(Lack of a) reaction in euro area yields

With the current situation in the ongoing Greek debt negotiations taking a turn for the worse this weekend, we take a look at other Euro area interest

With the current situation in the ongoing Greek debt negotiations taking a turn for the worse this weekend, we take a look at other Euro area interest rates on long-term debt to gauge how markets have reacted to the news of a Greek referendum on the Eurogroup's proposals, and the imposition of capital controls.

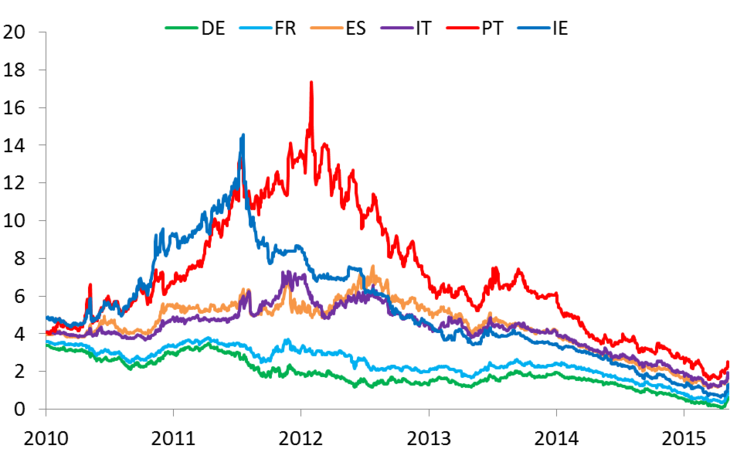

So far, markets have reacted in a fairly benign way, especially when put in the context of developments between 2010 and 2012.

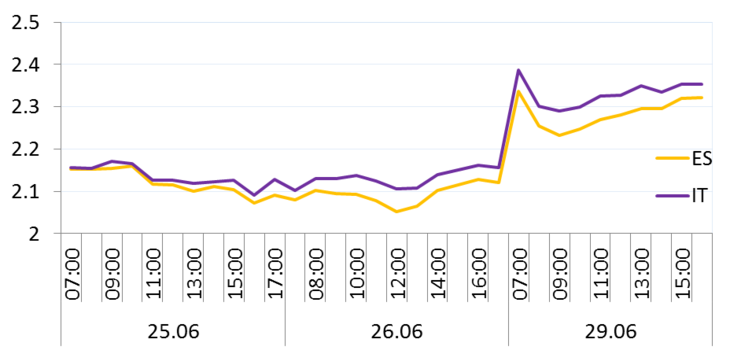

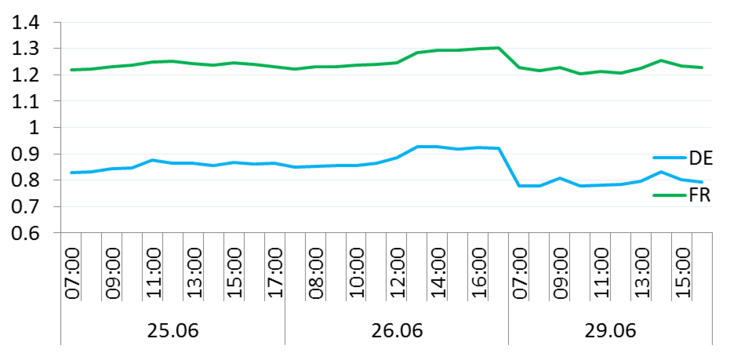

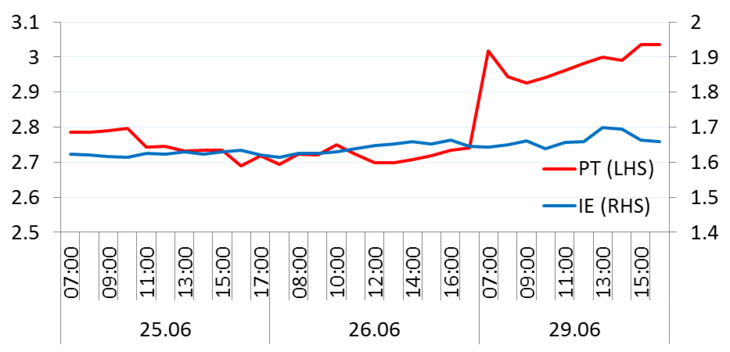

Figure 1: Intra-day Evolution of 10 Year Sovereign Yields (%, hourly data)

Source: Thomson Reuters Eikon, most recent data 17:00 CET (16:00 GMT)

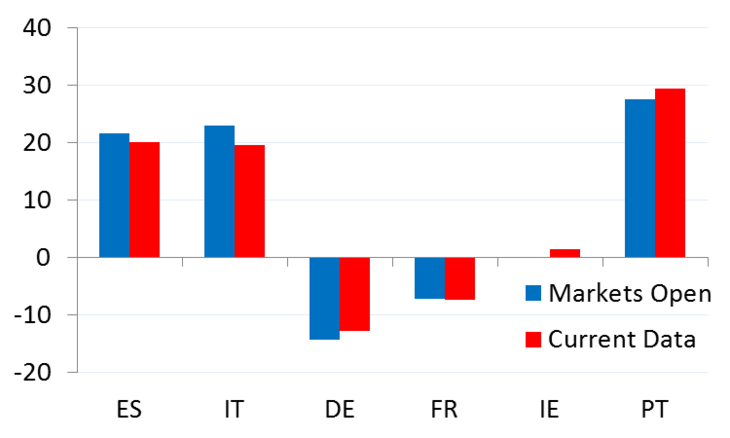

Figure 2: Change since Market Closing on Friday, 26.06.15 (basis points)

Source: Thomson Reuters Eikon, most recent data 17:00 CET (16:00 GMT)

Spain, Italy and Portugal show the biggest market reactions to the weekend’s news, with yields temporarily increasing by 22, 23 and 28 basis points respectively, from the last data on Friday to the point at which markets opened today. The markets have dampened their reaction since then somewhat (as shown by the red bars) in Spain and Italy.

Figure 3: Historical perspective of 10 year sovereign yields (%)

Source: Thomson Reuters Datastream

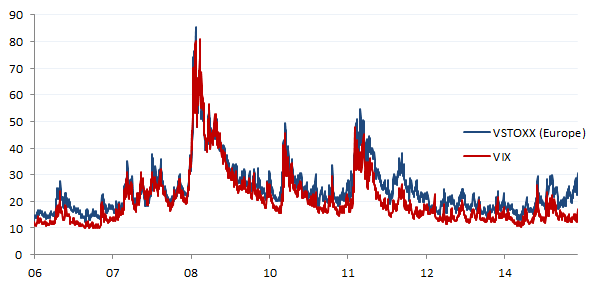

Taking a broader look at volatility, the VIX and VSTOXX indicies do not show significant signs of major stress yet, although the VSTOXX, the European index, has diverged locally from the VIX recently, but this evolution has been ongoing since before the weekend's events.

Figure 4: VIX volatility index

Source: Thomson Reuters EIKON