Update: financial market developments

Following on from our previous blogs, we take another look at the intra-day developments in financial markets after yesterday’s European Council meeti

Following on from our previous blogs, we take another look at the intra-day developments in financial markets after yesterday’s European Council meeting to discuss the urgent situation in Greece. While the general picture remains broadly the same as before, developments in the Portuguese 10-year yield are worth watching.

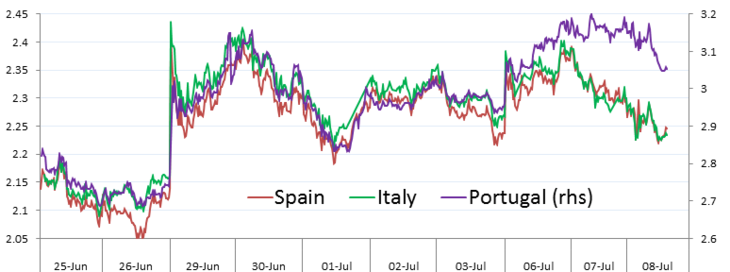

Figure 1: Intra-day developments in sovereign yields (%)

Source: Datastream ThomsonReuters

Spain, Italy and Portugal all had initial increases in yields following the the news that Greece would go to the polls (29/06). Yields have been more or less stable with some variance since then, however Portugal is beginning to diverge from the other two in the periphery group, starting some time yesterday or the day before. This could be a sign markets are slightly more nervous about the possibility of contagion from a Grexit scenario in Portugal than in Spain or Italy, however, these developments are still very mild in their historial context.

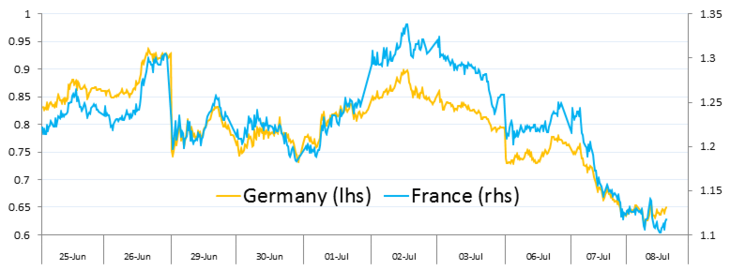

Germany and France have seen their yields fall over the last couple of days, undoing the slight up-tick we saw at the end of last week.

Source: Datastream ThomsonReuters

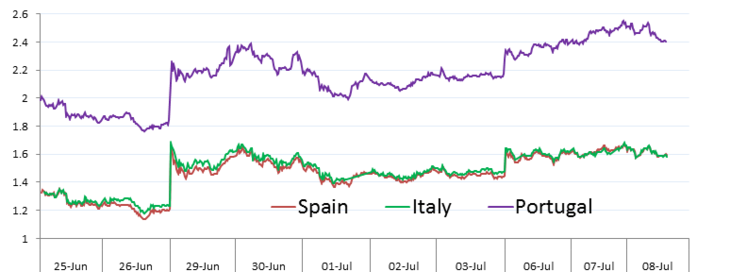

If we look at the Periphery spreads (against Germany) we can see that all have experienced increases around the referendum announcement and outcome. Portugal has continued to drift upwards while Spain and Italy are relatively more rooted at the higher level.

Source: Datastream ThomsonReuters

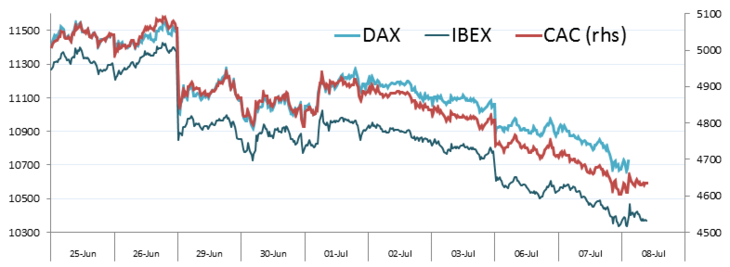

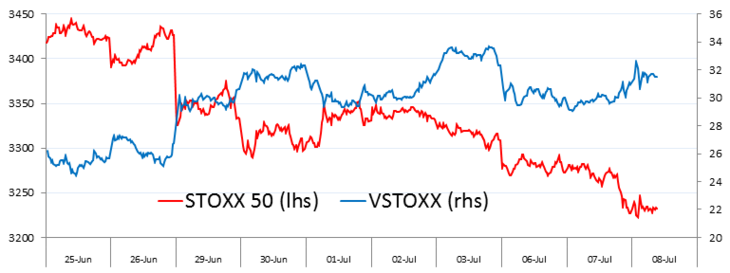

The stock markets appear to be a lot more downbeat than the bond markets. The national indicies of Germany, France and Spain are all continuing to slide lower. At theEuro area level, the STOXX 50 index exhibits a similar decline.

Figure 2: Stock Market Movements

Source: Datastream ThomsonReuters

Volatility (VSTOXX) remains above previous levels, albeit relatively stable around this new higher level.

Source: Datastream ThomsonReuters

Figure 3: The Euro-Dollar Exchange rate (USD per EUR)

Source: Datastream ThomsonReuters

The Euro has made up for some of the lost ground this morning, however this comes after several consecutive days of losses.