of fiscal union– once the crisis will have become completely fiscal. However, if we reverse the cart and the horse today, there is a chance to deal with Spain preemptively by organizing an EFSF program specifically targeted to recapitalizing the banking system thereby planting the seed of a de facto (probably not de jure) supranational restructuring framework by the same token.

3. The battle for the soul of the Worldbank

Interestingly, the debate over the appointment of the new Worldbank president has sparked a deeper debate about economic development and about the true role of the Worldbank. The Board will have to decide tomorrow between Jim Yong Kim and Ngozi Okonjo-Iweala as Mr. Ocampo left the race just a couple of days ago.

But the debate has taken a personal turn and only compares the respective skills of the candidate ex nihilo without raising the fundamental question about the real need of the Worldbank at this current juncture? Does the Bank need new strategy and intellectual apparatus to devise a different role for itself or an outstanding and experienced manager to promote and support economic development?

These are two different objectives that require very different presidents. I would tend to believe that the Ngozi Okonjo-Iweala is the best president for the former and that Jim Yong Kim would be a more intellectually daring president that could help to transition the bank away from national development and focus more of its intellectual and financial resources on human development.

Hence, the choice shouldn’t be about the citizenship of the candidate or about its credentials, which for all I can see, are both excellent, but really about the bank itself. Should the bank focus on economic development or should it focus on poverty alleviation. Should it seek to strengthen the macroeconomic backbone of a given country or should it seek to close poverty traps in which its citizens are falling?

Academic work over the last few years has focused essentially on randomized experience and policies designed to alleviate poverty, leaving national development behind especially as institutionalists (Acemoglu, Rodrik…) showed how ineffective had been policies that sought to impose and promote one monolithic growth strategy.

In addition, the world is changing and the Bank still dedicates a very large part of its resources to middle income economies whose access to finance isn’t really constrained anymore, whose reserves have grown exponentially and whose homegrown capacity to drive economic development might make the financing capacity of the bank redundant while diverting scarce resources away from the very poorest countries.

All in all, this makes me think that what the Bank really needs is an intellectual shake up more than an outstanding manager to carry on with business as usual. And as a result, although I firmly believe that the tradition of systematically electing an American citizen at the helm of the Worldbank needs to go, Jim Yong Kim is probably the best candidate to devise a new mission for the bank more focused on poverty alleviation and more consistent with the recent contributions of economic theory on the matter.

Happy to have your thoughts as usual,

Best,

Shahin