What is the meaning of TARGET balances?

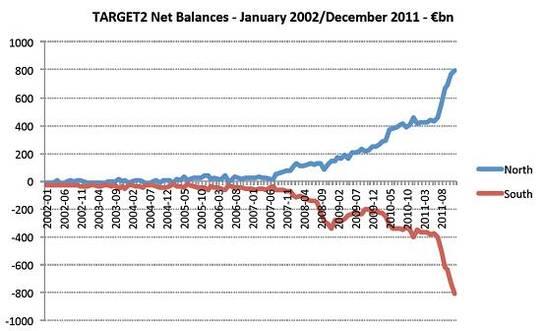

TARGET2 (the centralised payment system operated by euro area central banks) has recently drawn attention, due to the constantly diverging net balances of Southern and Northern countries. Divergence started at the onset of the financial crisis and has accellerated during summer 2011, with the intensifying of the euro crisis and of tensions on the interbank market.

TARGET2 is the operational tool through which National Central Banks (NCBs) of euro are Member States provide payment and settlement services for intra-Euro Area transactions. The settlement of payments between National Central Banks in different Euro Area countries gives rise to intra-Eurosystem cross-border obligations. All these obligations are aggregated and netted out at the end of each single business day, leaving each National Central Bank with a certain net TARGET2 balance against the ECB, the ultimate manager of liquidity. A positive TARGET2 balances correspondes to a net claim vis-à-vis the ECB and a negative balance corresponds to a net liability.

The divergence in net balances has been interpreted by some commentators as the evidence of surplus countries financing the accumulation of current account deficit of the periphery. However, the marked divergence in current account position before the crisis is not matched by a corresponding evolution of TARGET2 balances, which instead started diverging strongly from 2008 on. This suggests that TARGET2 balances should be interpreted as evidence of the decentralised distribution of central bank liquidity within the Eurosystem: countries undergoing net payment outflows need to rely more on Central Bank liquidity provision than countries in which money are flowing in. According to this view, TARGET2 can be interpreted as a compensation mechanism that allows sound banks in stressed countries to cover liquidity needs.

North: Netherlands, Germany, Luxembourg and Finland

South: Greece, Ireland, Portugal, Italy, Spain, France and Belgium